Consensus Reimagined: Beyond the Average

“Consensus is a lie.” A rather bold statement, don’t you think? When it comes to consensus, we commonly hear:

Consensus is a critical benchmark.

You have to know where the street is.

I don’t care about consensus.

I’m an independent thinker.

The great irony of consensus estimates is that there is no consensus as to the applicability of this data to the investment process.

However, there is one fundamental truth in stock picking: Analysts, directors of research, and portfolio managers must formulate independent views that collectively outperform the market.

The ability to identify unique market opportunities with a differentiated point of view will make or break your success. Interestingly, the fundamental requirement to create differentiated views naturally calls into question the approach of studying ‘consensus.’

However, consensus should not be thought of as a singular datapoint, but rather a collection of views that often differ significantly from one another and change, oftentimes dramatically, through time. Understanding the totality of the market view should, in fact, present opportunities.

Let’s deconstruct notions around consensus further…

What are consensus estimates?

DEFINITION: Consensus can be defined as the average reached by a group of equity analysts who cover a particular stock, regarding the projected earnings and revenues of a public company. It represents the combined estimates derived from individual assessments, forecasts, and subjective inputs of analysts, aiming to predict a company’s financial performance. Consensus estimates serve as a market expectation indicator and can influence investor sentiment and stock price movements.

Consensus estimates serve multiple purposes in the investment landscape:

For investors who have limited time to delve into the intricacies of a company, consensus estimates can serve as a useful tool in forecasting efficiently. They provide a snapshot of market expectations and help identify companies that are forecasted to outperform or underperform other companies in their peer group.

Moreover, consensus estimates can reflect the collective wisdom of the market, offering insights already reflected in the pricing and market sentiment. This creates opportunities for investors to express contrarian views on pricing, revenues, or other variables.

Investors can leverage consensus data to identify the fastest-growing companies within thriving sectors like technology or seek out companies that are emerging within industries facing challenges, such as traditional retail, even in researching publicly traded companies that are contributing to the infrastructure and broad scaling of AI capabilities.

Finally, it is important to note that consensus estimates are not static. As is the case with any investment thesis, consensus evolves as new information becomes available and market conditions change. It is vital for investors to track revisions and understand the dynamics of consensus as investment views are constantly recalibrated for changing market conditions.

Looking Beyond Consensus

When thinking only about consensus as a single data point, it’s understandable why investors may disregard consensus. From an investor’s point of view, consensus is an incomplete metric. Traditionally, consensus, centered on high-level metrics like revenue or EPS, misses out on the intricate factors driving a company’s success.

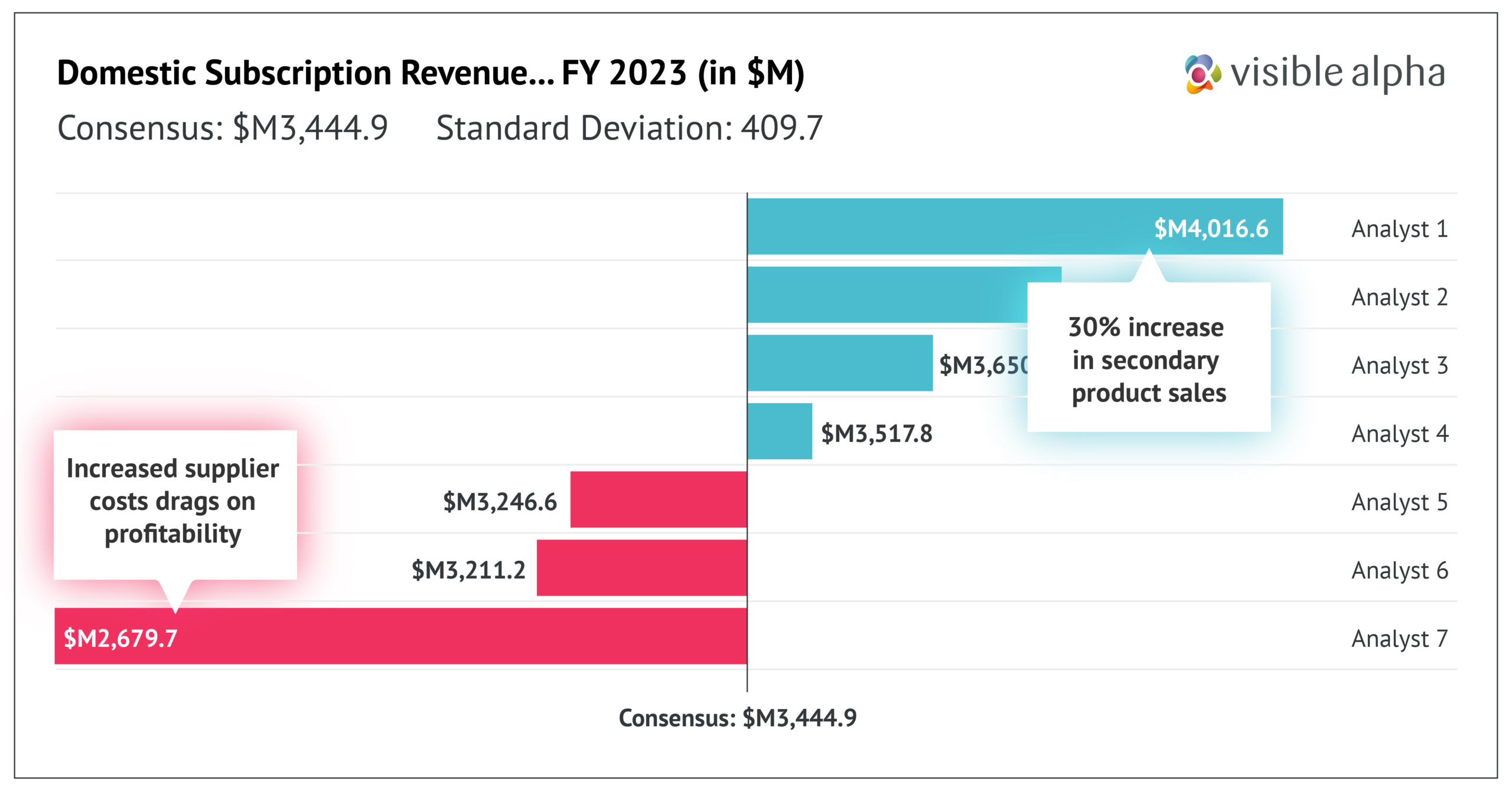

This narrow perspective can lead investors to overlook valuable insights and unique viewpoints, especially when considering detailed line items beyond basic metrics, found in the dispersion and revision pattern of forecasts from the analyst community. Recognizing the rich source of potential in the spread and revision trend of forecasts from the analyst community becomes crucial for buy-side professionals, as it indicates the presence of varying opinions among analysts as they change through time.

Large dispersion signifies the existence of untapped opportunities, while tight alignment among analysts may indicate limited potential for market gains. Dissenting voices are catalysts for growth and bring high-value unique perspectives to the table.

Example:

Let’s take a closer look at how the analysis of dispersion at a more granular level unlocks these advantages.

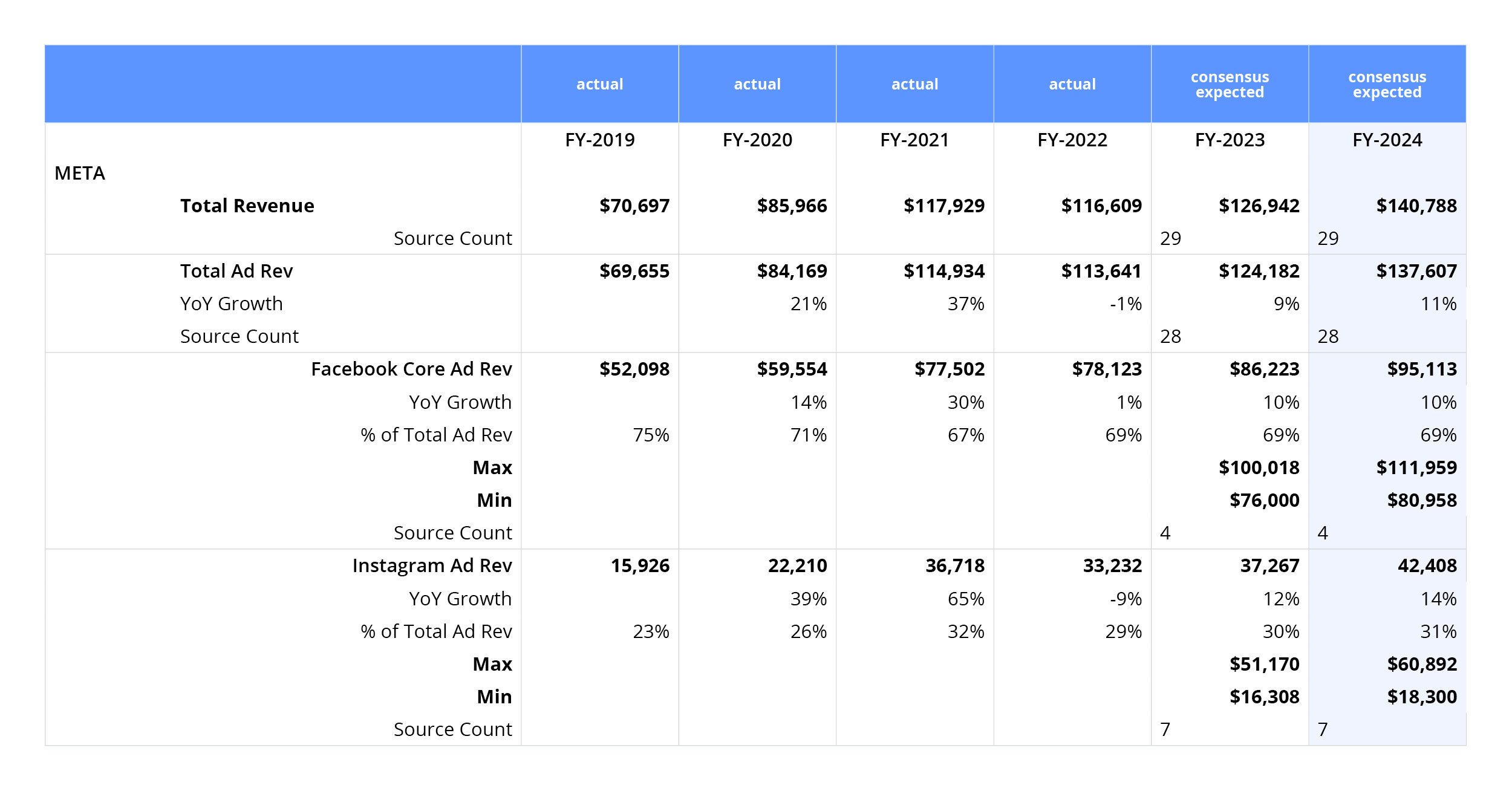

On the Q1 2023 earnings call, Meta CEO Mark Zuckerberg emphasized the significant impact of AI on Facebook and Instagram. AI recommendations now contribute to approximately 20% of the content in the feeds. This AI-driven enhancement to content and messaging in feeds has prompted analysts to revise their revenue estimates, reflecting anticipated increases in ad revenue.

