Chipotle reported fiscal 1Q17 results last Wednesday after the close that were well-above expectations on earnings. Management also reiterated its high-single digit comp guidance for the full year and their “stretch goals” of $10 EPS and 20% restaurant-level margins in 2017. However, the stock was only up 2% the day after earnings.

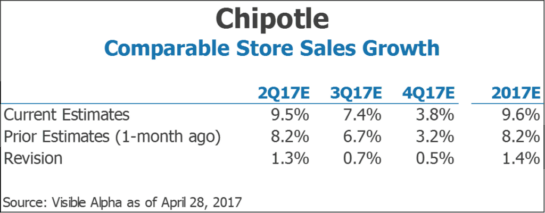

1. Comparable Store Sales Growth

Going forward, the focus is on comparable store sales growth for 2Q and the remainder of the year. While the 1Q17 comparable store sales growth of 17.8% was above expectations, bears pointed to the choppy monthly trends which, on a 2-year basis, had not improved in March or April. More optimistic investors were bullish on the outlook for comparable store sales growth as the company had just beaten expectations, recently launched a national advertising campaign, and had shown strength in digital orders. Visible Alpha’s consensus estimates point to a 9.5% comp for 2Q and 9.6% for the full year (at the high-end of management’s high-single digit guidance). Revisions were largest in the nearer quarters, suggesting that analysts remain somewhat cautious about improvements in the business once they begin to lap more difficult comparisons.

Discover insights hidden in stories that consensus does not tell. Request access to Visible Alpha.

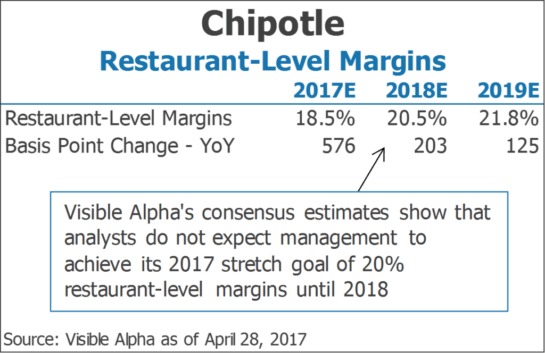

2. Restaurant-Level Margins

Restaurant-level margins are also a major focus for investors. The bull thesis suggests that margins could return to the mid 20’s on the back of several efficiency initiatives and a return to sales levels prior to Chipotle’s food-safety issues. Bears believe margins may be held back by higher labor costs, food costs, food safety procedures, and lower sales levels. Consensus data suggests that analysts currently expect the company to grow somewhere in between these scenarios, with restaurant-level margins reaching close to 22% by 2019. Additionally, analysts do not expect management to achieve their 2017 margin stretch goal until 2018.