In our weekly round-up of the top charts and market-moving analyst insights: Novartis (NYSE: NVS) agrees to acquire Chinook Therapeutics (NASDAQ: KDNY); Lululemon Athletica (NASDAQ: LULU) projected to see significant international revenue growth; Rent the Runway (NASDAQ: RENT) subscribers and revenue expected to rise; Ford Motor’s (NYSE: F) Model e division (electric vehicles) to expand.

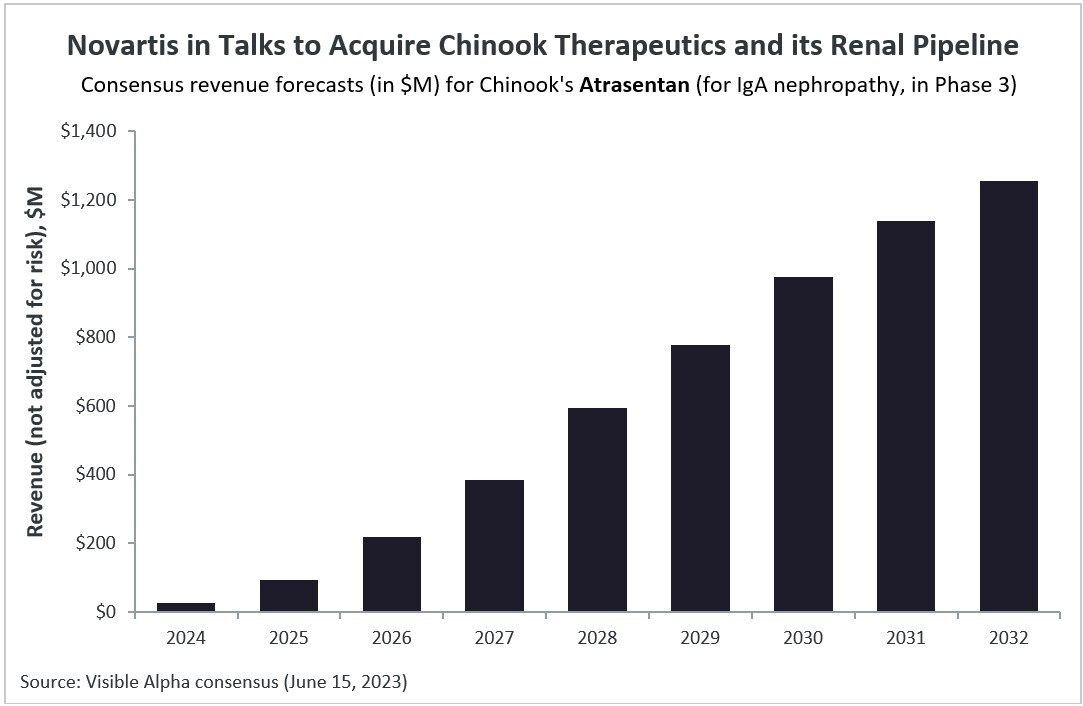

Novartis Agrees to Acquire Chinook Therapeutics and its Renal Pipeline

Novartis (NYSE: NVS) has agreed to acquire Chinook Therapeutics (NASDAQ: KDNY) for $3.2B up front, driven by Chinook’s innovative rare and severe kidney disease pipeline that will add to Novartis’ existing kidney disease focus. The acquisition is driven by Chinook’s lead program, atrasentan (currently in Phase 3 studies), a selective endothelin A receptor antagonist for IgA nephropathy. Visible Alpha consensus estimates show atrasentan ramping up to $1.25B in global revenue in 2032 ($932M on a risk-adjusted basis). Analysts peg the probability of regulatory approval at a consensus of 67.9%.

