Leading U.S. airlines — American Airlines (NASDAQ: AAL), United Airlines (NASDAQ: UAL), Delta Air Lines (NYSE: DAL), and Southwest Airlines (NYSE: LUV) — reported their first-quarter earnings in April 2024. Here’s a recap of those earnings releases, key takeaways, and the resulting shifts in analysts’ estimates, based on Visible Alpha consensus.

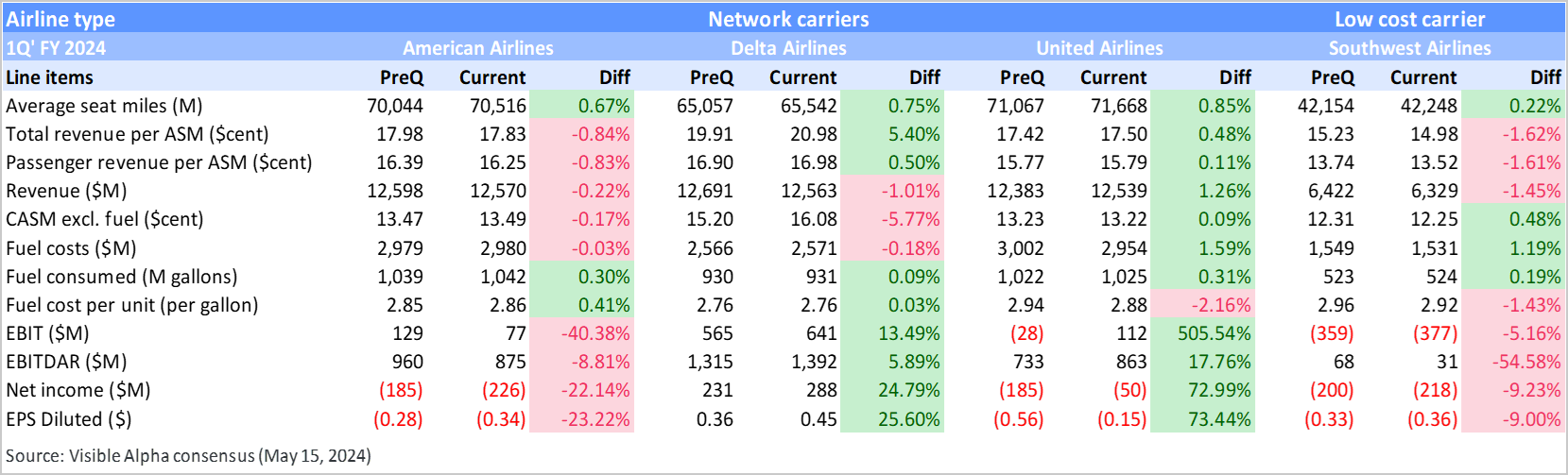

United Airlines exceeded analyst expectations in the first quarter of 2024, beating the Visible Alpha pre-1Q EPS consensus by 73.4%. Delta Airlines also performed well, surpassing EPS expectations by 25.6%. Although American Airlines fell short of EPS expectations by -23%, it provided a promising second-quarter EPS guidance of $1.15-1.45, exceeding pre-1Q estimates by 10.8%. Conversely, the low-cost carrier Southwest Airlines missed analyst expectations across all key metrics, falling short of EPS expectations by -9%.