When examining Facebook’s core ad revenues, our platform reveals consensus estimates that have been revised upward. Following Q1 2023, even the most conservative estimates have increased by $9B, narrowing the range. For 2023, the low-end estimate is now $76B (-12% below consensus), while the high-end estimate is $100B (14% ahead of consensus). These unique line items provide crucial insights into the growth potential of Facebook.

Collectively, the potential for AI to impact Facebook’s ad revenue led to a 12% increase in FY2024 expectations relative to consensus on January 3, 2023.

Delving into Instagram ad revenues, Visible Alpha highlights significant debate among the seven analysts forecasting. Varying views and calculations of the Instagram business and its projected growth result in a wide range of estimates. In 2023, estimates range from $16B (-56% below consensus) to $51B (38% above consensus), showcasing the importance of understanding these key drivers of growth.

Looking ahead to 2024, the range of estimates for Instagram ad revenues further expands. The high-end estimate of $61B contributes a remarkable 45% to total revenues, surpassing consensus by 43%. Conversely, the low estimate is -57% below consensus, reflecting the diversity of opinions among analysts.

By leveraging the dispersion of estimates of granular line items and embracing the varied viewpoints within the analyst community, investors can discover valuable opportunities that others might overlook and make informed decisions that set them apart.

The status quo

Traditional consensus providers have confined us to a narrow, one-dimensional perspective. Many consensus providers have historically relied on scraping sell-side research reports for analyst estimates, aggregating those estimates, and calculating the mean to create consensus. However, there are limitations with this methodology that hinder our understanding and ability to explore the full breadth of market possibilities:

- Lack of granularity: Sell-side research reports typically only include forecasts on top-level line items, such as revenue and EPS. Therefore, traditional consensus providers often miss the granular issues that are central to the investment thesis.

- Lack of comparability: The concern about comparability arises because traditional consensus estimates often don’t reveal the specific assumptions analysts make for each forecasted figure. This lack of transparency makes it challenging to compare one analyst’s forecast to another’s effectively, as each may use different bases for their predictions. Clarifying these assumptions is crucial for accurate comparison and a deeper understanding of the investment landscape.

Revolutionizing Consensus Creation

Unlike traditional consensus providers, Visible Alpha goes beyond top-level line items. We provide direct access to sell-side analyst models and offer deep consensus estimates on thousands of companies across various industries. With our tools at your disposal, you can explore the range of opinions and formulate a new perspective on market opportunities.

“Investors are looking for insights to understand what is behind analyst views for any key issue on a company. Visible Alpha’s deep consensus data addresses this buy-side problem of getting complete information about assumptions behind forecasts by providing a complete representation of analyst views sourced directly from analyst models.”

– Rodney Pedersen, Chief Revenue Officer, Visible Alpha

Our platform enables investment professionals and investor relations teams to identify the key drivers of revenue according to analysts’ perspectives. Moreover, we offer full transparency by allowing you to identify the spread of estimates including each individual analyst’s forecast for any line item. Finally, Visible Alpha offers a point-in-time snapshot of historical estimates allowing you to understand how market conviction on key issues is changing through time.

With Visible Alpha, you gain a competitive advantage by accessing consensus estimates with an unrivaled level of granularity, transparency, and historical context. This comprehensive view empowers you to perform relative analyses and extract actionable insights from sell-side models, ensuring that you make informed and independent investment choices.

“Visible Alpha’s consensus estimates can be used to represent what the market believes and what is already reflected in current pricing, providing scope for expressing contrarian views on pricing, revenues, or other variables.”

– Scott Rosen, Founder and Chief Research and Innovation Officer, Visible Alpha

It’s time to go beyond the limitations of traditional consensus, to go beyond the average.

See consensus in a new light with Visible Alpha

The Consensus Process: From Raw Data to Powerful Insight

In the fast-paced world of finance, where timely decisions can make or break success, the creation and analysis of consensus estimates play a pivotal role. This article delves into the multifaceted world of consensus forecasting, exploring the diverse methods and innovative approaches that shape the financial industry’s understanding of market expectations and company fundamentals.

Traditional Methods: The Backbone of Consensus Creation

How is consensus created?

Consensus estimates can be calculated through a variety of methods and approaches, each with its strengths and limitations. Without a reliable and accurate consensus data solution, creating and analyzing consensus is a meticulous and labor-intensive process for the sell side and buy side alike.

Let’s explore some of the traditional methods through which consensus can be generated:

Manual Sell-Side Analysis:

At the heart of consensus creation lies the meticulous work of sell-side equity research analysts. Sell-side equity research analysts play a crucial role in creating consensus by conducting in-depth research and analysis on the companies and industries within their coverage universes. These analysts carefully evaluate financial statements, industry reports, market trends, macroeconomic factors, and company-specific information to develop their forecasts for key financial and operational metrics. These individual forecasts are then averaged across all covering analysts by the buy side and corporations to create consensus for every line item under coverage. By leveraging their expertise and insights, sell-side analysts contribute to the formation of consensus estimates and historicals, which are, in turn, leveraged by corporate and investment professionals to inform their future decisions.

Pro:

- Can choose to leverage estimates only from trusted analysts

Cons:

- Extremely time and resource-intensive

- Line items are not standardized across different sell-side models

- Can be difficult to monitor sudden revisions and other critical changes to models

Traditional Consensus Providers:

Traditional consensus providers offer a consolidated view of analyst estimates by aggregating and analyzing the forecasts from sell-side research reports. These providers employ a process of collecting, adjusting, and aggregating the individual analyst forecasts to determine the consensus estimate for headline financial metrics.

While convenient, their reliance on static sell-side reports, which typically only provide top-level financial metrics, may limit the immediacy of data, sometimes failing to capture analysts’ most current projections.

Pro:

- Consensus estimates are already pre-aggregated, saving time and effort

Cons:

- Consensus is typically only available for the top-level line items that are available within research reports

- Manual work is required for creating custom consensus, as well as consensus on more granular company metrics

Provider-Assisted Manual Aggregation:

An intermediary approach involves providers assisting clients by aggregating forecasts from diverse sources, such as sell-side research reports, investment banks, and brokerage firms, offering a consolidated view. This is a labor-intensive task consisting of aggregating models and creating consensus estimates. This method, leveraging expertise and technology, provides a more auditable consensus estimate while alleviating the labor-intensive burden on clients.

Pro:

- Facilitates more well-rounded consensus while also generating significant time savings

Cons:

- Lack of real-time visibility into changes to individual analyst and consensus estimates

- Manual labor involved may lead to longer wait times from the provider for any updates

While these traditional consensus creation methods can and do serve investment and corporate professionals’ basic requirements, the various limitations of these methods have necessitated the creation of more innovative approaches to generating accurate and timely market consensus data.

Innovations Reshaping Consensus Creation

The Value of Analyst Models

In today’s fast-paced financial landscape, the process of creating consensus estimates can be time-consuming and resource-intensive. However, in addition to the above methods, alternative approaches to consensus creation have emerged, revolutionizing the way data is gathered and analyzed through technology that maximizes efficiency – saving on both time and resources – without sacrificing data quality or freshness. Understanding the fundamentals and mechanics of the actual analyst models becomes paramount in the consensus creation process. Visible Alpha is at the forefront of this innovation, utilizing machine learning algorithms and an in-house team of industry experts to analyze vast amounts of financial and operational estimates and historicals, market trends, and industry KPIs.

Let Us Do the Heavy Lifting

With Visible Alpha, you no longer have to settle for a one-dimensional perspective.

Visible Alpha Insights offers a comprehensive solution that goes beyond the offerings of traditional consensus data providers. Our proprietary consensus methodology is created through pulling data directly from the latest sell-side analyst models, followed by a mix of machine learning and human intervention, and rigorous standards for quality control, empowering you to break free from the consensus echo chamber and explore the full spectrum of market possibilities.

Unlike traditional providers of consensus data, our consensus data – which consists of both estimates and historicals and is normalized at the company and industry level for apples-to-apples comparisons – goes beyond headline financial metrics, with an average of over 160 financial line items and operational KPIs per company. Our data also benefits from high broker source counts, regular updates with each new model received from the sell side, and insight into the full calculation logic and audit trails for each individual line item, ensuring maximum data quality and freshness that you can trust. In addition, Visible Alpha includes insight into analyst trends and dispersions, as well as features such as the Revisions Analysis, Surprise Analysis, Target Price & Ratings, Industry Analysis, and Valuations pages.

In the fast-paced world of finance, time is both your most valuable asset and your greatest adversary. The ability to make timely, informed decisions and spot market opportunities can make or break your success.

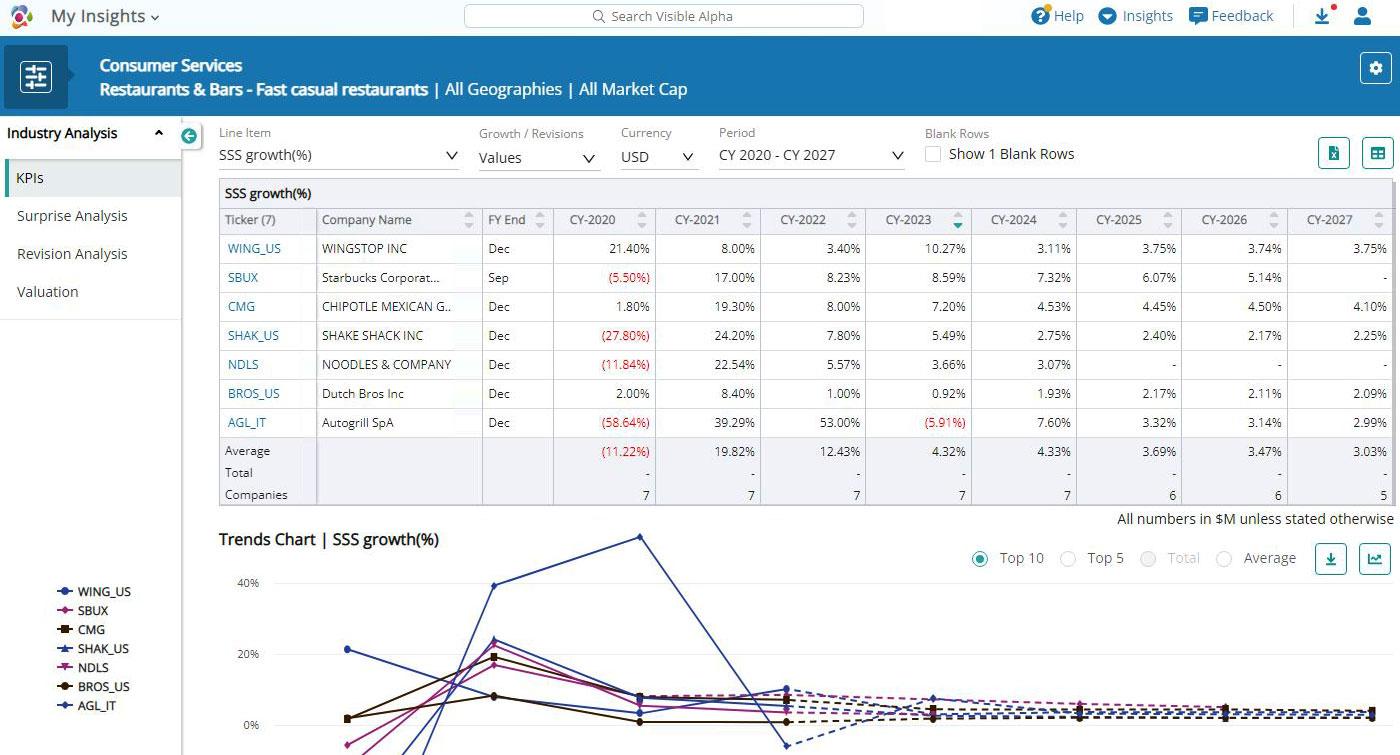

Example: Imagine analyzing the technology sector and trying to assess the competitive landscape. Visible Alpha Insights offers you access to both consensus estimates and historical actuals that span several years, giving you the ability to analyze a given technology company’s financial performance and key operational metrics over time. Our Industry Analysis feature then enables you to compare these same metrics across multiple industry peers at the same time, giving you greater insight into the technology sector as a whole. With just a few clicks, you can quickly and easily explore the market, uncover emerging trends, and identify potential investment opportunities that others may overlook.

