In our weekly round-up of the top charts and market-moving analyst insights: Cruise lines continue post-pandemic recovery; rising mortgage rates hit UK home builders in 2023; FedEx (NYSE: FDX) drives toward margin growth in 2024; BioMarin’s (NASDAQ: BMRN) Roctavian is the first FDA-approved gene therapy for hemophilia A.

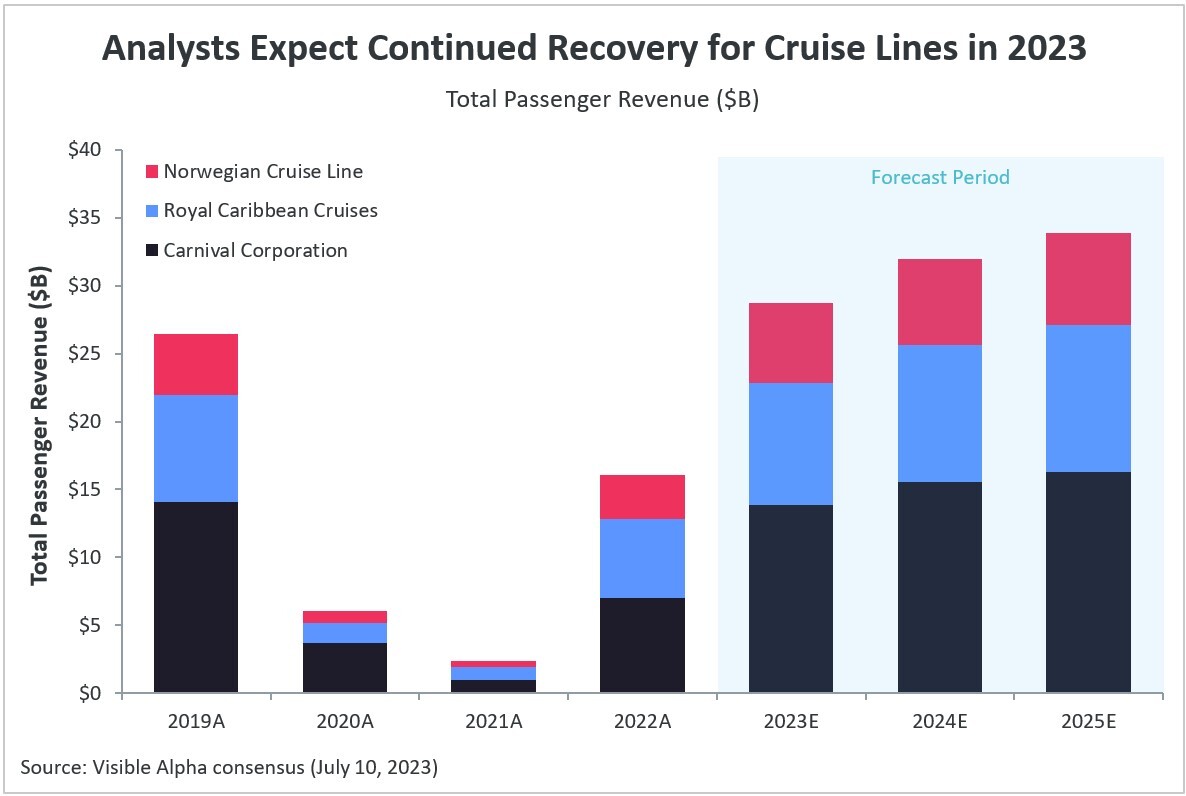

Analysts Expect Continued Recovery for Cruise Lines in 2023

Cruise companies that were heavily impacted in the past few years by the Covid-19 pandemic are expected to see a continued recovery, with 2023 revenues and bookings anticipated to exceed pre-pandemic levels for the first time since 2019.

For Carnival Corporation (NYSE: CCL), Royal Caribbean Cruises (NYSE: RCL), and Norwegian Cruise Line (NYSE: NCLH), analysts project passenger traffic to continue recovering sharply in 2023, with total passenger revenue year-over-year expected to be up 97%, 55%, and 80% respectively, based on Visible Alpha consensus.

