The U.S.-China EV Story in Four Charts

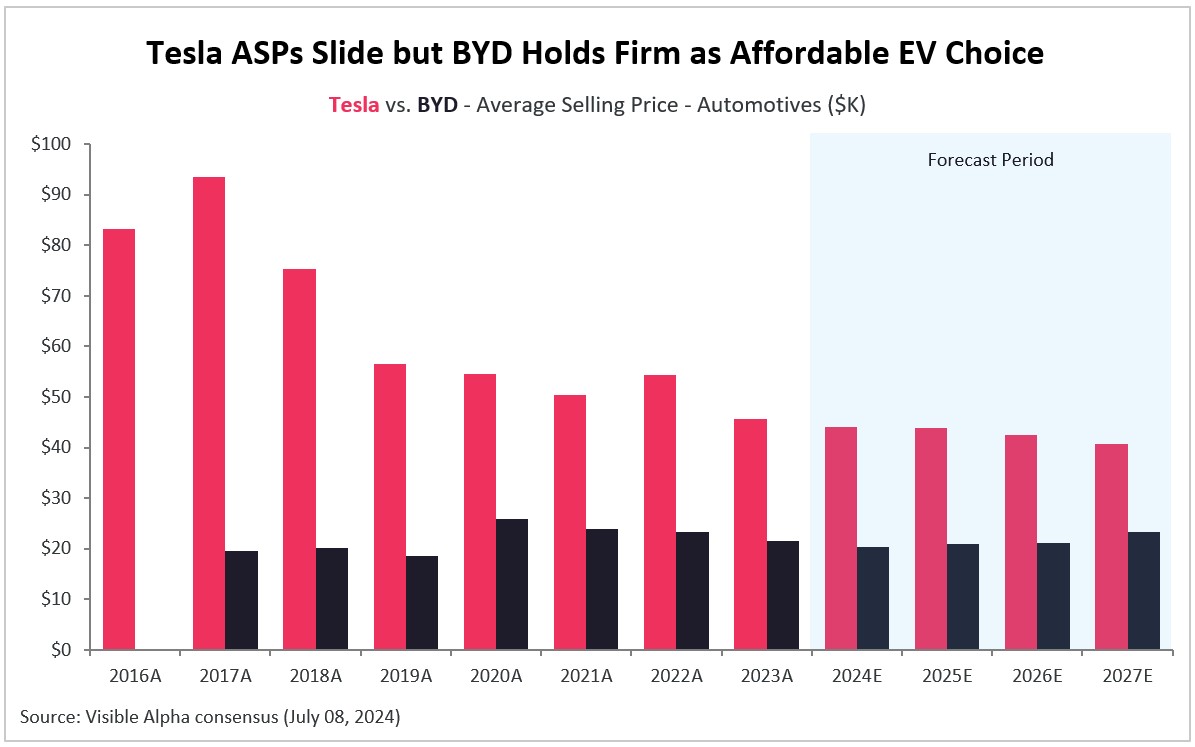

On the long list of rivalries between the U.S. and China, electric vehicles (EVs) have enjoyed an increasingly prominent role, mainly led by two players: Tesla (NASDAQ: TSLA) and BYD (SZSE: 002594). Tesla, a pioneer in the EV market, has traditionally focused on premium quality and performance, often catering to the higher-end market segment. In contrast, BYD has adopted a growth-first strategy, emphasizing affordability and wide market penetration.

BYD’s rise and Tesla’s strategic shift in the global EV market

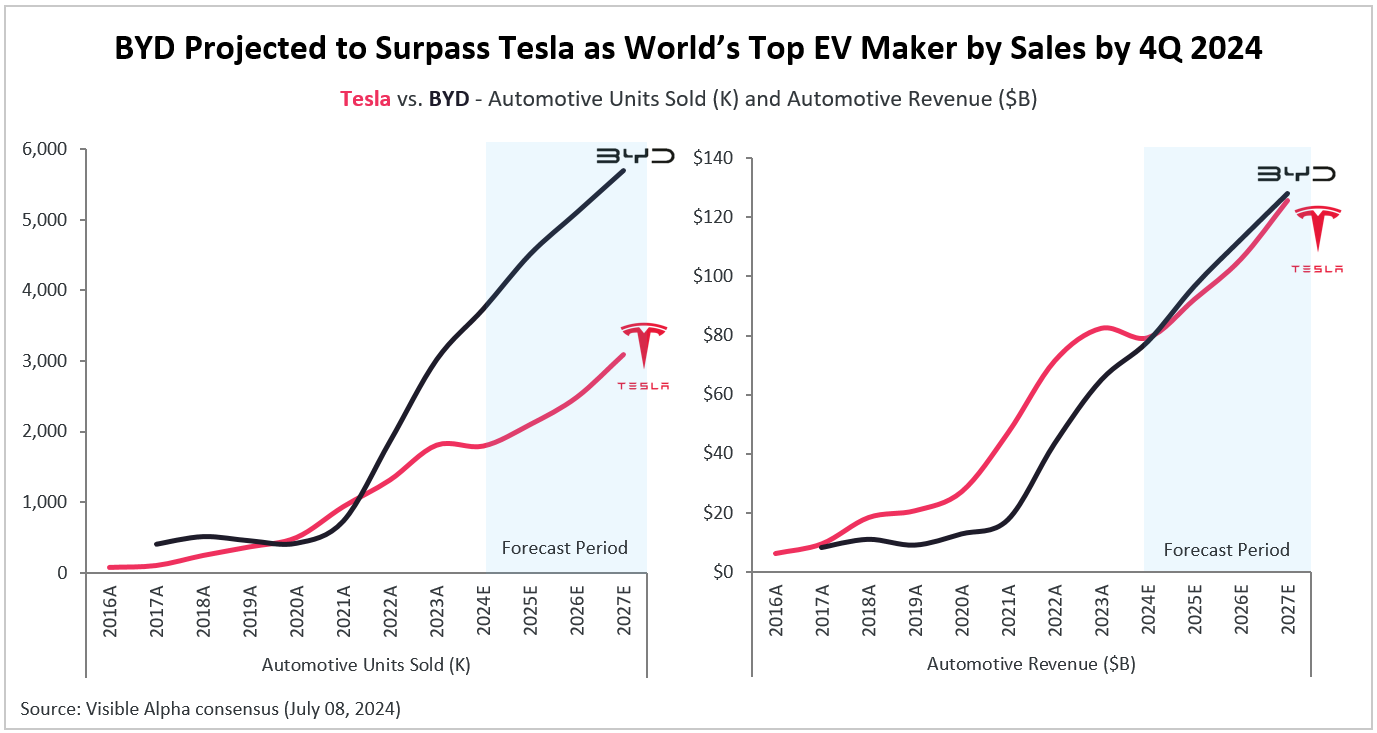

BYD surpassed Tesla in terms of the number of cars sold globally as early as the second quarter of 2022. The company is expected to sell 3.7 million vehicles in 2024, 1.9 million more than the estimated 1.8 million vehicles to be sold by Tesla. Despite this gap, Tesla has so far remained the largest EV player by sales. However, based on Visible Alpha consensus estimates, BYD is projected to drive past Tesla as the world’s top EV maker by sales in the fourth quarter of 2024, marking a significant milestone in the rivalry between the two companies.

Tesla’s automotive sales in 2024 are estimated to decline by -4% year over year to $79.1 billion, impacted by declining average selling prices (ASPs) and reduced deliveries, mainly of its Model 3 (-6.2% YoY), Model S (-5.3% YoY), and Model Y (-3.1% YoY) vehicles. In contrast, BYD sales growth is projected to remain strong at +23%, clocking in automotive revenues of $77.9; $1.2 billion lower than that of Tesla.

Analysts expect Tesla’s automotive sales to rebound in 2025, increasing by +16% from the previous year, driven by improved deliveries and production from the ongoing ramp-up of Tesla’s new factories in Texas and Germany. To compete with the growing number of inexpensive EVs, including those from China’s BYD, Tesla is also switching up its strategy and expanding its affordable offerings. The company plans to launch the Model 2 in 2024 and its compact series in 2025, which are expected to be priced lower than the Model 3 sedan, its cheapest car yet. The Model 3 has a projected average revenue per user (ARPU) of $37K in 2024. The Model 2 and compact series are anticipated to have an ARPU of $31K and $32K, respectively, in 2025.

Global EV competition: Chinese giants surge ahead of U.S. rivals

Taking a closer look at other EV manufacturers in the two countries reveals a dynamic similar to the Tesla versus BYD narrative. Chinese EV makers such as Li Auto (NASDAQ: LI), Nio (NYSE: NIO), and XPeng (NYSE: XPEV) have gained a substantial lead in the race, largely due to over a decade of support from Beijing through subsidies, tax breaks, and consumer incentives. Li Auto leads this group with an estimated automotive revenue of $19.7 billion in 2024, marking a 19% increase year over year. Nio follows with expected automotive sales of $8.3 billion (up +22% YoY), while XPeng is estimated to generate automotive sales of $5.5 billion, reflecting a +42% growth.