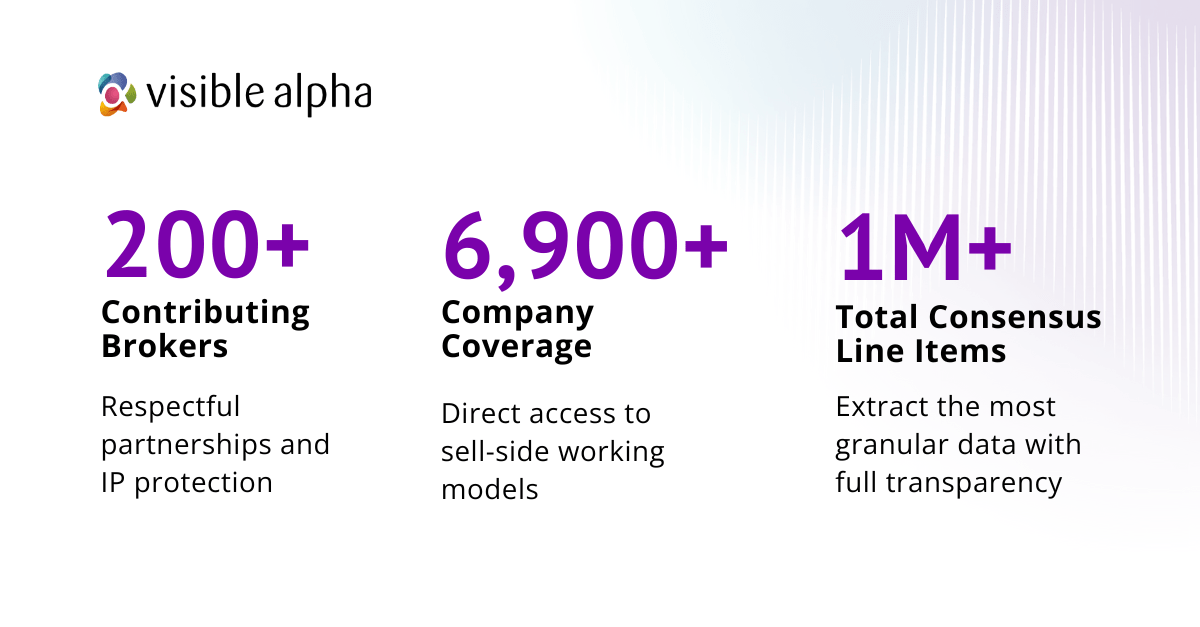

We understand the value of your time and need for streamlined research and optimized data. Visible Alpha Insights empowers you with precision, freshness, and interactivity, freeing you from tedious and time-consuming research and modeling workflows. With data sourced directly from the analyst models of over 200 broking firms, we handle the heavy lifting of ingesting, analyzing, and normalizing consensus data across the companies and industries that matter to you, so you can devote more of your time and energy to identifying advantageous market opportunities.

Visible Alpha disrupts the traditional paradigm by harnessing advanced technology and a cutting-edge data platform. Through our robust solution, we automate the labor-intensive tasks associated with creating consensus estimates, bringing efficiency and automation to the aggregation and analysis of data. This streamlined approach saves valuable time and resources, empowering users with reliable and comprehensive consensus estimates and actuals.

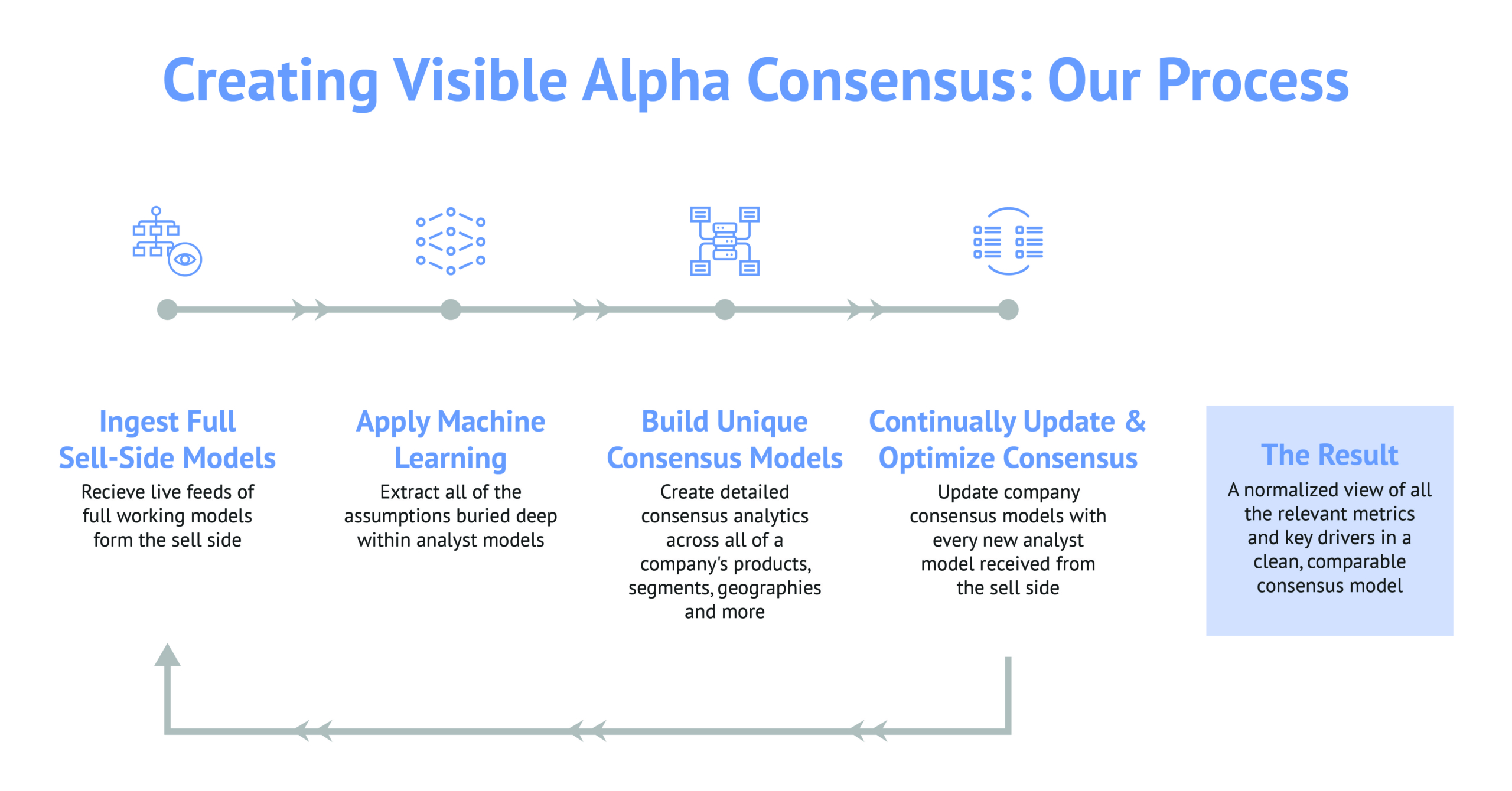

How does Visible Alpha create market consensus?

We first process full working models from the sell side. This involves initially extracting all line items directly from the raw models, presented as each analyst models each line item. We then take this data–line item by line item–and map it to be comparable for each company, including segment-level data, key company drivers, and YoY growth. Lastly, we also make the data comparable across an entire industry, including all financial and operating metrics for easy relative analysis of industry peers. Throughout this process, we apply machine learning and leverage our in-house industry experts to enable detailed, like-for-like comparisons across different analysts’ estimates.

Upon processing a number of analyst models for a given company, we create detailed consensus models across all of that company’s products, segments, geographies, and business drivers. Once the consensus models are uploaded to our platform, we then quickly and continually update any consensus estimates with every new analyst model and revision received. This provides you with a normalized view of all the relevant metrics and key drivers in a clean, comparable consensus model. Most importantly, we tackle the heavy lifting head-on to save you time and ensure the most accurate and timely consensus possible.

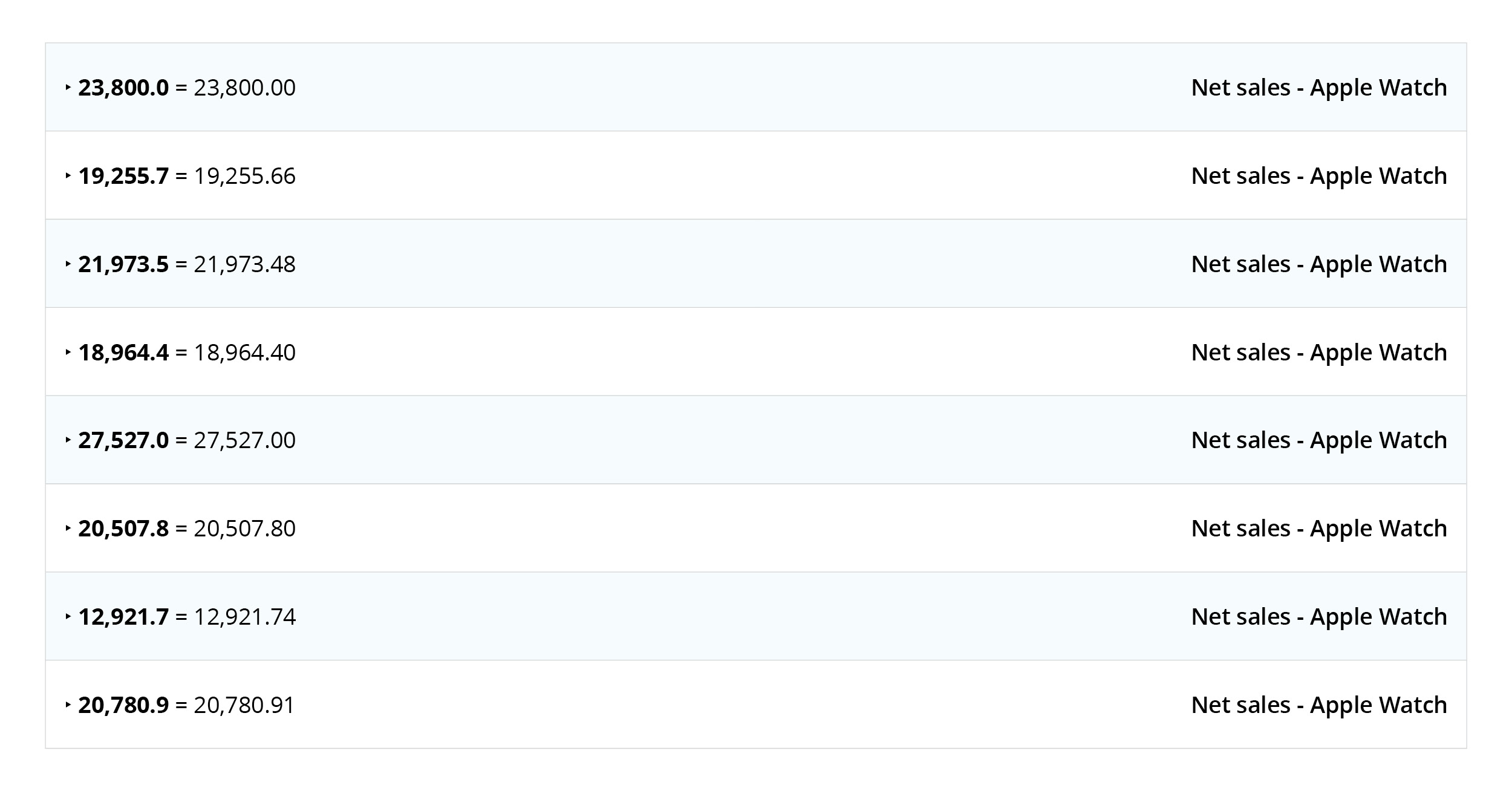

Let’s use Apple (AAPL) as an example. Many analysts covering Apple forecast net sales for the Apple Watch:

