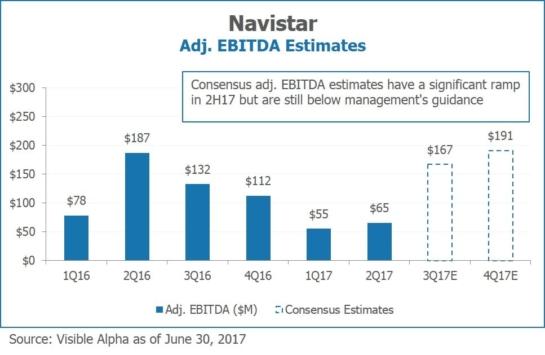

When Navistar reported 2Q17 results, investors were surprised at the company’s guidance. Navistar had just reported 2Q results that were well-below expectations. Adjusted EBITDA came in at $65 million, well-below the consensus of $130M. The company had also missed adj. EBITDA consensus estimates in 1Q. However, management maintained their guidance of full-year adj. EBITDA to be above the $508M reported in 2016. This implies 2H adj. EBITDA of at least $388M, which would be over 3x what they just reported in 1H17.

Navistar Managements View

Navistar management believes they will be able to achieve this guidance from a number of sources.

- Management expects stronger truck performance from improving industry conditions, new truck offerings and their new A26 engine, selling used trucks internationally, and reducing costs in the segment. Management is expecting both higher revenue and better margin performance in the back half of the year.

- Navistar’s Parts segment is expected to perform better in the second half due to seasonality.

- The company expects to achieve further cost savings through the year.

Do investors agree with management’s view?

Current consensus shows that while investors do expect a significant ramp in 2H, they still expect adj. EBITDA to fall short of management’s guidance by roughly $30M. Discover a new source of alpha >

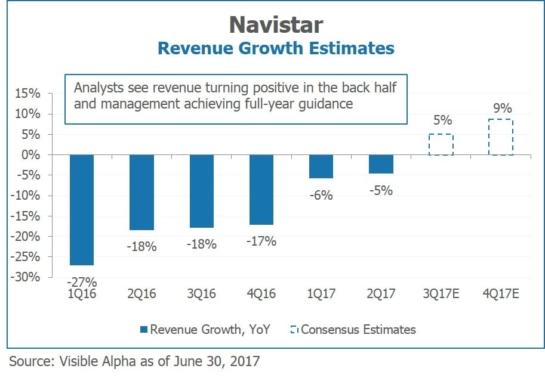

However, analysts do expect the company to achieve its revenue guidance of “similar to 2016.” Despite the revenue declines in the first half of the year, investors expect revenue to grow in 3Q and 4Q, leaving the year with revenue growth of 1%.

Visible Alpha transforms the entire investment management workflow with access to unique perspective and context that was previously unavailable in one place. Learn more >