Roku’s impressive growth to date has been driven by the cord-cutting trend, a growing number of streaming services and increased investment in original programming. The platform generates sales by promoting streaming services, earning a portion of subscription revenue when customers sign up for new services, and when customers view ads on Ad-supported channels on their platform.

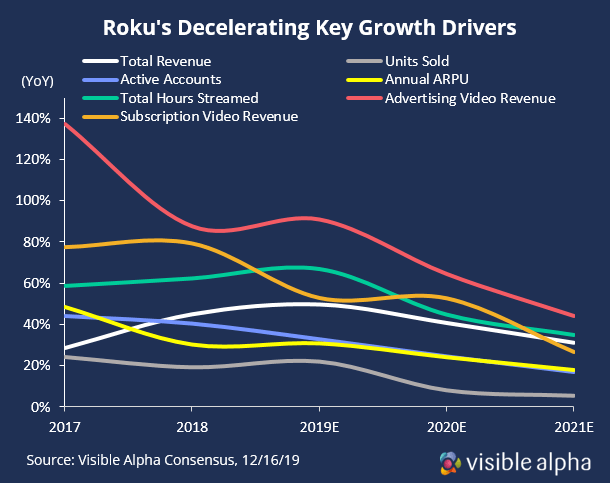

Growth Drivers Peaked

Despite the launch of new streaming services like Disney+ and Apple TV+, analysts project decelerating growth in most of Roku’s key drivers. Slowing growth expectations are largely being attributed to rising competition of alternative streaming hardware and smart TV operating systems, a lack of new OEM partners, and a longer timeline for international expansion. In addition, due to a new feature which prompts users to confirm they’re still watching a channel after a period of no engagement, the company also expects streaming hour growth to decline.

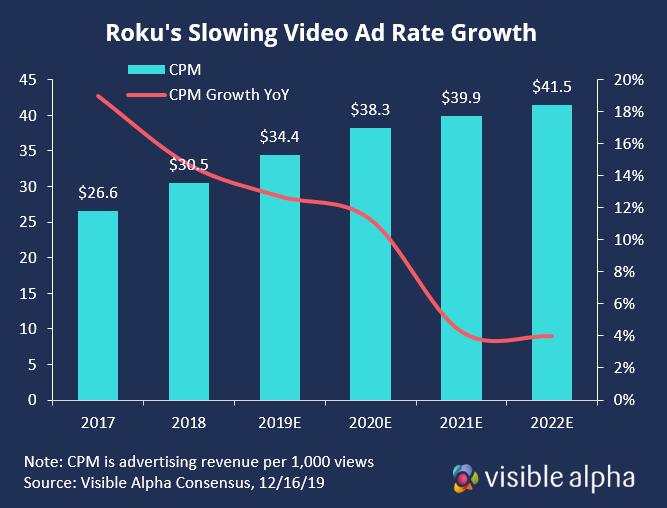

Slowing Ad Rate Growth

Roku’s cache of viewer data has enabled effective ad targeting features that have commanded premium ad rates, but analysts believe price per ad view may slow substantially over the next couple of years as other platforms become more competitive. Roku earns a portion of sales from Ad-supported channels on their platform and through The Roku Channel, which is their fifth most popular app.

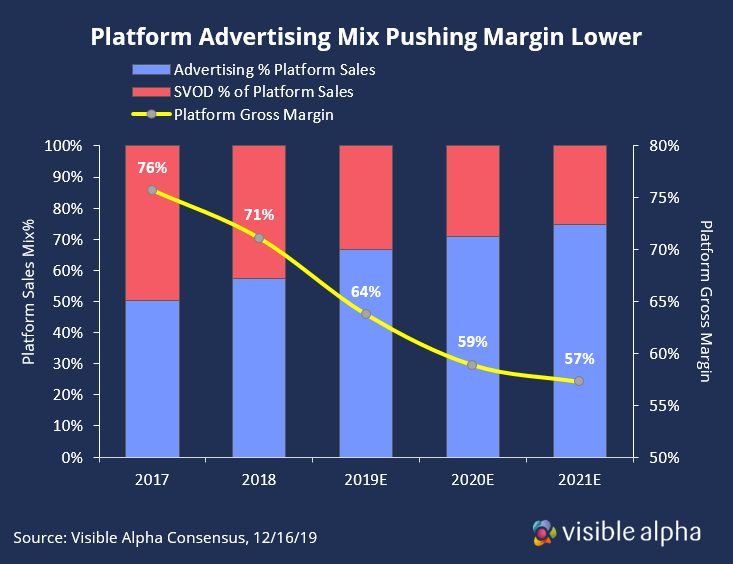

Margin Pressure

As advertising becomes the predominant driver of Roku’s revenue, margins may be pressured as sales from subscription-shares and promotions are displaced. The Roku Channel and other AVOD services on the platform contribute nearly 50% gross margin. The mix shift may be accelerated by the recent acquisition of Dataxu, a platform for marketers to buy video ad campaigns.

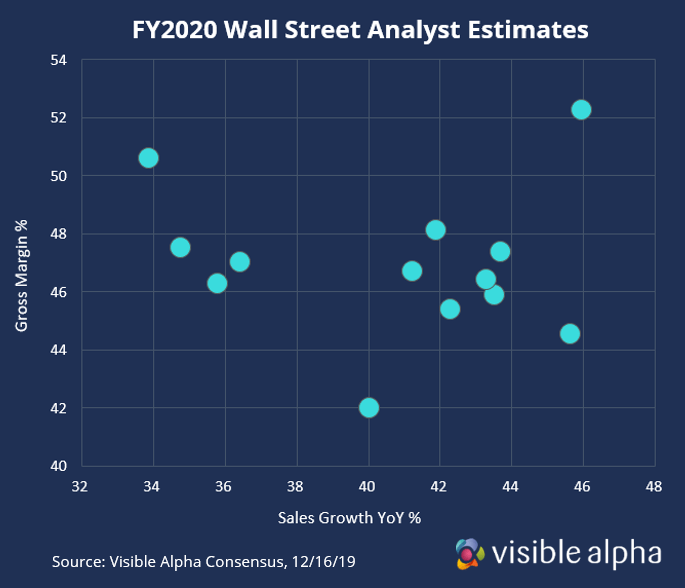

Growth & Profitability

As Roku’s growth projections decelerate more analysts are beginning to focus attention on profitability. Current estimates for 2020 revenue growth and gross margin are widely dispersed.

This content was created using Visible Alpha Insights.

Visible Alpha Insights is an investment research technology platform that provides instant access to deep forecast data and unique analytics on thousands of companies across the globe. This granular consensus data is easily incorporated into the workflows of investment professionals, investor relations teams and the media to quickly understand the sell-side view on a company at a level of granularity, timeliness and interactivity that has never before been possible.