While U.S. EV companies Rivian (NASDAQ: RIVN) and Lucid (NASDAQ: LCID) are anticipated to see strong sales growth in the forecast period; they currently lag behind their Chinese counterparts. Rivian (NASDAQ: RIVN), is projected to generate $4.6 billion in automotive sales in 2024 (a modest +6% YoY increase), but is expected to see growth accelerate starting from 2025. Analysts expect Rivian to surpass XPeng in automotive sales by 2027, and Nio by 2028, positioning itself as the fourth largest pure-play EV player globally, trailing only BYD, Tesla, and Li Auto.

Meanwhile, Lucid (NASDAQ: LCID) is forecasted to experience a significant surge in automotive sales as well, with a projected +21% increase in 2024, driven by higher units sold on the back of declining average selling prices (ASPs). Similar to Tesla, Lucid is also cutting its prices to boost sales. Analysts expect Lucid’s ASPs to decline by -17% year over year in 2024, having declined by -29% last year. The company’s ASPs have gone down from $184K in 2021 to an estimated $83K in 2024, and are expected to drop further to $71K by 2028.

China’s strategic advantages power its EV market leadership

While Rivian and Lucid adopt alternate strategies to boost sales in a market that is already pressured by higher lending rates and difficult economic conditions, China’s dominance in the EV supply chain is supported by key advantages including access to critical resources such as graphite and government support. China has a monopoly on several key materials used in battery production. Furthermore, the government in China has long offered both direct subsidies to automakers and tax exemptions for consumers, while also investing in building a robust public EV charging infrastructure.

This advantage has allowed Chinese EV companies to offer competitive pricing while still incorporating more powerful batteries and advanced technology. As a result, these companies have historically led in high-volume deliveries. Analysts anticipate strong delivery volumes for both U.S. and Chinese EV pure-plays in the forecast period. However, Chinese companies are expected to significantly outsell their U.S. counterparts.

The growth story of Chinese EV manufacturers, though, is not without challenges. In early June, the EU revealed plans to impose extra tariffs, potentially as high as 38%, on imported EVs from China, in addition to existing 10% car tariffs. This decision follows the U.S. announcement last month of increased tariffs on Chinese EVs and clean energy products, including 100% tariffs on EVs and 25% on EV batteries. Similarly, Canadian authorities have proposed additional tariffs on Chinese-manufactured EVs and batteries, mirroring actions by the U.S. and EU to curb the influx of lower-cost imports from China.

BYD vs. Tesla; Accenture’s Growth Dip; Solaria Ramps Up Solar

In our weekly round-up of the top charts and market-moving analyst insights: BYD (SZSE: 002594) leads in vehicle sales but Tesla (NASDAQ: TSLA) leads in revenue; Accenture (NYSE: ACN) is expected to see a modest growth rebound in 2024 after a tough 2023; Spain’s Solaria (SIX/BME: SLR) is ramping up solar capacity, driving revenue projections.

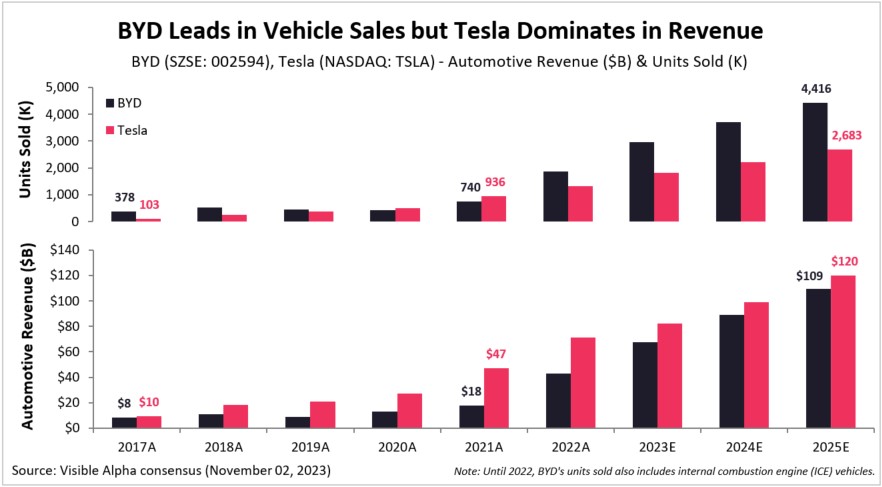

BYD Leads in Vehicle Sales but Tesla Dominates in Revenue

BYD and Tesla are two of the biggest players in the global electric vehicle (EV) space. While Tesla sells only EVs, BYD sells both EVs and plug-in hybrid electric vehicles. In 2022, China-based BYD (SZSE: 002594) sold 1.9 million vehicles, 555K units more than Tesla (NASDAQ: TSLA) did globally. According to Visible Alpha consensus, the gap between the units sold by the two companies is only expected to widen in 2023, with BYD projected to sell nearly 3 million vehicles, 1.1 million units more than Tesla. By 2025, BYD is projected to sell 4.4 million vehicles versus Tesla at an expected 2.7 million.

Despite BYD selling more units, however, Tesla still generates higher automotive revenue. In 2023, analysts expect Tesla to generate $82.4 billion in automotive revenue, compared to $67.8 billion for BYD. Between 2023-2025, BYD’s automotive revenue is projected to grow at a CAGR of 27% to $109 billion, while Tesla’s automotive revenue is expected to grow at a CAGR of 21% to $120 billion.

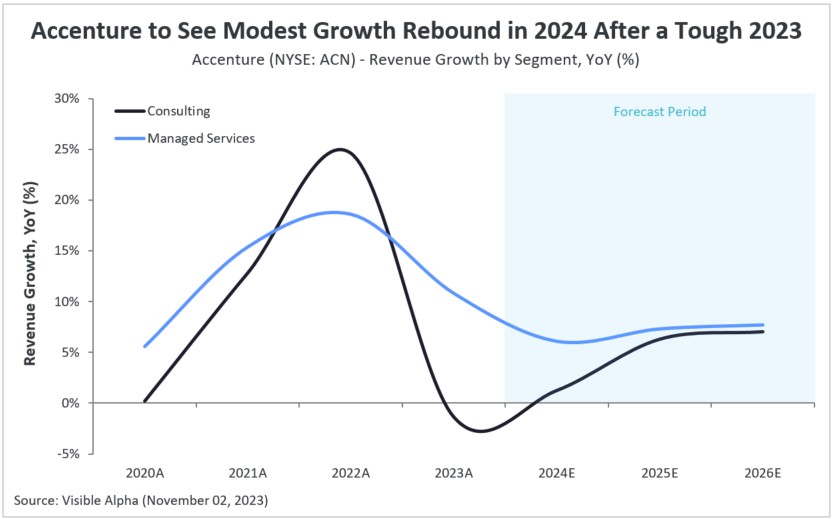

Accenture to See Modest Growth Rebound in 2024 After a Tough 2023

In 2023, Accenture (NYSE: ACN) experienced a significant decline in revenue growth as macroeconomic headwinds saw IT project ramp-downs, cautious spending patterns, and softer-than-expected bookings. According to Visible Alpha consensus, the company is expected to see a modest recovery in fiscal 2024, with a projected 4% growth in revenue. Specifically, Accenture’s Consulting business, which saw a -1% year-over-year decline in revenue in 2023, is anticipated to rebound with 1% revenue growth in 2024, reaching $34 billion. However, growth in the company’s Managed Services division is expected to slow down further to 6% in 2024, hitting $32.4 billion.

