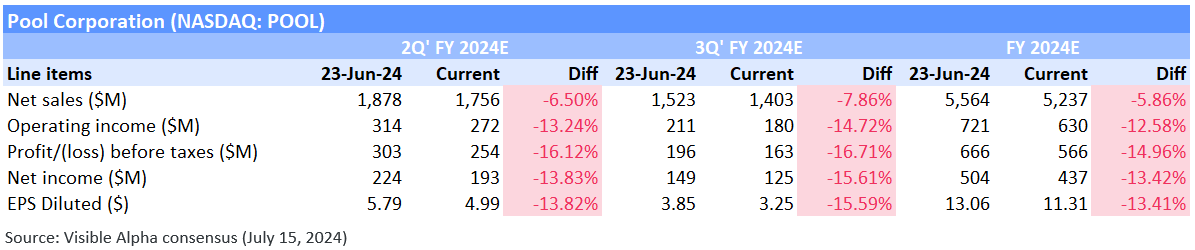

On June 24, U.S.-based Pool Corporation (NASDAQ: POOL), a distributor of swimming pool supplies and equipment, revised its 2024 earnings guidance amid slower demand during the swimming pool season. With peak selling season almost complete, the company now expects new pool construction activity to be down 15% to 20% in 2024 vs the prior year, with remodel activity down approximately 15%. Following the announcement, Visible Alpha consensus estimates show analysts have significantly revised estimates for Pool Corporation. For the upcoming second-quarter earnings, the company’s net sales are expected to decline by -5% year over year, with the company generating $1.8 billion in net sales, down -6.5% from the $1.9 billion estimated prior to the revised guidance.

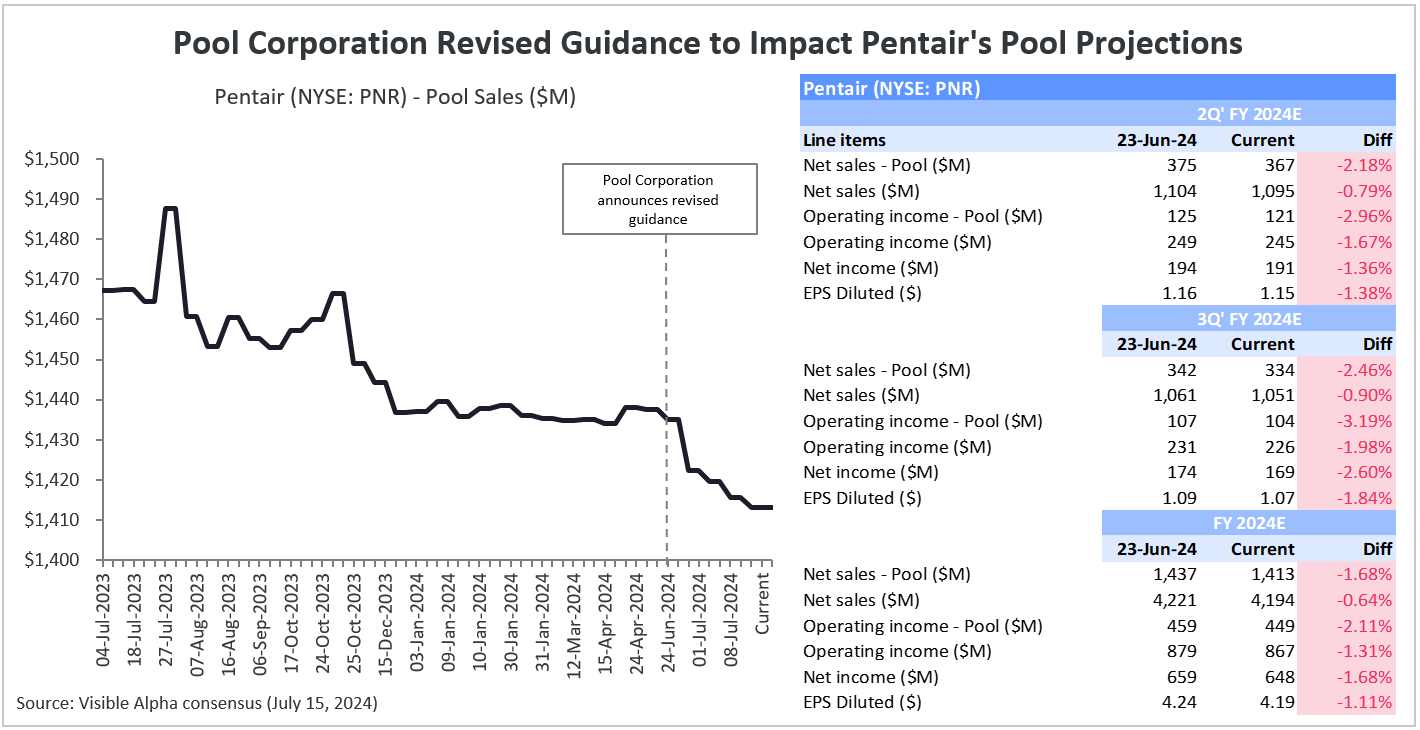

Pool Corporation is the largest distributor of Pentair’s (NYSE: PNR) pool equipment. Following the revised guidance by Pool, analysts have also revised their projections for Pentair’s pool segment, which accounts for approximately 34% of the company’s net sales. For the upcoming quarter, Pentair is now expected to generate $367 million in pool sales, down -2.2% from the earlier estimate of $375 million, before Pool Corporation’s revised guidance.

Pentair is set to report second-quarter results on July 23, with Pool Corporation following on July 25.

