With the rise of passive investments and increasing regulatory and cost pressures, investment research analysts and portfolio managers are on an eager (and somewhat frantic) search for alpha-generating insights. However, when inundated with research at all hours of the day from all angles, it’s not easy. Buy-side analysts are constantly heads-down in their search for the most relevant and insightful research reports, models and corporate access events to create an edge.

How do investment teams manage the inordinate amount of research they receive, cut through the noise and discover new sources of alpha?

One answer comes in the form of a collaborative and modern research management system.

Research management systems have become a hot topic in the investment research world primarily because of MiFID II. Under MiFID II regulations, research must be unbundled from trade execution and paid for separately. Because of this, investment managers want to quickly access the research they are paying for and want to be able to effectively and efficiently draw insights from that research. The easier it is to access, the faster ideas can be generated.

Why is it so hard to manage research?

Before we dive into research management systems, let’s first understand the challenge of managing investment research. Investment teams receive research from providers who have relationships with their firm. Before MiFID II, this could amount to hundreds of research providers. However, now that MiFID II has gone into effect, many buy-side firms directly impacted by the regulation are narrowing down the number of their research provider relationships and becoming more selective about the research they are willing to buy.

>Regardless of whether or not your firm is impacted by MiFID II and has reduced the number of sell-side relationships you work with, managing the research coming from those providers is still a challenge. Analysts at those providers are constantly calling investment teams, sending research via email and sometimes utilizing marketplaces to discover additional research. It’s a big challenge for investment teams to weed through all of this research and find the reports, models and corporate access events that truly add value to their investment ideas.

Whether a firm chooses to go P&L or continue to pass on the costs of research to clients, the need to scrutinize and justify research spend is more important than ever.

What is a research management system?

A research management system (RMS), is a place to discover, store, annotate and share research files. There are generic off-the-shelf systems and investment research-specific solutions. The majority of industry-specific RMS options are solely for written research reports, while very few support multiple content sets, such as reports, corporate access and models.

It’s important to note that the term “research management system” is a little deceptive, as it implies that it’s simply a management tool for the administrative side. However, there are many benefits to an RMS for the investment team.

How do analysts benefit from a research management system?

While an RMS aids in managing research, there are a bevy of other benefits:

- Reverse entitlements– understanding what content is authorized for consumption

- Efficiency – easy storage and access to research, cutting down on time it takes to find reports, models and corporate access invitations

- Sharing – easy sharing of internal and external research through a central portal

- Collaboration – the ability to make notes and comment on research and share with colleagues

- Discovery – easily access and find received research, as well as research shared with the entire investment team

- Organization – a clean, understandable method of storing research

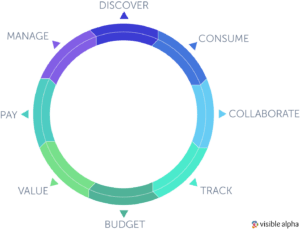

An RMS assists in many aspects of the investment research workflow, particularly in the tracking, collaboration and valuation stages.

That being said, one of the major benefits of an RMS is the centralization of research.

Why is a centralized location for investment research important?

Having all content sets in one place is key to optimizing the investment research workflow. An RMS shines in the collaboration stage, providing a way to easily share research, add notes and view comments from others in your firm. It’s a seamless solution compared to storing and sharing research via email, a shared drive and/or locally on your computer, where you’re the only one who can access it; instead, all content sets can be aggregated, stored and discoverable in one central location.

Why is investment research collaboration important?

There has been an increased focus on internal buy-side collaboration, both with internal and external research. In the past, analysts at the same firm worked in silos. But it’s been proven that collaboration, regardless of industry, improves performance.

Collaboration through an RMS provides firm-wide visibility into sell-side relationships. By providing feedback through the RMS rating system, as well as through comments, analysts gain insight into which research providers are offering the most value to their fellow analysts.

Learn more about how to improve buy-side collaboration to increase performance

From an administrative perspective, knowing which sell-side firms are providing the most value to investment teams is important for two things: 1) determining from which providers to continue receiving research, and 2) determining how to allocate the research budget. Through an RMS, administrators can see how analysts rate reports, models and corporate access events. This granular reporting will help the administrator understand sell-side value, as well as provide useful data points for provider evaluations.

Understand the fundamentals of provider evaluations

How does a research management system increase efficiency?

Along with collaboration, another benefit of an RMS is improving efficiency. Not only are investment managers searching for new sources of alpha, they are interested in decreasing the time from idea to trade execution.