In our weekly round-up of the top charts and market-moving analyst insights: LVMH’s (EPA: MC) revenue growth in Asia is expected to rebound; Philip Morris International (NYSE: PM) is poised to see significant growth in non-combustible products; Chubb’s (NYSE: CB) North America agricultural segment is facing a slowdown in growth.

Analysts Expect LVMH’s Revenue Growth in Asia to Rebound in 2023

Analysts expect LVMH’s (EPA: MC) revenue growth in Asia to rebound in 2023, buoyed by the late-2022 lifting of anti-Covid measures in China. Based on Visible Alpha consensus, LVMH’s revenue in Asia (excluding Japan) is expected to be up nearly 19% year over year in 2023, reaching €28 billion. This comes after only around 6% revenue growth in the previous year.

2023 revenue in Asia, with Japan included, is also expected to be up nearly 19% year over year, followed by Europe at almost 10%. LVMH’s strong recovery in China is also expected to benefit revenue growth for the luxury goods conglomerate’s fashion and leather goods division, which is projected to grow 13% year over year in 2023, and selective retailing division, projected to grow 16%.

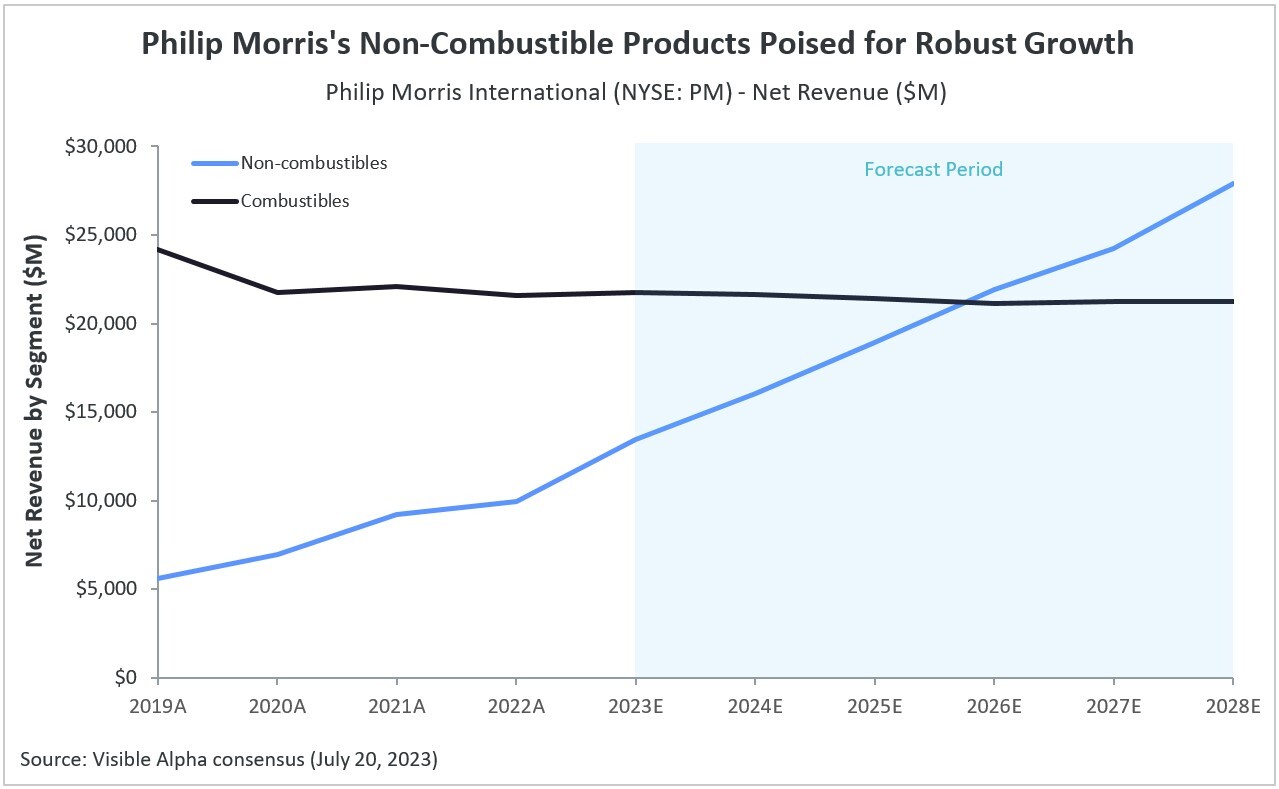

Philip Morris’s Non-Combustible Products Poised for Robust Growth

Philip Morris International (NYSE: PM) is poised to see significant growth in its non-combustible tobacco products, according to Visible Alpha consensus. While the net revenue from the company’s combustible tobacco products (cigarettes), has either remained stagnant or declined in recent years, revenue generated by non-combustible alternatives, such as e-cigarettes, heat-not-burn (HNB) tobacco products, and nicotine pouches, has been increasing rapidly.

