For investor relations (IR) teams, maintaining constructive relationships with investment banking and independent research analysts is critical. A significant facet of this collaborative association are the projections from sell-side broker analysts regarding a company’s future performance, meticulously recorded in their spreadsheet models. The aggregation of these models provides a quantifiable market perspective of the company, offering a wealth of insights for IR teams on how the investment community views the company.

The market’s view of a company’s business drivers

Traditional consensus metrics mostly focus on outcomes like revenue, net income, and earnings per share (EPS). A more detailed examination of the analysts’ models and the detailed forecasts contained in them, however, unveils a comprehensive understanding of how analysts believe those outcomes will be achieved. The resulting data reveals the driving forces behind the business, providing an invaluable market perspective that a company and its IR team can use for future planning and investor communications.

Harnessing analyst models and consensus data

Analyst model forecasts significantly influence market sentiment and shape investors’ perceptions of a company. Given the vast array of investible opportunities, institutional investors often rely heavily on sell-side research. According to Visible Alpha’s founder and Chief Research and Innovation Officer, Scott Rosen: “Investors look at sell-side analysis and forecasts because no other source is as broad and deep for providing thoughtful and detailed analysis of a company.”

Data consolidating the viewpoints of the sell-side analyst community empowers IR teams to grasp the information environment of their investors better, facilitating improved anticipation of potential investor reactions.

Tracking the evolution of these expectations in comparison to the company’s own projections and guidance equips IR teams to adjust communication strategies, engage in meaningful dialogues with sell-side analysts, identify investor concerns for internal discussions, and benchmark the company against industry peers.

