It was no surprise that hotels were among the “social distance losers” during the pandemic. When lockdowns went into effect, reservations were canceled, properties shuttered, and staff sent home. With uncertainty hanging in the air, hotel profitability took a massive hit, falling 34.3% in 2020 – the worst of any industry except for airlines, which fell 58.8%. [1]

However, since the spring of 2020, hotel stocks have rebounded sharply on investor optimism over a faster economic reopening. Shares of Wyndham Hotels & Resorts (NYSE:WH) increased 160%, for example, while Marriott International Inc.’s (NASDAQ:MAR) stock rose 100% since April 1, 2020. [2]

As recovery from the pandemic has accelerated in some markets, analysts have revised expectations for hotels upwards, particularly in China and the U.S. Analysts expect the industry’s recovery will be uneven, however, given lingering challenges stemming from the pandemic.

Leisure travel leads the way

While the travel industry is showing signs of life, some notable trends taking shape will impact the financials and stock performance of many of the larger chains. First, business travel has yet to rebound in a meaningful way. While airline bookings continue to climb, bookings for corporate travel remains far below pre-pandemic levels. Business travelers are lucrative in the industry as they are less likely to seek price discounts than leisure travelers. With many companies cutting back on travel budgets and implementing more technology for meetings such as Zoom and Slack, it remains to be seen whether the segment will come back to pre-pandemic levels.

Another trend that’s taking shape is the slow return of international travel. As many countries continue to struggle to contain Covid-19, international travel remains either off-limits, difficult or not on the radar yet. Domestic travel has recovered, particularly in China and the U.S. In the U.S., leisure travelers are leading the way and will likely continue to do so until more countries control the pandemic.

China hotel groups experienced fewer pandemic problems

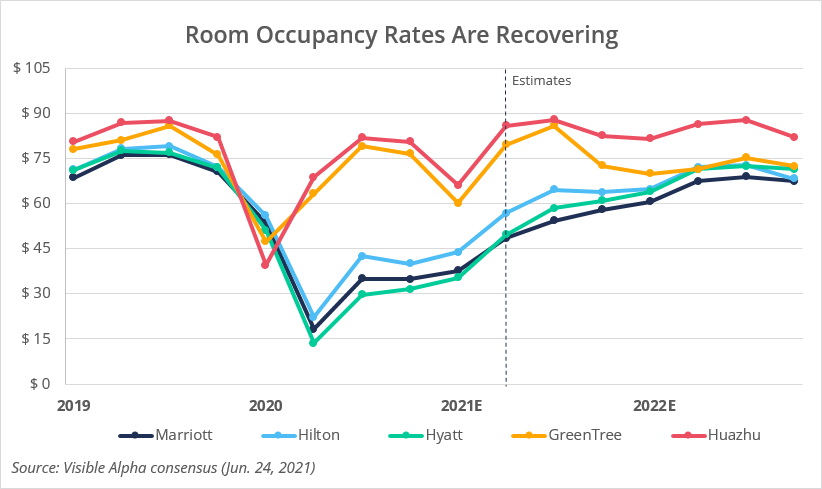

Room occupancies started improving in the latter half of 2020 and continue to rise. Two names stand out when looking at occupancy rates: Huazhu Group Ltd. (NASDAQ:HTHT) and GreenTree Hospitality Group (NYSE:GHG). Both are China-based hotel groups, with properties catering to the budget-minded crowd. Room occupancy rates at both hotels are forecast to return near pre-pandemic levels this year, versus U.S. mainstays Hyatt Hotels Corp. (NYSE:H), Marriott, and Hilton Worldwide Holdings (NYSE:HLT), which are forecast to remain well below 2019 occupancy levels through 2022.

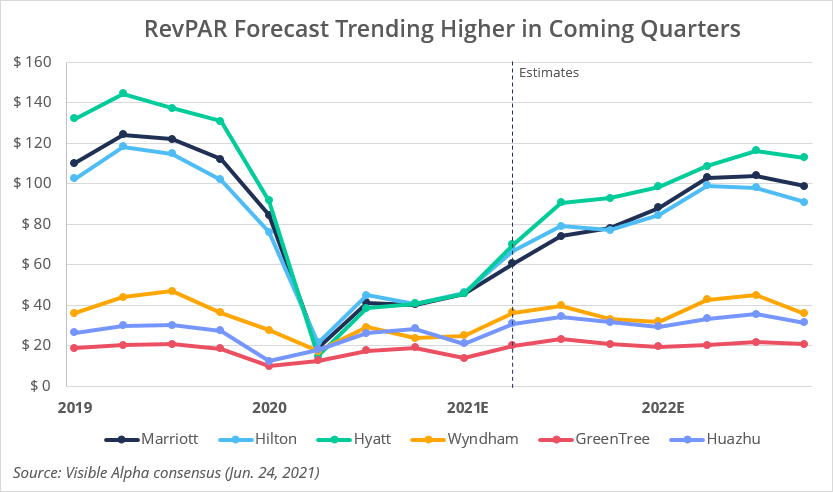

While the large U.S. chains generate far higher revenue per available room (RevPAR) than Huazhu and GreenTree, the two Chinese chains experienced less dramatic declines during the pandemic. RevPAR is forecast to grow through 2022, with large chains Marriott, Hilton and Hyatt recovering significant ground, but not forecast to reach pre-pandemic levels.

Balance sheets are improving, but an upstart competitor still lurks

While they continue to shore up financially, one trend will continue to challenge hotels – a growing flight to online lodging platforms. Room rates were declining even before the pandemic as hotels sought to compete with the likes of Airbnb. That trend will continue to challenge hotels, especially in the economy and midscale markets. Even though room prices remain down, luxury and upscale hotels have shown room pricing durability over time. Luxury and upscale hotels tend to have better pricing power and can better withstand challenges such as inflation as they can pass on higher costs to consumers via higher room rates. Hyatt, Marriott, and Hilton’s average daily room rates are forecast to grow 7%, 11% and 11.3%, respectively in 2022, compared to 4.2% for Huazhu and 2% for GreenTree.

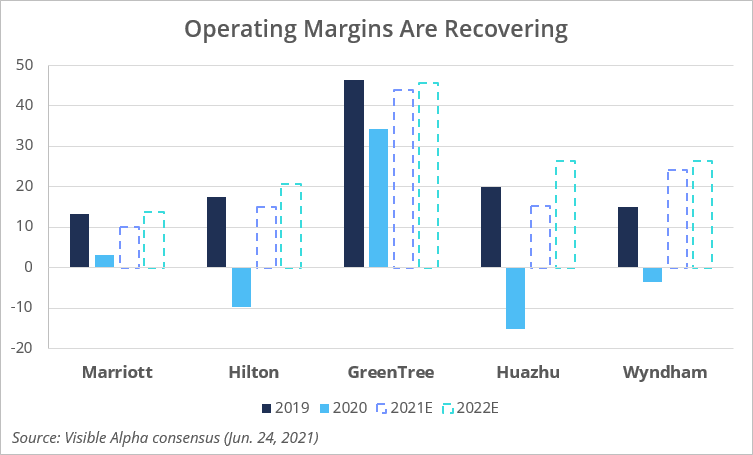

In terms of financials, analysts expect GreenTree to deliver industry-leading operating margins in 2021 and 2022 at a robust 45.6%. GreenTree was one of a small few that posted a positive margin for 2020. While posting mostly negative margins in 2020, most of the industry is expected to return to profitability this year but is forecast to remain below 2019 operating margin levels for the next two years.

As questions remain, returns may vary

With vaccination rates rising and Covid-19 cases falling, people are getting the bug to travel once again. Airports are busy, traffic has returned, and hotels are reopening in most major markets around the globe. It seems the travel industry is percolating after suffering a near-fatal blow in 2020. However, some names are rebounding faster during this period of uncertainty. The unknowns surrounding business and international travel remain enormous questions for the industry. The implications for investors could be significant as the industry isn’t moving in lockstep during a recovery that could last years.

[1] Airlines for America data, pre-tax profit margin, 2020

[2] Bloomberg, as of June 21, 2021

This content was created using Visible Alpha Insights.

Visible Alpha Insights is an investment research technology platform that provides instant access to deep forecast data and unique analytics on thousands of companies across the globe. This granular consensus data is easily incorporated into the workflows of investment professionals, investor relations teams and the media to quickly understand the sell-side view on a company at a level of granularity, timeliness and interactivity that has never before been possible.