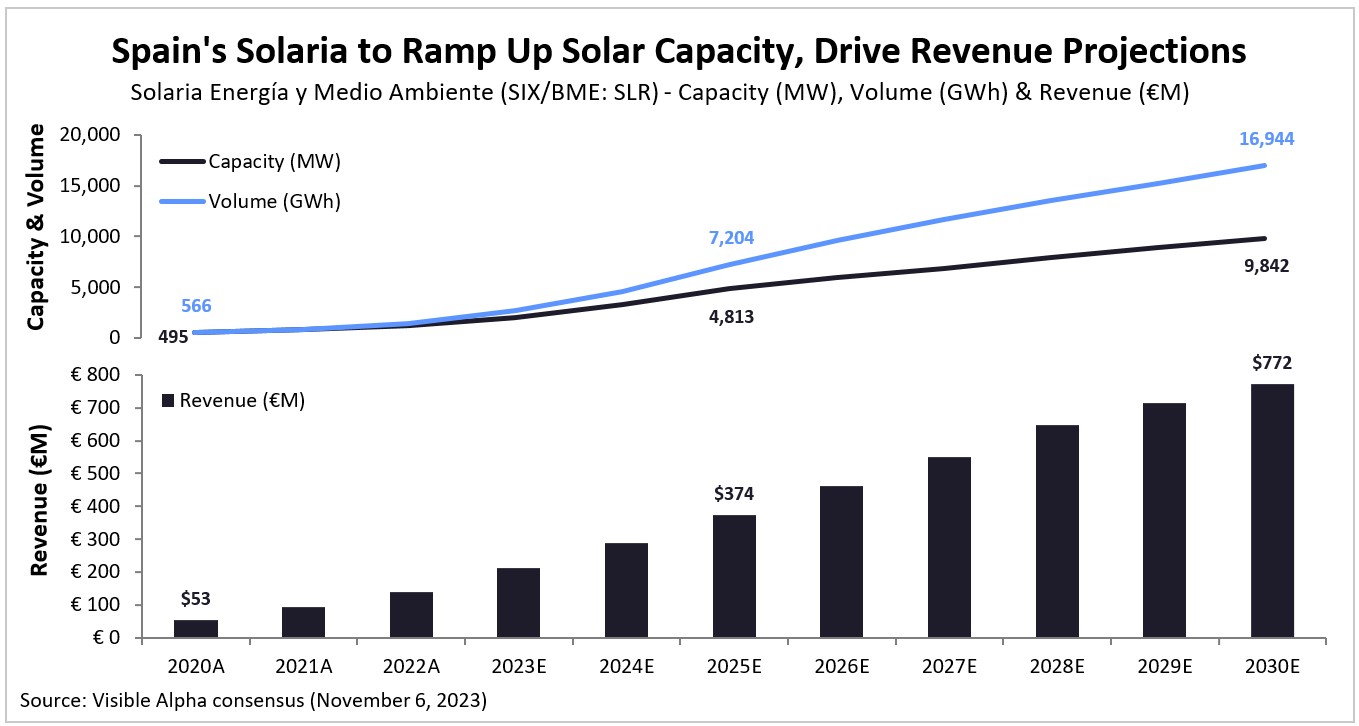

Spain’s Solaria to Ramp Up Solar Capacity, Driving Revenue Projections

Spain’s Solaria Energía y Medio Ambiente (SIX/BME: SLR), a solar power generation company, is set to substantially boost its installed capacity. According to Visible Alpha consensus, analysts expect Solaria’s total capacity to increase from 1,172 megawatts (MW) in 2022 to an estimated 2,048 MW in 2023, reaching 9,842 MW by 2030. Between 2023 and 2026, the company is projected to see annual double-digit growth in its installed capacity in Spain, Italy, and Portugal. This expansion is expected to drive the company’s solar production volume from 1,434 gigawatt hours (GWh) in 2022 to 2,729 GWh in 2023, and then grow at a projected CAGR of 30% to 16,944 GWh by 2030. With rising capacity and volume, Solaria’s total solar revenue is forecasted to increase to €211 million in 2023, and then grow at a CAGR of 20% to €772 million by 2030.

Tesla’s Race to Challenge Ford and GM; Nel ASA’s Rising Green Hydrogen; AppLovin’s Software Surge

In our weekly round-up of the top charts and market-moving analyst insights: Tesla (NASDAQ: TSLA) is poised to challenge Ford Motor (NYSE: F) and General Motors (NYSE: GM) in automotive units sold by 2027; Nel ASA’s (OSE: NEL) green hydrogen revenue is expected to surge in the coming years amid the clean energy wave; and AppLovin (NASDAQ: APP) is projected to see software platform revenue grow by 60% year over year in 2023.

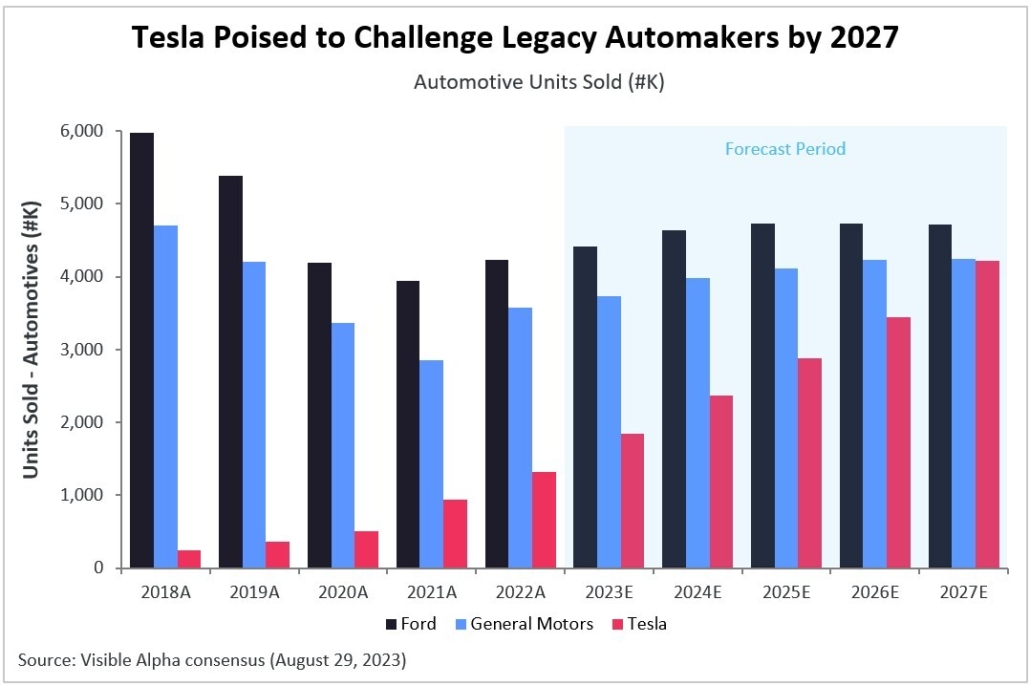

Tesla Poised to Challenge Legacy Automakers by 2027

While Ford Motor (NYSE: F) and General Motors (NYSE: GM) plan to ramp up EV production, analysts expect Tesla (NASDAQ: TSLA) to sell nearly as many automotive units overall as General Motors by 2027. Based on Visible Alpha consensus estimates, Tesla is forecasted to sell 4.21 million units in 2027, up from 1.85 million units expected in 2023. This is in comparison to Ford’s 4.72 million units and General Motors’ 4.25 million units expected to be sold in 2027.

In terms of revenue, analysts expect Tesla’s automotive revenue to surpass both Ford and General Motors by 2027. Tesla’s automotive revenue is projected to grow from an estimated $85 billion in 2023 to $185 billion by 2027. In comparison, Ford is projected to generate $178 billion while General Motors is expected to generate $172 billion in 2027. Between 2023-2027, Tesla’s automotive revenue is expected to grow at a CAGR of 21%, whereas Ford and General Motors are both expected to see their automotive revenues grow at a CAGR of 3%.

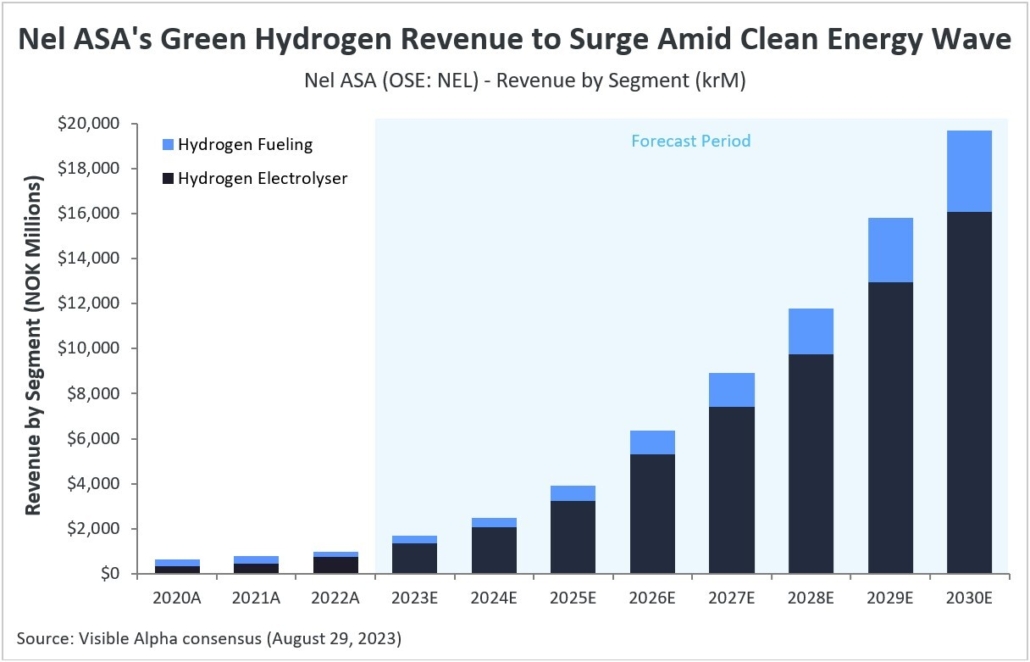

Nel ASA’s Green Hydrogen Revenue to Surge Amid Clean Energy Wave

Nel ASA (OSE: NEL), a Norwegian company specializing in hydrogen production solutions, is poised for significant growth in the forecast period according to Visible Alpha consensus. The company is a leading provider of hydrogen electrolyzers and is a key player in the emerging hydrogen economy. Green hydrogen, recognized as the most sustainable type of hydrogen, is positioned to be pivotal in the global shift towards cleaner and more sustainable energy sources.

Analysts expect the company to see revenue grow at a CAGR of 41% between 2020 and 2030. Looking at the company’s revenue segments, Hydrogen Electrolyser revenue is expected to grow at a CAGR of 47% between 2020-30, while Hydrogen Fueling revenue is projected to grow at a CAGR of 28%. Analysts expect the company to turn profitable by 2026, generating an operating income of NOK 7.9 million.