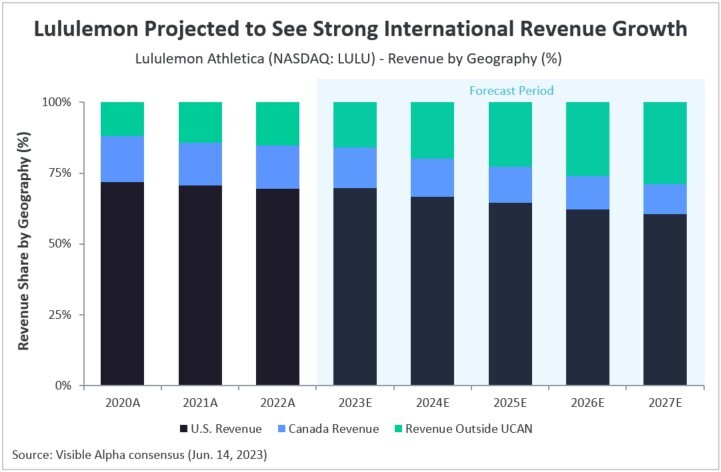

Analysts Anticipate Strong International Revenue Growth for Lululemon Athletica, Outpacing U.S. and Canada

Apparel retailer Lululemon Athletica (NASDAQ: LULU) is projected to see significant revenue growth in markets outside of the U.S. and Canada (UCAN). The company currently operates in UCAN, Europe, Asia, and Australasia. According to Visible Alpha consensus, the proportion of revenue generated internationally (excluding UCAN) is expected to increase from 15% in 2022 to 29% by 2027. Revenue outside of UCAN is expected to grow at a CAGR of 33% between 2022-27, and projected to reach $3.9 billion by 2027. Lululemon plans major expansion in its international markets, particularly in China. Analysts project Lululemon will add 49 new stores outside of UCAN in 2023, many of which will be in Asia.