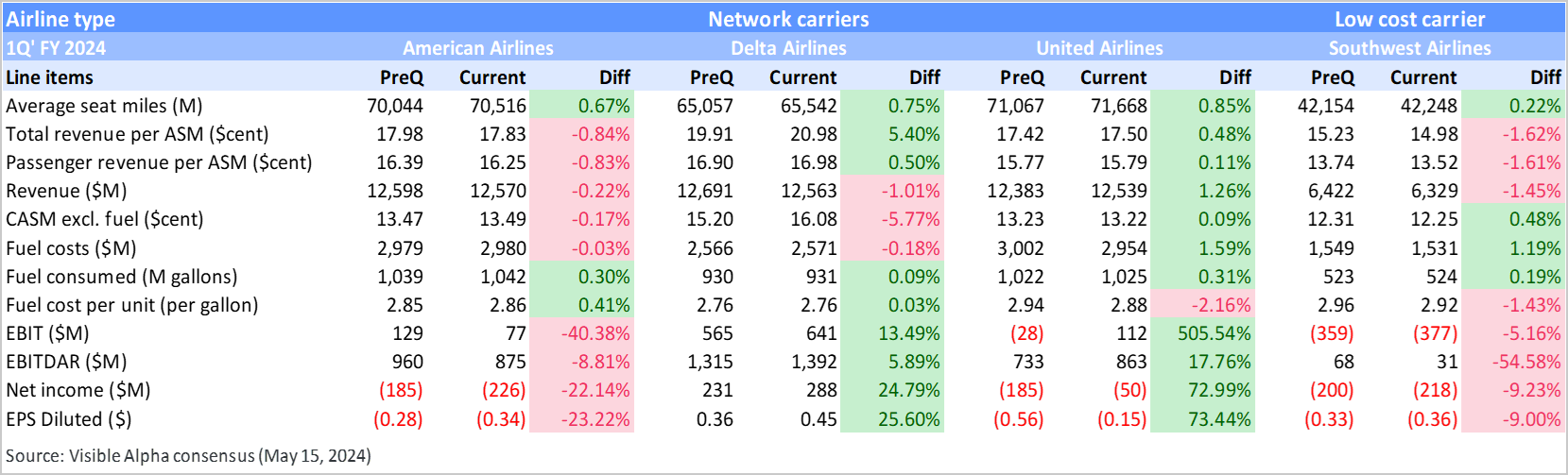

Leading U.S. airlines — American Airlines (NASDAQ: AAL), United Airlines (NASDAQ: UAL), Delta Air Lines (NYSE: DAL), and Southwest Airlines (NYSE: LUV) — reported their first-quarter earnings in April 2024. Here’s a recap of those earnings releases, key takeaways, and the resulting shifts in analysts’ estimates, based on Visible Alpha consensus.

United Airlines exceeded analyst expectations in the first quarter of 2024, beating the Visible Alpha pre-1Q EPS consensus by 73.4%. Delta Airlines also performed well, surpassing EPS expectations by 25.6%. Although American Airlines fell short of EPS expectations by -23%, it provided a promising second-quarter EPS guidance of $1.15-1.45, exceeding pre-1Q estimates by 10.8%. Conversely, the low-cost carrier Southwest Airlines missed analyst expectations across all key metrics, falling short of EPS expectations by -9%.

Figure 1: 1Q 2024 consensus pre-Q estimates, actuals, and surprises

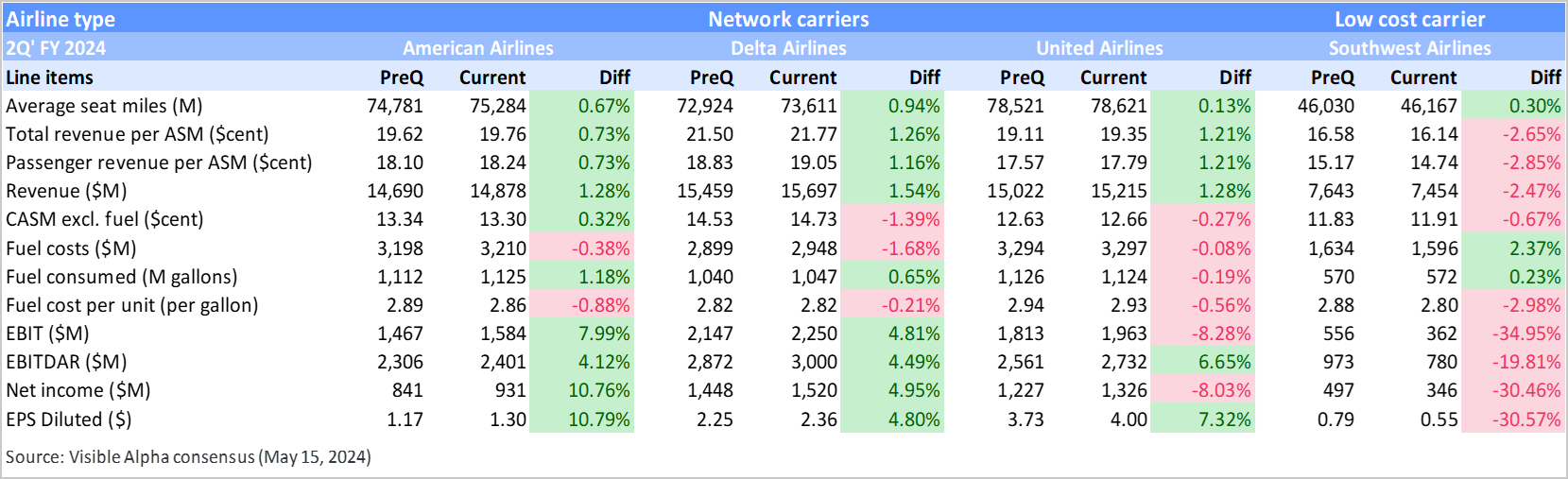

After the first quarter release, all network carriers have provided positive and better-than-expected guidance for the second quarter and the full year. However, expectations for the low-cost carrier Southwest Airlines have decreased due to its disappointing performance in the first quarter.

As shown in Figure 2 below, analysts have raised the 2Q 2024 EPS expectations for network carriers as follows:

- American Airlines: up by 10.79%

- United Airlines: up by 7.32%

- Delta Airlines: up by 4.8%

For the full year (Figure 3), EPS expectations have increased as follows:

- American Airlines: up by 7.29%

- United Airlines: up by 8.95%

- Delta Airlines: up by 2.73%

In contrast, analysts have lowered EPS estimates for Southwest Airlines by -30.57% for the 2Q and by -22.74% for the full year.

Figure 2: 2Q 2024 consensus estimate revisions

1Q 2024 Earnings Review

American Airlines

According to Visible Alpha consensus, American Airlines’ total revenue fell short of analyst expectations by $28 million, coming in at $12.6 billion. This shortfall was due to heightened competition in key markets, which affected the airline’s yields and load factors, thereby impacting unit revenue. The airline also reported a net loss of $226 million, primarily due to increased fuel expenses and other operational costs.

Despite these challenges, analysts are optimistic for the forecast period. The company plans to enhance its premium offerings and expects to save around $400 million in costs for 2024. For the upcoming quarter, analysts expect total revenue to increase by 5.9% year over year and 18% sequentially. For the full year, analysts estimate revenues will grow by 5.5%, reaching $55.7 billion.

Delta Air Lines

Total revenues for the first quarter were slightly below expectations, missing by -1.01%, at $12.6 billion compared to the pre-quarter consensus of $12.7 billion. However, Delta exceeded expectations across all other key metrics, driven by a rebound in corporate travel and strong demand for domestic and premium travel. For the upcoming quarter, analysts expect total revenue to increase by 7.4% year over year and by 25% sequentially. For 2024, analysts project revenues to rise by 7.2%, reaching $58.6 billion.

United Airlines

First-quarter revenues exceeded expectations by $156 million. United also surpassed EPS expectations, driven by stronger-than-anticipated revenue and unit costs in line with projections. Demand remained robust throughout the quarter. The grounding of Boeing MAX 9 had a $200 million impact on the airline’s profit, but overall performance was bolstered by strong travel demand and adjustments in domestic capacity, particularly through increased availability of domestic premium seats. For the second quarter, total revenue is expected to increase by 7.3% year over year and 21% sequentially, reaching $15.2 billion. For 2024, analysts estimate revenues to be up +7.5% to $57.7 billion.