By adding all of these estimates together and taking the mean, we find that the FY 2023 consensus estimate for Apple Watch net sales is $19,556.2 million. While the consensus estimates may project a certain level of net sales for Apple Watch, it’s important to recognize that the spread of forecasts from the analyst community holds the true potential for identifying untapped growth opportunities. By exploring the range of forecasts and uncovering the outliers, Visible Alpha enables you to see the real market potential that consensus alone fails to reveal.

With Visible Alpha Insights, you can access consensus estimates with ease, unlocking the power of market insights and gaining a competitive edge. Our advanced technology eliminates the need for cumbersome manual processes, allowing you to make faster, more informed decisions with confidence.

Consensus Estimates: An Introductory Understanding

What Are Consensus Estimates and Why Do They Matter?

Consensus estimates are the collective forecasts made by equity analysts regarding a public company’s future earnings, primarily focusing on earnings per share (EPS) and revenue. These estimates provide a synthesized view of diverse analyst opinions, serving as a crucial benchmark for investors and financial analysts. By offering a consolidated outlook on a company’s performance, consensus estimates help set market expectations and guide investment decisions, ensuring a well-informed financial market.

Consensus estimates are critical in financial analysis. Consensus estimates are derived from the aggregate forecasts of multiple analysts covering a stock. These forecasts include predictions for earnings per share (EPS) and revenue over various time frames. The size and scope of the company, along with the number of analysts contributing, define the depth and breadth of the consensus.

Far from being simple predictions, consensus estimates embody the collective insight and foresight of financial experts, reflecting a blend of analytical rigor and market sentiment. This article will explore how these estimates are formulated, their critical role in investment decisions, and the broader impact they have on the financial landscape.

The Practical Application: A Real-World Example

In a real-world instance, Nvidia’s Q3 2024 results offer a clear example of consensus estimates’ impact. They reported revenues of $18.1 billion, surpassing the predicted consensus estimate from covering analysts of $16.2 billion.

In this context of Nvidia’s Q3 2024 results, it’s crucial to highlight that consensus estimates are utilized by a broad spectrum of financial stakeholders, including financial analysts, fund managers, and corporate executives. These groups rely on consensus estimates to gauge a company’s performance relative to market expectations, informing investment decisions and strategy adjustments. Nvidia’s significant revenue beat not only showcased its strong performance but also illustrated the critical role consensus estimates play in setting those market expectations. Understanding this, we can see that consensus estimates serve as a benchmark for evaluating corporate success, influencing investment choices and market sentiments. This example underscores why accurate consensus forecasting is essential for all market participants looking to make informed decisions in a dynamic financial environment.

For a detailed analysis, please refer to Visible Alpha’s report on Nvidia’s Q3 2024 earnings here.

Consensus Estimates and Market Dynamics

These estimates are not just numbers; they reflect the complex interplay of market expectations, company performance, and investor sentiment. Their accuracy and reliability can influence market efficiency and investor trust. For instance, when a company consistently misses or beats consensus estimates, it can have profound implications. A beat can enhance investor confidence, potentially driving up the stock price as the market reacts to the positive surprise, indicating the company’s performance is exceeding expectations. Conversely, consistent misses may erode trust, suggesting potential operational or financial challenges, leading to decreased stock value. Both scenarios highlight the significance of consensus estimates in shaping investor behavior and market dynamics, as they adjust their investment strategies based on these outcomes.

The Analytical Approach: Beyond Numbers

When analysts create consensus estimates, they employ various financial models to forecast a company’s future performance. This process involves estimating key financial metrics, such as earnings per share (EPS) and revenue, by analyzing and projecting the company’s future cash flows and other financial activities. Among these models, the Discounted Cash Flow (DCF) model is commonly used for its focus on evaluating a company’s valuation by projecting future cash flows and discounting them to their present value. This is part of a broader analytical effort to predict how well a company will perform financially in the future. Other methods also play crucial roles, for instance:

- Comparables Analysis (Comps): Analysts often use this technique to value a company by comparing it to similar companies in the same industry. For example, evaluating a retail company’s value by comparing it to its peers based on metrics like price-to-earnings (P/E) ratio.

- Precedent Transactions: This method involves analyzing the prices paid for similar companies in the past. It’s particularly useful in mergers and acquisitions. For instance, determining the value of a tech startup by looking at recent acquisition prices of similar startups.

- Leveraged Buyout (LBO) Model: Used primarily in private equity and investment banking, this model assesses the potential return on investment when a company is bought using a significant amount of borrowed money. For example, projecting the returns of a leveraged buyout deal for a manufacturing firm.

Each of these methods contributes a different perspective, enriching the overall analysis and helping to shape a more nuanced consensus estimate. By incorporating these diverse techniques, analysts can provide a more comprehensive view of a company’s financial prospects.

Consensus estimates are crucial in understanding a company’s financial future. Though highly informative, they are not perfect and should be viewed as part of a broader analytical context that includes market trends and specific company factors. With this comprehensive guide, investors and analysts are better equipped to interpret these estimates, enhancing their ability to make informed decisions in the financial markets.

In the swiftly evolving landscape of asset management, marked by unrelenting market volatility and competitive pressures, the strategic management of talent has emerged as a pivotal battleground for industry leaders. With global assets under management projected to surpass $145.4 trillion by 2025, as noted in PwC’s “Asset & Wealth Management Revolution 2020’ report, the urgency for asset management firms to adeptly navigate these turbulent waters is more pronounced than ever.

For a deep dive into the dynamics of asset management, offering actionable strategies for thriving in this ever-evolving environment and emphasizing the crucial role of strategic talent management, be sure to explore our comprehensive eBook. ‘Do More With Less People: How Research and Investment Leaders at Asset Managers Can Get More From Equity Research Talent’ serves as an essential companion piece to this article, providing in-depth insights and a more detailed exploration of the themes we’ve touched upon here.

Understanding the Current Market Landscape

The asset management industry, traditionally seen as stable, is now at the mercy of fluctuating market dynamics. This volatility is not just a backdrop but a central player in shaping the industry’s future. It demands a reevaluation of strategies, particularly in managing the most crucial asset any firm possesses – its people.

The Importance of Talent in Asset Management

Human capital stands at the forefront of this challenge. A McKinsey report on asset management highlights the disproportionate impact that top talent has on performance, underscoring the necessity of not just hiring the best but also ensuring their continued growth and satisfaction. In an industry where intellectual capital translates directly into financial performance, the stakes in talent management are exceedingly high.

Strategies for Attracting and Retaining Top Talent

The race for top talent in asset management is fierce and evolving. Firms are increasingly recognizing the need for a robust technological infrastructure as a key lure for high-caliber professionals, especially the younger, tech-savvy generation who are natives of the digital realm. According to Deloitte’s ‘2024 Investment Management Outlook,’ the allure of advanced analytics tools and cutting-edge data platforms is a significant factor in attracting and retaining talent. This shift highlights that traditional methods of what has worked in the past may not always be the best approach in the current landscape.

Moreover, a supportive work environment that fosters growth, learning, and adaptability is no longer just a perk but a necessity for keeping talent engaged and productive. Embracing innovative approaches and modern technology is essential in attracting a workforce that is adept at navigating the complexities of today’s market.

Leveraging Technology for Talent Optimization

The integration of technology in asset management has evolved beyond efficiency and into the realm of strategic necessity. As underscored in Deloitte’s “2024 Investment Management Outlook,” investment management firms are increasingly investing in advanced technology and control systems to not only meet client expectations but also to enhance internal efficiency amid performance and margin pressures. This evolution points to the emergence of theme-driven portfolio construction and underscores the need for personalized and timely client interactions. The Outlook also highlights the transformative potential of emerging technologies like generative AI and quantum computing, which can revolutionize the way asset management firms operate. Moreover, aligning organizational objectives with a purpose-driven approach enhances culture, efficiency, productivity, and collaboration.

This holistic integration of technology and strategic focus is vital for firms looking to attract, retain, and optimize top talent in a competitive market.

Leadership’s Role in Talent Management

The impact of leadership on talent management is profound. As Kirsten Behncke Colyer, Chief Human Resources Officer at Visible Alpha, aptly puts it,

“The latest generation of professionals introduces a fresh paradigm: a tech-savvy skillset with a preference for efficiency over extended hours.”

Effective leadership in today’s asset management firms is about creating an environment where technology and talent converge to drive innovation and performance. It’s about understanding the unique capabilities of each team member and leveraging them to the fullest.

The tumultuous market environment presents both a challenge and an opportunity for asset management firms. The strategic management of talent, supported by a strong technological foundation and enlightened leadership, is not just a response to these challenges but a proactive step towards securing a firm’s future in an uncertain world.

For those keen to delve deeper into these strategies, our eBook offers comprehensive insights and actionable advice.

Innovation and Expansion: Visible Alpha in 2023

As we welcome 2024, we reflect on a pivotal year at Visible Alpha — a year not just of growth, but of meaningful evolution. In 2023, we significantly expanded our services and refined our platforms to better serve the needs of financial professionals worldwide. But what does this mean for you, and why are these developments important?

Understanding Visible Alpha’s Role and Impact

Visible Alpha specializes in creating consensus data with unparalleled granularity and transparency, by extracting forecasts, assumptions, and logic from comprehensive sell-side models. This process involves compiling and analyzing vast amounts of data, including detailed financial models, research reports, and market forecasts, to offer a clear view of the financial landscape.

Our goal is to provide financial professionals with clear, comprehensive insights that are crucial for making informed investment decisions.