Assessing the spectrum of analysts’ perspectives

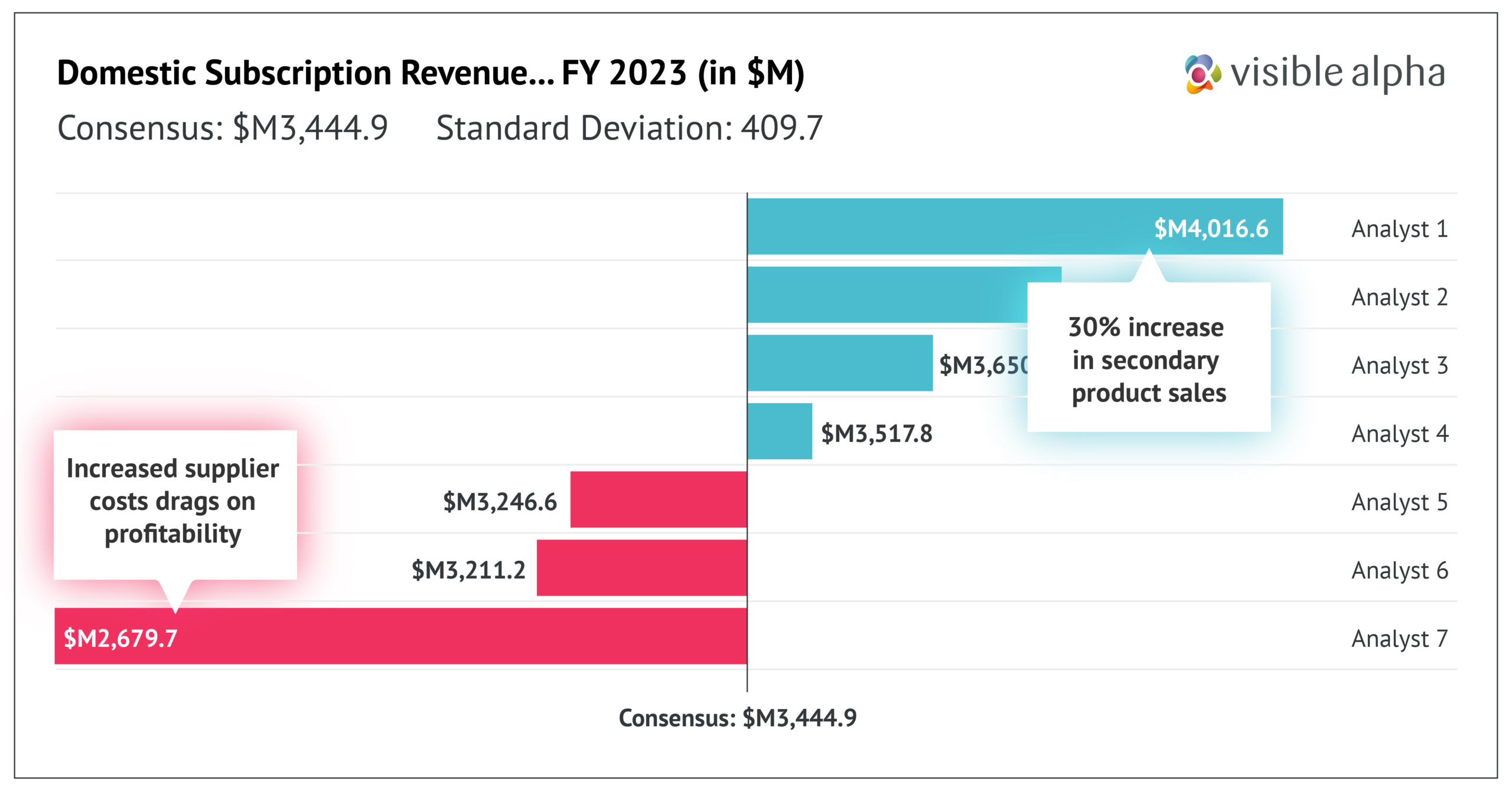

Determining the critical investment questions that analysts and investors have about a company is a straightforward task for IR teams. However, quantifying these investment controversies is more challenging. Analyzing the range of analyst views on key line items – unit volume growth of a new product, net impact of cost reduction, maintenance of margins for major product lines, etc. – can provide precise measurements of market expectations and the level of uncertainty surrounding the company’s most important performance metrics.

“The consensus is just the mean, a statistic that roughly summarizes a variety of different expectations. This can often be less interesting and useful than knowing the range of forecasts. Sometimes there is very tight agreement and sometimes a widely divergent spectrum of views,” explains Rosen.

A broad spread of forecasts on a key business driver could signal the need for more transparency or improved guidance on the part of the company to clarify a point of confusion, or could reflect significant differences in analyst opinions on a fundamental issue. This information enables IR teams to proactively address concerns with specific analysts and to quantify any investment controversies that may drive investor behavior.

The importance of timely responses

For an IR team, accurately tracking critical changes in key forecasts can be a herculean task, considering the ever-increasing size and complexity of analyst models and the frequency of revisions. Analysis of Visible Alpha’s data indicates that the average number of consensus line items per company was 161, with a high well above 1,500. Each of those line items experience an average of 14 revisions per company during a quarter, with some seeing more than 100.

The repercussions of delays in tracking these changes could severely hinder an IR team’s ability to respond effectively. This underlines the importance of receiving timely and detailed insights to maintain an agile approach.