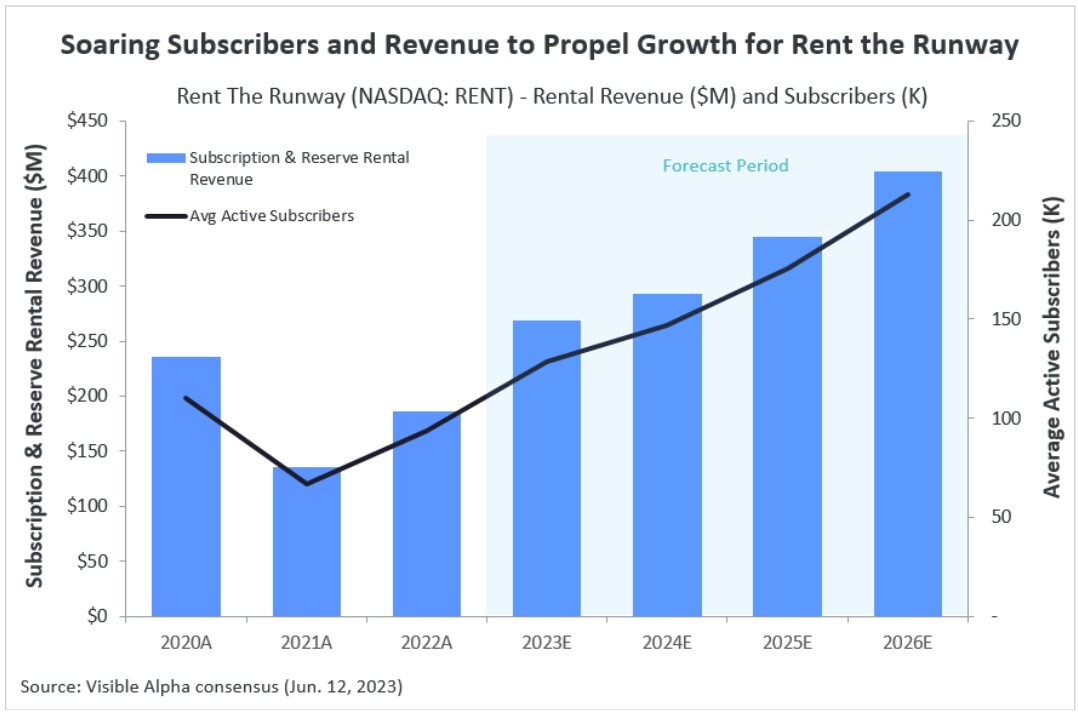

Soaring Subscribers and Revenue to Propel Growth for Rent the Runway

Analysts are expecting strong subscriber growth for Rent the Runway (NASDAQ: RENT), a fashion rental service provider with 129K average active subscribers expected in 2023, according to Visible Alpha consensus. The company claims demand for workwear has been surging as more people return to the office. Analysts expect subscription and reserve rental revenue to grow by 45% in 2023 to $269 million, with projections reaching $404 million by 2026.

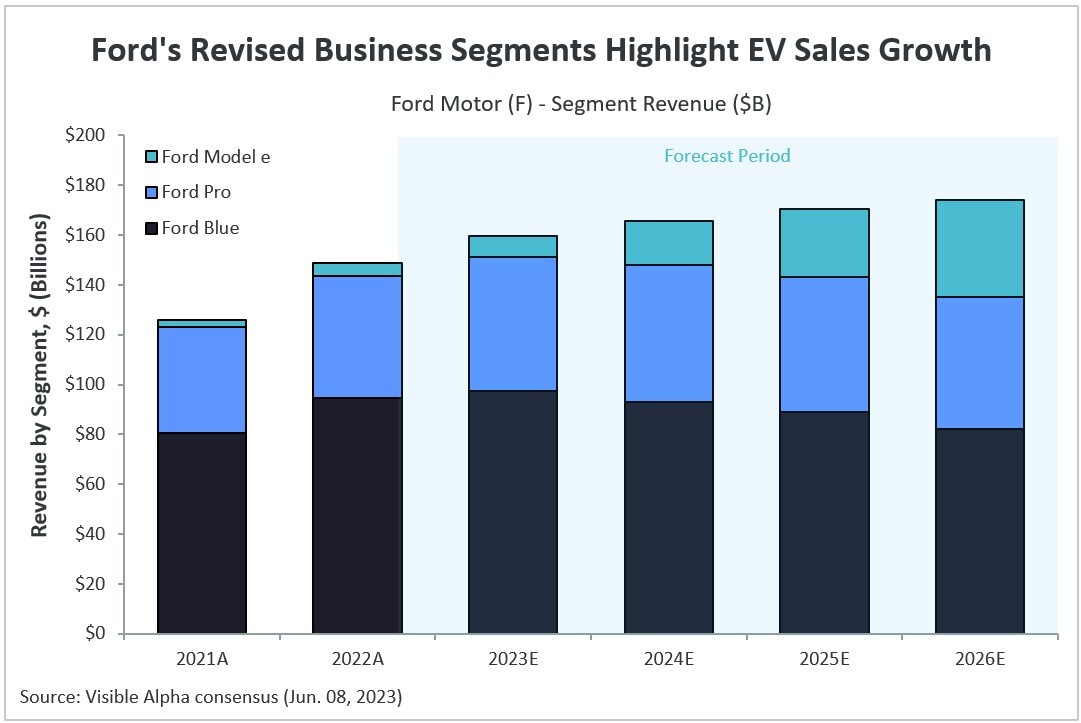

Ford’s Revised Business Segments Highlight EV Sales Growth

Ford Motor’s (NYSE: F) revised business segment classification — Ford Blue (gas and hybrid vehicles), Ford Model e (electric vehicles), and Ford Pro (commercial products and services) — has highlighted analysts’ projections for significant growth in revenue and units sold, specifically in the EV segment. Analysts project 63% revenue expansion for Ford’s Model e division in 2023, far surpassing the projected 3% growth for Ford Blue. Ford Model e units sold are projected to rise substantially from 96K units in 2022 to around 795K units by 2026.