Why Partnerships and Coverage Expansion Matter

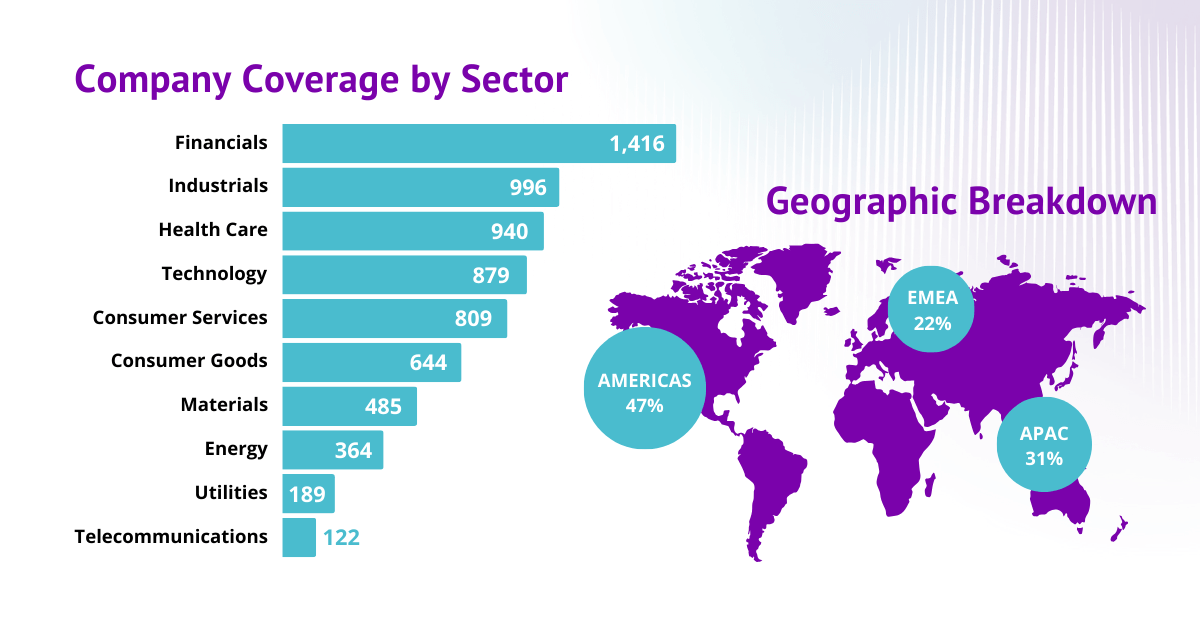

In the past year, we’ve enhanced our services by significantly increasing our global partnerships, notably surpassing 200 sell-side contributors, with 44 new broker partnerships across the globe, including a strong presence in the EMEA and APAC regions. This expansion is not just about numbers. It represents a deeper, more diverse array of market insights that can transform the way financial professionals develop and communicate investment strategies with confidence.

Building on this momentum, our company coverage continues to show robust growth year over year. This past year, we’ve expanded our coverage to over 16,745 companies, with consensus coverage increasing from 6,402 companies to 6,900+. Globally, we have over 26 million total analyst line items and 1 million total consensus line items.

Data Trends

No matter your role in the world of finance, the Visible Alpha Insights platform equips you with unparalleled data and analysis tools. These tools significantly enhance decision-making by offering detailed insights into company performance across various sectors. We looked into what sectors and tickers captivate our users. This past year, buy-side user engagement metrics showed keen interest in sectors such as financials, health care, industrials, and technology, with companies such as Netflix, Amazon, Microsoft, Google (Alphabet), Apple, and Meta leading searches in their respective sectors.

User Perspectives

The feedback from our clients underscores the value that Visible Alpha brings to the table, especially in refining business strategies and aiding critical decision-making processes. Our clients often highlight how the platform’s granular consensus data and access to analysts’ models facilitate deep dives into market trends, tracking shifts, and interpreting sentiment changes with greater efficiency. A standout feature that garners frequent praise is the Visible Alpha Excel add-in, known for its ability to simplify and accelerate intricate data analysis, thereby freeing up time for more strategic pursuits.

Users highlight how Visible Alpha is more than a tool; it’s a strategic partner in navigating the complexities of market analysis and business decision-making. This viewpoint is best expressed through our clients’ statements:

|

“Visible Alpha lets me analyze my payment processor competitors, monitor covering brokers’ perspectives, and easily track revisions to spot changes in market sentiment before my shareholders do.” – Thomas McCrohan, EVP Investor Relations, Shift4 |

| “Visible Alpha is the best source for reported/consensus non-GAAP metrics which, for REITs, is everything. The Excel add-in promotes complex cross-coverage analyses not practical without automation.” – Waterfront Capital Partners ($635m AUM) |

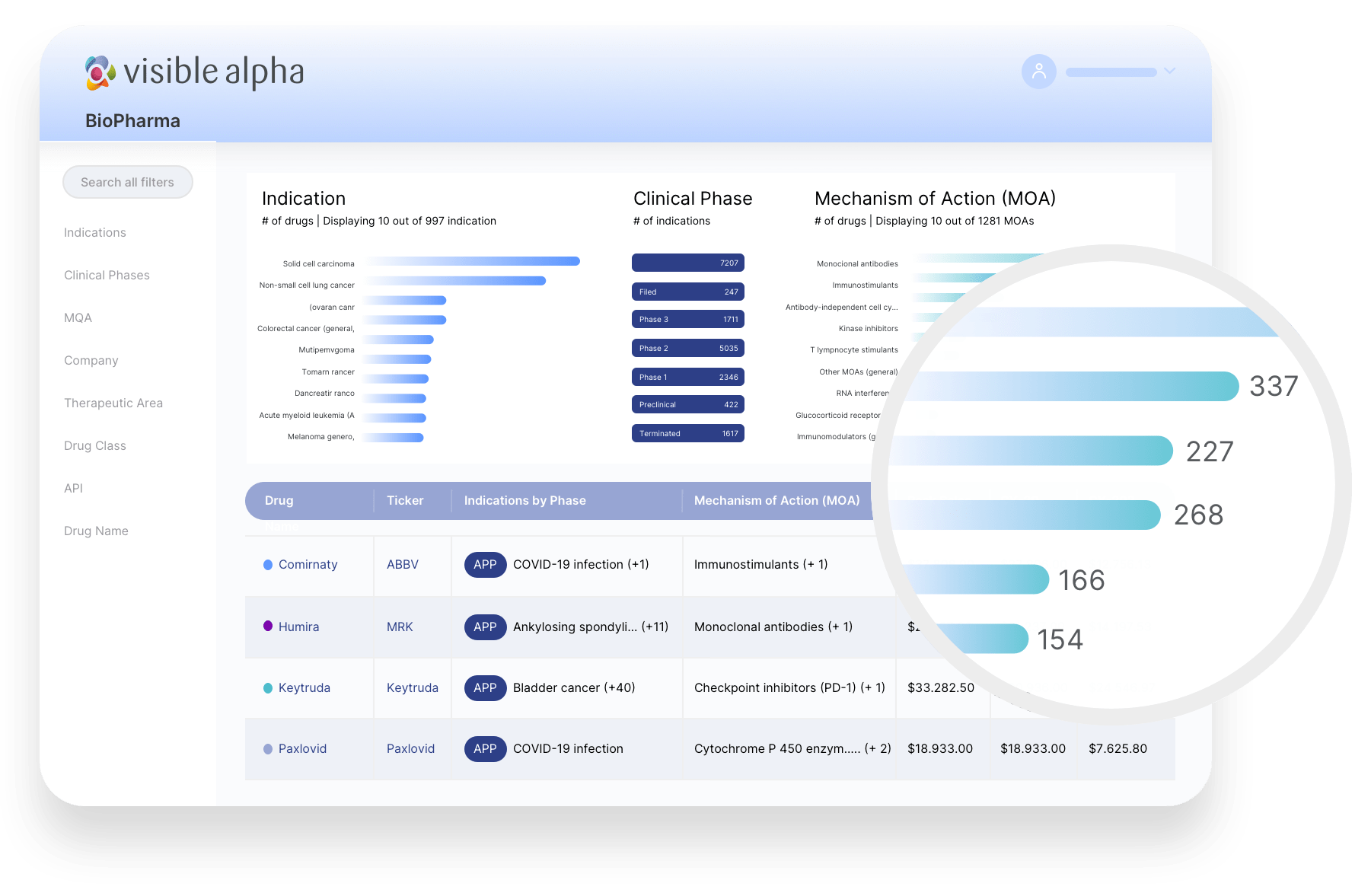

Introducing Visible Alpha BioPharma

We’re excited to announce the launch of Visible Alpha BioPharma, a standalone addition to our suite. This new product is specifically designed to meet the unique needs of professionals in the pharmaceutical and biotech sectors, offering a new dimension of market data analysis.

Alongside this significant development, we have also made several focused updates to our Visible Alpha Insights platform. Key among these are the Industry Analysis and Target Price & Ratings features, further enriching the user experience and data accessibility.

Visible Alpha BioPharma

Visible Alpha BioPharma represents more than just a new product – it’s a bespoke solution designed for professionals grappling with the pharmaceutical and biotech sectors’ unique challenges. Recognizing the challenges posed by rapid drug development innovation, ever-changing regulatory environments, varied clinical trial outcomes, and market volatility, BioPharma steps in as a crucial resource. This platform goes beyond offering comprehensive drug data and granular consensus estimates; it’s a strategic tool that empowers investment professionals with the deep insights needed to make informed decisions in a sector that’s constantly evolving.

With BioPharma, users gain the ability to swiftly identify emerging opportunities, assess market competitiveness, understand market expectations, and delve into detailed historical data and forward-looking estimates. This powerful add-on to Visible Alpha Insights enables you to conduct rapid analysis at the individual drug level, ensuring you’re equipped with the targeted, actionable insights essential for staying informed and ahead in this dynamic field. Leverage BioPharma today, and transform the way you navigate the intricacies of the pharmaceutical and biotech industries.

New Visible Alpha Insights Features

Industry Analysis

The Industry Analysis feature is a game-changer for users looking to stay ahead in their market strategies. It enables a deep dive into industry trends and growth trajectories, allowing you to identify key competitors and benchmark against them. With this tool, you can quickly compare peers using the most relevant performance indicators, tailored to each industry’s unique landscape. This is about empowering you with the ability to make faster, more informed decisions by offering a comprehensive view of companies within the same industry or sub-industry. Additionally, with the inclusion of filters for specific geographies and company sizes, you can tailor your analysis to fit your precise market focus. This feature transforms your approach to industry analysis, making it more efficient, targeted, and strategically sound, ultimately giving you a competitive edge in your market planning and execution.