Analysts anticipate 36% year-over-year growth in net revenue for non-combustible products this year, in stark contrast to less than 1% growth projected for combustible products. Revenue from non-combustibles is expected to surpass that of combustibles by 2026.

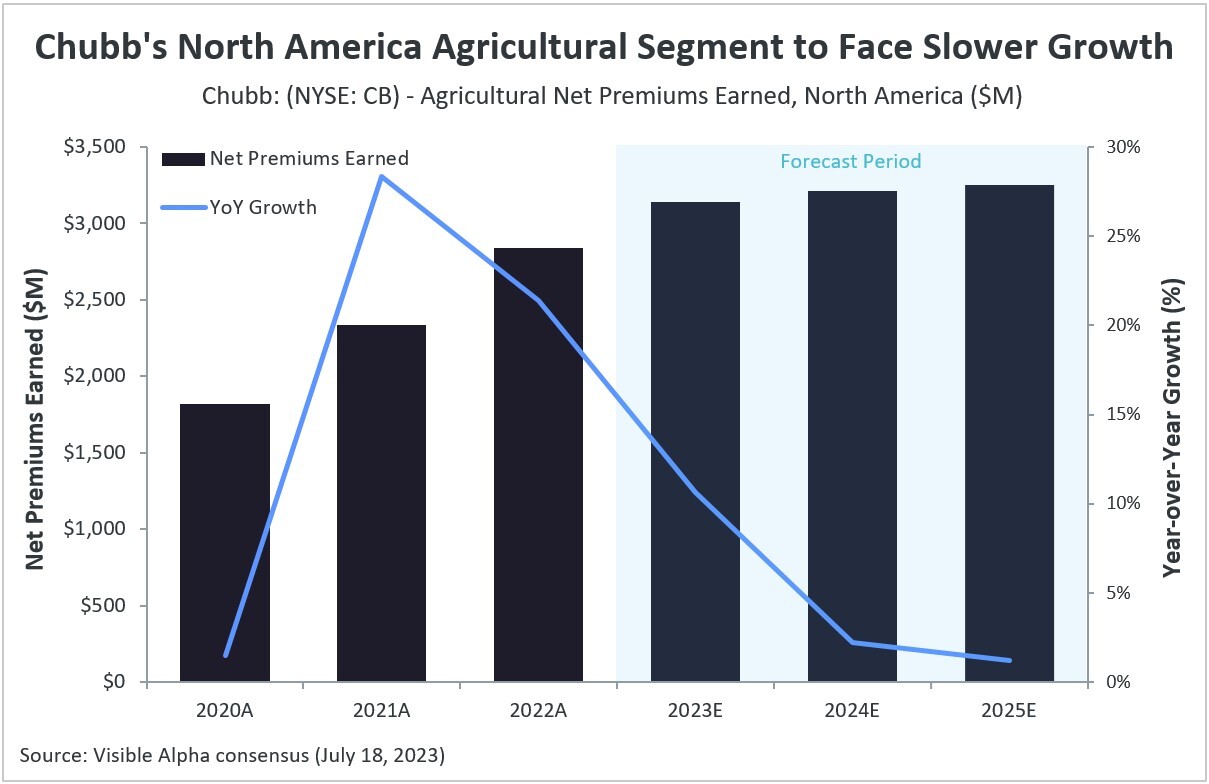

Chubb’s North America Agricultural Segment to Face Slower Growth, Say Analysts

Analysts project a deceleration in the growth rate of net premiums earned by property & casualty insurance giant Chubb (NYSE: CB) within its North American agricultural division during the forecasted period, according to Visible Alpha consensus.

This slowdown in growth is influenced by several factors, including climate volatility and its impact on crop productivity; and given that Chubb’s agricultural segment falls under the federally subsidized crop insurance program, the insurer is limited in its ability to impose higher premiums on agricultural insurance policies.