Last week, Uber announced its new CEO would be Dara Khosrowshahi – the former CEO of Expedia. While the attention is on the fast-growing company that he’s moving towards, Mr. Khosrowshahi is also leaving behind a company that has many of its investors bullish on its future prospects. Expedia stock is now up over 25% year-to-date and over 160% over the last five years. Why are investors so bullish?

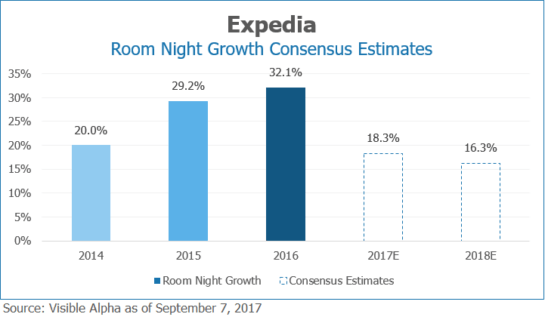

While Trivago (of which EXPE owns 61% of) recently lowered its full-year outlook, analysts remain bullish on Expedia’s overall room night growth. The company is expected to benefit from higher traffic conversion, favorable comparisons, and an expanding property selection in 2017 and 2018. As a result, analysts expect high-teen growth in room nights in 2017 and mid-teen growth in 2018.

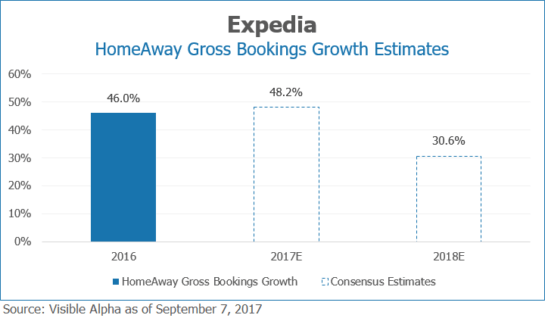

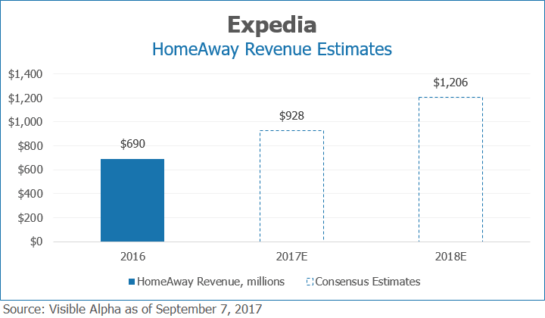

Additionally, on a company segment level, analysts remain particularly bullish on HomeAway’s revenue outlook. Management is in the early innings of several initiatives that are expected to drive increased bookings, including improved search results, expanded listings, site improvements, and distribution on the core Online Travel Agency (OTA) platform. Analysts expect HomeAway bookings growth to accelerate in 2017 and remain strong in 2018, which should drive strong revenue growth in the segment.

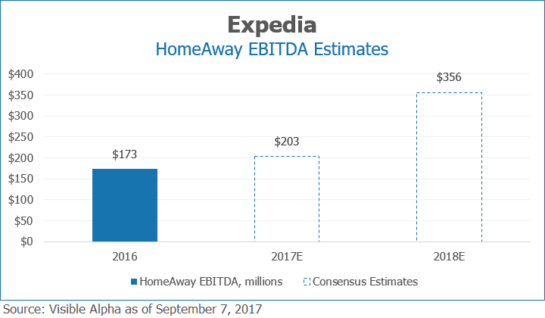

And ultimately, with the help of the increased scale, analysts expect HomeAway to achieve management’s $350 million EBITDA guidance in 2018.

Discover insights for Expedia and more than 1,700 other companies.