Analysts Predict a Bumpy Ride for Lumber and Used Car Prices

Along with the economy reopening, and accompanying financial and monetary stimulus, comes a pent-up demand for goods and services. Of course, that doesn’t necessarily align with the readiness of the supply chain to meet that demand in a timely manner. Within this environment, prices have begun to rise across the economy as evidenced by an increase in the Consumer Price Index (CPI). A key debate that is playing out in the media, as well as among investors and policymakers, is how much inflation we’ll experience and for how long. The latest CPI data for the month of June, issued by the U.S. Bureau of Labor Statistics, indicates a 5.4% increase from last year – the biggest surge of consumer prices since 2008.

In this article, we examine Visible Alpha’s granular consensus from several different angles to explore analysts’ expectations with regard to lumber and used car pricing.

Lumber: Three takeaways and consensus realized prices across the industry

The recent rise in lumber pricing has heavily impacted the housing market and everyday consumers. While lumber prices have now started to descend, they still remain elevated well-above pre-pandemic levels. We examined Visible Alpha’s consensus data for Weyerhaeuser (NYSE:WY), one of the largest lumber producers in the world, to see if analyst expectations could provide insight on these changes in prices, and how this would impact the industry.

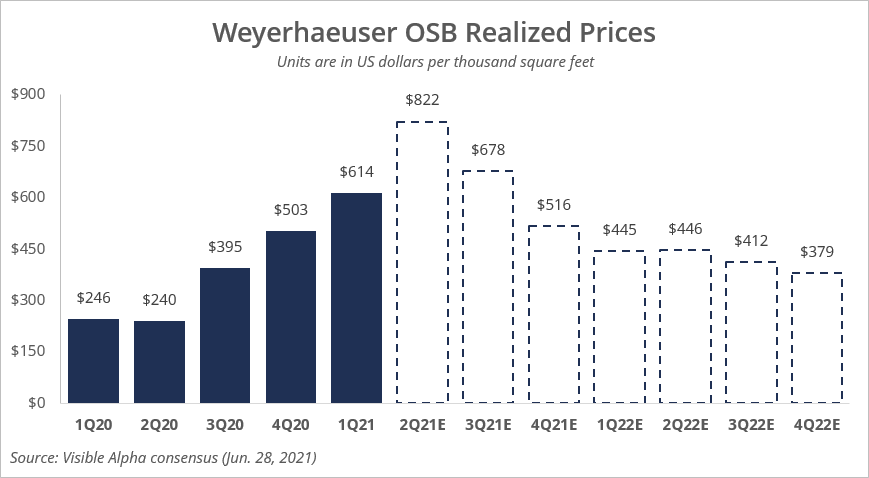

First, analysts expect lumber prices for Weyerhaeuser to continue to rise. Analysts forecast realized oriented strand board (OSB) pricing in 2Q21 to reach $822, or 242% higher than the same period last year, and 34% sequential growth from last quarter’s elevated levels.

Second, while analysts expect prices to taper off from 2Q’s peak levels later this year – dropping back to $516 by year end – they expect prices to remain more than 50%-100% above pre-pandemic levels throughout all of 2022.