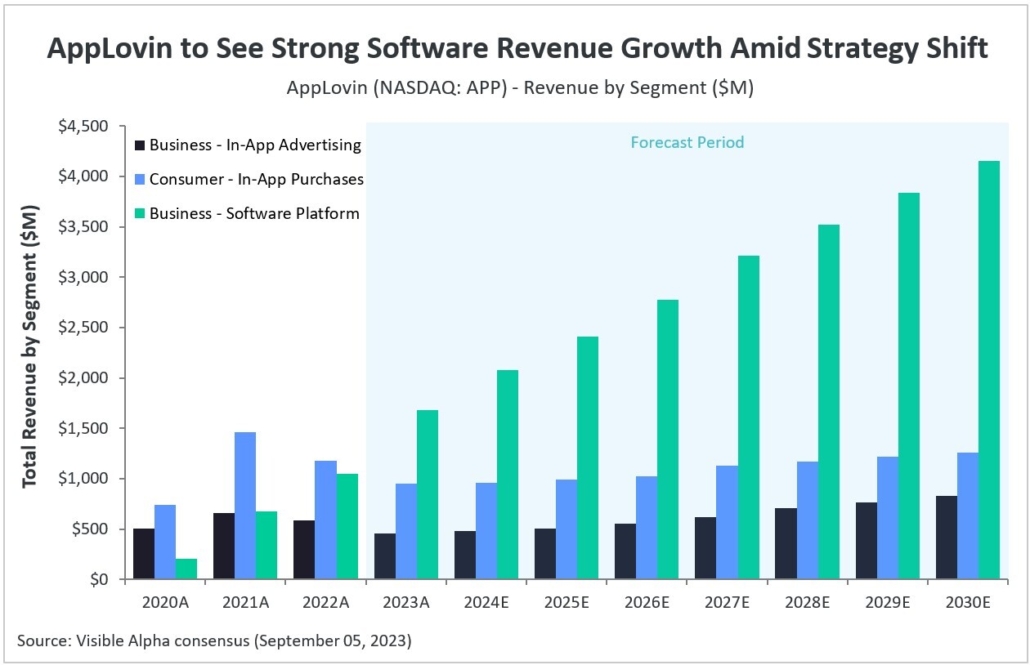

AppLovin to See Strong Software Revenue Growth Amid Strategy Shift

AppLovin (NASDAQ: APP), a mobile advertising company that delivers advertisement platforms for app developers, is projected to see software platform revenue grow by 60% year over year in 2023, based on Visible Alpha consensus. This growth is expected to be driven by Axon 2.0, the latest version of the company’s AI-based ad tech platform, which it launched earlier this year.

While consumer in-app purchases used to be the company’s primary revenue-generating segment, analysts anticipate that software platform revenue will outpace in-app revenue in 2023, reaching a total of nearly $1.68 billion. As the company shifts its focus towards its software platform, app-related revenue is projected to continue to decline. After dropping by 11% last year, in-app advertising revenue from the company’s business segment is expected to decline by 23% in 2023, while in-app purchase revenue from its consumer segment is expected to decline by 19% in 2023, after also declining by around 19% in 2022.

Celsius Energy Drink Boost; Booking Shifts to Merchant Revenue; Hubspot’s FCF to Expand; Ford Otosan Poised for Growth

In our weekly round-up of the top charts and market-moving analyst insights: Celsius Holdings (NASDAQ: CELH) is expected to see energy drink revenue surge in 2023; Booking Holdings (NASDAQ: BKNG) is projected to shift further from an agency model towards a merchant model; HubSpot Inc. (NYSE: HUBS) is poised to see strong revenue growth, improved margins, and a rise in free cash flow; and Turkey’s Ford Otosan (BIST: FROTO) is expected to see another strong year in 2023.

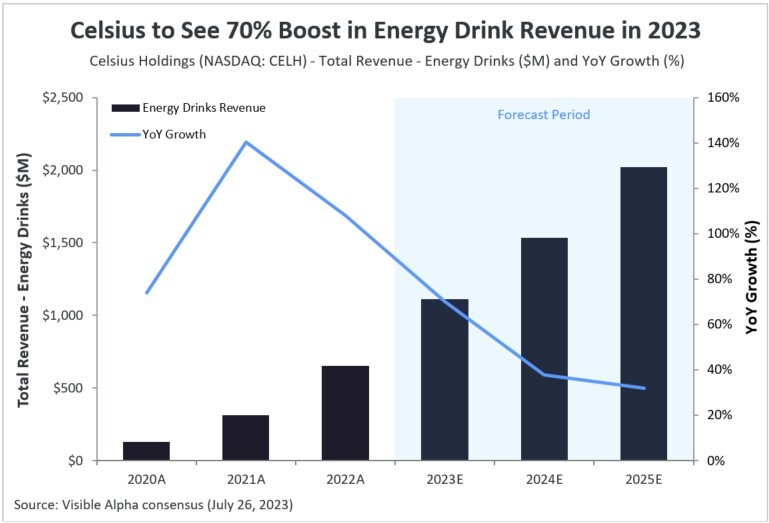

Celsius to See 70% Boost in Energy Drink Revenue in 2023

Celsius Holdings (NASDAQ: CELH) is expected to see energy drink revenue soar 70% in 2023 to over $1.1 billion, according to Visible Alpha consensus. The energy drink manufacturer has exhibited strong revenue growth over the past few years, having launched across the U.S. via Walmart in 2020 and signing a distribution contract with PepsiCo in 2022. The company’s revenue is expected to maintain strong growth in the forecasted years, though at a slowing pace as the market matures.

North America remains the company’s largest market with estimated revenue of nearly $1.1 billion (+74% YoY) in 2023, followed by Europe at $34 million (+10% YoY), and Asia at $5 million (+33% YoY).

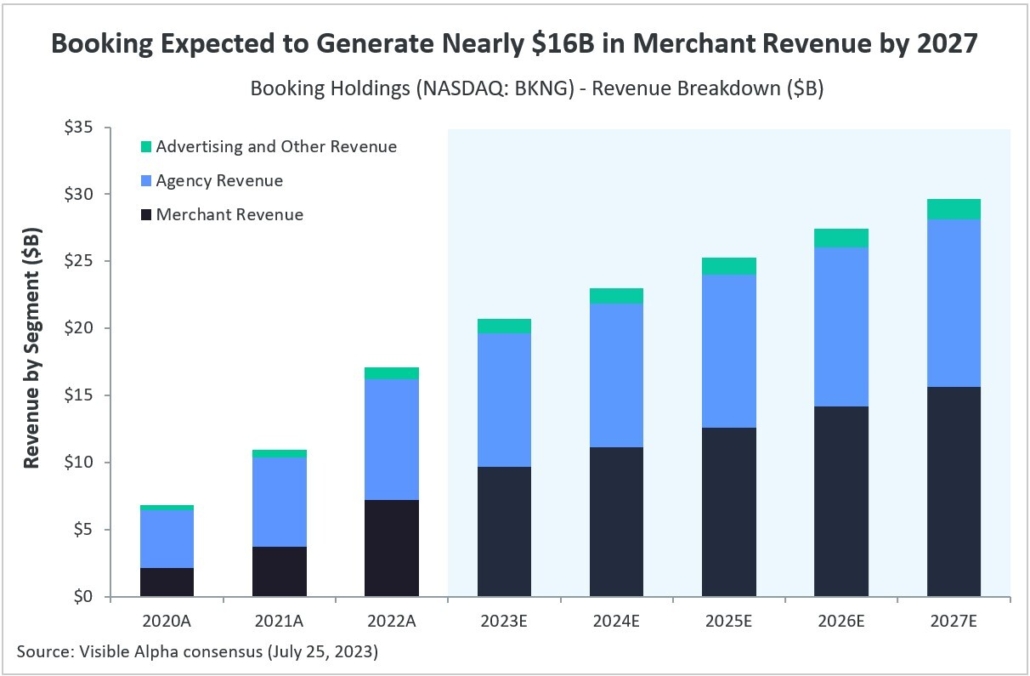

Booking Expected to Generate Nearly $16B in Merchant Revenue by 2027

In 2023, approximately half of Booking Holdings’ (NASDAQ: BKNG) reservations are projected to be handled through the company’s payment platform as they continue to shift from their original agency model to a merchant model.

Based on Visible Alpha consensus, Booking is expected to generate nearly $10 billion in agency revenue (+11% YoY) and $9.6 billion in merchant revenue (+34% YoY) in 2023. Booking’s advertising and other revenues are expected to generate a little over $1 billion (+17% YoY) by the end of 2023.

By 2027, analysts expect the merchant model to generate $15.7 billion in revenue, or 53% of the company’s total revenue, while the agency model is projected to bring in $12.4 billion.

