In our weekly round-up of the top charts and market-moving analyst insights: Celsius Holdings (NASDAQ: CELH) is expected to see energy drink revenue surge in 2023; Booking Holdings (NASDAQ: BKNG) is projected to shift further from an agency model towards a merchant model; HubSpot Inc. (NYSE: HUBS) is poised to see strong revenue growth, improved margins, and a rise in free cash flow; and Turkey’s Ford Otosan (BIST: FROTO) is expected to see another strong year in 2023.

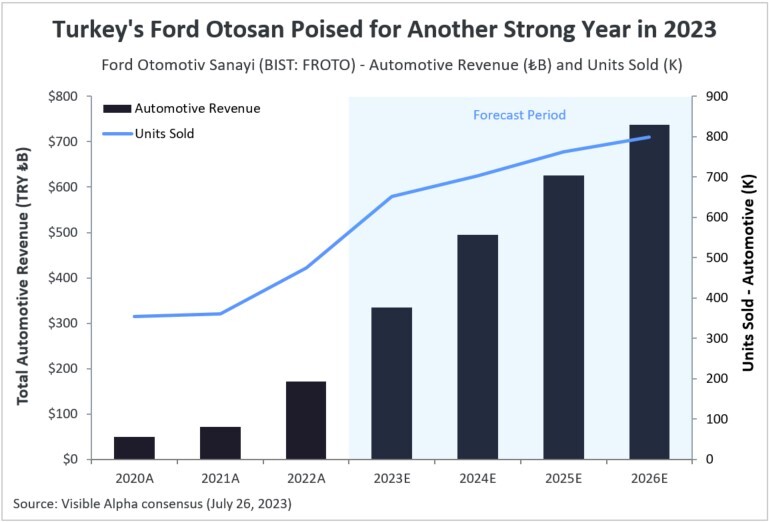

Celsius to See 70% Boost in Energy Drink Revenue in 2023

Celsius Holdings (NASDAQ: CELH) is expected to see energy drink revenue soar 70% in 2023 to over $1.1 billion, according to Visible Alpha consensus. The energy drink manufacturer has exhibited strong revenue growth over the past few years, having launched across the U.S. via Walmart in 2020 and signing a distribution contract with PepsiCo in 2022. The company’s revenue is expected to maintain strong growth in the forecasted years, though at a slowing pace as the market matures.

North America remains the company’s largest market with estimated revenue of nearly $1.1 billion (+74% YoY) in 2023, followed by Europe at $34 million (+10% YoY), and Asia at $5 million (+33% YoY).

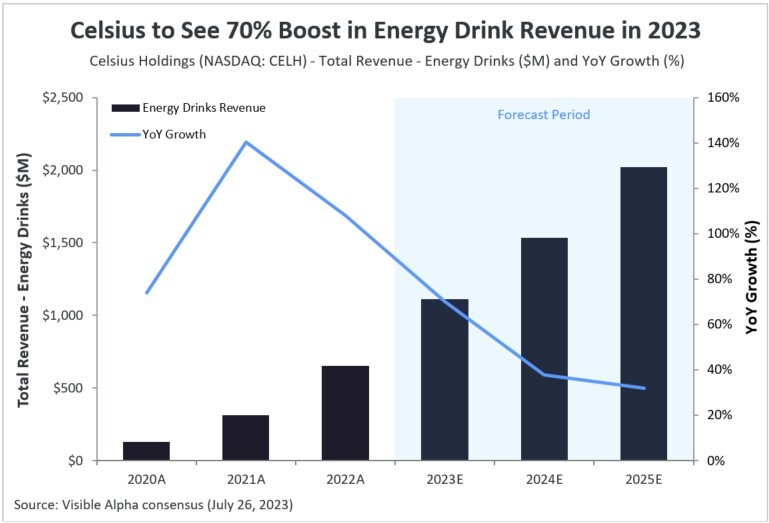

Booking Expected to Generate Nearly $16B in Merchant Revenue by 2027

In 2023, approximately half of Booking Holdings’ (NASDAQ: BKNG) reservations are projected to be handled through the company’s payment platform as they continue to shift from their original agency model to a merchant model.

Based on Visible Alpha consensus, Booking is expected to generate nearly $10 billion in agency revenue (+11% YoY) and $9.6 billion in merchant revenue (+34% YoY) in 2023. Booking’s advertising and other revenues are expected to generate a little over $1 billion (+17% YoY) by the end of 2023.

By 2027, analysts expect the merchant model to generate $15.7 billion in revenue, or 53% of the company’s total revenue, while the agency model is projected to bring in $12.4 billion.

