In our weekly round-up of the top charts and market-moving analyst insights: BYD (SZSE: 002594) leads in vehicle sales but Tesla (NASDAQ: TSLA) leads in revenue; Accenture (NYSE: ACN) is expected to see a modest growth rebound in 2024 after a tough 2023; Spain’s Solaria (SIX/BME: SLR) is ramping up solar capacity, driving revenue projections.

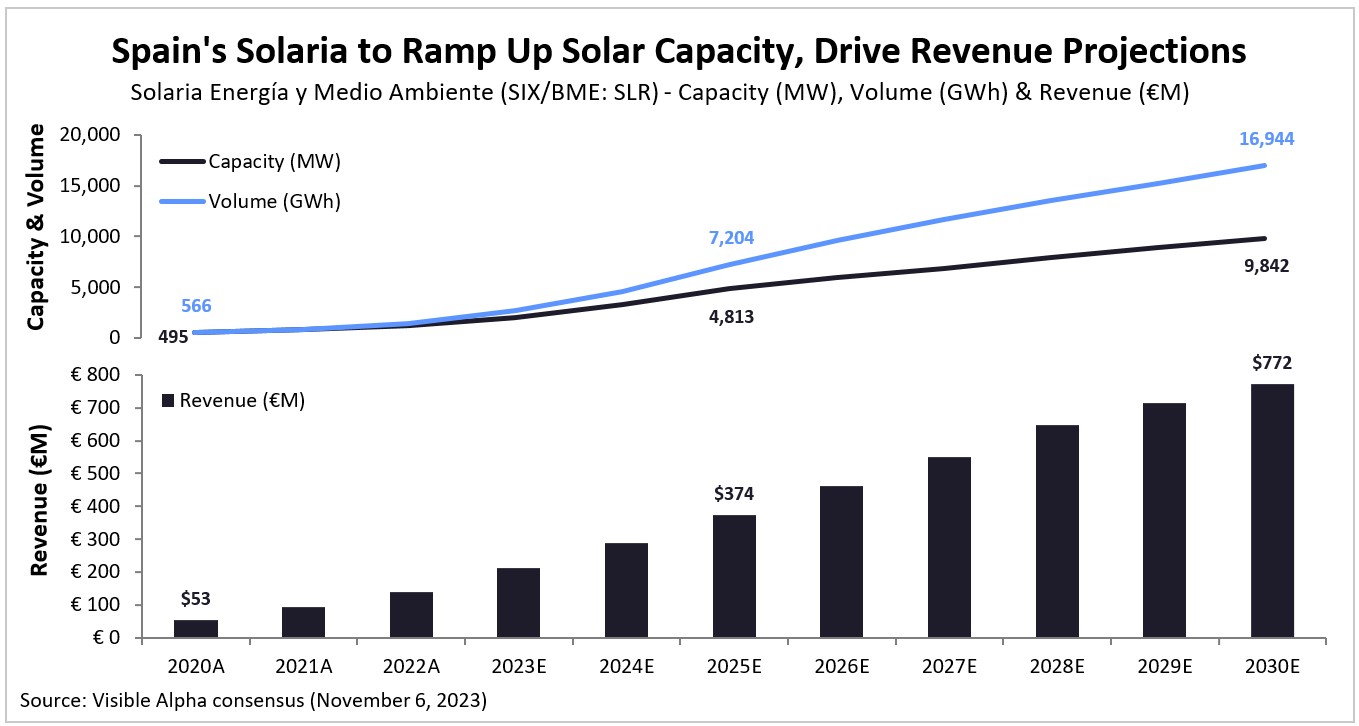

BYD Leads in Vehicle Sales but Tesla Dominates in Revenue

BYD and Tesla are two of the biggest players in the global electric vehicle (EV) space. While Tesla sells only EVs, BYD sells both EVs and plug-in hybrid electric vehicles. In 2022, China-based BYD (SZSE: 002594) sold 1.9 million vehicles, 555K units more than Tesla (NASDAQ: TSLA) did globally. According to Visible Alpha consensus, the gap between the units sold by the two companies is only expected to widen in 2023, with BYD projected to sell nearly 3 million vehicles, 1.1 million units more than Tesla. By 2025, BYD is projected to sell 4.4 million vehicles versus Tesla at an expected 2.7 million.

Despite BYD selling more units, however, Tesla still generates higher automotive revenue. In 2023, analysts expect Tesla to generate $82.4 billion in automotive revenue, compared to $67.8 billion for BYD. Between 2023-2025, BYD’s automotive revenue is projected to grow at a CAGR of 27% to $109 billion, while Tesla’s automotive revenue is expected to grow at a CAGR of 21% to $120 billion.

