Investors have become increasingly bullish on Amazon over the last month with the stock up 7% compared to the S&P’s gain of 1% as of 4/24/17. Let’s take a closer look at Visible Alpha’s consensus estimates to find the source of bullishness.

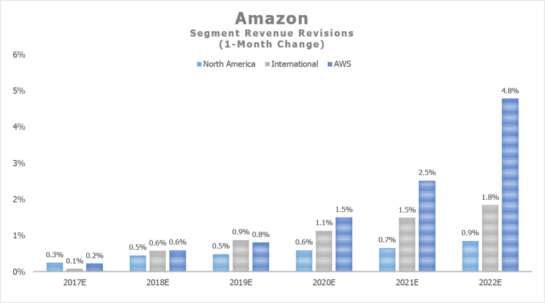

Revenue estimates have moved up significantly over the last month. While revisions within all of their segments are modestly positive in 2017 and 2018, analysts have significantly revised their estimates upwards in the out years between 2019 and 2022. Much of the optimism comes from the long runway ahead for the company in its International and AWS segments. In international, Amazon is increasing efforts to expand prime features and product selection. In AWS, Amazon remains the leader in a young but fast-growing cloud computing industry.

Source: Visible Alpha as of April 24, 2017.

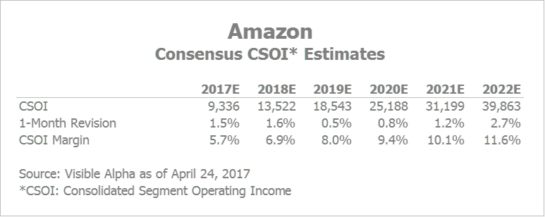

In terms of profitability, investors expect CSOI (consolidated segment operating income) margins to expand over time. Of note are the 1-month revisions in profitability, which have outpaced the revenue revisions mentioned above (signaling that investors are increasingly bullish on margin expansion). Amazon recently disclosed new financials in their 10-K, which suggested a fast-growing prime membership and advertising business, both of which are higher-margin businesses.