Southwest Airlines

Southwest Airlines fell short of analyst expectations in the first quarter due to weak unit revenue. Revenue for the quarter was below the Visible Alpha consensus estimate, coming in at $6.3 billion against expectations of $6.4 billion. The company also reported a net loss of $218 million. The weakness in revenue per available seat mile (RASM) during the first quarter of 2024 was caused by lower-than-expected last-minute leisure travel demand and underperforming markets that didn’t grow as anticipated. The airline revised its full-year 2024 guidance downward, citing delays in Boeing aircraft deliveries.

Figure 3: FY 2024 consensus estimate revisions

Nvidia’s Data Center Dominance; RTX’s Jet Grounding Impact on Earnings; Lundin’s Copper Mine Acquisition

In our weekly round-up of the top charts and market-moving analyst insights: the move to accelerated computing is driving Nvidia’s (NASDAQ: NVDA) data center segment growth; analysts lower earnings and FCF projections for RTX (NYSE: RTX) after Airbus jet grounding announcement; Lundin Mining’s (TSE: LUN) copper mine acquisition is poised to boost production and cut costs.

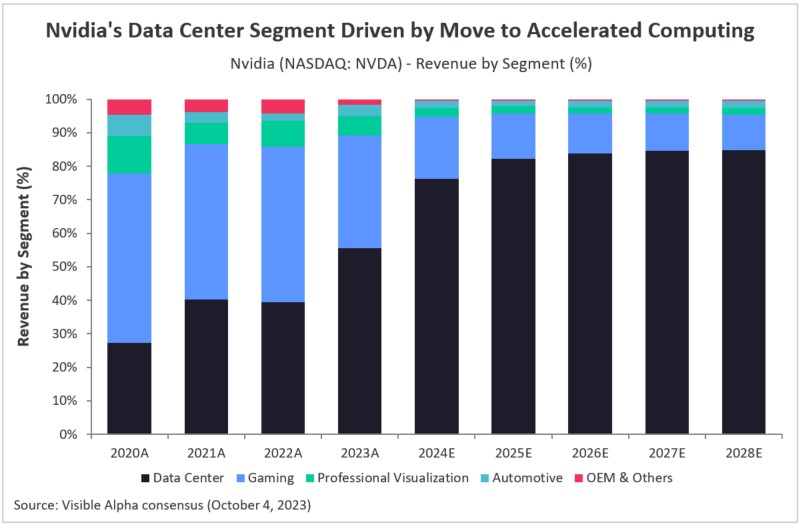

Nvidia’s Data Center Segment Driven by Move to Accelerated Computing

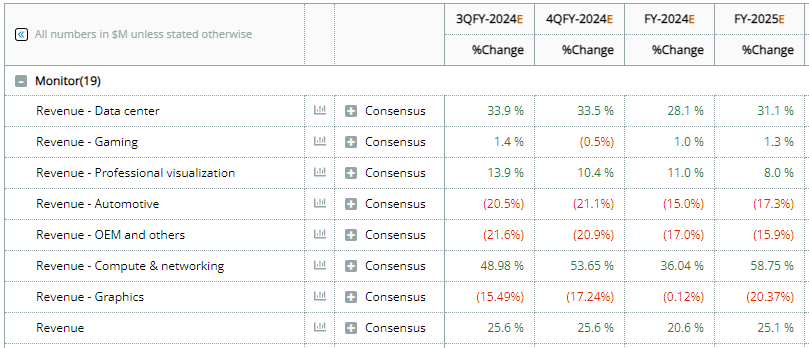

Generative AI’s (GAI) continuing move toward accelerated computing has created a sharply increased demand for Nvidia’s (NASDAQ: NVDA) data center platform, especially its data center GPUs (graphics processing units).

According to Visible Alpha’s consensus, analysts expect the data center segment to account for 76.1% of Nvidia’s total revenue in fiscal 2024, a substantial increase from 55.6% in 2023. Nvidia’s total revenue is estimated to rise by 103% year over year in fiscal 2024, primarily driven by an estimated 178% year-over-year increase in data center revenue. Revenue generated from the data center segment in 2024 is projected to reach $41.7 billion in FY 2024 from $15 billion in FY 2023. Analysts also expect the company overall to generate $26.9 billion in operating income in 2024, up from $4.2 billion in 2023.

To learn more about Nvidia’s latest developments and insights following the company’s Q2 FY2024 earnings report, explore our Post-Q2 FY2024 Earnings Update on Nvidia.

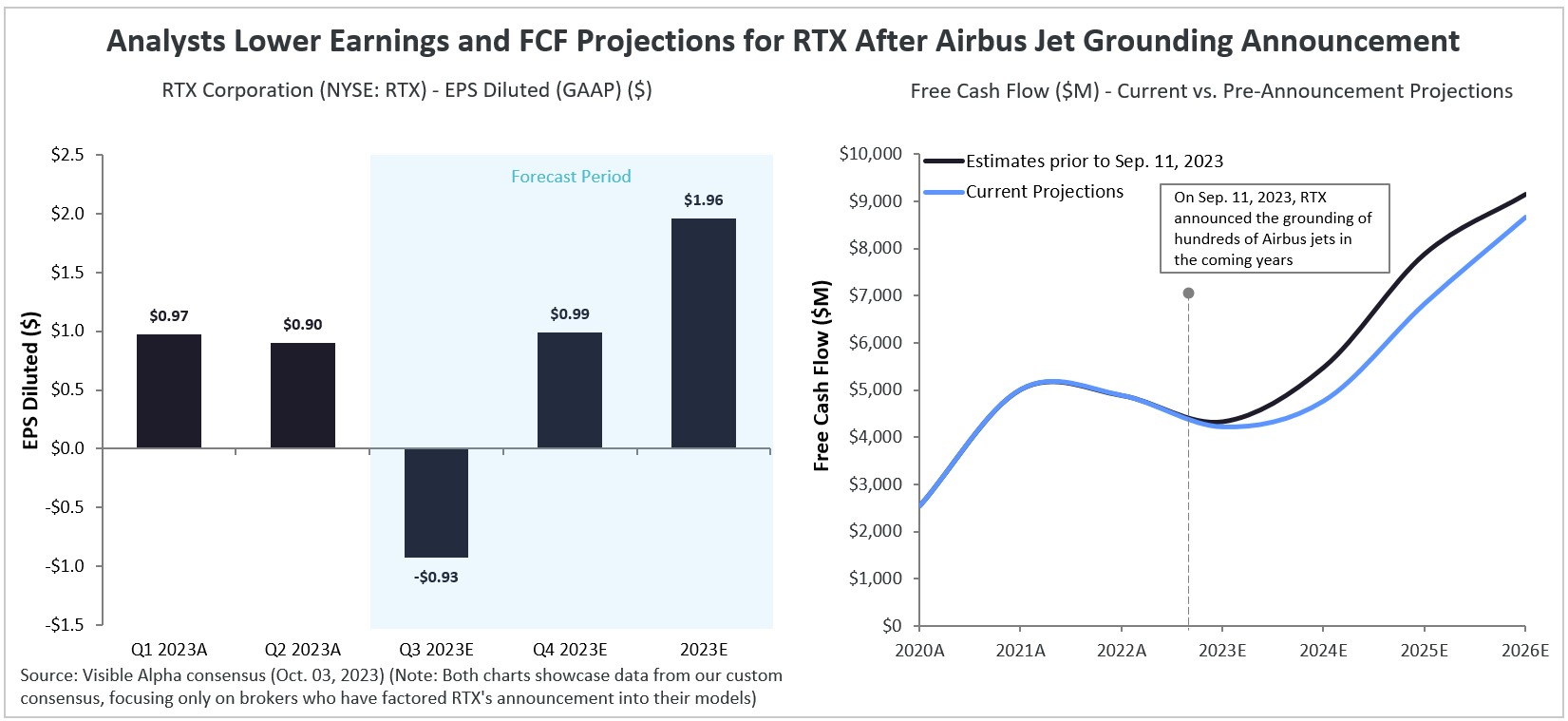

Analysts Lower Earnings and FCF Projections for RTX After Airbus Jet Grounding Announcement

