In our weekly round-up of the top charts and market-moving analyst insights: Tesla (NASDAQ: TSLA) is poised to challenge Ford Motor (NYSE: F) and General Motors (NYSE: GM) in automotive units sold by 2027; Nel ASA’s (OSE: NEL) green hydrogen revenue is expected to surge in the coming years amid the clean energy wave; and AppLovin (NASDAQ: APP) is projected to see software platform revenue grow by 60% year over year in 2023.

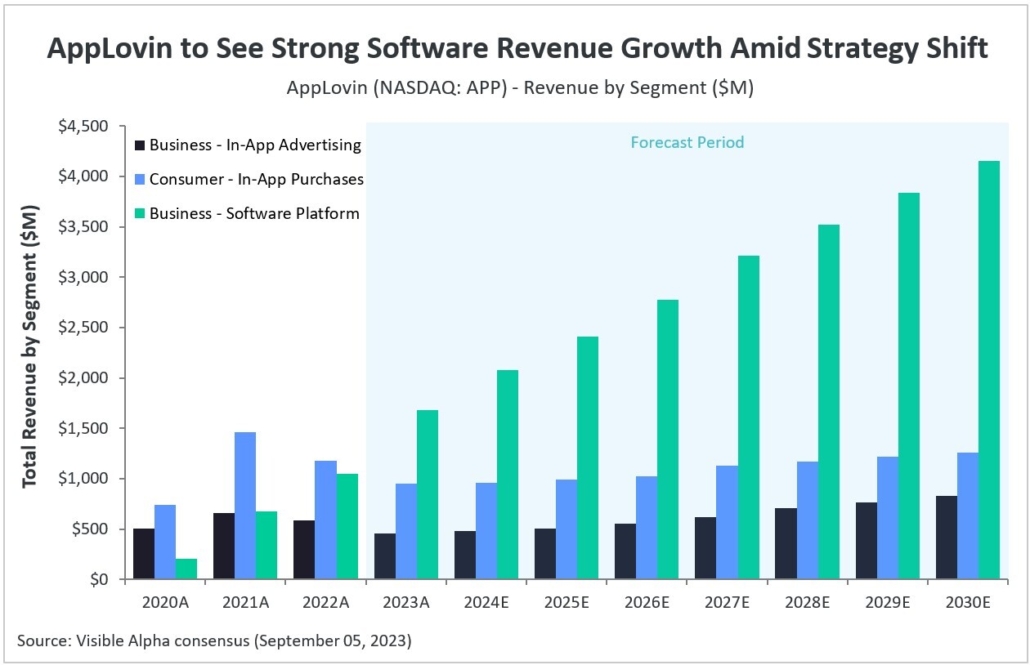

Tesla Poised to Challenge Legacy Automakers by 2027

While Ford Motor (NYSE: F) and General Motors (NYSE: GM) plan to ramp up EV production, analysts expect Tesla (NASDAQ: TSLA) to sell nearly as many automotive units overall as General Motors by 2027. Based on Visible Alpha consensus estimates, Tesla is forecasted to sell 4.21 million units in 2027, up from 1.85 million units expected in 2023. This is in comparison to Ford’s 4.72 million units and General Motors’ 4.25 million units expected to be sold in 2027.

In terms of revenue, analysts expect Tesla’s automotive revenue to surpass both Ford and General Motors by 2027. Tesla’s automotive revenue is projected to grow from an estimated $85 billion in 2023 to $185 billion by 2027. In comparison, Ford is projected to generate $178 billion while General Motors is expected to generate $172 billion in 2027. Between 2023-2027, Tesla’s automotive revenue is expected to grow at a CAGR of 21%, whereas Ford and General Motors are both expected to see their automotive revenues grow at a CAGR of 3%.