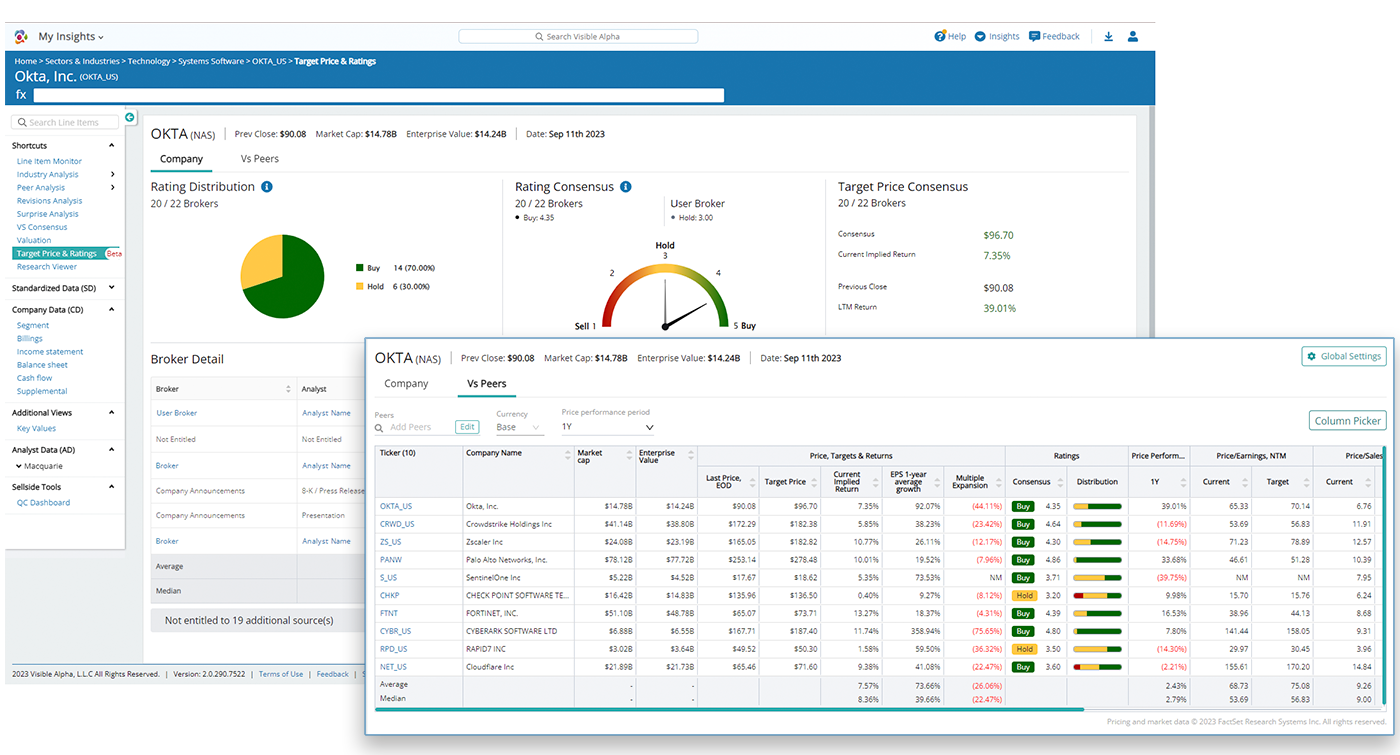

Target Price & Ratings

The Target Price & Ratings feature enables users to easily determine market sentiment – and the drivers behind it – toward a specific company or industry peer group through an easy-to-read overview of broker expectations for a company’s performance. With this feature, viewers can see the various analysts covering a company, along with their individual target price and rating values, and then compare these ratings with some of the company’s closest competitors.

Book a demo to see Industry Analysis and Target Price & Ratings in action.

The Road Ahead

Every feature we introduced, every partnership we formed, was done with a singular focus: to empower our clients with the tools and insights necessary to thrive in a rapidly changing market landscape. Your feedback has been the cornerstone of our evolution, guiding us to refine our services in ways that directly benefit your workflow and decision-making processes.

Looking ahead, Visible Alpha is poised to introduce further enhancements to our existing solutions like BioPharma distribution pages and updates to our entitlements platform. These enhancements are not just additions to our platform; they are reflections of our dedication to staying at the forefront of market intelligence, ensuring that you always have access to the most advanced tools and data.

Stay informed with Visible Alpha by subscribing to our newsletter. You’ll receive the latest product updates, expert analysis, and in-depth market trend insights, all enhanced by the comprehensive data that only Visible Alpha can offer.

The Visible Alpha AI Monitor: Measuring AI Growth and Its Impact

The Visible Alpha AI Monitor aggregates publicly-traded U.S. technology companies, providing a comprehensive measure of the current state and projected growth of the core AI industry. This encompasses the AI-exposed revenues for companies that are building AI infrastructure and capabilities for both enterprises and consumers.

Investors may use the Visible Alpha AI Monitor to generate new ideas to capture growth emanating from the core AI industry, as well as to evaluate the potential AI exposure of technology stocks in their existing portfolios.

We have identified specific line items that capture potential growth of AI-related revenues that are available in the Visible Alpha Insights platform (see the goals, objectives, and methodology of the AI Monitor at the bottom of this page).

Key Takeaways

|

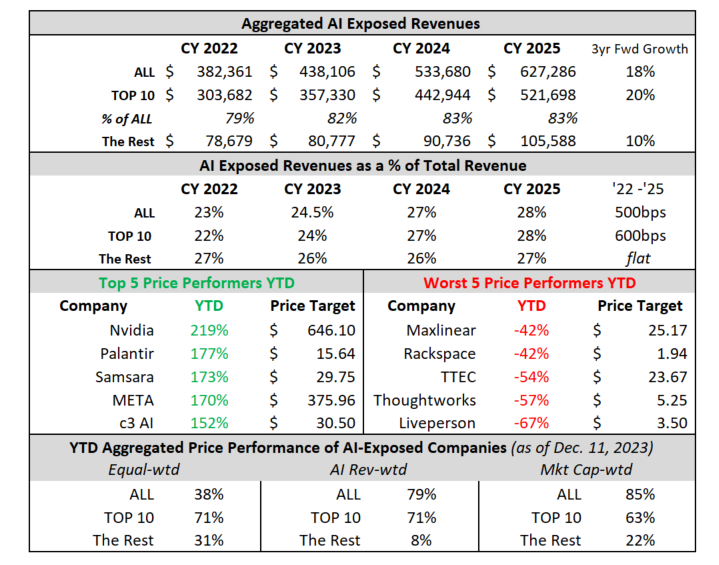

Figure 1: AI growth and performance overview

Source: Visible Alpha consensus (December 12, 2023). Stock price data courtesy of FactSet. Current stock prices are as of the market close on December 11, 2023. TOP 10 = IBM, Qualcomm, Oracle, Microsoft, Intel, Amazon, Adobe, Dell, Nvidia, Google. These firms currently have the largest revenue-generating segments geared to AI.

Current AI Landscape

At the moment, there is an arms race to convert data centers to accelerated computing to support AI and machine learning. As a result of the unexpectedly strong demand this year from cloud service providers, Nvidia (NASDAQ: NVDA) has seen the sum of its estimates over the next three years increase an astonishing $155 billion since January 2023. Meanwhile, the aggregate of the other nine largest AI-exposed revenue generators is expected to decline over $75 billion, driven by downward revisions to the revenue outlooks for AWS, Google Cloud, Azure IaaS/PaaS, and Qualcomm. Given the magnitude of Nvidia’s projected increases, is the growth in this part of the stack now priced in? As we move up the stack, what companies may begin to see their revenue explode, like Nvidia has, or possibly implode as AI takes hold?

Nvidia has been dominating the AI landscape, which has led it to drive the AI-exposed revenue outlook for the 10 largest AI-exposed revenue generators and the overall Visible Alpha AI Monitor. However, large and small companies have been investing in AI. Will these investments impact the broader industry and create opportunities for a wider array of firms to grow their AI revenues and emerge as new leaders? Which companies will be the winners and which ones may see their business models and profits decline?

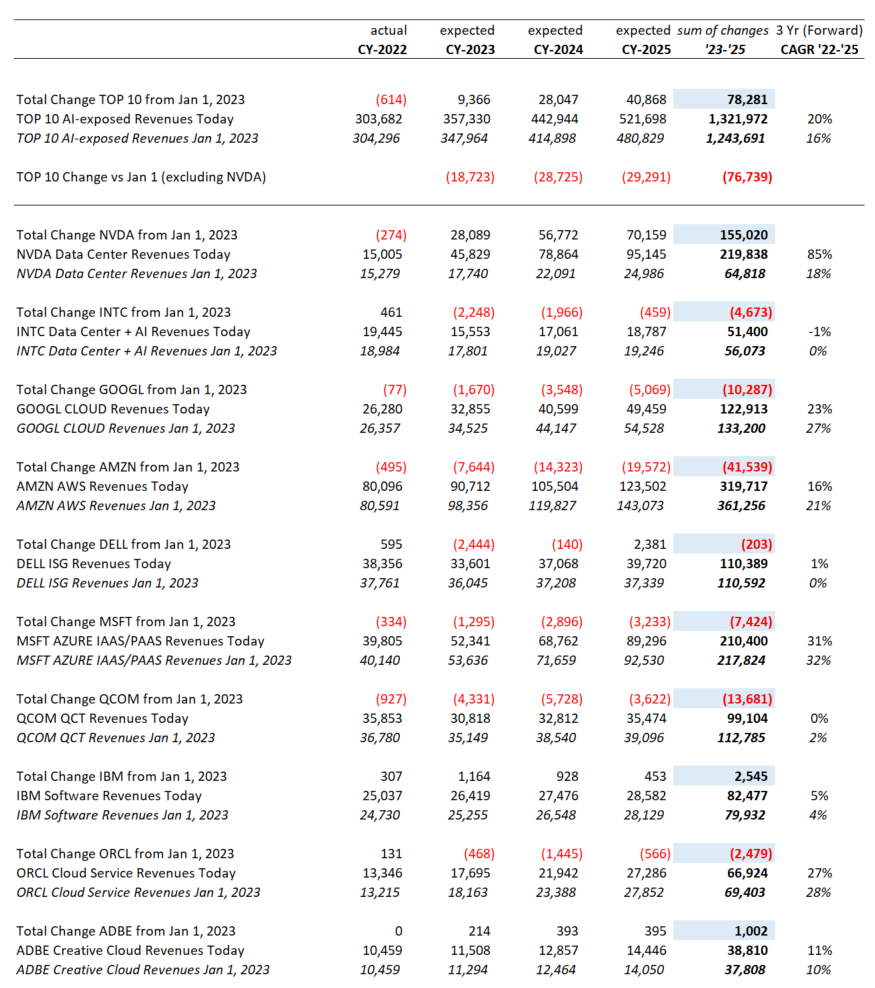

Figure 2: Top 10 breakdown of AI-exposed revenue expectations

Source: Visible Alpha consensus (December 12, 2023). TOP 10 = IBM, Qualcomm, Oracle, Microsoft, Intel, Amazon, Adobe, Dell, Nvidia, Google. These firms currently have the largest revenue-generating segments geared to AI. Based on higher analyst counts, we are using the non-GAAP revenue number for Oracle and Ansys.