RTX Corporation (formerly Raytheon Technologies) (NYSE: RTX), the U.S. aerospace and defense company, announced on September 11, 2023, the grounding of an estimated 600-700 of its Pratt & Whitney Geared Turbofan (GTF) engines from Airbus A320neo jets. The reason for the grounding is to conduct quality inspections between 2023-2026 due to a manufacturing flaw. RTX operates through four segments: Collins Aerospace, Pratt & Whitney, Raytheon Intelligence & Space, and Raytheon Missiles & Defense, and this issue primarily impacts the Pratt & Whitney segment of the company.

As a result, analysts have adjusted their EPS and free cash flow expectations downward, with a projected decrease in diluted EPS (GAAP) of -44% year over year and free cash flow of nearly -14% year over year in 2023, according to Visible Alpha consensus estimates. Analysts expect an operating loss of -$1.25 billion in 2023 for the company’s Pratt & Whitney segment, but recovery is expected to commence starting in 2024. (Note: These data points are from Visible Alpha’s custom consensus, focusing only on brokers who have factored RTX’s announcement into their models.)

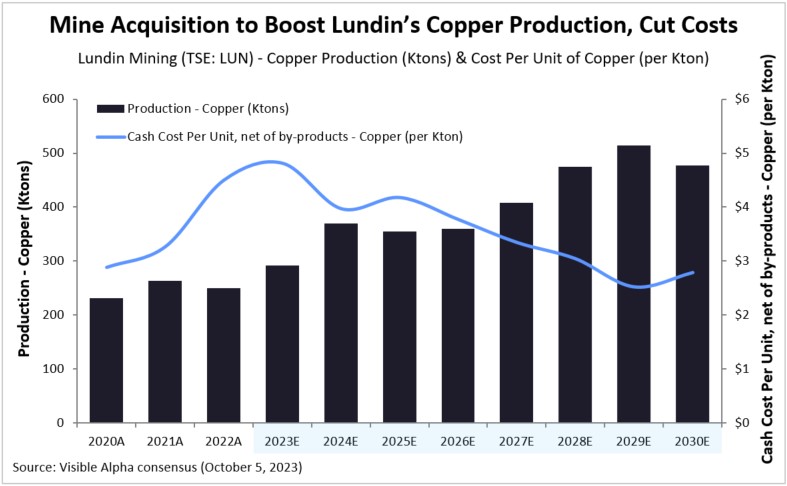

Mine Acquisition to Boost Lundin’s Copper Production, Cut Costs

Toronto-based mining company Lundin Mining (TSE: LUN) made a significant move in July 2023 by acquiring a 51% ownership stake in SCM Minera Lumina Copper Chile, which operates the Caserones copper-molybdenum mine in Chile. This mine is strategically located just around 100 kilometers away from Lundin’s Candelaria operation in Chile and only 20 km from its Josemaria project, located across the border in Argentina.

Based on Visible Alpha consensus estimates, following the acquisition, Lundin’s cash cost per unit net of by-products – copper (per Kton) is projected to trend downwards starting in 2024, while copper production volume is expected to pick up. The geographic proximity among the three mines is expected to create opportunities for synergies in terms of supply, logistics, and management. Analysts anticipate that these synergies will result in cost reductions for the company as shared resources and infrastructure are efficiently optimized. In 2024, copper production is projected to ramp up to 370 Ktons from an expected 292 Ktons in 2023 (+26.5% expected year-over-year). Meanwhile, cash cost per unit, net of by-products, is estimated to be $3.98 per Kton of copper in 2024, down from a projected $4.82 per Kton in 2023 (-17.5% expected year-over-year).

Bringing AI to Heavy Industry

Key Takeaways

|

The move to accelerated computing could have the potential to enable deeper integration of AI into heavy industry. How could this impact companies that adopt and scale innovative solutions to their manufacturing processes?

As we’ve seen already, this move to accelerated computing in data centers has been underpinning the investment story for Nvidia. As Cloud Service Providers (CSP) and consumer internet companies have raced to transform their data centers from general purpose computing to accelerated computing, the platform shift has opened questions about the broader, longer-term implications of moving from the CPU (central processing unit) to the GPU (graphics processing unit).

Figure 1: Upward revenue revisions (%) for Nvidia (NASDAQ: NVDA) segments

Source: Visible Alpha Insights (September 14, 2023)

Accelerated computing enables faster data processing with lower power consumption. In addition to speed and energy efficiency, accelerated computing is highly optimized for specific tasks, making it easier to scale tasks that can be parallelized (i.e., big data applications), making it ideal for AI/ML, modeling, and graphics. Generative AI (GAI) is currently used mainly by light industry (information, words, images, and music), but not broadly by heavy industry as of yet.

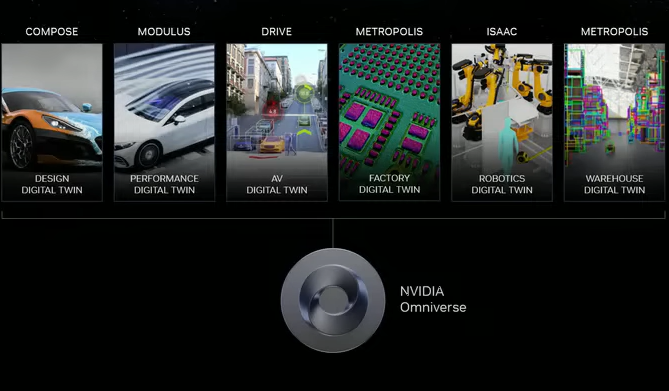

This platform move has the potential to enable deeper integration of AI/ML to heavy industry and to provide a foundation for the broader use and application of robotics. At Computex 2023, Nvidia CEO Jensen Huang highlighted the Omniverse and how the Digital Twin will provide a virtual environment for replicating environments and situations ideal for testing automation.

The Digital Twin can be applied to many industrial scenarios and help manufacturers manage risks and deliver more precise results and, ultimately, more impactful solutions. For example, a factory may wish to personalize parts of its assembly and want to test this in a virtual factory or want to have greater visibility into the timing of its supply chain.

Figure 2: The Digital Twin

Source: Nvidia Keynote at Computex 2023

Virtual factory: Digitalizing heavy industry

Back in October 2016, Nvidia (NASDAQ: NVDA) and Fanuc (TSE: 6954) teamed up to build AI-powered factory robots with GPU-accelerated deep learning in the cloud. Given the innovations with the Omniverse, manufacturing, factory automation and industrial robotics may begin to show new capabilities.