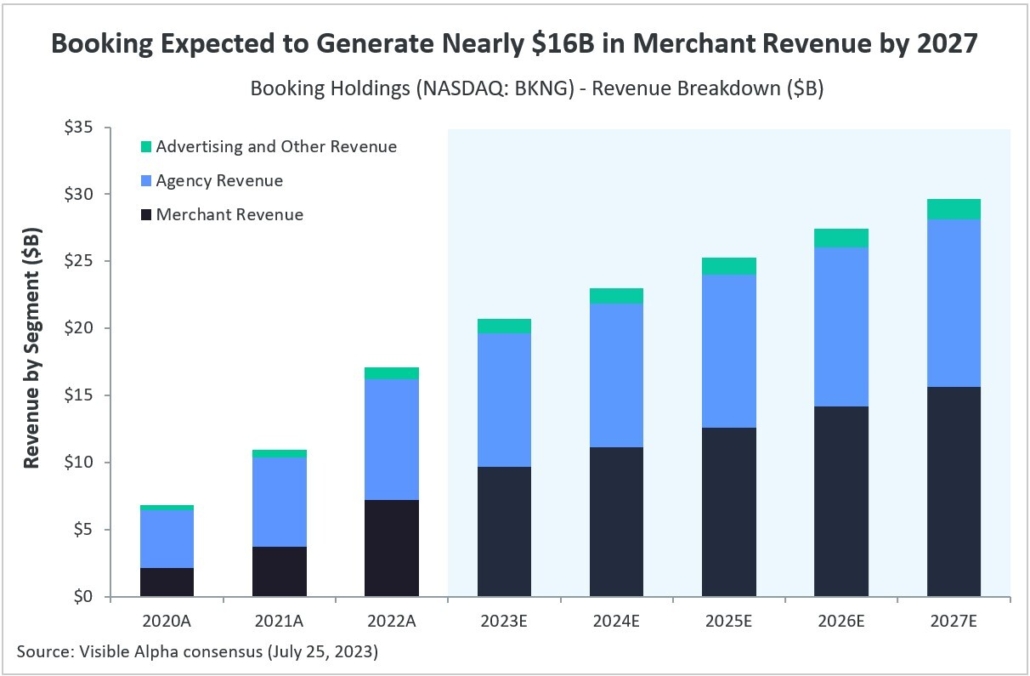

Strong Revenue Growth, Improved Margins to Expand HubSpot’s FCF

HubSpot Inc. (NYSE: HUBS), a CRM software developer, is anticipated to sustain double-digit revenue growth in the forecast period, though at a moderated pace, according to Visible Alpha consensus. Analysts project the company’s total revenue to reach $2 billion (+20.7% YoY) in 2023. Subscription revenue is expected to rise by 21%, and professional services and other revenue are estimated to grow by 7.3% year-over-year.

HubSpot is also expected to maintain profitability, with an estimated operating margin of 13.4% in 2023 and continued improvement in the forecast period due in part to better cost discipline. According to Visible Alpha consensus, free cash flow (FCF) is anticipated to rise by 25.7% in 2023, potentially supporting HubSpot’s growing financial health.

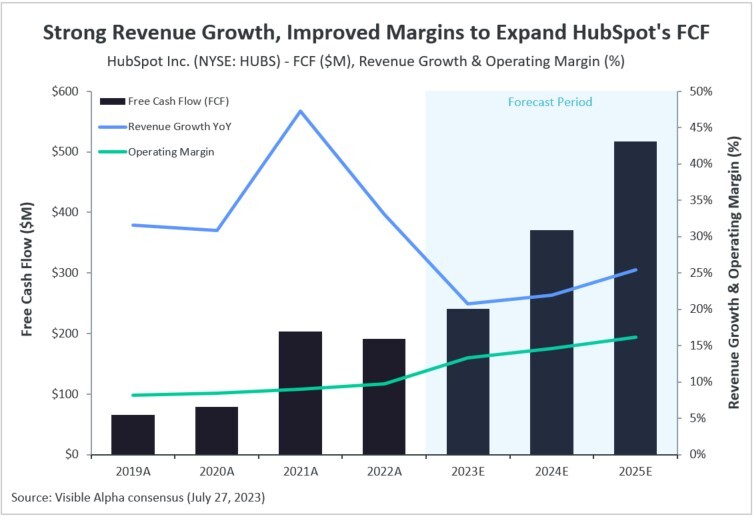

Turkey’s Ford Otosan Poised for Another Strong Year in 2023

Ford Otomotiv Sanayi A.Ş. (BIST: FROTO), otherwise known as Ford Otosan, the joint venture between Ford Motor (NYSE: F) and Turkey’s Koç Holding (BIST: KCHOL), is poised for substantial growth in 2023 according to Visible Alpha consensus.

Analysts expect automotive revenue of the Turkey-based auto manufacturer to surge 95% year-over-year in 2023, reaching an estimated TRY ₺334 billion (USD $12 billion). This outlook is underpinned by a projected 37% growth in the number of units sold, totaling 652K units in 2023. From 2023 to 2026, analysts expect Ford Otosan’s total automotive revenue to grow at a CAGR of 22%.