Performance Summary

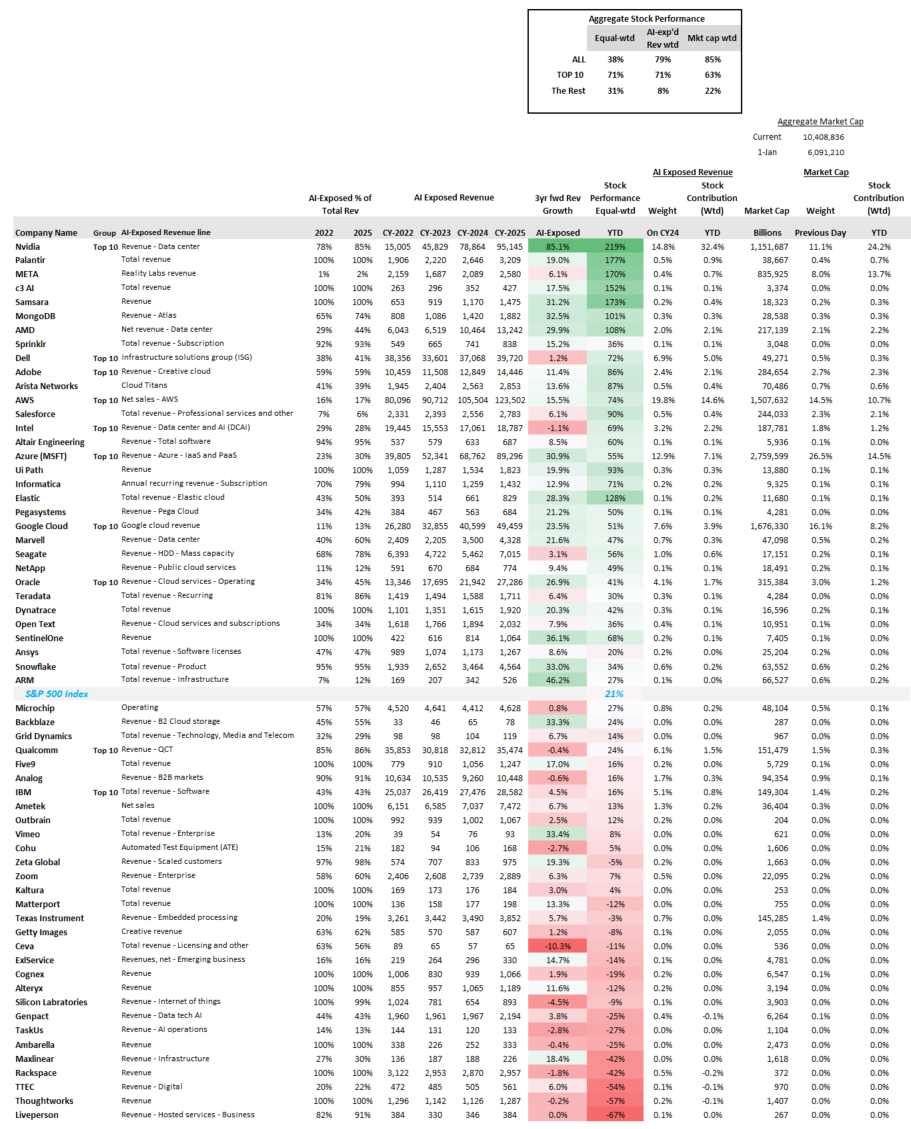

Currently, the Visible Alpha AI Monitor universe of 62 publicly-traded U.S. companies is 82% weighted to the 10 largest companies, with the remaining 18% dispersed among 52 companies.

On a market-cap weighted and AI-exposed-revenue weighted basis, the Visible Alpha AI Monitor was driven by substantial stock price outperformance (vs. the S&P 500 index) of the largest companies this year. In addition, the smaller companies were meaningful underperformers (vs. the S&P 500 index), especially on an AI-exposed-revenue weighting.

On an equal-weighted basis, the AI Monitor would have generated significantly lower return when compared to the market-cap and AI-exposed-revenue weighted aggregations this year, driven by the drag of a lower return generated by the 52 remaining names. Stock selection was an important dimension among the 52 names, as more than 50% of the companies underperformed the index.

Top 10

Based on an analysis of the 10 largest players from January of this year, 2025 revenue forecasts for AI-exposed revenue segments increased $40 billion in total. However, $70 billion of that is from Nvidia, which means that the rest of the Top 10 saw revenue estimates decline almost $30 billion in aggregate. This was driven by lower expectations for AWS, Google Cloud, and Qualcomm QCT. However, though expectations came down for these companies, stock performance was strong for eight of the Top 10 companies, the exceptions being Qualcomm and IBM, both of which appear to have lower AI-exposed revenue.

The Rest (smaller contributors)

The remaining list of 52 companies may serve as a good place for investors to discover new ideas by surfacing expanding new players. While smaller companies in aggregate have not performed as well as the Top 10, there have been some clear outperformers relative to others.

Among the smaller firms, revenue growth expectations are very mixed. Strong double-digit revenue growth is expected at some firms, while others are seeing estimates decline. These dynamics may help investors identify emerging trends in the space. We have already seen that to be true this year with Palantir, C3 AI, Samsara, and MongoDB delivering very strong outperformance (vs. the S&P 500 index), while more than half of the smaller companies in the AI Monitor substantially underperformed the index. Rackspace, TTEC, Thoughtworks, and Liveperson fell by more than 50%.

The role of Nvidia

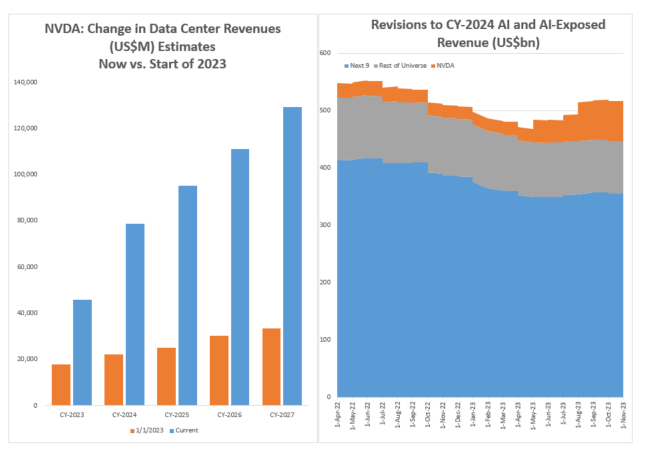

The magnitude of growth baked into Nvidia, combined with this year’s over 200% stock performance, has been absolutely staggering. Looking further out to the end of 2027, Visible Alpha consensus for Nvidia revenue has exploded by nearly $100 billion from a modest $33 billion in January to now a whopping $129 billion currently projected in Data Center revenues alone.

Nvidia has driven the total AI Monitor and the Top 10 companies, as analysts began to anticipate enormous growth to come from transitioning data centers to accelerated computing to support AI. Nvidia made up 30% of the 85% aggregated market-cap weighted stock performance of the Visible Alpha AI Monitor. Looking at only the Top 10 market-cap weighted stock performance, Nvidia was close to 40% of the 65% aggregated return. Given the strength of both the revisions to future growth and the stock performance that followed, to what extent has the strength in Nvidia’s fundamentals already been priced in?

Figure 3: Nvidia’s Data Center revenue estimates and revisions

Figure 4: AI Monitor detailed breakdown

Source: Visible Alpha consensus (December 12, 2023). TOP 10 = IBM, Qualcomm, Oracle, Microsoft, Intel, Amazon, Adobe, Dell, Nvidia, Google. These firms currently have the largest revenue-generating segments geared to AI. Based on higher analyst counts, we are using the non-GAAP revenue number for Oracle and Ansys.

Final Thoughts

While this year has clearly been the Year of Nvidia, Palantir and C3 AI have seen their exposure to AI translate into meaningful stock outperformance relative to the S&P 500 index. However, for many firms it is not clear how AI-exposure will impact business models.

For example, Meta Platforms is investing in AI and has seen its stock rise 170% in 2023, but it is not clear how their AI strategy will show up in their numbers and at what pace. On a three-year forward basis, Meta’s AI-exposed revenue growth, as seems to be reflected in Reality Labs, is only expected to be 6%, but it’s obscured by the other businesses in this segment.

There are numerous such examples where the AI-exposed revenue growth projections and the stock performance do not appear correlated. As the AI story unfolds over the next few years, will the transparency of AI drivers improve and drive stock outperformance?

As 2023 comes to a close, will this year’s best performers, like Nvidia and Palantir, continue to drive the Visible Alpha AI Monitor in 2024 or will we see a rotation into less appreciated firms where the growth may not yet be priced in?

AI Monitor Goals and ObjectivesThe objective of the Visible Alpha AI Monitor is to show the investment community which companies are likely to drive AI going forward. As the world embraces AI and its applications to enterprise workflows and our daily lives, big questions exist about how AI’s impact on company business models will unfold over the next 3-5 years. AI can potentially free people from tedious work to enable more focus on critical workflows that require human creativity and analysis. A primary goal of the Visible Alpha AI Monitor is to show which U.S. companies and specific line items we are keeping an eye on as the embryonic AI theme emerges across company fundamentals and begins to scale broadly across the economy. We are monitoring how AI may be reflected in the numbers and which companies may be benefitting more or less. This universe attempts to be comprehensive and to show investors the dynamics of both the large and smaller U.S. players. Additionally, it aims to help investors identify new names that may be smaller and less covered, but potentially growing and emerging more quickly. AI Monitor MethodologyUsing Visible Alpha’s comprehensive database of detailed estimates pulled directly from sell-side analysts’ spreadsheet models, we have assembled an aggregation with an initial universe of 62 publicly-traded companies that are contributing to the infrastructure and broad scaling of AI capabilities. This monitor aims to provide a current and future snapshot as to where AI-related revenues are and are not growing across each of these 62 companies, and particularly the ten largest. We have aggregated the revenues of specific business segments at firms that are driving the wider AI trend. For larger firms, we have attempted to pinpoint where in their revenue model AI is driving growth. For some smaller firms, we are simply incorporating 100% of revenues. The AI-exposed revenue lines we identify are intended to be used as a proxy for monitoring the growth of each company’s AI business. Given both lack of discrete company disclosures and how intertwined AI and conventional technologies and services can be, these lines should not be taken as exact quantifications of AI revenues, but are, we believe, the best systematic approximation available. For Visible Alpha subscribers, details of these companies can all be found within the Visible Alpha Insights platform. Each company included in the monitor has coverage by at least four sell-side analysts. In addition, given the quickly evolving state of the AI space, these line items are subject to change and may shift significantly over time. We plan to refresh the data on an ongoing basis and provide regular updates. |

For investor relations (IR) teams, maintaining constructive relationships with investment banking and independent research analysts is critical. A significant facet of this collaborative association are the projections from sell-side broker analysts regarding a company’s future performance, meticulously recorded in their spreadsheet models. The aggregation of these models provides a quantifiable market perspective of the company, offering a wealth of insights for IR teams on how the investment community views the company.

The market’s view of a company’s business drivers

Traditional consensus metrics mostly focus on outcomes like revenue, net income, and earnings per share (EPS). A more detailed examination of the analysts’ models and the detailed forecasts contained in them, however, unveils a comprehensive understanding of how analysts believe those outcomes will be achieved. The resulting data reveals the driving forces behind the business, providing an invaluable market perspective that a company and its IR team can use for future planning and investor communications.

Harnessing analyst models and consensus data

Analyst model forecasts significantly influence market sentiment and shape investors’ perceptions of a company. Given the vast array of investible opportunities, institutional investors often rely heavily on sell-side research. According to Visible Alpha’s founder and Chief Research and Innovation Officer, Scott Rosen: “Investors look at sell-side analysis and forecasts because no other source is as broad and deep for providing thoughtful and detailed analysis of a company.”

Data consolidating the viewpoints of the sell-side analyst community empowers IR teams to grasp the information environment of their investors better, facilitating improved anticipation of potential investor reactions.