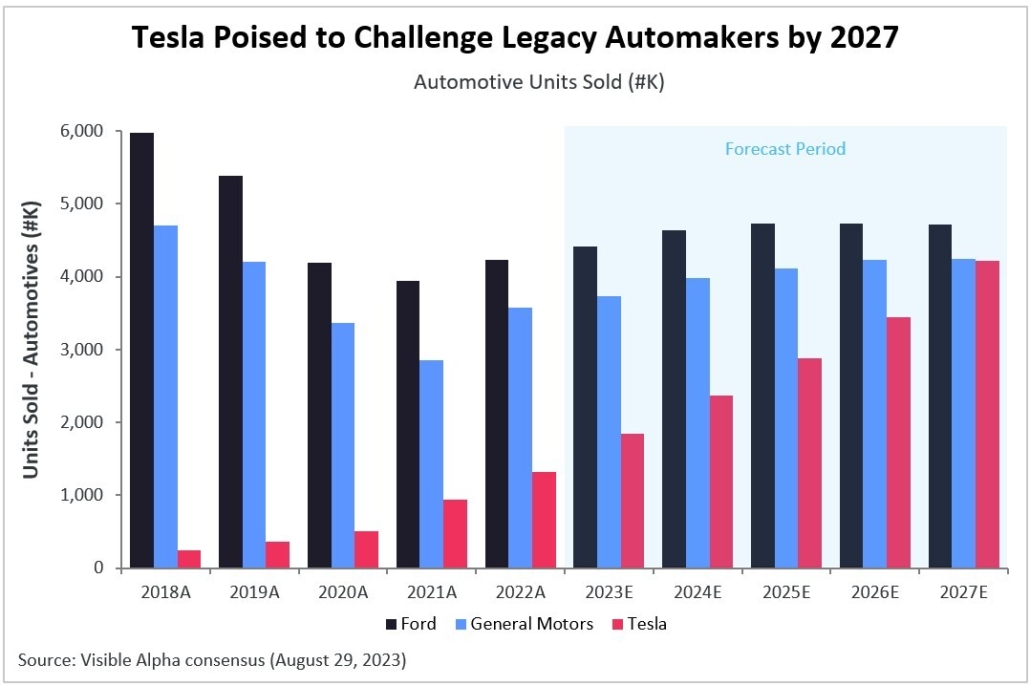

Nel ASA’s Green Hydrogen Revenue to Surge Amid Clean Energy Wave

Nel ASA (OSE: NEL), a Norwegian company specializing in hydrogen production solutions, is poised for significant growth in the forecast period according to Visible Alpha consensus. The company is a leading provider of hydrogen electrolyzers and is a key player in the emerging hydrogen economy. Green hydrogen, recognized as the most sustainable type of hydrogen, is positioned to be pivotal in the global shift towards cleaner and more sustainable energy sources.

Analysts expect the company to see revenue grow at a CAGR of 41% between 2020 and 2030. Looking at the company’s revenue segments, Hydrogen Electrolyser revenue is expected to grow at a CAGR of 47% between 2020-30, while Hydrogen Fueling revenue is projected to grow at a CAGR of 28%. Analysts expect the company to turn profitable by 2026, generating an operating income of NOK 7.9 million.

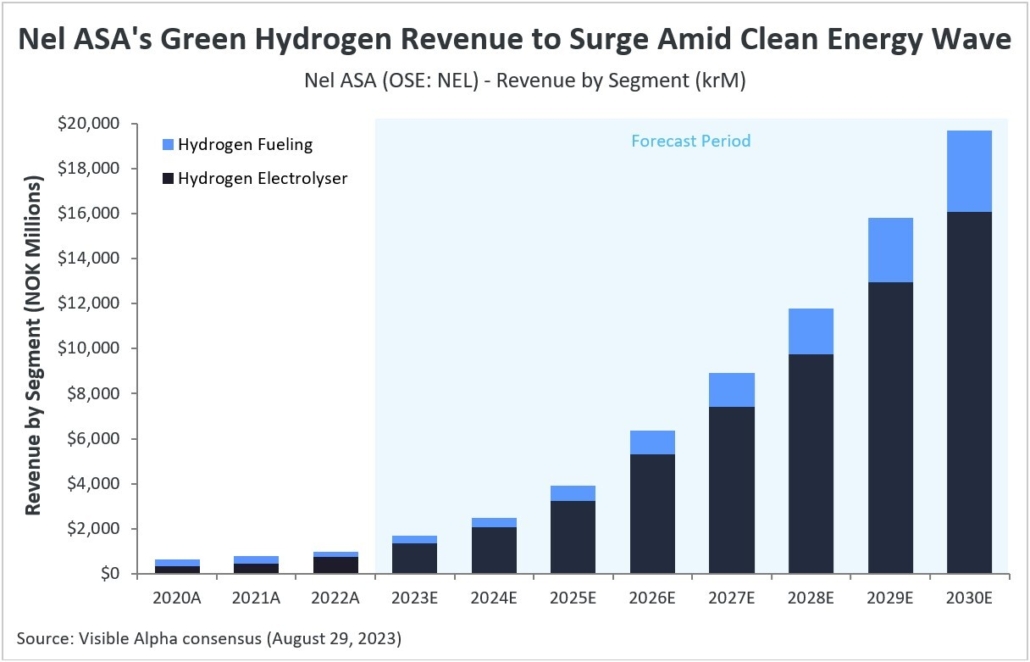

AppLovin to See Strong Software Revenue Growth Amid Strategy Shift

AppLovin (NASDAQ: APP), a mobile advertising company that delivers advertisement platforms for app developers, is projected to see software platform revenue grow by 60% year over year in 2023, based on Visible Alpha consensus. This growth is expected to be driven by Axon 2.0, the latest version of the company’s AI-based ad tech platform, which it launched earlier this year.

While consumer in-app purchases used to be the company’s primary revenue-generating segment, analysts anticipate that software platform revenue will outpace in-app revenue in 2023, reaching a total of nearly $1.68 billion. As the company shifts its focus towards its software platform, app-related revenue is projected to continue to decline. After dropping by 11% last year, in-app advertising revenue from the company’s business segment is expected to decline by 23% in 2023, while in-app purchase revenue from its consumer segment is expected to decline by 19% in 2023, after also declining by around 19% in 2022.