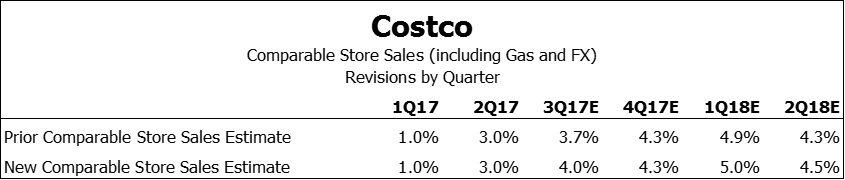

Costco reported March monthly sales last week that demonstrated continued comparable store sales acceleration. The company reported 6% comparable store sales growth (including gas and FX) for March. As a result of the positive number, estimates have been revised upward for the company through the rest of the year as well as into 2018. Investors are expecting comparable store sales to accelerate as several tailwinds help, including the removal of the tobacco headwind, easing deflation trends, increasing membership fees, and a credit card change.

Source: Visible Alpha as of April 11, 2017; Prior estimates are as of April 4, 2017.

Uncover insights on the companies you care about.

Request a 30-day trial of Visible Alpha.

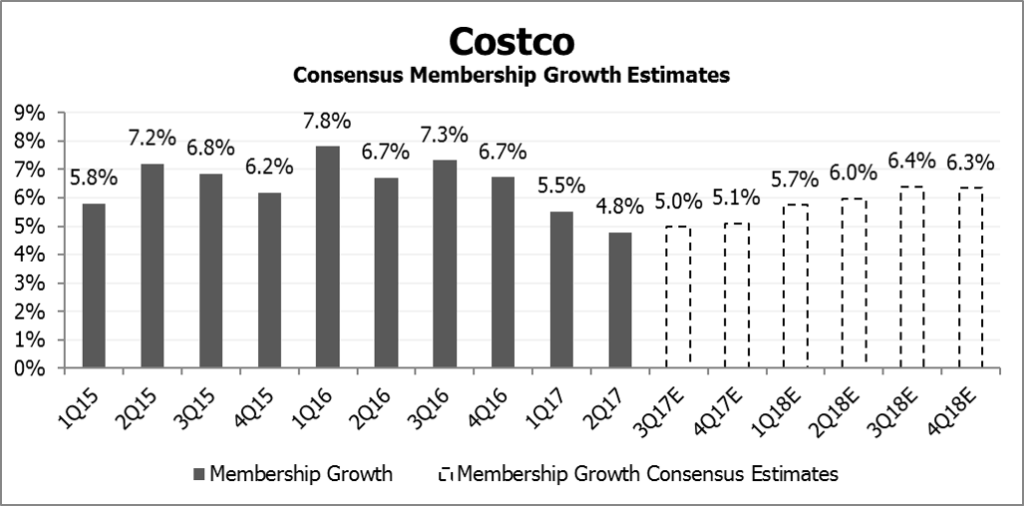

Earlier this year, Costco announced that they would be increasing their membership fees by ~10% in June. This has been a source of debate among investors, as some believe that the increase could hurt membership retention due to competition from other retailers. However, Visible Alpha’s consensus membership estimates show that analysts expect membership growth to reaccelerate despite the price increase.

Source: Visible Alpha as of April 11, 2017.

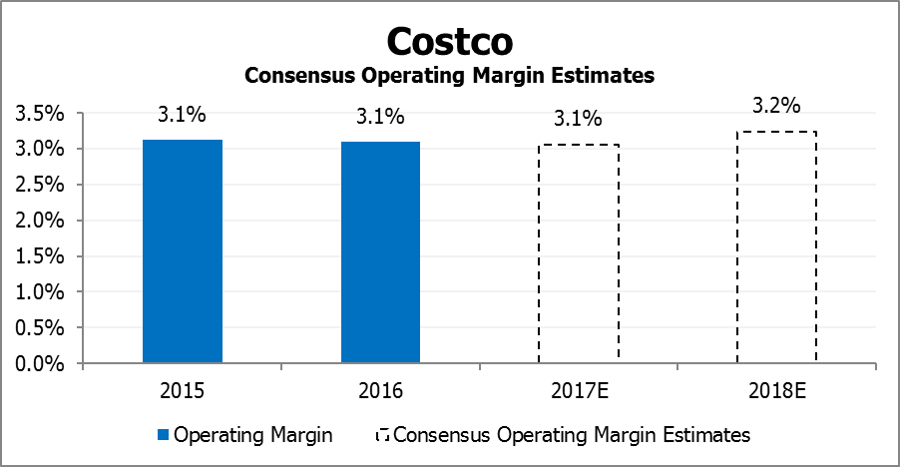

However, despite the membership growth, consensus operating margin estimates show that analysts do not expect much of the fee increase or other tailwinds to fall to the bottom line, perhaps due to the competitive environment. Operating margin is expected to remain flat in 2017 and expand by just 10 basis points in 2018.

Source: Visible Alpha as of April 11, 2017.