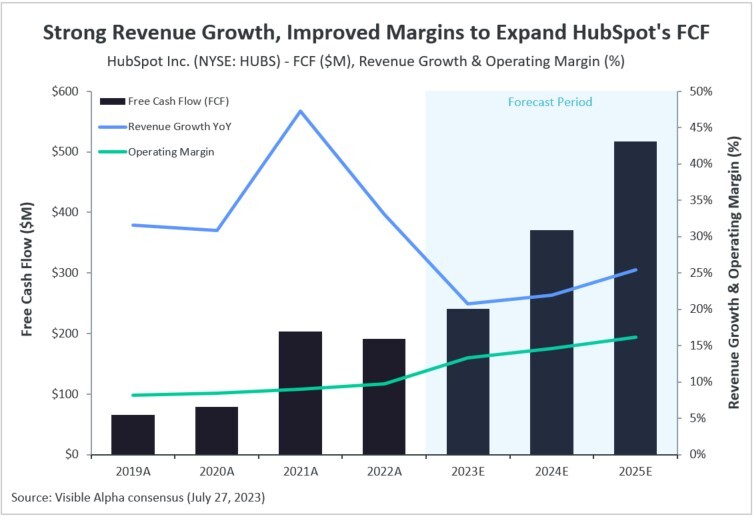

Strong Revenue Growth, Improved Margins to Expand HubSpot’s FCF

HubSpot Inc. (NYSE: HUBS), a CRM software developer, is anticipated to sustain double-digit revenue growth in the forecast period, though at a moderated pace, according to Visible Alpha consensus. Analysts project the company’s total revenue to reach $2 billion (+20.7% YoY) in 2023. Subscription revenue is expected to rise by 21%, and professional services and other revenue are estimated to grow by 7.3% year-over-year.

HubSpot is also expected to maintain profitability, with an estimated operating margin of 13.4% in 2023 and continued improvement in the forecast period due in part to better cost discipline. According to Visible Alpha consensus, free cash flow (FCF) is anticipated to rise by 25.7% in 2023, potentially supporting HubSpot’s growing financial health.

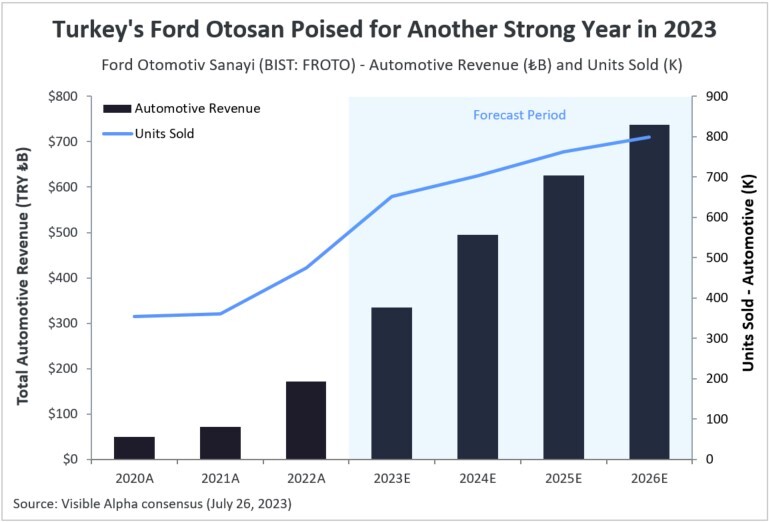

Turkey’s Ford Otosan Poised for Another Strong Year in 2023

Ford Otomotiv Sanayi A.Ş. (BIST: FROTO), otherwise known as Ford Otosan, the joint venture between Ford Motor (NYSE: F) and Turkey’s Koç Holding (BIST: KCHOL), is poised for substantial growth in 2023 according to Visible Alpha consensus.

Analysts expect automotive revenue of the Turkey-based auto manufacturer to surge 95% year-over-year in 2023, reaching an estimated TRY ₺334 billion (USD $12 billion). This outlook is underpinned by a projected 37% growth in the number of units sold, totaling 652K units in 2023. From 2023 to 2026, analysts expect Ford Otosan’s total automotive revenue to grow at a CAGR of 22%.

LVMH Asia Revenue Growth to Rebound; Non-Combustibles to Boost Philip Morris; Chubb’s Agricultural Segment Growth Slowing

In our weekly round-up of the top charts and market-moving analyst insights: LVMH’s (EPA: MC) revenue growth in Asia is expected to rebound; Philip Morris International (NYSE: PM) is poised to see significant growth in non-combustible products; Chubb’s (NYSE: CB) North America agricultural segment is facing a slowdown in growth.

Analysts Expect LVMH’s Revenue Growth in Asia to Rebound in 2023

Analysts expect LVMH’s (EPA: MC) revenue growth in Asia to rebound in 2023, buoyed by the late-2022 lifting of anti-Covid measures in China. Based on Visible Alpha consensus, LVMH’s revenue in Asia (excluding Japan) is expected to be up nearly 19% year over year in 2023, reaching €28 billion. This comes after only around 6% revenue growth in the previous year.

2023 revenue in Asia, with Japan included, is also expected to be up nearly 19% year over year, followed by Europe at almost 10%. LVMH’s strong recovery in China is also expected to benefit revenue growth for the luxury goods conglomerate’s fashion and leather goods division, which is projected to grow 13% year over year in 2023, and selective retailing division, projected to grow 16%.

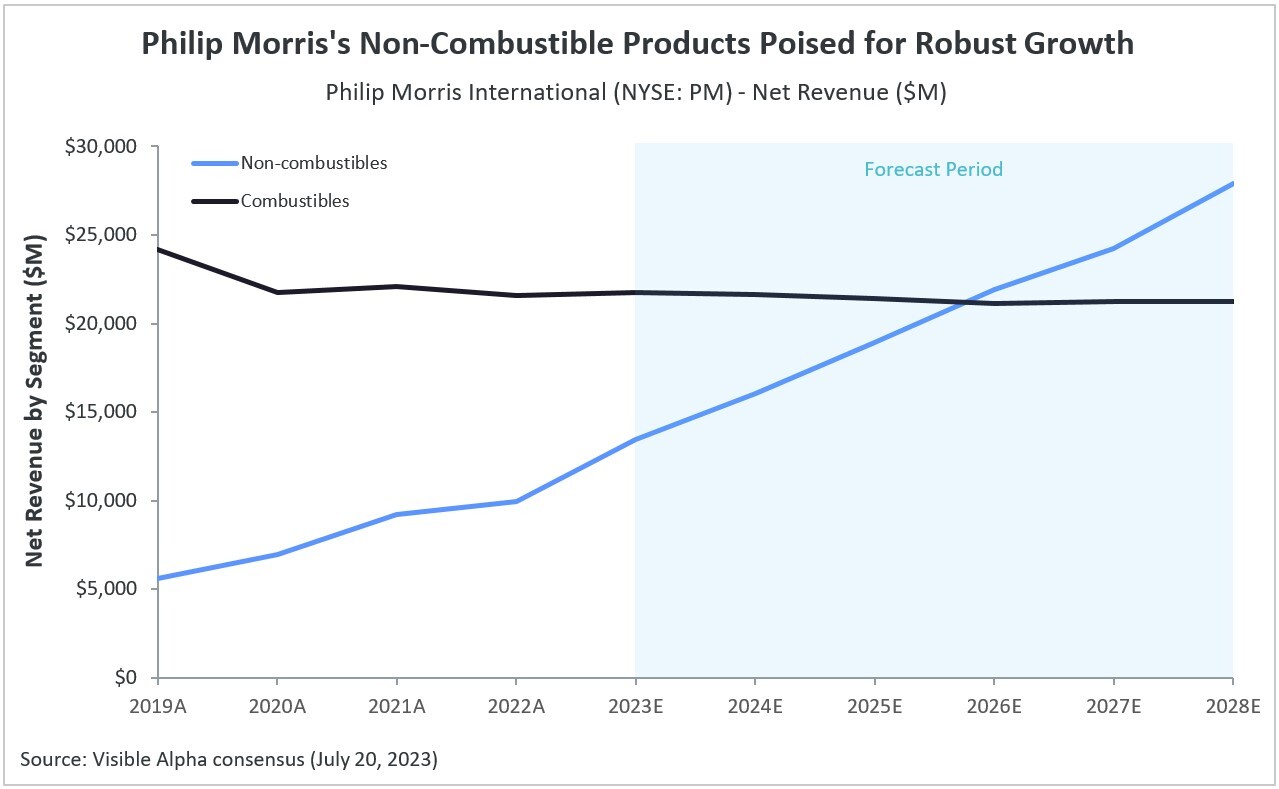

Philip Morris’s Non-Combustible Products Poised for Robust Growth

Philip Morris International (NYSE: PM) is poised to see significant growth in its non-combustible tobacco products, according to Visible Alpha consensus. While the net revenue from the company’s combustible tobacco products (cigarettes), has either remained stagnant or declined in recent years, revenue generated by non-combustible alternatives, such as e-cigarettes, heat-not-burn (HNB) tobacco products, and nicotine pouches, has been increasing rapidly.

Analysts anticipate 36% year-over-year growth in net revenue for non-combustible products this year, in stark contrast to less than 1% growth projected for combustible products. Revenue from non-combustibles is expected to surpass that of combustibles by 2026.

