A Global Meta-Analysis of Investment Research Analyst Forecasts

While the world reels from the social and economic shocks caused by the Covid-19 pandemic and the measures taken to mitigate its impact, the rebound in equity markets suggests that investors are already looking forward to a return to some semblance of normalcy.

But how does the market expect that recovery to play out?

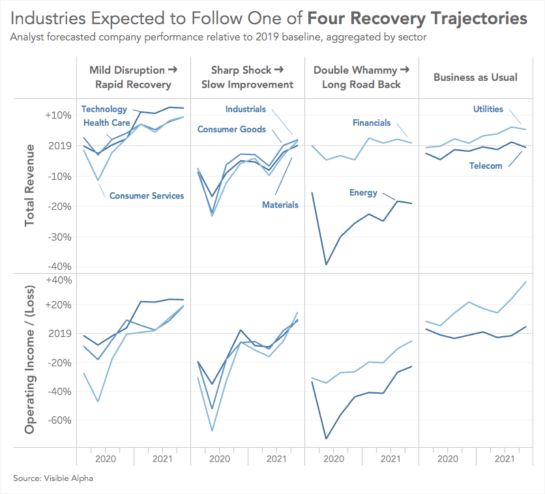

By combining the forecasts of over 4,300 investment research analysts on thousands of public companies around the world, Visible Alpha created a mosaic of market expectations for the global economy over the next two years, with four consistent and distinct trajectories emerging from our analysis.

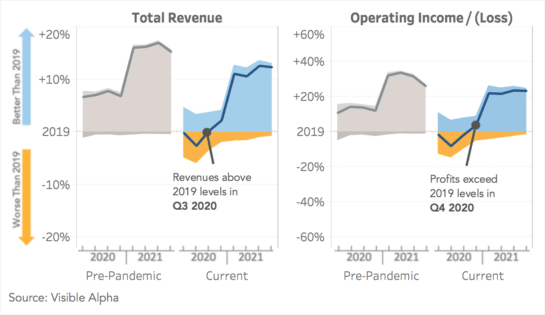

A detailed analysis of this data is presented in an interactive report. The report provides aggregated consensus expectations for pre-pandemic forecasts (as of Jan. 1) and current forecasts (since March 15) for revenue and profitability for 10 sectors and 52 industry groups.

When are companies expected to recover?

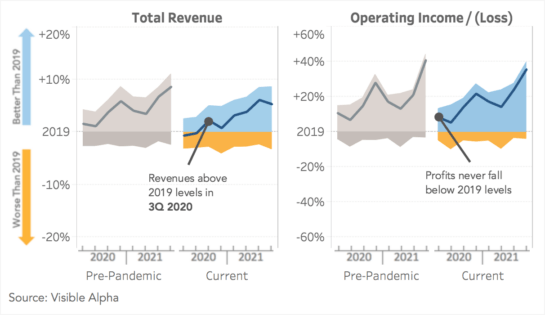

In the following analysis, “recovery” is defined as the point at which a sector’s revenues or operating income have returned to their 2019 levels.

While individual companies and even whole sub-industries will have very different experiences, our analysis suggests that expectations of recovery for economic sectors follow patterns that can be broken into four broad categories:

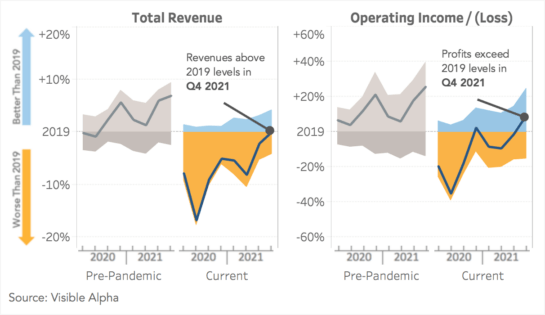

Mild Disruption ➔ Rapid Recovery

While the Consumer Services, Health Care and Technology industries are experiencing a disruption (extremely severe in some cases), the underlying demand and economics appear largely unchanged, with analysts expecting a return to relative normalcy within a year.