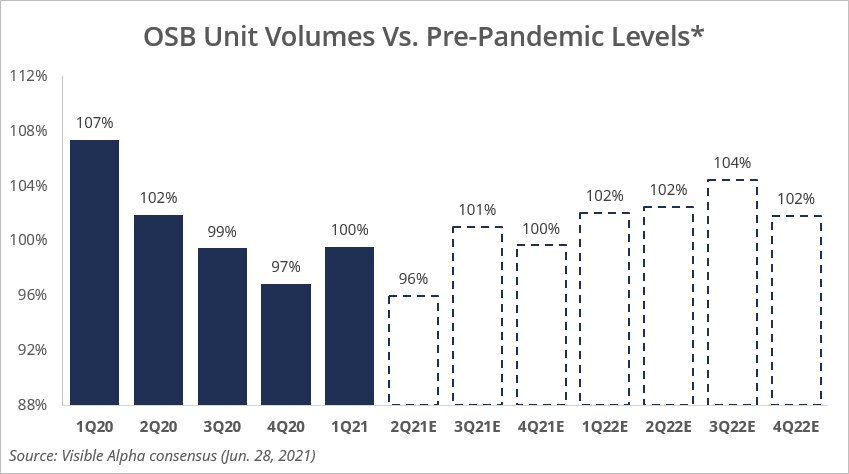

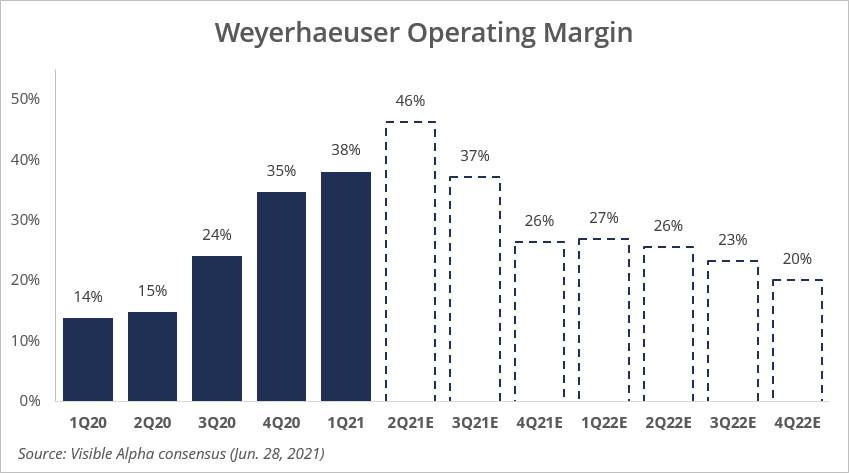

Third, while Weyerhauser volumes are not expected to recover until 3Q21, margins are currently benefiting from the higher pricing and are expected to remain strong for the full year.

* 2019 quarterly unit volumes are used for the pre-pandemic levels. 2Q21’s 96% means that 2Q21 volumes are expected to be 96% of 2Q19 volumes

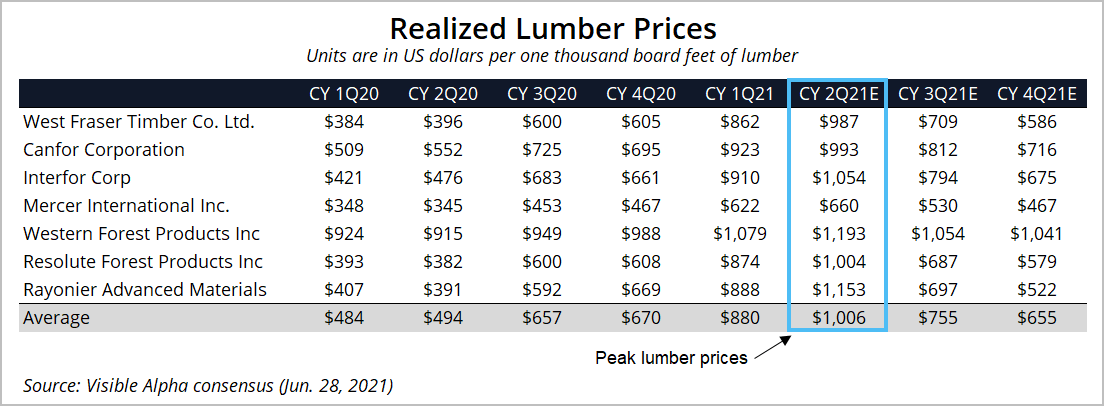

* Similar trends can be seen across other industry players such as West Fraser (NYSE:WFG) and Canfor (OTCMKTS:CFPZF). Glancing at the averages across the rest of the industry shows similar expectations in general lumber, where peak prices are expected in 2Q before falling in the second half of the year.

Similar trends can be seen across other industry players such as West Fraser (NYSE:WFG) and Canfor (OTCMKTS:CFPZF). Glancing at the averages across the rest of the industry shows similar expectations in general lumber, where peak prices are expected in 2Q before falling in the second half of the year.

Used cars: A pricing pattern somewhat similar directionally to lumber

While lumber and used cars might not naturally occur in salt-and-pepper pairs in watercooler conversation, in the case of recent pricing changes, used cars look similar directionally in some ways to lumber.

Consumers are reporting much higher pricing on used cars. For Carvana (NYSE:CVNA), one of the largest used car vendors in the nation, analyst expectations differ greatly within the retail and wholesale channels.