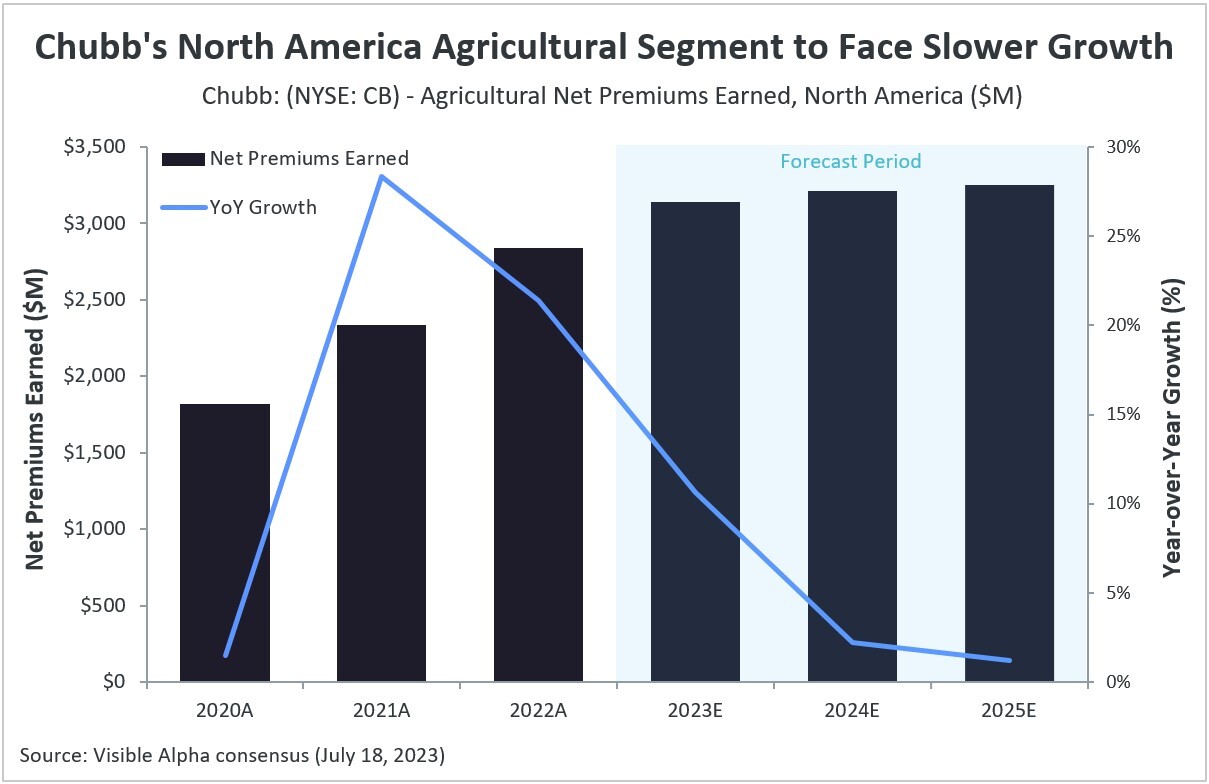

Chubb’s North America Agricultural Segment to Face Slower Growth, Say Analysts

Analysts project a deceleration in the growth rate of net premiums earned by property & casualty insurance giant Chubb (NYSE: CB) within its North American agricultural division during the forecasted period, according to Visible Alpha consensus.

This slowdown in growth is influenced by several factors, including climate volatility and its impact on crop productivity; and given that Chubb’s agricultural segment falls under the federally subsidized crop insurance program, the insurer is limited in its ability to impose higher premiums on agricultural insurance policies.

Shell Powers Up Renewables; AB InBev to See U.S. Decline; WHSmith Targets Growth in Airports

In our weekly round-up of the top charts and market-moving analyst insights: Shell (LSE: SHEL) looks to power up renewables; analysts see declines in North America sales volume for AB InBev (EBR: ABI); WHSmith’s (LSE: SMWH) travel division is expected to see strong revenue growth.

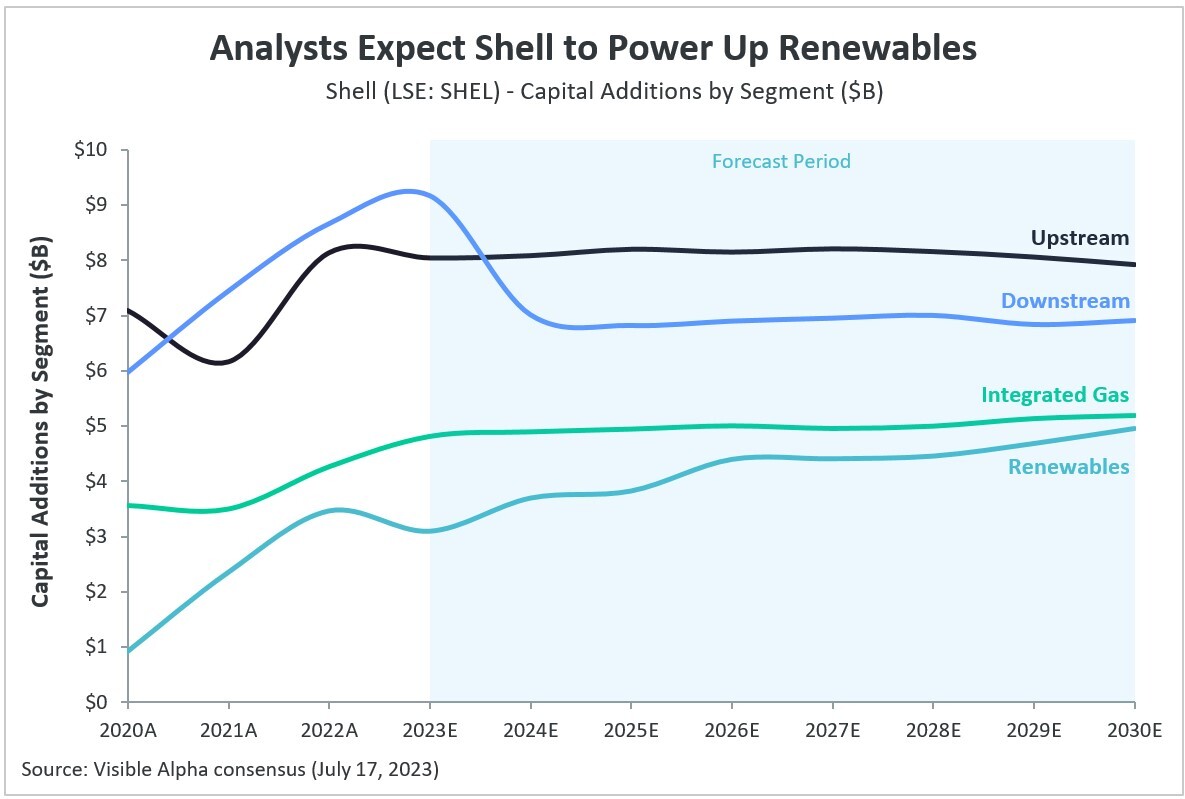

Analysts Expect Shell to Power Up Renewables

Shell (LSE: SHEL) is expected to raise its investment in renewable energy and low-carbon projects in accordance with the EU’s carbon emission regulations. To achieve net-zero emissions by 2050, Shell plans to invest $10-15 billion between 2023-25 in developing low-carbon energy solutions such as biofuels, hydrogen, EV charging, and carbon capture & storage.

In 2023, according to Visible Alpha consensus, analysts expect the company to allocate $9.2 billion to its downstream business, $8.1 billion to its upstream business, $4.8 billion to integrated gas, and $3.1 billion to renewables.