According to Huang, the $45 trillion global manufacturing industry is racing to have its factories become software defined to ensure they can produce products with quality and speed, and as cost efficiently as possible. The application of AI via software to manufacturing can support these objectives.

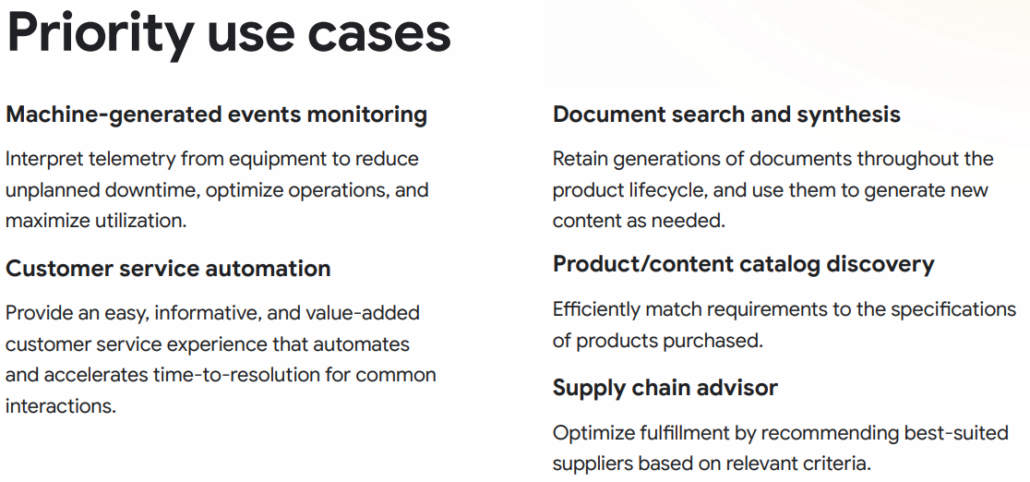

Figure 3: GAI use cases for manufacturing

Source: Google Cloud GAI Use Cases for Manufacturing

By leveraging one unified source of data across the company, teams can virtually design, build, and operate a factory before actually breaking ground. In the Omniverse, teams can start by building a Digital Twin of their factory, unifying siloed datasets to provide a real-time view of their factory data to their planning teams, stakeholders, and suppliers. In the cloud, native Digital Twin planners can then optimize the factory virtually before deploying changes to the real factory.

Figure 4: Factory simulation in a Digital Twin

Source: Nvidia Keynote at Computex 2023

Fully autonomous robots can be trained on complex tasks entirely in simulation and operations can be validated before deployment to the real world. This process has the potential to significantly help manufacturers reduce risks, improve efficiency, and reduce cost in heavy industries like automotive and electronics manufacturing.

Companies and expectations

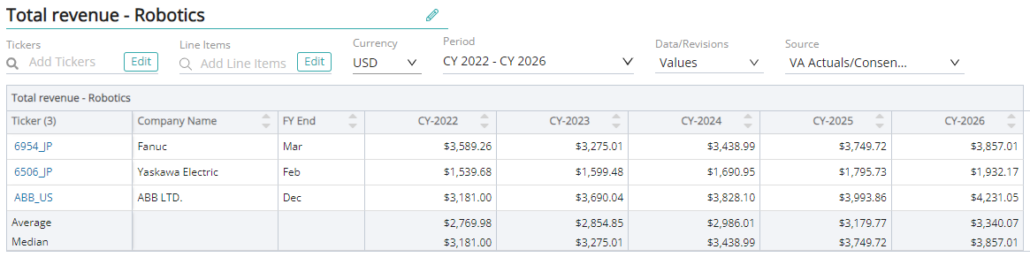

There are several players in the factory automation and industrial robotics space. Based on Visible Alpha data, growth and profitability vary among the players. Additionally, China’s slowing, foreign exchange impacts, and product cyclicality have created some volatility in the pace and outlook for growth. However, with the consensus outlook looking cautious, could this be an interesting time to revisit these names, given the broader industry trends?

Figure 5: Peer analysis of robotics revenue in U.S. dollars

Source: Visible Alpha Insights (September 14, 2023)

How these firms integrate some of the new AI capabilities to the brain of the robot and to aspects of automation will be critical to the investment story and outlook. The potential growth could be significant for companies that adopt and scale innovative solutions to their manufacturing processes. Additionally, based on the platform shift to accelerated computing, Nvidia seems well-positioned to support the tech stack and data unification that needs to happen to embed AI more holistically into the manufacturing process and to the supply chain.

- Will these innovations drive a scalable new product cycle?

- Will these manufacturing enhancements have higher price points and margins?

- Which companies are positioned to benefit longer term?

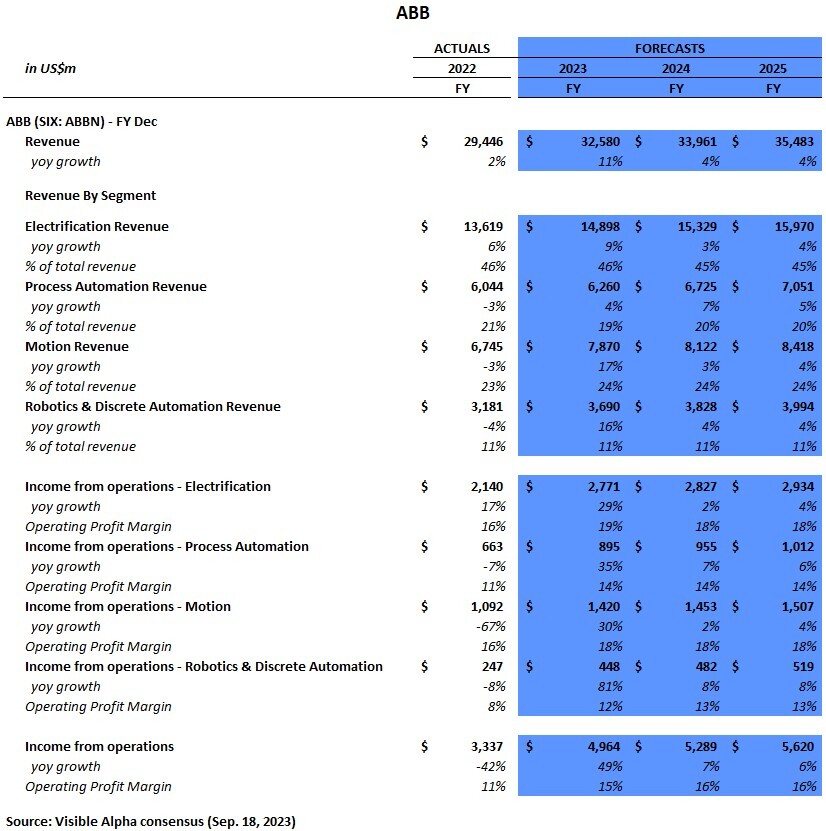

ABB: Sweden/Switzerland-based ABB (SIX: ABBN) has a leading electrification, robot, automation, and motion portfolio that it connects to software to drive better performance.