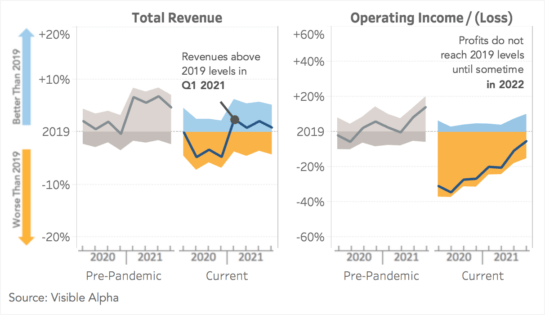

Sharp Shock ➔ Slow Improvement

Consumer Goods, Industrials and Materials sector companies have taken a massive shock, and most will take the better part of two years just to get back to 2019 levels. Nevertheless, analysts expect steady progress each quarter in that direction.

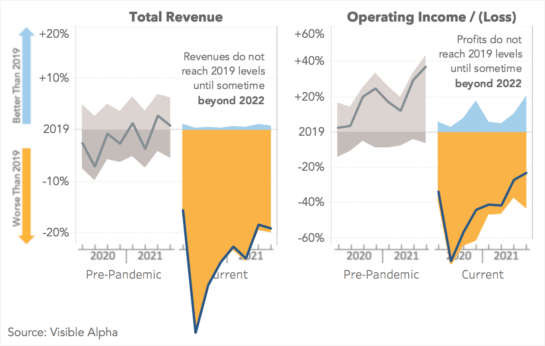

Double Whammy ➔ Long Road Back

Energy has taken the sharpest hit, with both demand and supply side shocks. While Financials haven’t been as dramatically impacted, analysts predict that both these sectors have reset to lower levels of profitability. A return to pre-pandemic economics appears to be a longer-term prospect for companies in these industries.

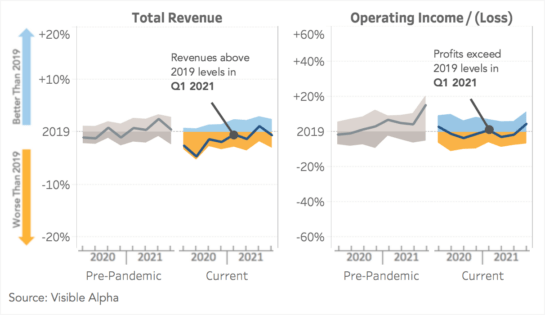

Business as Usual

The Utilities and Telecommunications industries are viewed as being largely immune to the impact of recent events, with revenue expectations almost indistinguishable from pre-pandemic forecasts.