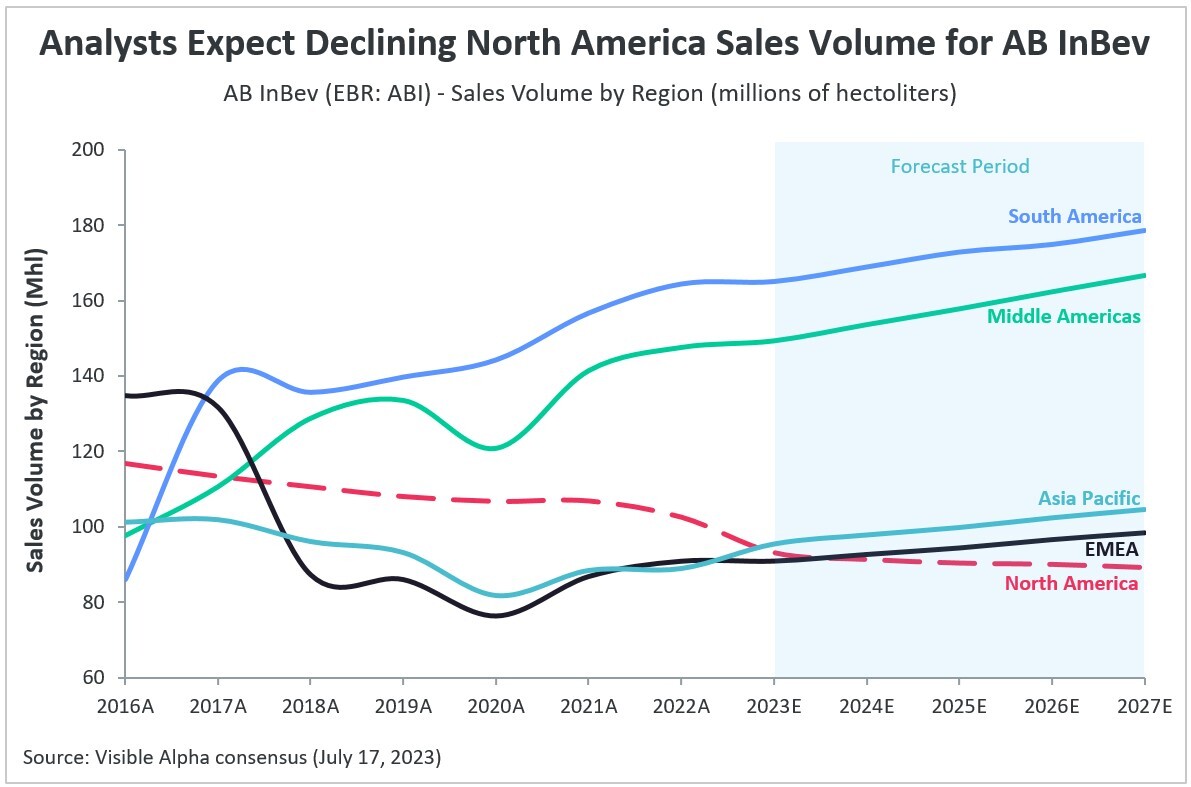

Analysts Expect Declining North America Sales Volume for AB InBev

Analysts expect North America sales volume for AB InBev (EBR: ABI), the company behind Budweiser and Bud Light beer brands, to decline by 9% year over year in 2023, according to Visible Alpha consensus.

The U.S. is expected to account for this sharp decline, with U.S. sales volume projected to fall by 10%. The strongest sales volume growth in 2023 is projected to occur in the Asia-Pacific region at 7%, followed by the Middle Americas (Central America, Mexico, Caribbean) at 1%.

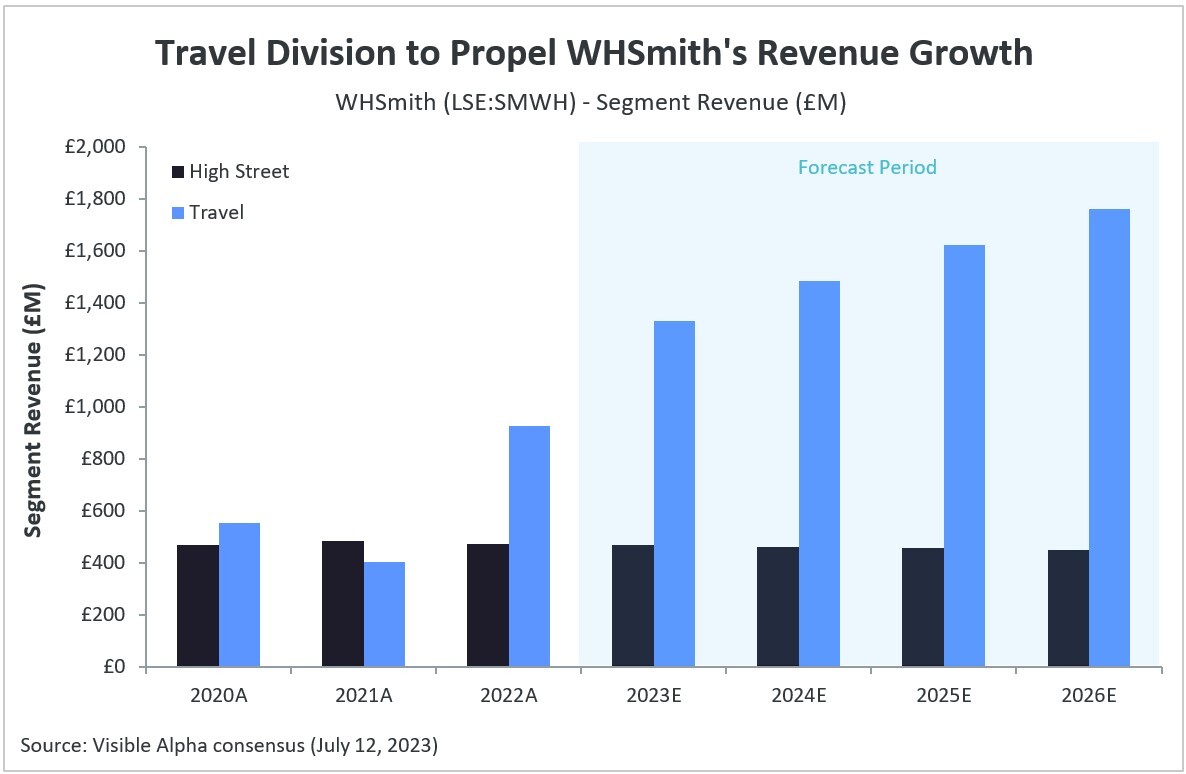

Travel Division to Propel WHSmith’s Revenue Growth, Say Analysts

UK-based books and convenience retailer WHSmith (LSE: SMWH) is expected to continue seeing revenue growth driven by its travel division (airports, train stations, motorway service areas, and hospitals).

According to Visible Alpha consensus, the retailer’s travel segment revenue is expected to increase by 44% in 2023 compared to the previous year. The British retailer is expanding its travel division, with focused store expansions outside of the U.K., especially in North America.

Novartis Acquisition; LULU’s Global Growth; RENT to Rise; Ford’s EV Sales

In our weekly round-up of the top charts and market-moving analyst insights: Novartis (NYSE: NVS) agrees to acquire Chinook Therapeutics (NASDAQ: KDNY); Lululemon Athletica (NASDAQ: LULU) projected to see significant international revenue growth; Rent the Runway (NASDAQ: RENT) subscribers and revenue expected to rise; Ford Motor’s (NYSE: F) Model e division (electric vehicles) to expand.

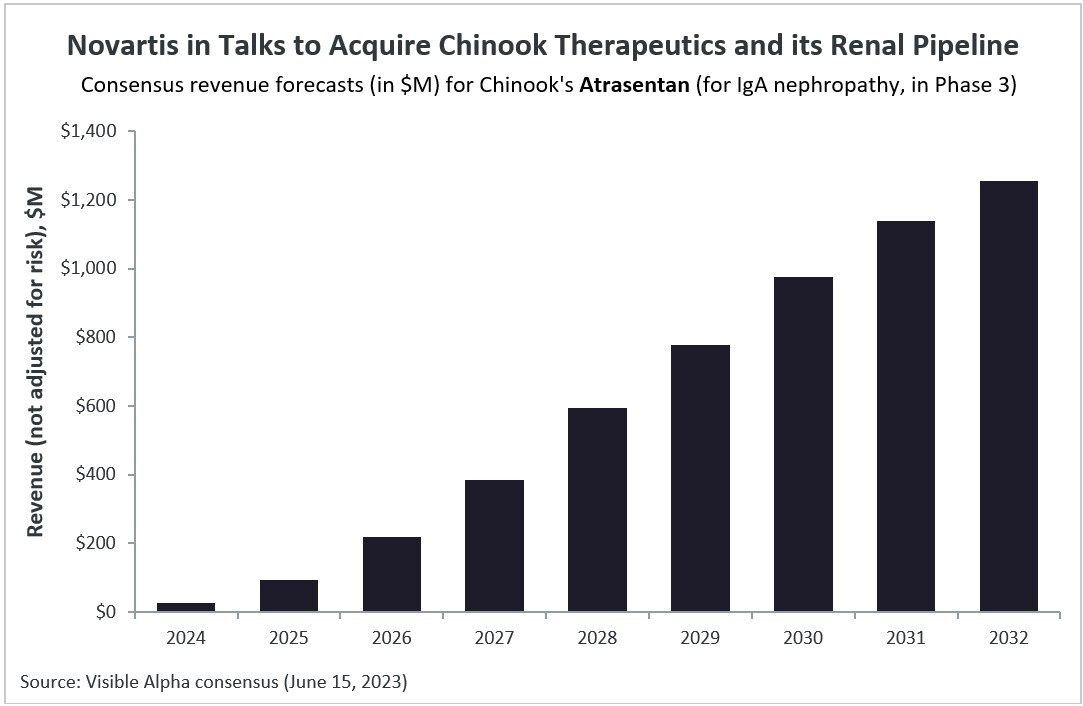

Novartis Agrees to Acquire Chinook Therapeutics and its Renal Pipeline

Novartis (NYSE: NVS) has agreed to acquire Chinook Therapeutics (NASDAQ: KDNY) for $3.2B up front, driven by Chinook’s innovative rare and severe kidney disease pipeline that will add to Novartis’ existing kidney disease focus. The acquisition is driven by Chinook’s lead program, atrasentan (currently in Phase 3 studies), a selective endothelin A receptor antagonist for IgA nephropathy. Visible Alpha consensus estimates show atrasentan ramping up to $1.25B in global revenue in 2032 ($932M on a risk-adjusted basis). Analysts peg the probability of regulatory approval at a consensus of 67.9%.