ABB is projected to generate a 16% margin, driven by its higher margin Electrification and Motion segments, but revenue growth is only projected to be 4% for FY 2024 and FY 2025. Could longer-term innovations in factories drive an uptick to numbers?

Figure 6: ABB segment revenue and income consensus

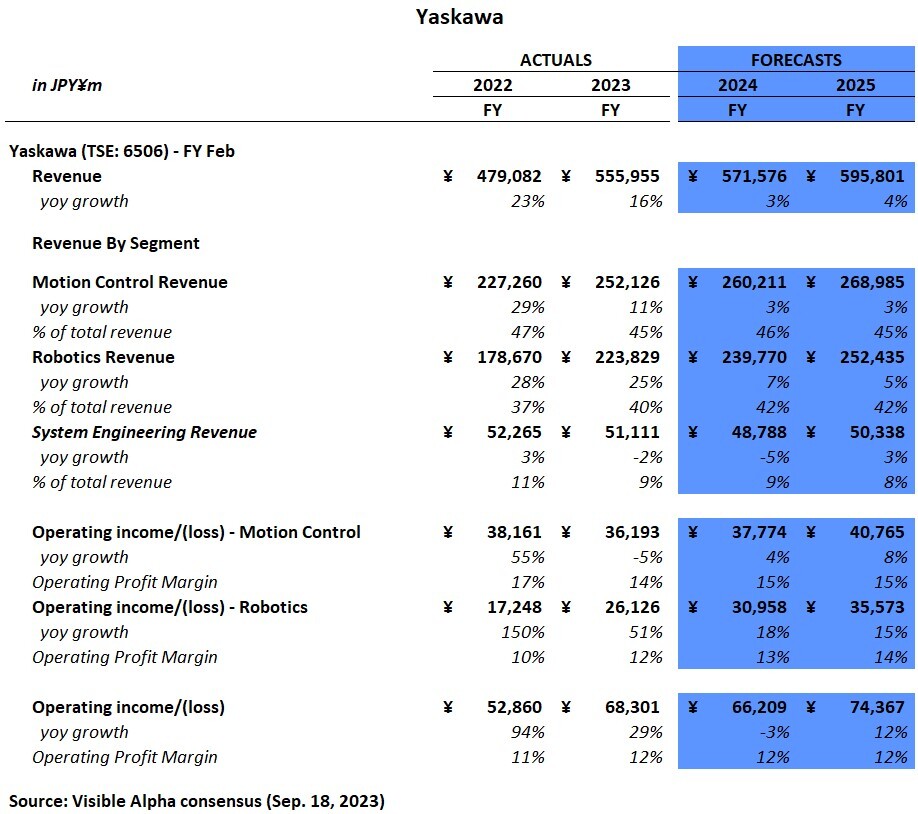

Yaskawa: Japan-based Yaskawa (TSE: 6506) is a leading manufacturer of motion controls and robotics for the automobile, semiconductor, food and biotech industries.

Similar to ABB, Yaskawa is projected to generate a 12% margin, driven by its higher margin Robotics and Motion segments. While the revenue and profitability growth of its robotics segment is expected to outperform other segments, the company overall is expected to see mild growth till FY 2026. Could longer-term expectations be overly cautious given the shift toward AI?

Figure 7: Yaskawa segment revenue and income consensus

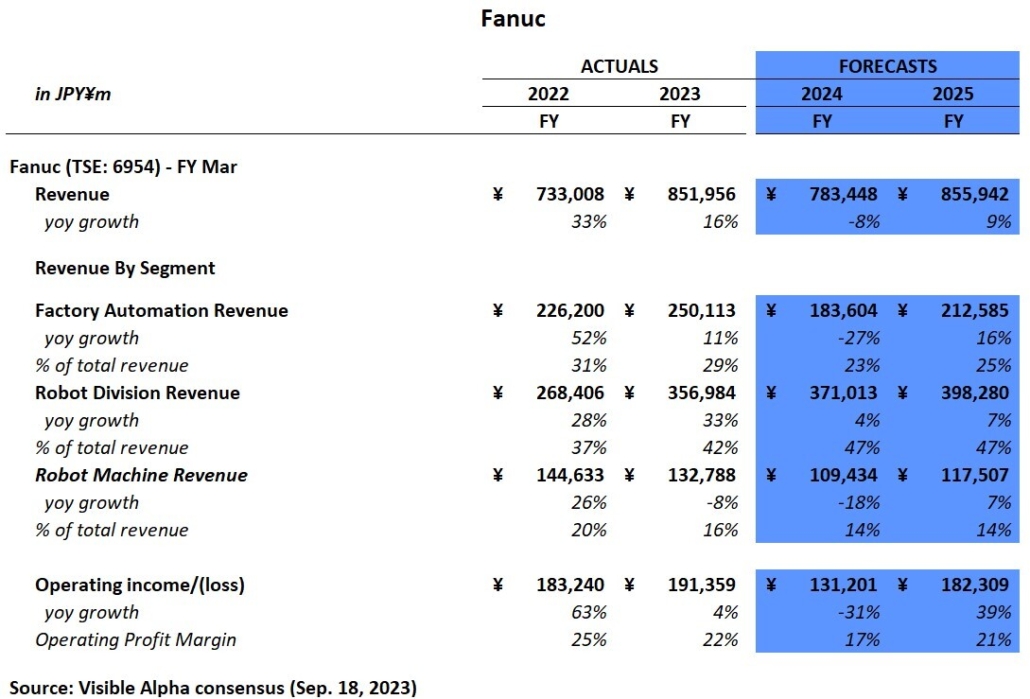

Fanuc: Japan-based Fanuc (TSE: 6954) is a global leader in factory automation and robotics. Fanuc is the clear leader for profitability in automation and robotics with over 20% operating profit margins expected. With enhancements to robotics and factory automation, could Yaskawa, ABB and Kuka (Midea) catch up to Fanuc? Could Fanuc’s projected margins return to their FY 2022 level of 25%?