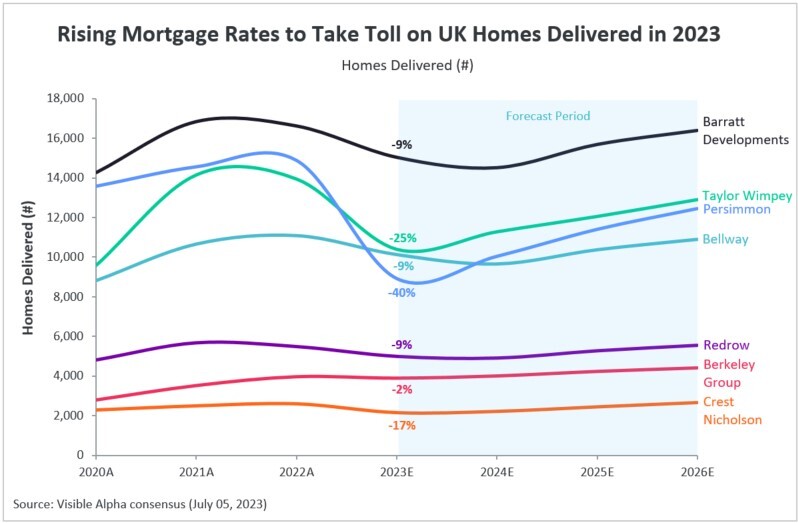

Rising Mortgage Rates to Take Toll on UK Homes Delivered in 2023

Analysts project a substantial decrease in the number of homes delivered by prominent UK home-building companies in 2023, fueled by surging mortgage rates.

Among the companies affected the most, Persimmon (LSE: PSN), Taylor Wimpey (LSE: TW), and Crest Nicholson (LSE: CRST) are expected to see year-over-year declines of 40%, 25%, and 17%, respectively, in the number of homes delivered in 2023.

The peak of home deliveries for leading players was seen in 2021-22. Analysts expect some of these companies to regain their previous peaks by 2026.

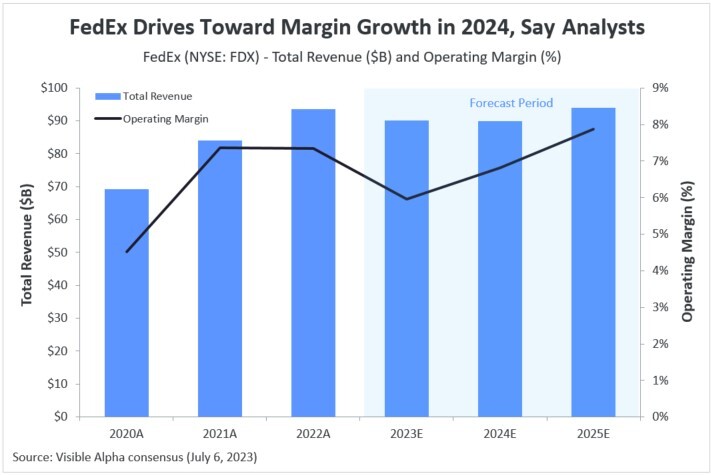

FedEx Drives Toward Margin Growth in 2024, Say Analysts

FedEx (NYSE: FDX) aims to save $4 billion by the end of FY 2025 through its DRIVE cost-cutting campaign to boost profits and margins.

According to Visible Alpha consensus, analysts expect operating margin growth for FedEx starting in 2024, following cost-cutting measures and an anticipated fuel price decline.

Revenue is projected to decrease by 3.5% to $90.2 billion in 2023, compared to $93.5 billion in 2022, with an operating margin of 6.0%, down from 7.3% in 2022. However, a rebound is expected starting in 2024, with a projected operating margin of 6.8%, followed by 7.9% in 2025.

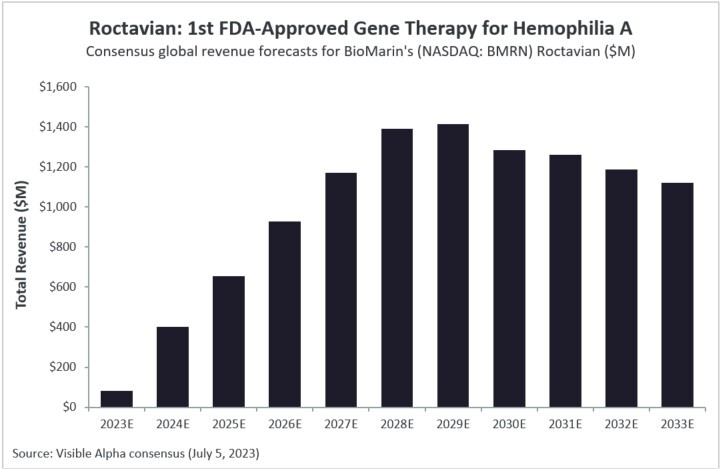

Roctavian: 1st FDA-Approved Gene Therapy for Hemophilia A

On June 29, 2023, the FDA approved Roctavian, the first approved gene therapy for hemophilia A, an inherited bleeding disorder. Roctavian, a one-time infusion developed by BioMarin Pharmaceutical (NASDAQ: BMRN) is a major advancement in the treatment of hemophilia A.

Visible Alpha consensus revenue estimates show peak global sales of $1.4B in 2029. The cost of treatment is $2.9M per patient, but rebates and discounts bring the price down to $1.9M.

There are approximately 6,500 hemophilia A patients in the U.S., and about 2,500 will be eligible for treatment with Roctavian.