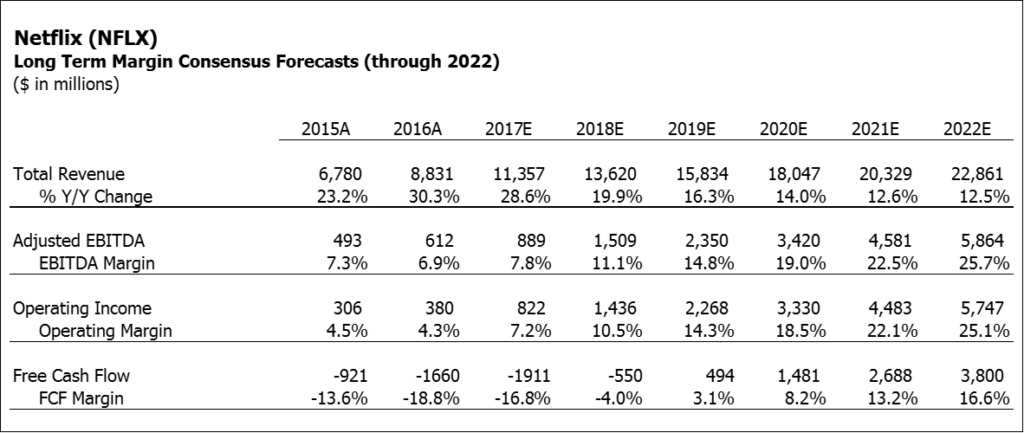

Netflix (NFLX) will report 1Q17 results after the market close on Monday, April 17th. While investors will pay special attention to NFLX’s ability to grow its international subscriber base, they will also keep an eye on the company’s efforts to improve its margins. The current Visible Alpha consensus estimates show steadily increasing margins (Operating, EBITDA and Free Cash Flow) over the long term, even in light of steadily decreasing revenue growth and an expected increase in content spending in both original and licensed content.

An Investigation into Margin Forecasts

The current Visible Alpha consensus forecasts for adjusted EBITDA margin and operating margins include an annual increase of 300bps or greater for each year through the long term outlook to 2022. In terms of Free Cash Flow Margin, Visible Alpha consensus current forecasts a 200 bps improvement in 2017 and a 1200 bps improvement in 2018.

Source: Visible Alpha. Request a 30-day trial or learn more.

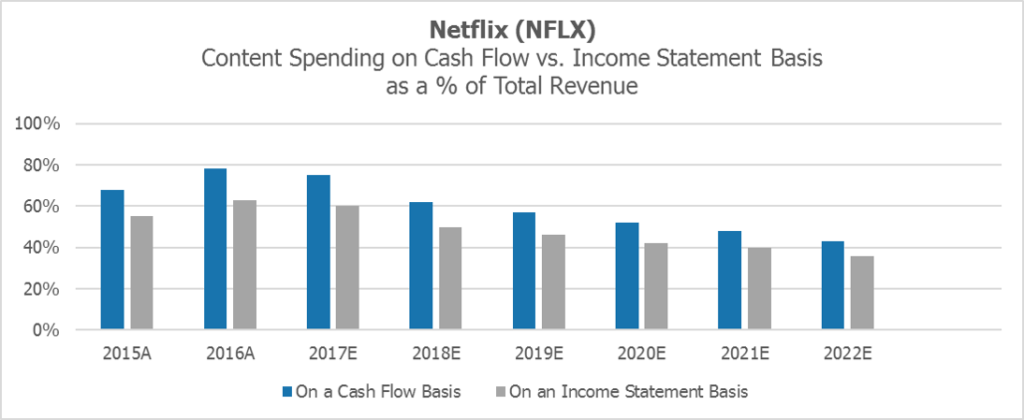

Slowdown in Content Spending

A significant reason for this improvement is the slowdown in content spending, the biggest driver to Netflix’s cost of revenue (60% of total revenue in 2016). For example, Visible Alpha consensus expects content spending on a free cash flow basis to grow only 23% year over year in FY2017, compared to 45% or more during the past two years. This may prove challenging. NFLX has, including on its most recent investor conference call, repeatedly stated that content investments will continue to increase going forward, especially in its expanding foreign markets where spending on original content (lower initial margin) is critical.

Source: Visible Alpha

Note: Income statement numbers are estimates based on management commentary that content spending expenses are approximately 80% of the cash outlflow related to content spending value per the cash flow statement.

Other Challenges

The other challenge to NFLX’s margin improvement efforts is slowing growth. Revenue growth is expected to slow from 30% in 2016 to 16% in 2019, and management clearly stated in its last conference call that it does not plan to raise subscription prices in the foreseeable future.