Figure 8: Fanuc segment revenue and income consensus

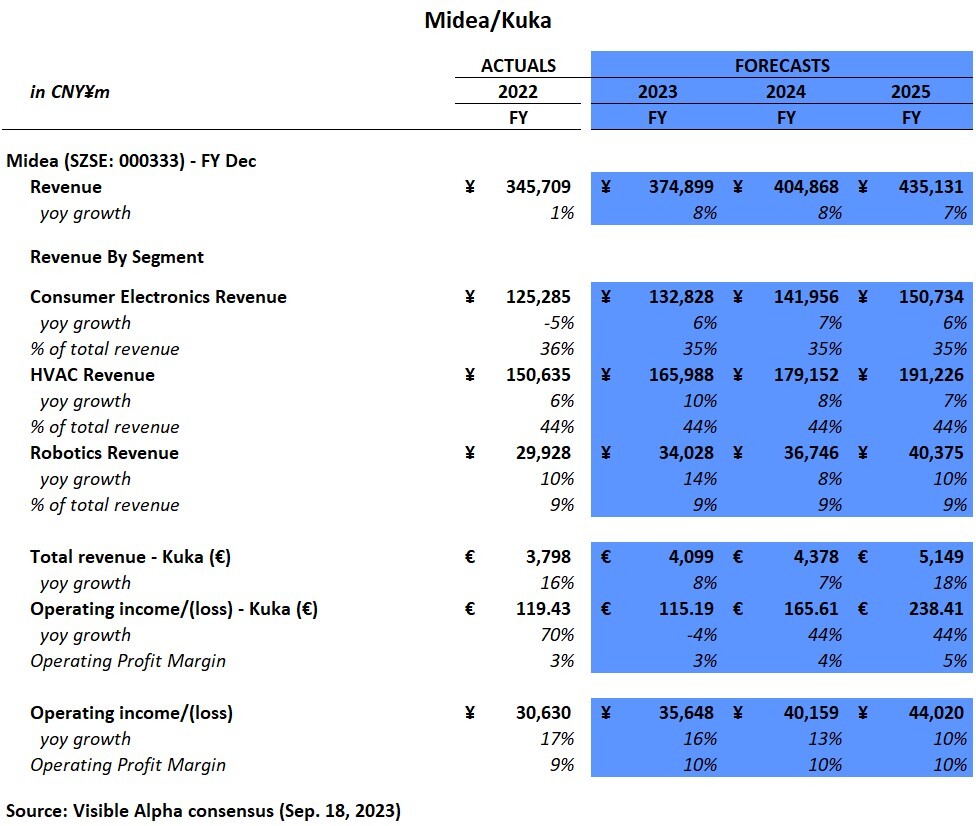

Midea (Kuka): Midea (SZSE: 000333) is an electrical appliance manufacturer based in China. Leading German-based robotics firm, Kuka, was acquired by Midea in 2016.

Figure 9: BMW factory simulation using Kuka robots

Source: Nvidia Keynote at Computex 2023

Kuka’s margins remain well-below both Midea’s 10% margin and the 15-20% ranges of competitors. Will parent company Midea be able to drive margin expansion at Kuka?

Figure 10: Midea (and Kuka) segment revenue and income consensus

Cruise Lines Pick Up; Mortgage Rates Hit UK Homebuilding; FedEx Drives Growth; FDA Approves Hemophilia Therapy

In our weekly round-up of the top charts and market-moving analyst insights: Cruise lines continue post-pandemic recovery; rising mortgage rates hit UK home builders in 2023; FedEx (NYSE: FDX) drives toward margin growth in 2024; BioMarin’s (NASDAQ: BMRN) Roctavian is the first FDA-approved gene therapy for hemophilia A.

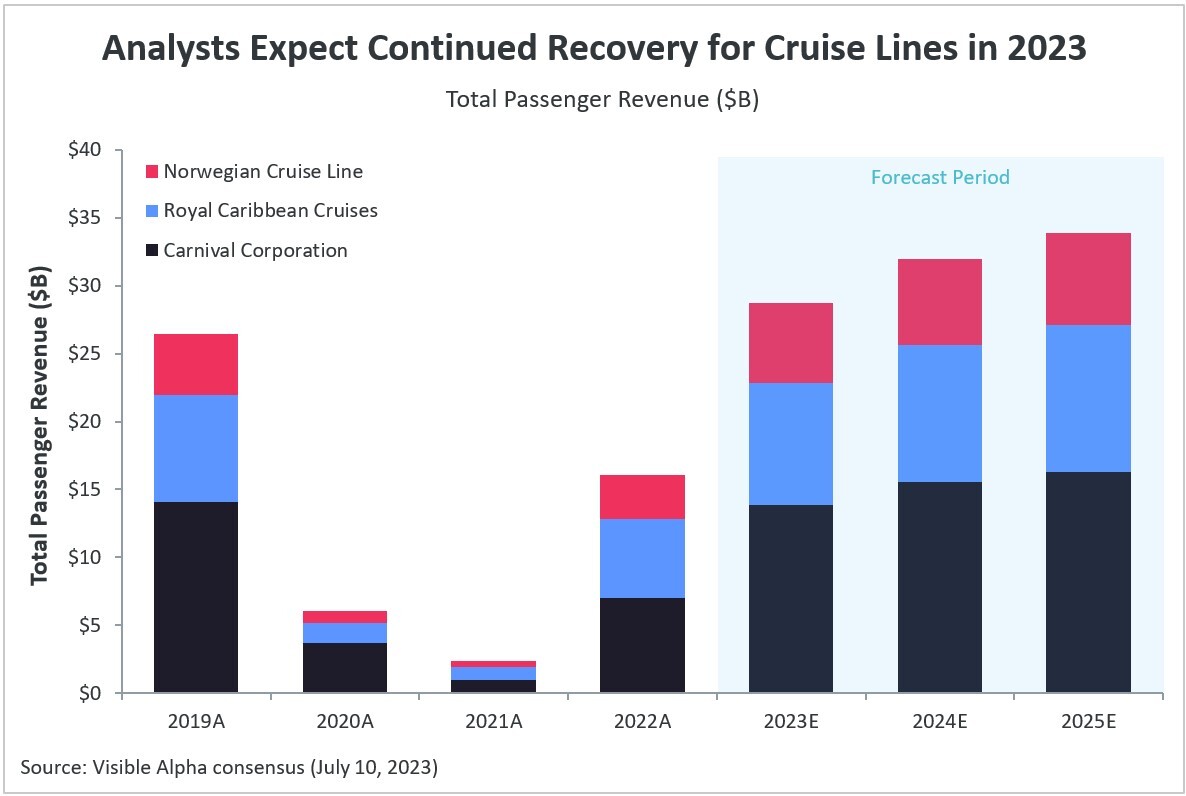

Analysts Expect Continued Recovery for Cruise Lines in 2023

Cruise companies that were heavily impacted in the past few years by the Covid-19 pandemic are expected to see a continued recovery, with 2023 revenues and bookings anticipated to exceed pre-pandemic levels for the first time since 2019.

For Carnival Corporation (NYSE: CCL), Royal Caribbean Cruises (NYSE: RCL), and Norwegian Cruise Line (NYSE: NCLH), analysts project passenger traffic to continue recovering sharply in 2023, with total passenger revenue year-over-year expected to be up 97%, 55%, and 80% respectively, based on Visible Alpha consensus.