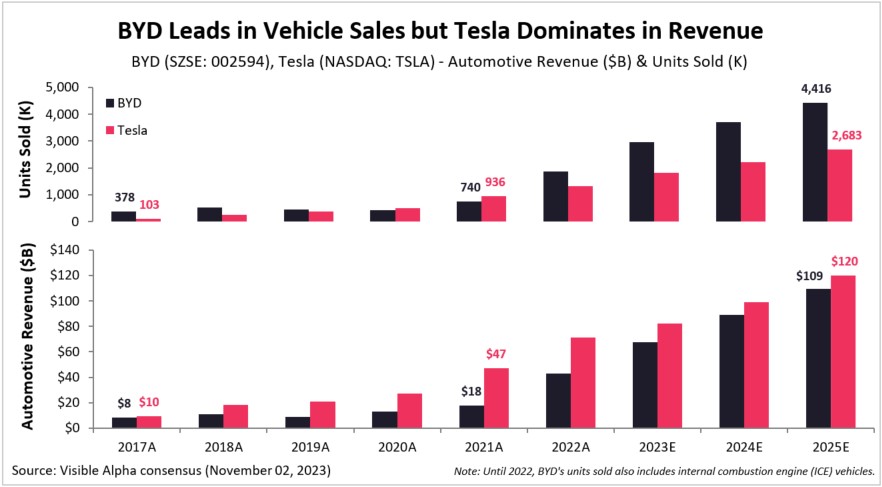

Accenture to See Modest Growth Rebound in 2024 After a Tough 2023

In 2023, Accenture (NYSE: ACN) experienced a significant decline in revenue growth as macroeconomic headwinds saw IT project ramp-downs, cautious spending patterns, and softer-than-expected bookings. According to Visible Alpha consensus, the company is expected to see a modest recovery in fiscal 2024, with a projected 4% growth in revenue. Specifically, Accenture’s Consulting business, which saw a -1% year-over-year decline in revenue in 2023, is anticipated to rebound with 1% revenue growth in 2024, reaching $34 billion. However, growth in the company’s Managed Services division is expected to slow down further to 6% in 2024, hitting $32.4 billion.

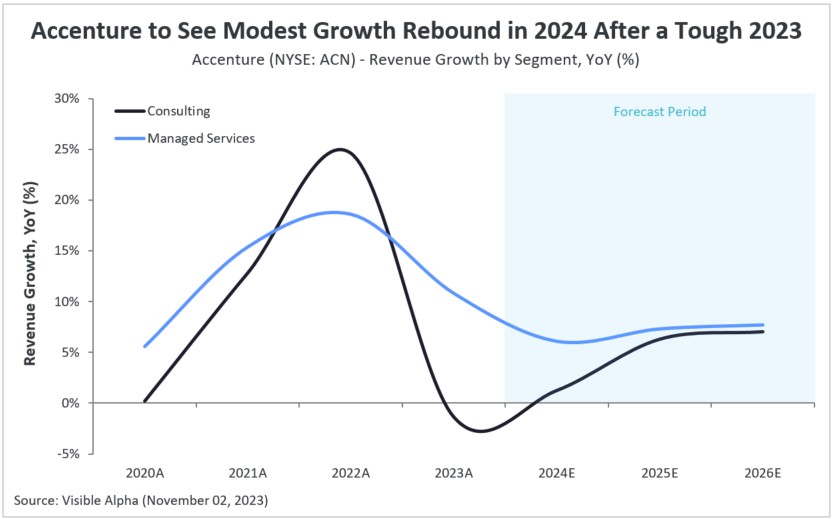

Spain’s Solaria to Ramp Up Solar Capacity, Driving Revenue Projections

Spain’s Solaria Energía y Medio Ambiente (SIX/BME: SLR), a solar power generation company, is set to substantially boost its installed capacity. According to Visible Alpha consensus, analysts expect Solaria’s total capacity to increase from 1,172 megawatts (MW) in 2022 to an estimated 2,048 MW in 2023, reaching 9,842 MW by 2030. Between 2023 and 2026, the company is projected to see annual double-digit growth in its installed capacity in Spain, Italy, and Portugal. This expansion is expected to drive the company’s solar production volume from 1,434 gigawatt hours (GWh) in 2022 to 2,729 GWh in 2023, and then grow at a projected CAGR of 30% to 16,944 GWh by 2030. With rising capacity and volume, Solaria’s total solar revenue is forecasted to increase to €211 million in 2023, and then grow at a CAGR of 20% to €772 million by 2030.