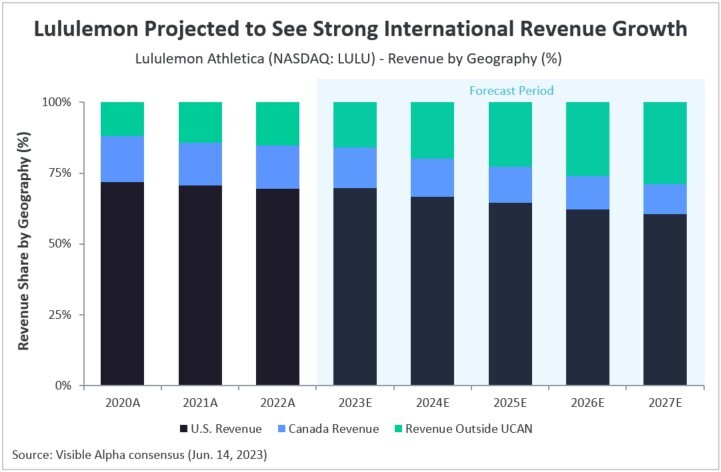

Analysts Anticipate Strong International Revenue Growth for Lululemon Athletica, Outpacing U.S. and Canada

Apparel retailer Lululemon Athletica (NASDAQ: LULU) is projected to see significant revenue growth in markets outside of the U.S. and Canada (UCAN). The company currently operates in UCAN, Europe, Asia, and Australasia. According to Visible Alpha consensus, the proportion of revenue generated internationally (excluding UCAN) is expected to increase from 15% in 2022 to 29% by 2027. Revenue outside of UCAN is expected to grow at a CAGR of 33% between 2022-27, and projected to reach $3.9 billion by 2027. Lululemon plans major expansion in its international markets, particularly in China. Analysts project Lululemon will add 49 new stores outside of UCAN in 2023, many of which will be in Asia.

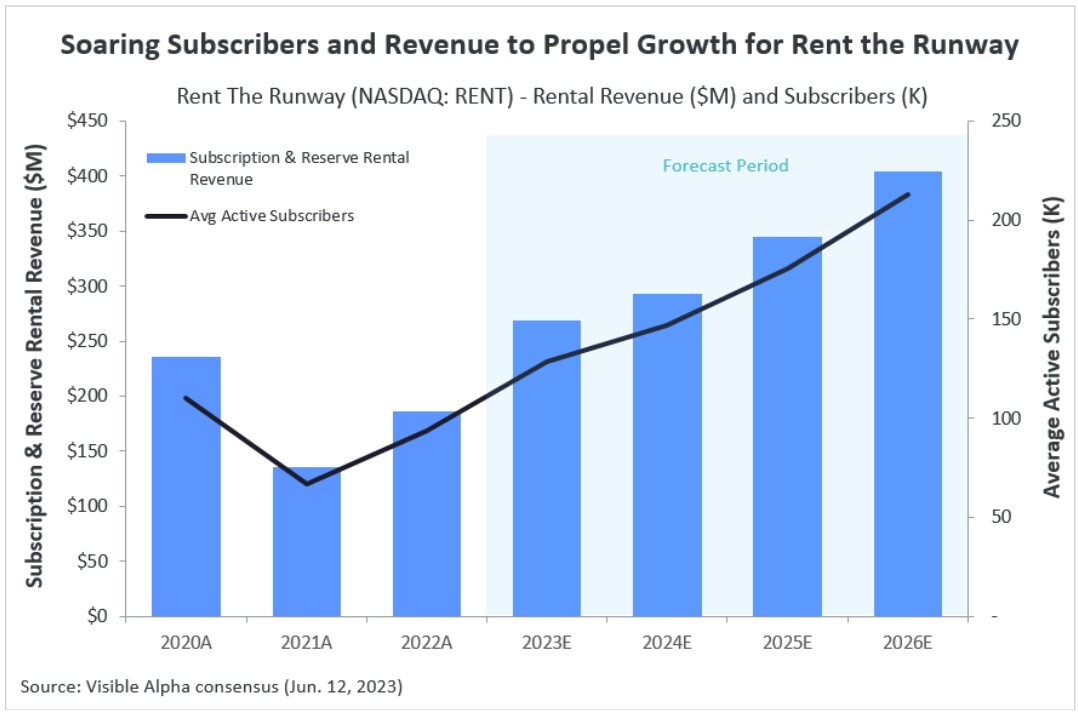

Soaring Subscribers and Revenue to Propel Growth for Rent the Runway

Analysts are expecting strong subscriber growth for Rent the Runway (NASDAQ: RENT), a fashion rental service provider with 129K average active subscribers expected in 2023, according to Visible Alpha consensus. The company claims demand for workwear has been surging as more people return to the office. Analysts expect subscription and reserve rental revenue to grow by 45% in 2023 to $269 million, with projections reaching $404 million by 2026.

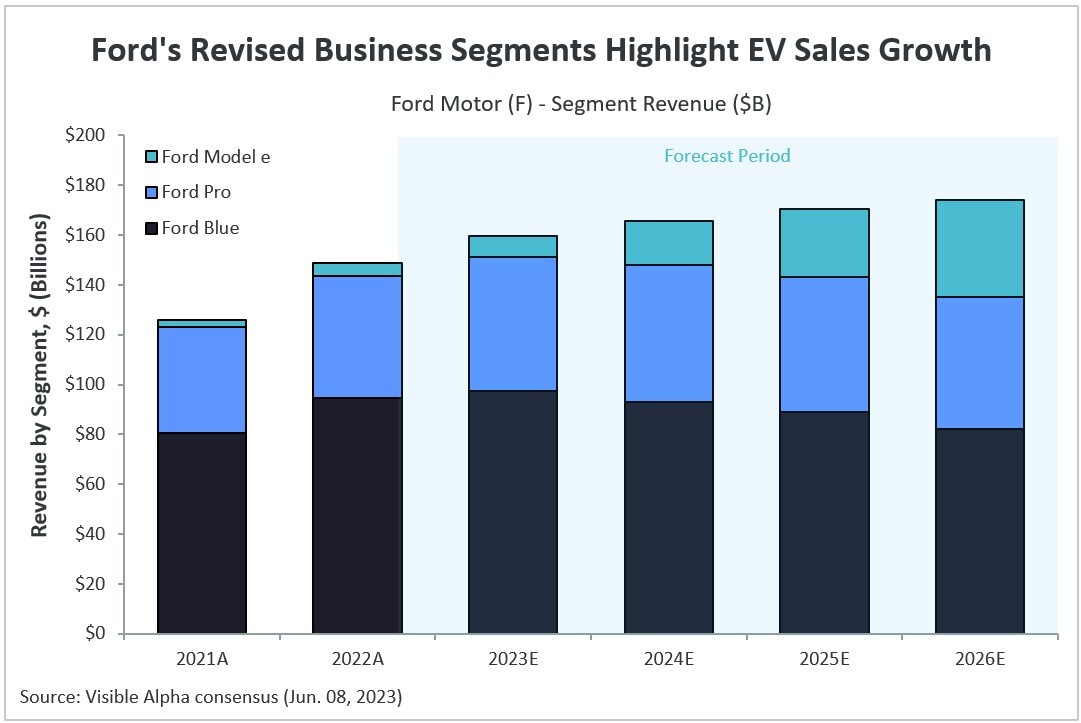

Ford’s Revised Business Segments Highlight EV Sales Growth

Ford Motor’s (NYSE: F) revised business segment classification — Ford Blue (gas and hybrid vehicles), Ford Model e (electric vehicles), and Ford Pro (commercial products and services) — has highlighted analysts’ projections for significant growth in revenue and units sold, specifically in the EV segment. Analysts project 63% revenue expansion for Ford’s Model e division in 2023, far surpassing the projected 3% growth for Ford Blue. Ford Model e units sold are projected to rise substantially from 96K units in 2022 to around 795K units by 2026.

Winnebago Slowing Down; CRISPR’s Gene Editing Therapy; Alibaba’s New Organizational Structure

In our weekly round-up of the top charts and market-moving analyst insights: CRISPR’s (CRSP) new gene-editing therapy is expected to be evaluated by the FDA; franchise sales are expected to drive growth for Xponential Fitness (XPOF); Alibaba (BABA) announces a new organizational structure; Winnebago (WGO) is poised to sell fewer units but at higher prices this year; and analysts continue to cut forecasts for deposits at Schwab (SCHW) Bank.

Model 3 and Model Y to Continue Dominating Tesla Sales; Carvana Sales Estimates Crash

In our weekly round-up of the top charts and market-moving analyst insights: Tesla’s Model 3 and Model Y are expected to continue contributing the most to Tesla’s overall sales; Carvana’s used car sales are projected to move even lower; Coinbase is not expected to recover lost revenue any time soon; and Nerdwallet’s credit cards segment is poised to help drive sales growth.

High Spirits: Alcoholic Beverages By the Numbers

Experts say the consumption of alcoholic beverages rose significantly during the pandemic, but there hasn’t been nearly as much news on how the industry fared as a result. How did companies that brew, distill, distribute, and sell alcoholic beverages do over the past few years? And what do analysts predict for the alcoholic beverages sector in the New Year? Read more