Beyond earnings: An ongoing process

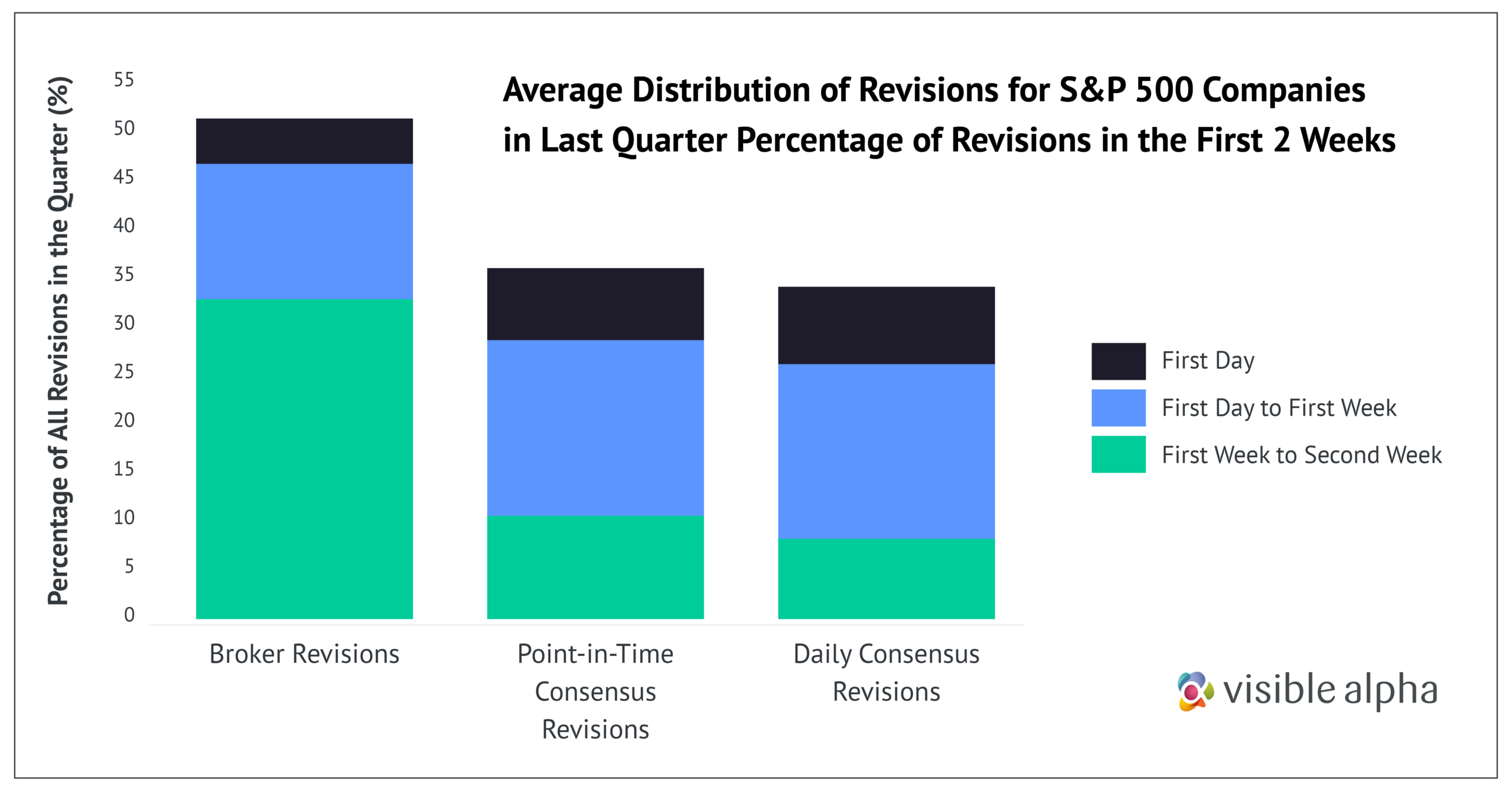

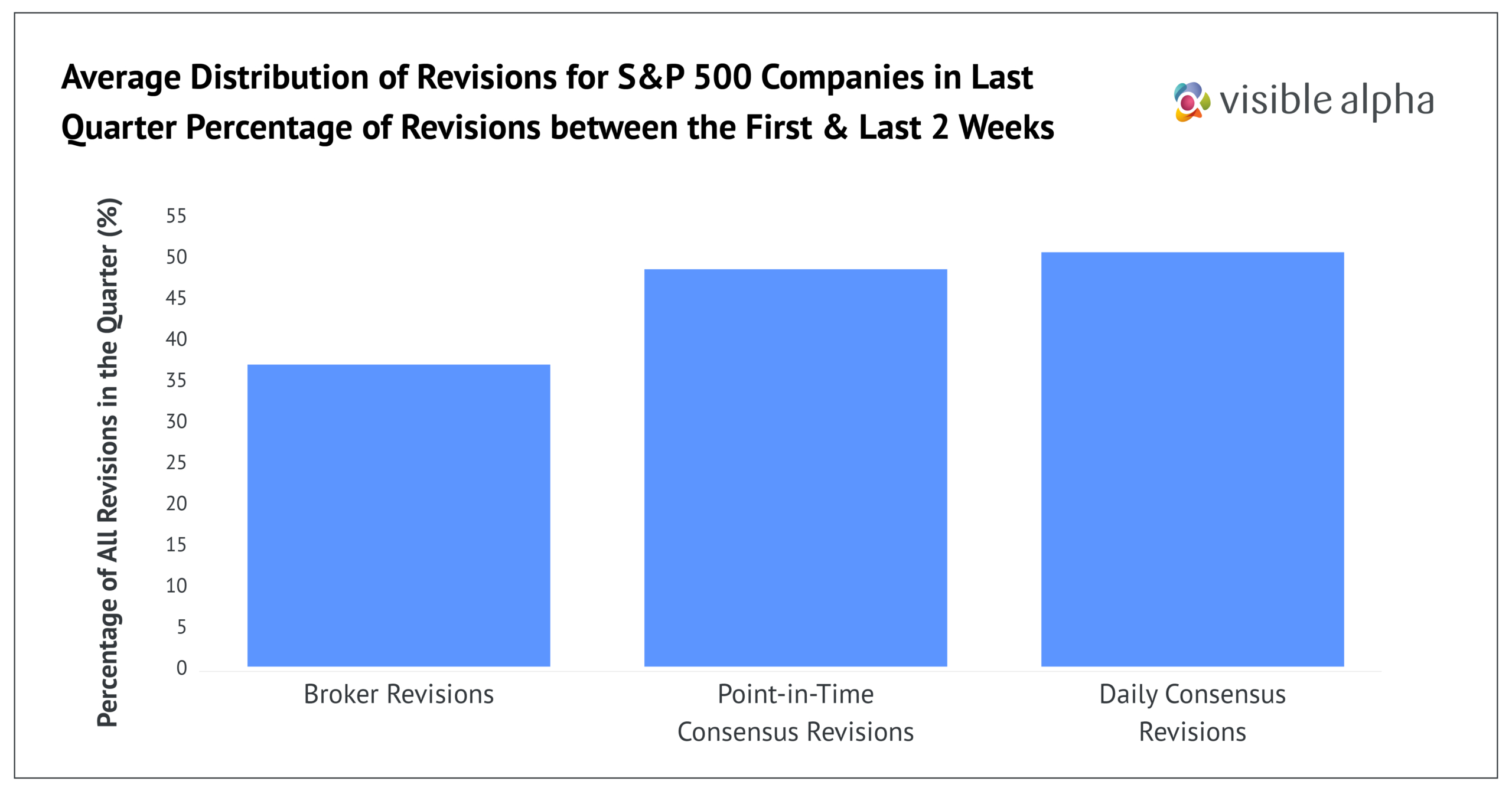

According to a Visible Alpha study, while a significant percentage of analyst revisions (32%) occur within a day of an earnings announcement, the flow of information from analysts continues during the rest of the quarter. Almost 50% of analyst revisions are made between two weeks after earnings and two weeks before the next reporting.

This study underscores the substantial value for IR teams in keeping a constant finger on the pulse of ongoing analyst updates. Real-time consumption of sell-side models and forecasts provides an invaluable tool for staying ahead of the curve. Outdated snapshots of analyst sentiment, or high-level forecasts that do not illuminate the market’s changing view of their company’s key drivers, cannot serve the interests of IR teams in a constantly evolving information landscape.

The bottom line: Timely and comprehensive insights

Having timely access to comprehensive sell-side analyst models, forecasts, and market consensus can equip IR teams with invaluable insights. These insights may not only inform internal business strategy, but also foster effective external communications with analysts and investors. For investor relations, managing expectations through the strategic use of consensus can offer a robust competitive advantage, fostering stronger relationships and facilitating more informed decision-making.

This article was originally published in the Informed edition 119 – Summer 2023 by the IR Society.