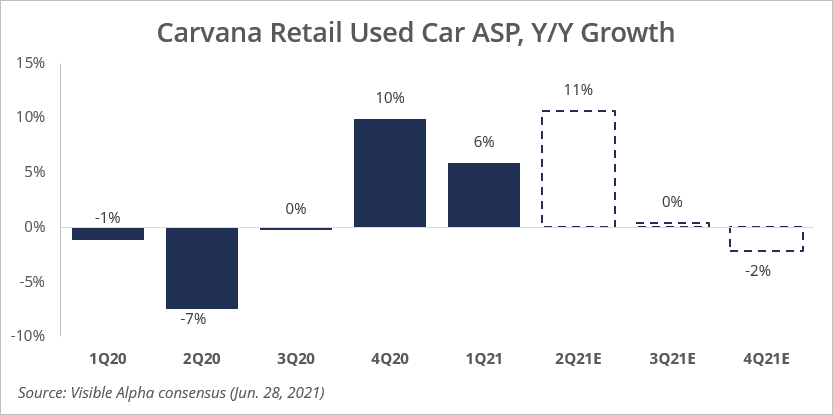

Within retail, pricing expectations are relatively muted on average. Analysts expect prices to increase by 11% year over year in 2Q21 – a sizable increase, but a much lower growth rate than what was seen in lumber and what might be suggested based on media reports. Beyond 2Q, analysts expect prices to stop growing in 3Q and to decline in 4Q.

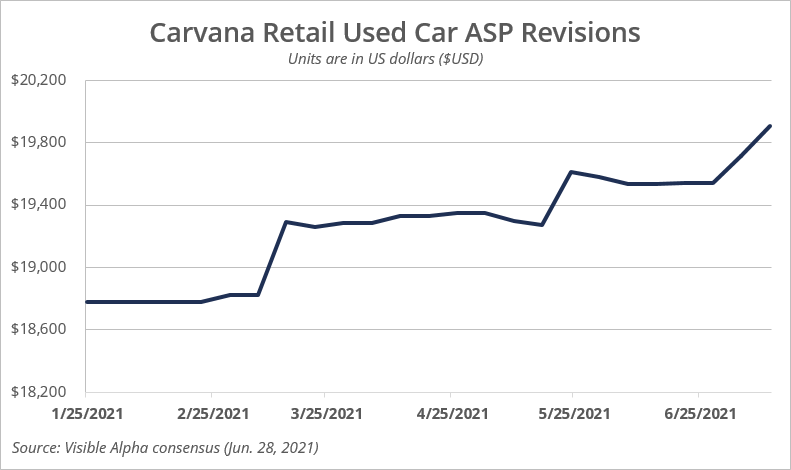

However, the consensus increase of 11% hides a more complex story. Analysts disagree widely on what used car pricing will be in retail for 2Q, with estimates as low as a 5% increase and as high as a 33% increase. Revisions over the last four months have also increased significantly from a 5% increase to the current 11%. As we approach 2Q earnings, consensus could continue to fluctuate as analysts fine tune their estimates.

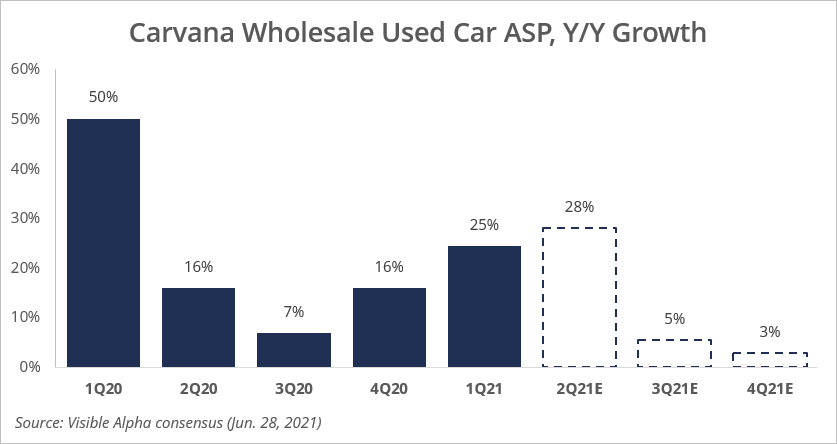

Within wholesale, we find much higher pricing expectations. Four of the last five quarters have seen increases of at least 16%, and analysts expect another large increase in 2Q21 of 28% before beginning to taper back down in the second half of the year.

Will inflation have staying power in 2021? While no one can say with complete certainty when inflation might take its leave, Visible Alpha’s consensus data and analyst estimates on lumber and used car pricing may help to suggest its possible trajectory and stamina.

This content was created using Visible Alpha Insights.

Visible Alpha Insights is an investment research technology platform that provides instant access to deep forecast data and unique analytics on thousands of companies across the globe. This granular consensus data is easily incorporated into the workflows of investment professionals, investor relations teams and the media to quickly understand the sell-side view on a company at a level of granularity, timeliness and interactivity that has never before been possible.