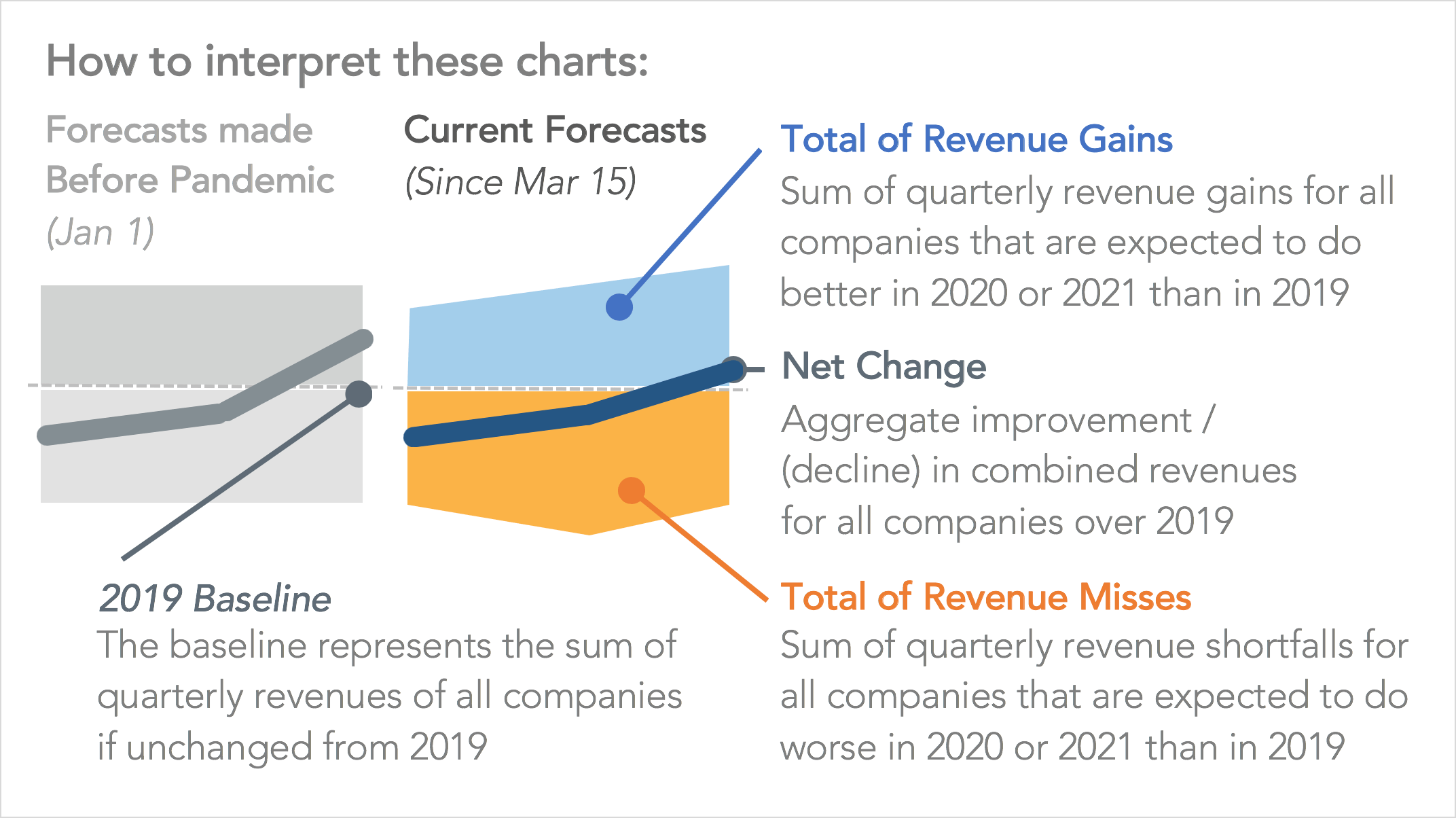

Sector Chart Legend

The dark line represents the change in aggregate revenue or operating income compared to 2019. If the line is in the bottom area, the sector is generating less sales or profit than it did in 2019; if it is on the top, is exceeding 2019 levels. The shaded regions show the magnitude of companies doing better or worse. The area above the line is the total amount of sales or profit in excess of 2019 levels from companies that are doing well, and the area below the line is the sum of all shortfalls below 2019 levels from companies that are doing worse. |

Rapid Recovery: Technology, Health Care and Consumer Services

While consumer demand is currently depressed, analysts are forecasting a rapid recovery for companies in these industries. A few mega-caps are driving much of the outperformance, but that was true before the pandemic as well.

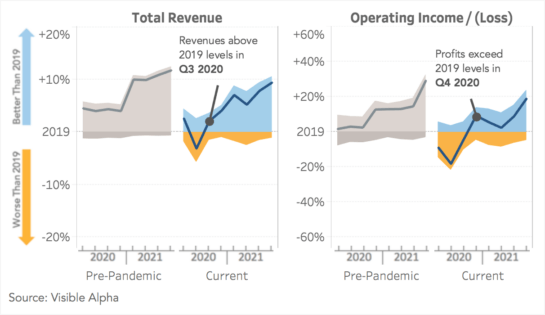

Technology: Recovered by Q3 / Q4 2020

Aggregate performance (lines) and summed gains/shortfalls (shaded areas) vs. 2019 levels.

The Technology sector is still projected to grow aggregated sales by 0.2% this year, after analysts revised revenue estimates 6.4% lower due to the negative impacts of Covid-19. Social distancing behavior and shelter-in-place ordinances have crippled small businesses and their demand for digital advertising, which in turn prompted analysts to revise sales estimates for Facebook (FB) and Google (GOOGL) lower by around 17% in 2Q20. However, the Technology sector is expected to have a rapid recovery that analysts project will exceed all other sectors in aggregated sales. Google (GOOGL) and Apple (AAPL) are projected to lead the sector’s recovery over the next few years as digital ad rates recover and a new generation of 5G-enabled smartphones come to market. Analysts expect the sector will make a full recovery to 2019 sales levels by 3Q20 and to exceed pre-pandemic forecasts for 2020 very early in 2021.

Health Care: Recovered by Q3 / Q4 2020

Aggregate performance (lines) and summed gains/shortfalls (shaded areas) vs. 2019 levels.

The pandemic has largely disrupted the Health Care sector by reducing non-Covid-19 related medical visits and elective procedures. The near-term impact has reduced demand for diagnostic testing and prescription volumes due to higher unemployment and decreased insurance coverage. Some analysts expect generic drug pricing to inflate over the next couple of years as lockdowns in China and India could tighten supply. AmerisourceBergen (ABC) would be a beneficiary of higher generic pricing and is the largest contributor to the recovery in the Health Care sector. Analysts currently expect the sector’s aggregated sales to grow by 2.4% in 2020, after revising estimates 4.3% lower than pre-pandemic expectations. Revenues are expected to accelerate in 2021, with the sector making up almost all lost ground by 2022. That said, the industry is growing from a low base, with the largest proportion of loss-making companies of any sector except Energy – even after accounting for early stage Pharma and Biotech R&D firms.

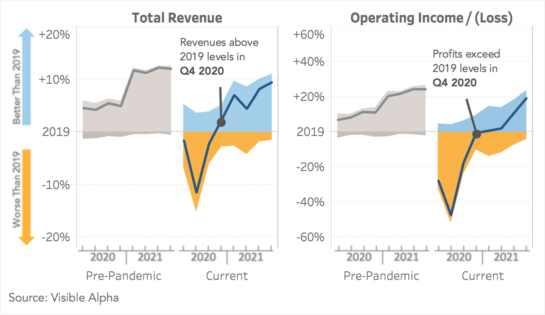

Consumer Services: Recovered by Q4 2020

Aggregate performance (lines) and summed gains/shortfalls (shaded areas) vs. 2019 levels.

The pandemic has had a mixed impact in the Consumer Services sector with some ecommerce retailers, such as Amazon (AMZN), Walmart (WMT), Alibaba (BABA) and JD (JD), benefiting from virus-induced demand, while Travel and Leisure companies saw a catastrophic collapse in business since global travel lockdowns began in March. In forecasts made since March 15, the Consumer Services sector saw 2020 revenue estimates lowered by 7.2%, and the sector’s aggregate sales are now expected to fall to 2.9% below 2019 levels. The impact has been felt very unevenly, with well-positioned companies able to navigate the environment much more effectively than others. In fact, with the exception of Energy, more companies in the Consumer Services industries than any other sector are being pushed into the red in 2020, with the number of companies expected to make operating losses this year more than tripling from 5% to 16% of our sample.

Nevertheless, analysts are currently projecting that Consumer Services will have a relatively robust recovery, with the overall sector getting back to 2019 sales and operating income levels by the fourth quarter of 2020. Analysts expect the sector to continue to grow rapidly thereafter, with revenues and profitability reaching almost the same levels as they had been predicted to achieve prior to the pandemic.

Slow Improvement: Consumer Goods, Industrials and Materials

Given the interconnected global supply chain, it is perhaps not surprising that these sectors appear to be expected to move in lockstep. While the world’s industrial base is facing an unprecedented shock, analysts are looking forward to slow but steady growth to bring these industries back to health.

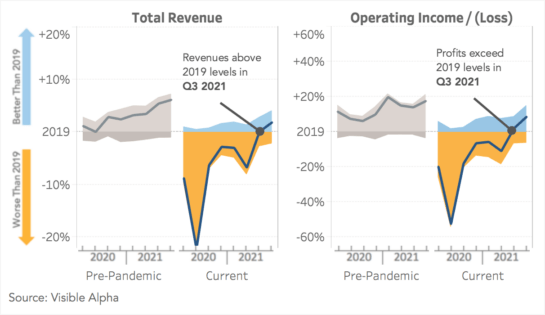

Consumer Goods: Recovered by Q3 2021

Aggregate performance (lines) and summed gains/shortfalls (shaded areas) vs. 2019 levels.

The near term impact of Covid-19 has disrupted global automobile production and softened demand for new cars, causing a disproportionate impact on the Consumer Goods sector. The aggregated 2020 sales estimate for the sector is currently projected to shrink by nearly 9% from 2019 levels, which is down from positive 0.5% at the start of the year. Analysts believe it will take until 3Q21 for the sector to recover from the impact of Covid-19 on an aggregated sales basis. Tesla (TSLA) and BYD (BYD) are expected to lead the recovery for the Consumer Goods sector and be the largest contributors to aggregated sales over the next couple of years as they ramp up production of electric vehicles. Outside the Automotive industry, Food and Beverage giants Archer-Daniels-Midland (ADM), PepsiCo (PEP), Tyson (TSN) and the WH Group (0288_HK) are expected to provide a further engine of growth. However, while there are bright spots, many more companies will be spending the next two years slowly digging out from a very deep hole.