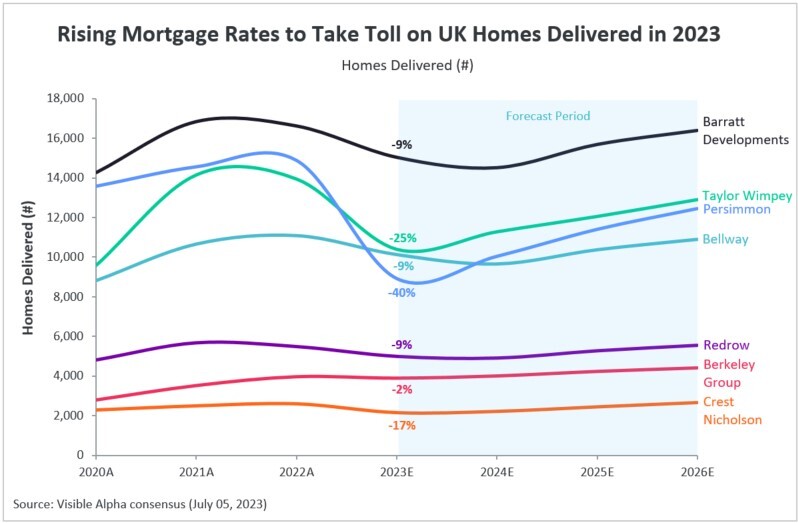

Rising Mortgage Rates to Take Toll on UK Homes Delivered in 2023

Analysts project a substantial decrease in the number of homes delivered by prominent UK home-building companies in 2023, fueled by surging mortgage rates.

Among the companies affected the most, Persimmon (LSE: PSN), Taylor Wimpey (LSE: TW), and Crest Nicholson (LSE: CRST) are expected to see year-over-year declines of 40%, 25%, and 17%, respectively, in the number of homes delivered in 2023.

The peak of home deliveries for leading players was seen in 2021-22. Analysts expect some of these companies to regain their previous peaks by 2026.

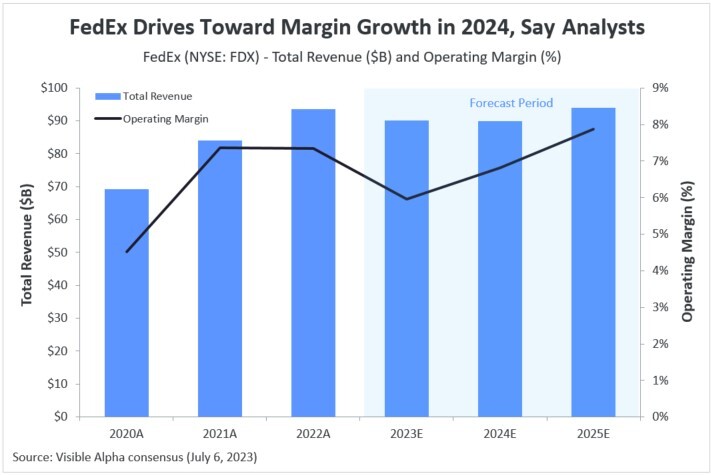

FedEx Drives Toward Margin Growth in 2024, Say Analysts

FedEx (NYSE: FDX) aims to save $4 billion by the end of FY 2025 through its DRIVE cost-cutting campaign to boost profits and margins.

According to Visible Alpha consensus, analysts expect operating margin growth for FedEx starting in 2024, following cost-cutting measures and an anticipated fuel price decline.

Revenue is projected to decrease by 3.5% to $90.2 billion in 2023, compared to $93.5 billion in 2022, with an operating margin of 6.0%, down from 7.3% in 2022. However, a rebound is expected starting in 2024, with a projected operating margin of 6.8%, followed by 7.9% in 2025.

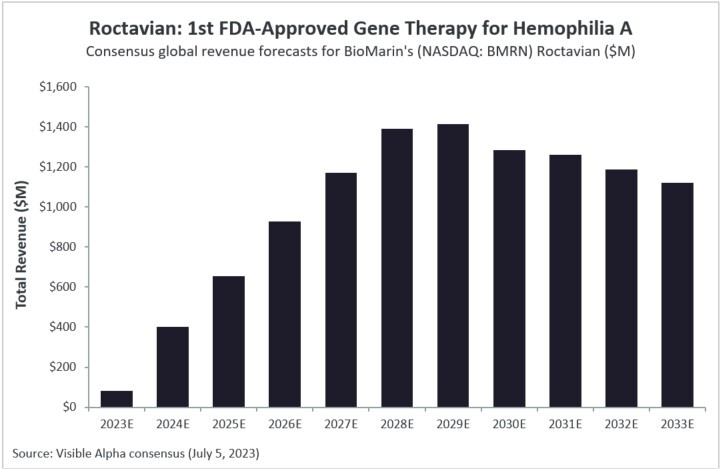

Roctavian: 1st FDA-Approved Gene Therapy for Hemophilia A

On June 29, 2023, the FDA approved Roctavian, the first approved gene therapy for hemophilia A, an inherited bleeding disorder. Roctavian, a one-time infusion developed by BioMarin Pharmaceutical (NASDAQ: BMRN) is a major advancement in the treatment of hemophilia A.

Visible Alpha consensus revenue estimates show peak global sales of $1.4B in 2029. The cost of treatment is $2.9M per patient, but rebates and discounts bring the price down to $1.9M.

There are approximately 6,500 hemophilia A patients in the U.S., and about 2,500 will be eligible for treatment with Roctavian.

Generac’s Generator Headwinds; Alibaba’s Cloud Growth; Boeing & Airbus Sell Larger Planes

In our weekly round-up of the top charts and market-moving analyst insights, Generac’s generators are facing a potentially steep drop in residential sales, Alibaba’s computing and infrastructure sales appear poised to double, and wide-body aircraft deliveries from both Boeing and Airbus are expected to take-off.

Auto Manufacturing: Supply Chains, Chips, and Other Challenges

Weakness. Disruption. Delay. Failure. These are the words commonly associated with industry supply chains today. The pandemic threw supply and demand, transport, and production into disarray, and current events still show little sign of relenting. Initial confidence had supply chains restoring and recovering themselves as the economy rebalanced. Today, inflation, the threat of recession, and deteriorating, if not broken, supply chains continue to cause problems for a global economy struggling to recover, and no industry is taking more hits than auto manufacturing.

Airlines: Chaos and Consensus

Summer headlines are littered with tales of chaotic air travel and disgruntled travelers. With frequent cancellations, extended delays, stranded passengers, extraordinary flight change incentives, new Covid-related restrictions, economic instability, and an ongoing pilot shortage, the airline industry’s turbulent recovery collided with pent-up travel demand just in time to wreak havoc on the summer travel season.

Higher Container Rates, Fuel Costs Revisions Lead Target’s Margin Warning

Target (TGT) recently lowered its 2022 guidance for operating margins, citing excess inventory and higher transportation costs. Target’s statements echo what other retailers, such as Walmart, have said –- supply chain disruptions and higher transportation costs are beginning to crimp margins. Target’s newly revised guidance calls for 2Q operating margins to be around 2%, rising to 6% in the second half of 2022. According to Visible Alpha consensus, analysts are currently estimating that 2022 operating margins will be around 5.1%, down from over 8% when forecasted in May.

Multiple and intermittent waves of disruption have impacted the home building industry in recent years. After more than two years of Covid-induced upheaval, home buyers and builders are now grappling with decades-high inflation. Furthermore, the U.S. Federal Reserve’s policy interest rate hike to tackle inflation is, in turn, raising mortgage rates, making home purchases much more expensive for home buyers. In this blog, we analyze the impact of these economic factors on the top five U.S. homebuilders by revenue: D.R. Horton (DHI), Lennar (LEN), PulteGroup (PHM), NVR (NVR_US), and Toll Brothers (TOL).