Figure 1: 1Q 2024 consensus pre-Q estimates, actuals, and surprises

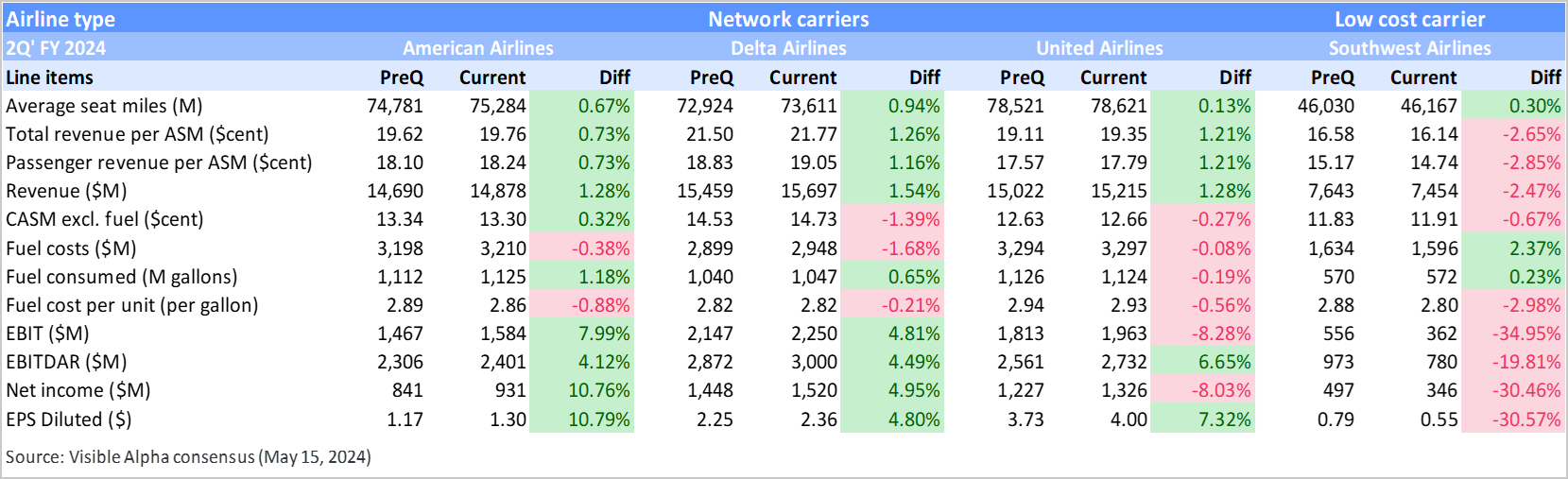

After the first quarter release, all network carriers have provided positive and better-than-expected guidance for the second quarter and the full year. However, expectations for the low-cost carrier Southwest Airlines have decreased due to its disappointing performance in the first quarter.

As shown in Figure 2 below, analysts have raised the 2Q 2024 EPS expectations for network carriers as follows:

- American Airlines: up by 10.79%

- United Airlines: up by 7.32%

- Delta Airlines: up by 4.8%

For the full year (Figure 3), EPS expectations have increased as follows:

- American Airlines: up by 7.29%

- United Airlines: up by 8.95%

- Delta Airlines: up by 2.73%

In contrast, analysts have lowered EPS estimates for Southwest Airlines by -30.57% for the 2Q and by -22.74% for the full year.

Figure 2: 2Q 2024 consensus estimate revisions

1Q 2024 Earnings Review

American Airlines

According to Visible Alpha consensus, American Airlines’ total revenue fell short of analyst expectations by $28 million, coming in at $12.6 billion. This shortfall was due to heightened competition in key markets, which affected the airline’s yields and load factors, thereby impacting unit revenue. The airline also reported a net loss of $226 million, primarily due to increased fuel expenses and other operational costs.

Despite these challenges, analysts are optimistic for the forecast period. The company plans to enhance its premium offerings and expects to save around $400 million in costs for 2024. For the upcoming quarter, analysts expect total revenue to increase by 5.9% year over year and 18% sequentially. For the full year, analysts estimate revenues will grow by 5.5%, reaching $55.7 billion.

Delta Air Lines

Total revenues for the first quarter were slightly below expectations, missing by -1.01%, at $12.6 billion compared to the pre-quarter consensus of $12.7 billion. However, Delta exceeded expectations across all other key metrics, driven by a rebound in corporate travel and strong demand for domestic and premium travel. For the upcoming quarter, analysts expect total revenue to increase by 7.4% year over year and by 25% sequentially. For 2024, analysts project revenues to rise by 7.2%, reaching $58.6 billion.

United Airlines

First-quarter revenues exceeded expectations by $156 million. United also surpassed EPS expectations, driven by stronger-than-anticipated revenue and unit costs in line with projections. Demand remained robust throughout the quarter. The grounding of Boeing MAX 9 had a $200 million impact on the airline’s profit, but overall performance was bolstered by strong travel demand and adjustments in domestic capacity, particularly through increased availability of domestic premium seats. For the second quarter, total revenue is expected to increase by 7.3% year over year and 21% sequentially, reaching $15.2 billion. For 2024, analysts estimate revenues to be up +7.5% to $57.7 billion.

Southwest Airlines

Southwest Airlines fell short of analyst expectations in the first quarter due to weak unit revenue. Revenue for the quarter was below the Visible Alpha consensus estimate, coming in at $6.3 billion against expectations of $6.4 billion. The company also reported a net loss of $218 million. The weakness in revenue per available seat mile (RASM) during the first quarter of 2024 was caused by lower-than-expected last-minute leisure travel demand and underperforming markets that didn’t grow as anticipated. The airline revised its full-year 2024 guidance downward, citing delays in Boeing aircraft deliveries.