Industrials: Recovered by Q4 2021

Aggregate performance (lines) and summed gains/shortfalls (shaded areas) vs. 2019 levels.

Industrials are also expected to be dramatically convulsed by Covid-19 and then see a steady improvement into 2021, but with a wide degree of variability within its industries. As expected, travel-related industries like Airlines are the most heavily impacted as all passenger travel has essentially stopped. Revenue is expected to decline by 72% in Q2 and by 13% for 2021, while operating income is expected to look even worse. Road & Rail is also expected to see revenue declines of 15% in 2Q20, as slower economic activity impacts their volumes. However, the industry does expect to see growth take it beyond 2019 levels by late 2021. Analysts forecast only slight declines for the Marine industry and a recovery in early 2021, as floating storage tankers benefit from the glut of oil supply. Overall, the Industrials sector is expected to see a 23% revenue decline in 2Q20 and a recovery to baseline in 4Q21.

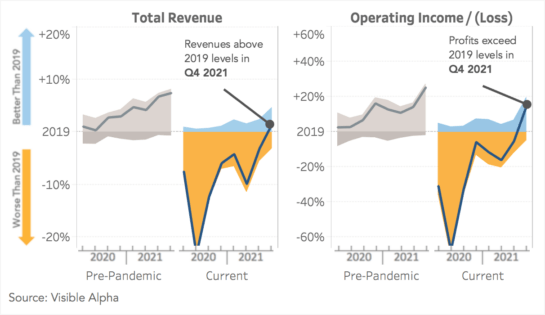

Materials: Recovered by Q4 2021

Aggregate performance (lines) and summed gains/shortfalls (shaded areas) vs. 2019 levels.

Analysts are forecasting that the Materials sector’s aggregated sales will shrink by nearly 10% in 2020 as the pandemic severely impacts many of the industries in the sector. Demand has fallen for chemicals used in everyday items like furniture and cars, prompting analysts to lower estimates for chemical giant BASF (BASFN_DE) by 24% in 2Q20. Operations and production have also been disrupted across the sector due to Covid-19 shutdowns. Mining giant Glencore (GLEN_UK) has had the largest impact on the sector’s downward revisions, as their mining operations have been hampered by coronavirus precautions. Analysts are not forecasting a swift recovery with estimates currently predicting that it will take until 4Q21 for the sector’s aggregated sales to reach 2019 levels.

Long Road Back: Financials and Energy

For all other sectors in our analysis, profitability eventually returns to 2019 levels sometime in the next two years, albeit at different rates. Neither Energy nor Financials, however, are expected to return to their pre-pandemic levels of earnings before at least 2022, and Energy is likely to take much longer.

Financials: Q1 2021 – FY 2022

Aggregate performance (lines) and summed gains/shortfalls (shaded areas) vs. 2019 levels.

The Financials sector is also expected to face longer-term headwinds. Within Financials, Banks are expecting to see elevated charge-offs as signs of credit deterioration are beginning to show. Banks are therefore increasing provisions for loan losses and seeing larger negative impacts on operating income. REITs are also seeing large longer-term losses, as they are negatively impacted by the business and consumer disruption from the pandemic. Storage, residential and commercial REITS are all expected to remain below 2019 levels over the coming quarters. Meanwhile, Insurance sees a more mixed, somewhat positive outlook, as claims are expected to be muted in the near-term though rise once the lockdown is removed. UnitedHealth Group (UNH) in particular is expected to show continued growth in revenue and operating income for 2020 and 2021. For the Financials sector overall, analysts forecast a 5% decline in revenue and a 34% decline in operating income in 2Q20. For 2021, analysts expect revenue to grow 5% above 2019 levels but for operating income to remain 10% below 2019 levels.

Energy: Recovering sometime after 2022

Aggregate performance (lines) and summed gains/shortfalls (shaded areas) vs. 2019 levels.