Tracking the evolution of these expectations in comparison to the company’s own projections and guidance equips IR teams to adjust communication strategies, engage in meaningful dialogues with sell-side analysts, identify investor concerns for internal discussions, and benchmark the company against industry peers.

Assessing the spectrum of analysts’ perspectives

Determining the critical investment questions that analysts and investors have about a company is a straightforward task for IR teams. However, quantifying these investment controversies is more challenging. Analyzing the range of analyst views on key line items – unit volume growth of a new product, net impact of cost reduction, maintenance of margins for major product lines, etc. – can provide precise measurements of market expectations and the level of uncertainty surrounding the company’s most important performance metrics.

“The consensus is just the mean, a statistic that roughly summarizes a variety of different expectations. This can often be less interesting and useful than knowing the range of forecasts. Sometimes there is very tight agreement and sometimes a widely divergent spectrum of views,” explains Rosen.

A broad spread of forecasts on a key business driver could signal the need for more transparency or improved guidance on the part of the company to clarify a point of confusion, or could reflect significant differences in analyst opinions on a fundamental issue. This information enables IR teams to proactively address concerns with specific analysts and to quantify any investment controversies that may drive investor behavior.

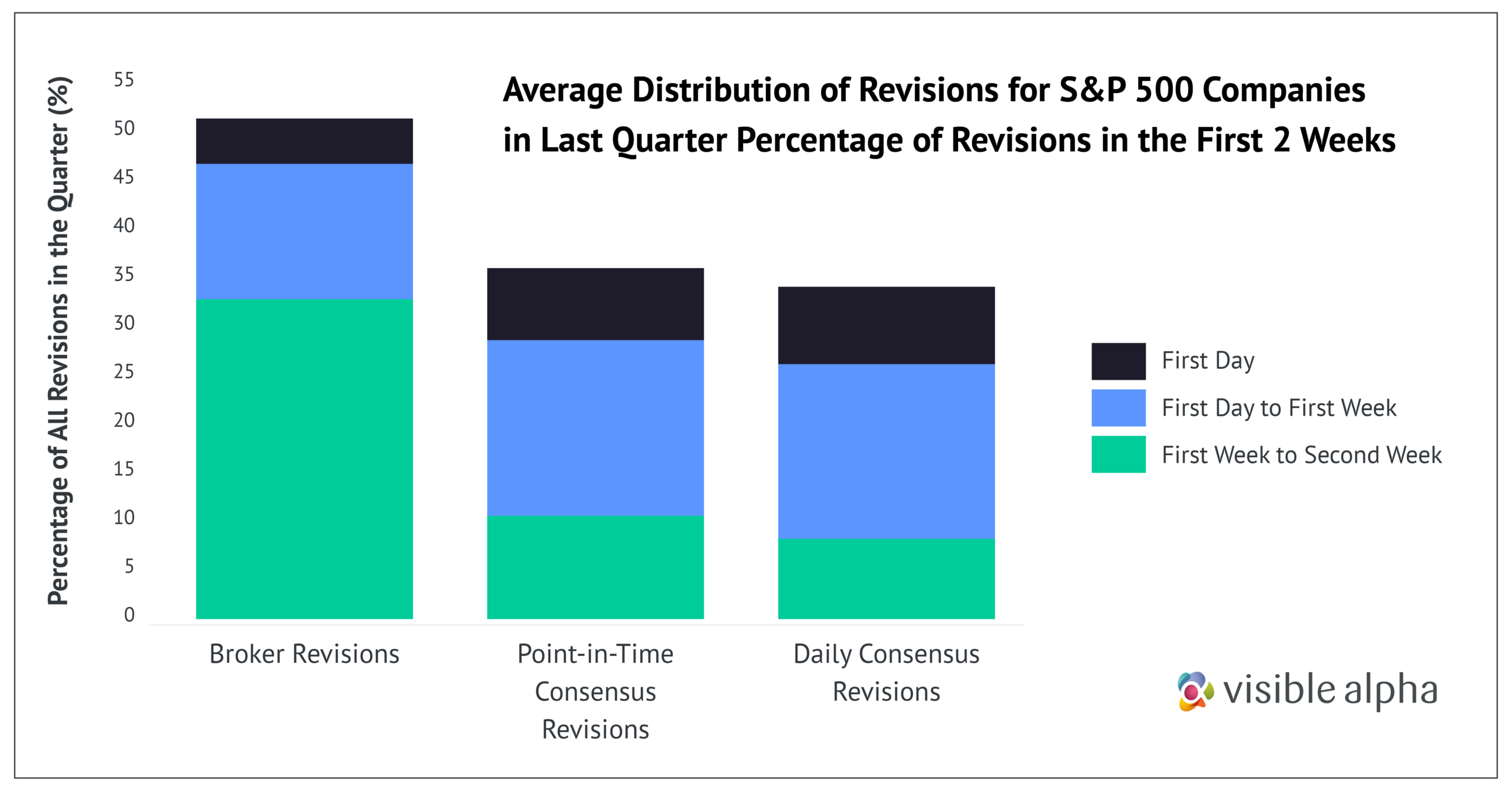

The importance of timely responses

For an IR team, accurately tracking critical changes in key forecasts can be a herculean task, considering the ever-increasing size and complexity of analyst models and the frequency of revisions. Analysis of Visible Alpha’s data indicates that the average number of consensus line items per company was 161, with a high well above 1,500. Each of those line items experience an average of 14 revisions per company during a quarter, with some seeing more than 100.

The repercussions of delays in tracking these changes could severely hinder an IR team’s ability to respond effectively. This underlines the importance of receiving timely and detailed insights to maintain an agile approach.

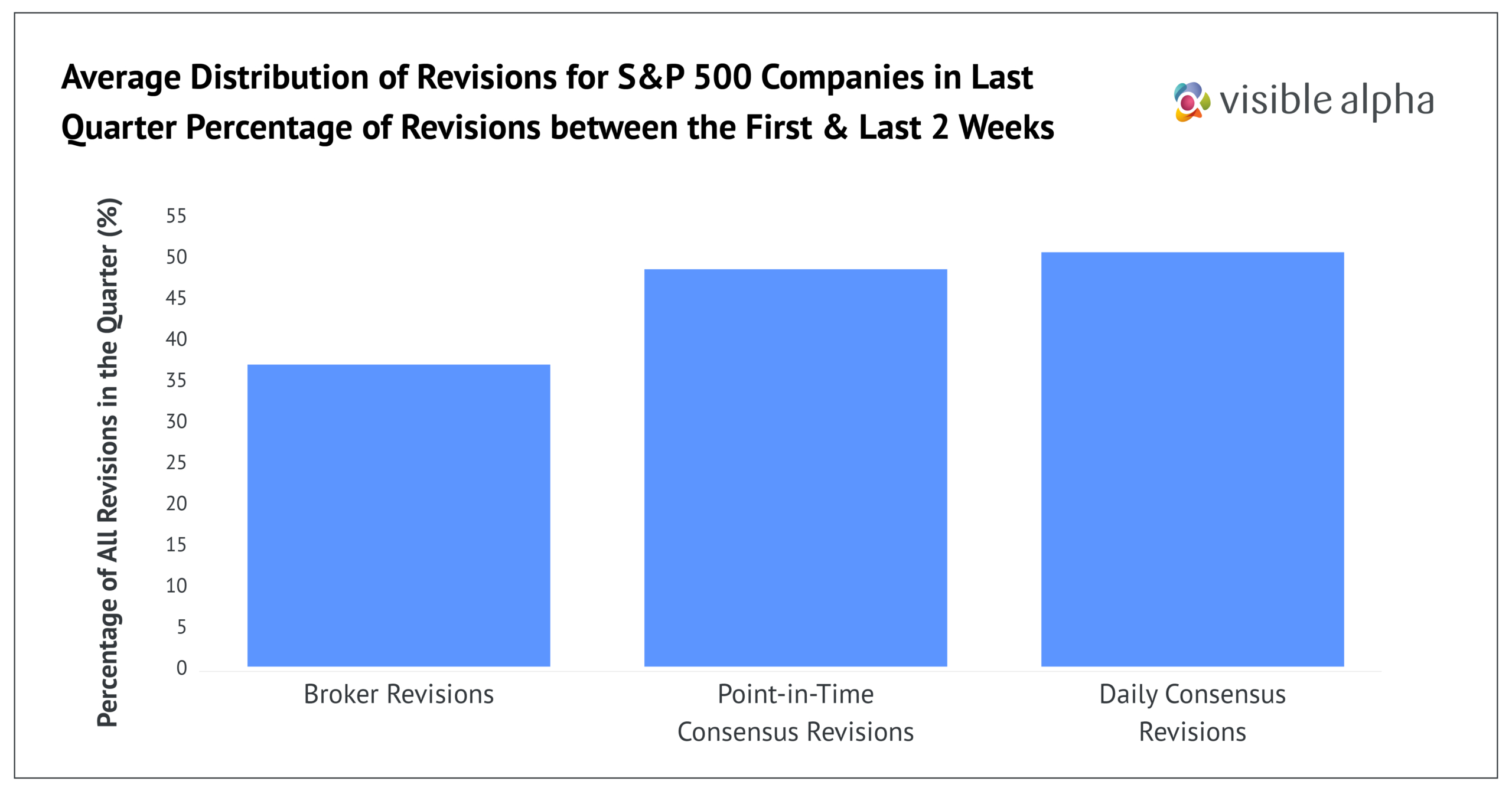

Beyond earnings: An ongoing process

According to a Visible Alpha study, while a significant percentage of analyst revisions (32%) occur within a day of an earnings announcement, the flow of information from analysts continues during the rest of the quarter. Almost 50% of analyst revisions are made between two weeks after earnings and two weeks before the next reporting.

This study underscores the substantial value for IR teams in keeping a constant finger on the pulse of ongoing analyst updates. Real-time consumption of sell-side models and forecasts provides an invaluable tool for staying ahead of the curve. Outdated snapshots of analyst sentiment, or high-level forecasts that do not illuminate the market’s changing view of their company’s key drivers, cannot serve the interests of IR teams in a constantly evolving information landscape.

The bottom line: Timely and comprehensive insights

Having timely access to comprehensive sell-side analyst models, forecasts, and market consensus can equip IR teams with invaluable insights. These insights may not only inform internal business strategy, but also foster effective external communications with analysts and investors. For investor relations, managing expectations through the strategic use of consensus can offer a robust competitive advantage, fostering stronger relationships and facilitating more informed decision-making.

This article was originally published in the Informed edition 119 – Summer 2023 by the IR Society.

The importance of real-time analyst earnings estimates

Analyst and consensus estimates revisions are highly sought after by investment professionals, who typically obtain estimates revisions by either collecting and ingesting analyst spreadsheet models directly or by leveraging a third-party service provider to process the models. In the latter approach, investors typically receive analyst and consensus estimates two weeks after earnings and two weeks prior to the next earnings announcement, summarizing any revisions made.

The Data Deluge

Active managers are in a world of accelerating change. Poor active management performance and the search for lower fees have caused a flood of funds into passive investment vehicles and have put pressure on active funds to perform. The pressure for alpha has never been more intense, and investors need more help than ever.

The Rise of Alternative Data

In short, alternative data refers to any non-traditional data that is used to make investment decisions. It’s a hot topic in the investment management industry right now, and a paper from Deloitte nicely sums up the current sentiment: