In 2019, integrated energy companies were expecting 2020 to provide epic delivery of cash flow, but the outlook quickly soured when the Covid-induced global recession drove Brent prices from over $50 to below $20 in less than a month. Government-led lockdowns kept everyone at home, grounded flights, interrupted industrial production and led to steep declines in energy demand. In mid-2020, large cap integrated energy companies were priced to fail, and investors saw little upside opportunity.

Today oil prices are back almost precisely to their pre-pandemic levels, having made a gradual recovery over the last 12 months. During this time, integrated energy companies adapted remarkably quickly – cutting costs, shuttering production, deferring projects, reducing dividends, lowering their cash balance points, and accelerating and compressing 10 years of strategic planning and developments with respect to their commitment to decarbonization into just 10 months of rapid realignment.

Was the Covid-19 pandemic the only driving force behind a seemingly invigorated focus on renewable energy?

On March 24, 2021, Banco Santander’s Head of Pan-European Oil, Gas & Integrated Energy Equity Research, Jason Kenney, joined Visible Alpha’s Research & Innovation Lab to discuss his views on the accelerated transformation of the integrated energy industry regionally and globally.

Mr. Kenney shared that while the pandemic certainly had an impact on the oil majors’ decarbonization targets and interest in ESG, last year was a rare conjunction of multiple disparate streams cresting at the same time. For any oil company, projects take multiple years to come to fruition and begin generating cash, and so 2020 was always going to be the year of delivery. Here are a few notable precursors that have driven developments:

- In 2015, the Paris Agreement, the international treaty on climate that has spurred both government and private action, was adopted (and signed in 2016).

- In 2017, the Hydrogen Council, a global CEO-led initiative of 92 leading energy, transport, industry and investment companies, was formed with a united and long-term vision to develop the hydrogen economy.

- In 2018, the world watched as Greta Thunberg rose to the global stage, protesting government inaction on climate.

- In 2019, the public and media rhetoric started focusing on climate change as cyclones in Mozambique wiped out entire cities, India faced its worst water crisis, and wildfires burned Australia, Brazil and the West Coast of the United States.

When Covid-19 swept across the globe in 2020, industry participants saw an opportunity, as they successfully adjusted to the short-term demand crisis, to use the dislocation to accelerate their adaptation to public concerns about climate change and the shift to renewable energy.

“Their resilience measures were simply outstanding,” Mr. Kenney said.

Companies were able to bounce back by keeping their commitments to low-carbon capital expenditure while deferring other projects, looking at their advantage portfolios and lowering their cash balance point 30-40% – a phenomenal feat for companies at this size and scale to do in just one year.

After transitioning back to normalcy over the course of 2021, key strategy discussions will be the focus of 2022 and 2023, as the oil majors decide how they want to spend in the next five years. With 2022 setting itself up to deliver a wall of cash, these companies will be determining how to spend that money. Mr. Kenney said he was recently asked, “Is it better to be an early mover or a fast follower?” His response was that early movers will see an advantage, but with the right balance sheet, fast followers will be rewarded as well.

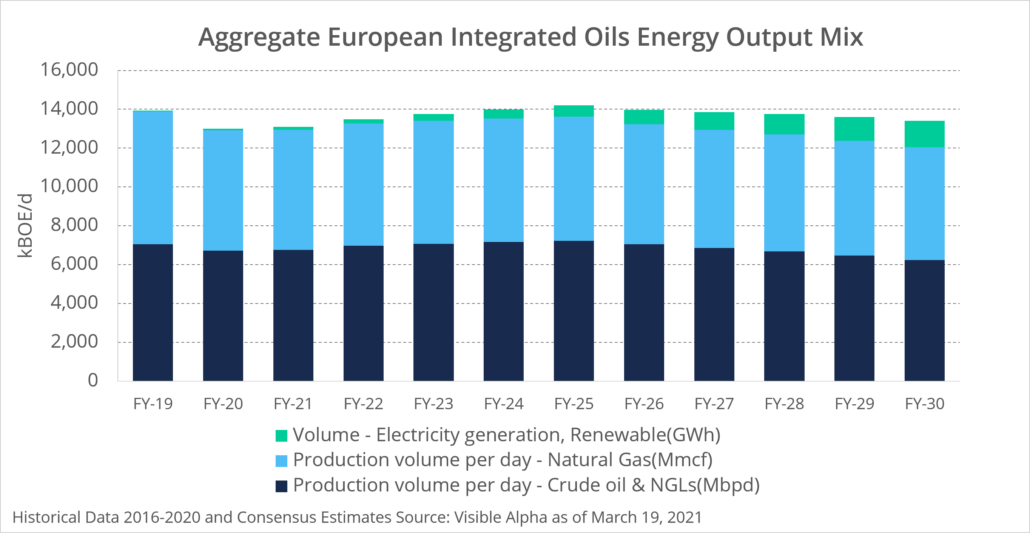

In looking further into the future, Mr. Kenney sees electrification as crucial to a decarbonized economy, and the energy majors as well positioned to capitalize on the continued growth in distribution. This convergence and blending of the energy and utility sectors is a major development to watch.

In fact, over the past several years Visible Alpha has seen a growing number of analysts adding electricity generation (or renewable generation) forecasts into their more traditional energy producer models.

While fossil fuels will still be important for decades to come, companies will ultimately have to cut emissions in many different ways if they seek to achieve a zero carbon economy by 2050. And this is a big part of what investors should be evaluating for renewable capacity for each company.

Watch the full webinar here to learn more about integrated energy companies’ return on capital, competition with the utilities sector, green hydrogen and more. For more information on the key performance indicators in the upstream oil and gas industry, read our upstream oil and gas industry guide.