What are the key revenue drivers in social media, and how does the market react to surprising new information about them? Visible Alpha’s analysis of earnings announcement surprises in social media using detailed KPI estimates that drive revenue, in addition to top and bottom-line forecasts, highlights that user growth information has a large impact on stock returns following earnings announcements.

Through our analysis, we find that user growth is a key revenue driver to unlocking the outcome in social media’s earnings announcements. The consensus closely tracks this revenue driver, which accounts for half the revenue growth historically, and surprises on the announcement day are not as common as other KPIs we analyzed. Beating or missing the consensus on user growth yields outsized returns on the announcement day: we estimate 2.8% excess daily return following the announcement per 1% user growth surprise. The strong earnings response coefficient on user growth exceeds that of EPS, revenue, or the monetization part of the revenue handily.

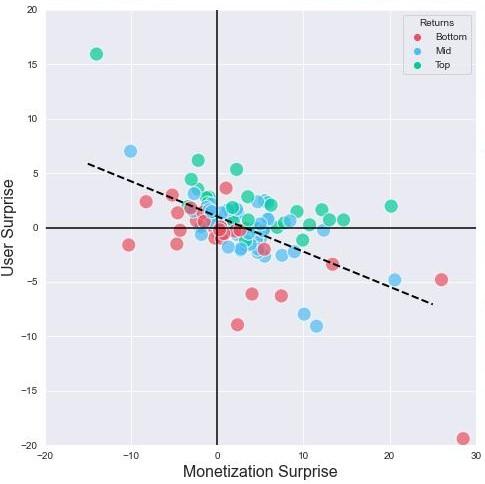

The figure above marks each KPI surprise and color-codes the excess stock return following the earnings announcement. The dashed line shows that user growth and monetization surprises are negatively correlated; a positive surprise in one component of revenue provides some buffer for a weaker surprise in the other component. The top 25% of returns in the sample (green dots) tend to happen when user growth beats expectations, while the worst 25% returns (red dots) happen when user growth misses.

The impact of user growth on social media returns is not a statistical wonder; it is rooted in the social media business model popularized by Facebook. When we break down revenue growth on a timeline, we find that social media companies tend to start with rapid user growth and tepid monetization. Over time user growth slows while monetization via ads or subscription fees steadily ramps up. Therefore, user growth is a sneak-peek into the future path of revenues, not just the current period. An unexpected user growth acceleration or slowdown might convey information about future cash flows and valuation of social media companies, making it a strong predictor of announcement day returns.

While KPI surprises do a good job of explaining announcement date returns, weekly returns following the announcement do not show a predictable drift in the direction of surprise, or a reversal for that matter. This points at market efficiency; new information coming in the earnings announcement is incorporated into returns the same day.

Our approach allows us to go beyond saying that a company has had a good quarter because the reported EPS exceeded the consensus expectations. We aim to provide a deeper diagnosis on why the company had a good quarter: was it because more users signed on to a social media platform than anticipated, or was it because the company charged higher for ads shown to users on its platform than analysts thought it could? We assess the impact of unexpected surprise in each KPI on stock returns following the announcement to evaluate whether some KPIs matter more to the market than others.

Download the industry report to learn more >