The Energy sector is currently facing two separate shocks to oil prices: a demand shock driven by the impact of Covid-19, and a supply shock driven by the breakdown in negotiations between Russia and OPEC. While a new deal was recently reached, oil prices remain at unprecedented low levels. As a result, sell-side analysts currently anticipate sector revenue and operating income to decline by 39% and 73% in 2Q (respectively), and remain about 19% and 31% below 2019 levels in 2021. A third of companies in our sample are expected to lose money in 2020, up from 10% that were forecast at the start of the year to be in the red. For 2021, 6% of companies were projected to make losses, and that number is now 30%.

Business as Usual: Telecom and Utilities

While most companies across the board have seen severe disruptions to their business performance, in the Telecommunications and Utilities sectors, analysts have made only relatively mild revisions to their forecasts.

Telecom: Recovered in Q1 2021

Aggregate performance (lines) and summed gains/shortfalls (shaded areas) vs. 2019 levels.

Not surprisingly, Telecommunications estimates are only modestly negative since Covid-19 hit. Companies like Verizon (VZ) are noting increasing usage as people rely on internet connectivity more than ever. That said, the extreme financial stress many consumers face could force them to comb through every expense, including their Internet bills. Analysts currently forecast a 5% decline in revenue and a 1% decline in operating income in 2Q20. The sector is expected to return to its previous state of relatively lackluster growth in 2021.

Utilities: Recovered in Q3 2020

Aggregate performance (lines) and summed gains/shortfalls (shaded areas) vs. 2019 levels.

Analysts continue to expect growth for Utilities. Commercial and industrial demand for electricity and natural gas is likely to be muted, but offset by rising demand for residential services. Analysts have also compared the lockdown to weather impacts, which highly-regulated utility companies have learned to mitigate over time. With attractive rates in the debt market, some firms have taken the opportunity to issue debt, ensuring adequate liquidity. Overall, analysts are forecasting a relatively flat revenue outlook for 2020 with a return to growth in 2021. With the profit of many public utilities decoupled from their revenues or output, the operating income environment for most firms in the sector are not expected to change significantly from pre-Pandemic forecasts. One firm whose profits are not decoupled, and whose customers are primarily residential, is NextEra Energy (NEE_US), which has seen the highest upward revisions and is forecast to lead the pack in top line growth.

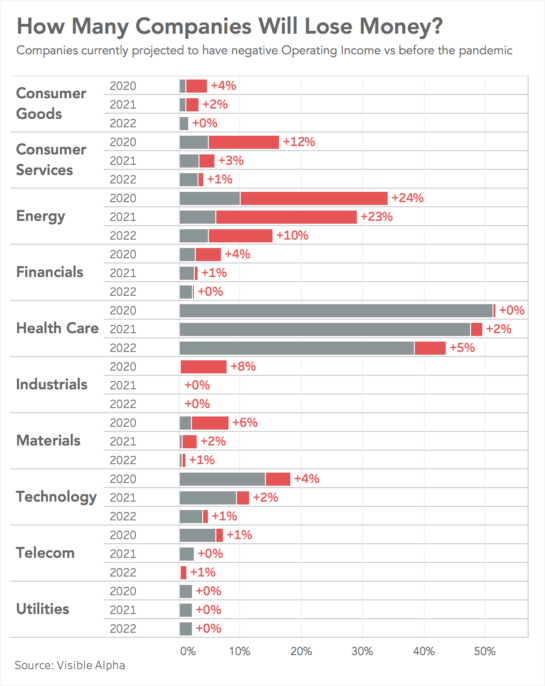

Who is actually losing money?

We have measured the broadly experienced downturn here by looking at companies that are making less revenue or profit than they did in 2019. However, the majority of broadly traded public companies that are the subject of this analysis are expected to remain profitable.

Nonetheless, there is a not insignificant minority of companies that analysts believe will go into the red. In the table below, we show how many companies are now forecast to lose money. Some companies were already expected to have negative operating income, which is indicated by the grey portion of the bar. The additional red bars and percentages are the proportion of companies that analysts think will be pushed into making losses. Not surprisingly, Energy dominates the count of newly impoverished companies, but most sectors experience an uptick in 2020, largely in-line with the patterns identified above.

With the notable continuing exception of Energy, however, the red ink appears to be short-lived. Most sectors are expected to return sharply towards pre-pandemic levels of loss-making in 2021.