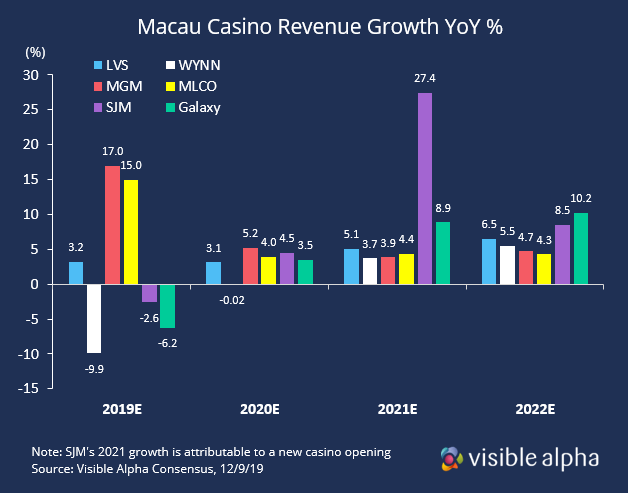

Casino operators in Macau have been struggling from less visiting traffic due to tensions in Hong Kong, macro uncertainties, and tighter travel restrictions ahead of President Xi’s December visit for Macau’s 20th handover anniversary. However, analysts believe upcoming infrastructure improvements and an expected easing of security measures following the year-end celebration will increase mass-market tourism and sales through 2020.

High-Roller Headwinds

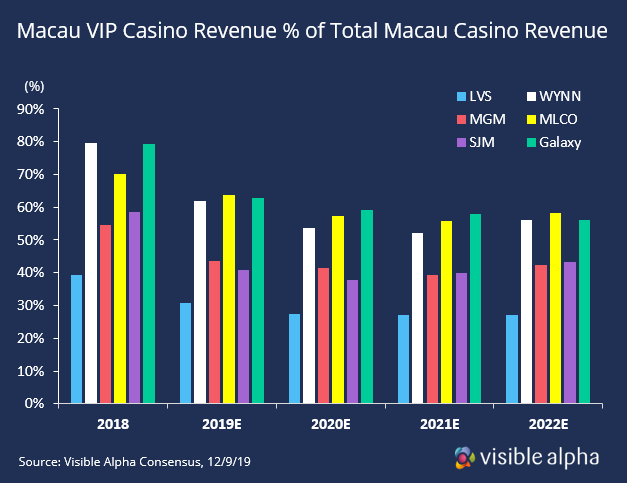

Macau’s VIP gamblers have long been the main driver of the peninsula’s success, contributing up to 70% of total casino revenue, but lately they have been the source of weakness. In 2019, the government made substantial efforts to reduce Macau’s reliance on high-rollers by tightening visa policies and cracking down on shady lending practices. Macau’s whales are also more sensitive to macro conditions and exports, which have fallen due to ongoing trade disputes with the United States. This combination of factors had a significantly negative impact on VIP gambling revenue over the last year. For a while, Wynn had the largest exposure to the VIP market but has ceded share to Melco Resorts and MGM. Las Vegas Sands remains the least exposed to the VIP market with many properties on the Cotai Strip, an area more frequented by mass players.

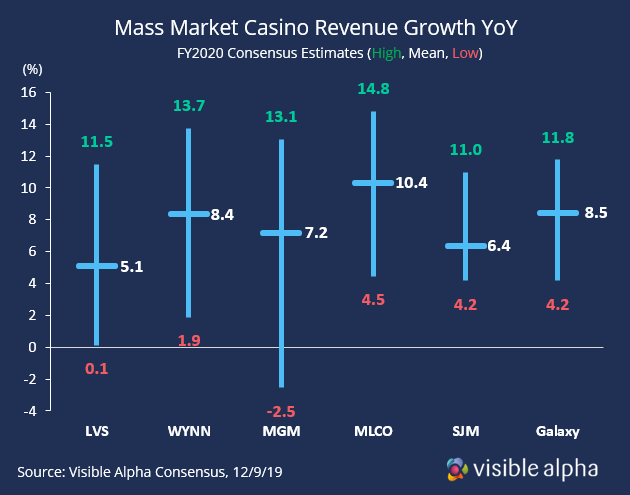

Infrastructure Improvements to Spur Mass Market Growth

Wall Street analysts believe mass market players will be Macau’s main driver of growth in 2020 as traveling to Cotai becomes easier. Several infrastructure improvements, such as the new Cotai-Hengqin Port and adjacent train station connected to mainland China are expected to cut wait times by up to four hours and increase mass traffic when they’re opened later this month. A newly established Macau administration is also expected to expand motor vehicle plate issuance for the Hong Kong-Zhuhai-Macau bridge, which opened last year but remains largely underutilized.

This content was created using Visible Alpha Insights.

Visible Alpha Insights is an investment research technology platform that provides instant access to deep forecast data and unique analytics on thousands of companies across the globe. This granular consensus data is easily incorporated into the workflows of investment professionals, investor relations teams and the media to quickly understand the sell-side view on a company at a level of granularity, timeliness and interactivity that has never before been possible.