In our weekly round-up of the top charts and market-moving analyst insights: Eli Lilly’s (NYSE: LLY) Mounjaro is poised for a surge in sales with expected approval for obesity; Plug Power (NASDAQ: PLUG) is expected to see rising revenues fueled by its hydrogen ecosystem; OPAL Fuels’ (NASDAQ: OPAL) strategic focus on renewable natural gas is set to boost future revenue.

Eli Lilly’s Mounjaro Set for Revenue Surge with Expected Obesity Approval

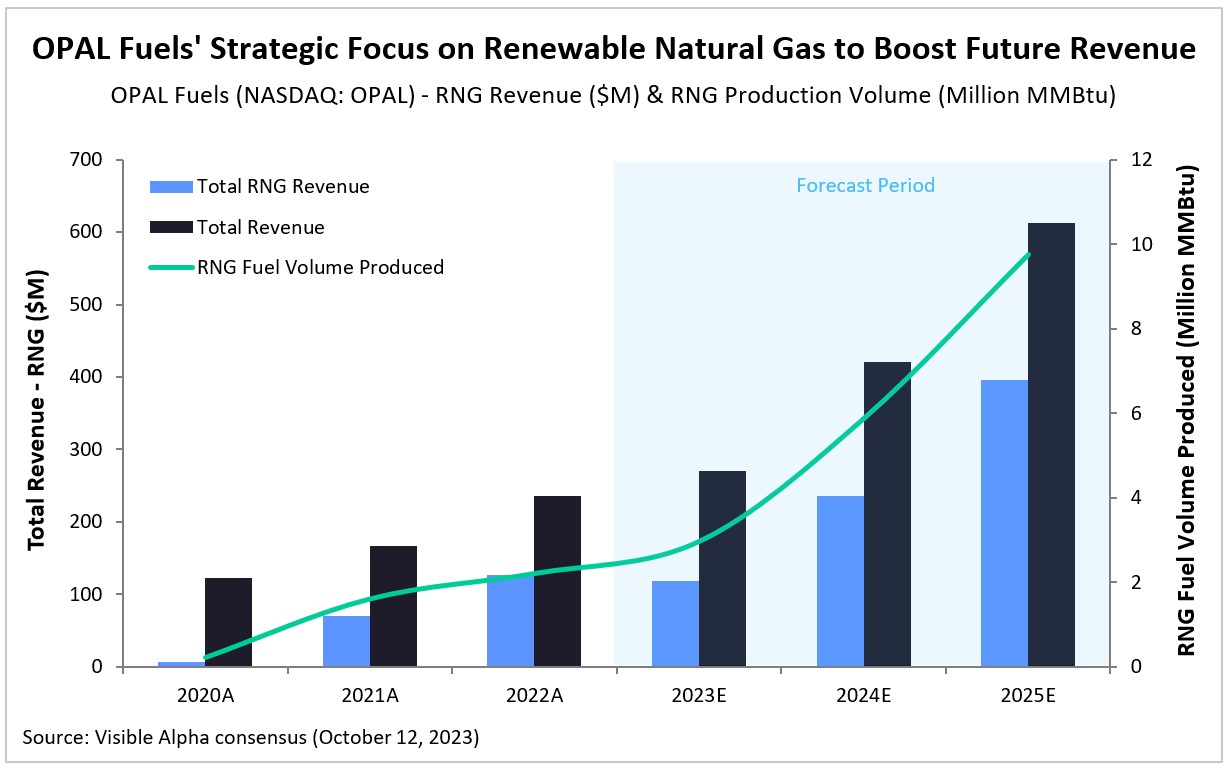

According to Visible Alpha consensus, Eli Lilly’s (NYSE: LLY) Mounjaro is expected to generate revenue of $4.61 billion in 2023 and more than double in 2024, reaching a total of $9.51 billion. Looking ahead to 2030, consensus estimates suggest that Mounjaro’s revenue for type 2 diabetes (T2D) and obesity is projected to reach as high as $42 billion.

Mounjaro was approved in May 2022 for T2D, but has not yet been approved for obesity. In October 2022, Eli Lilly secured FDA fast-track designation for the possible approval of Mounjaro for obesity. FDA approval for obesity is expected by the end of 2023. Risk-adjusted revenue projections for Mounjaro are nearly as high as projections that are not adjusted for risk, as the probability of success for FDA approval for obesity is 97.33%, according to Visible Alpha consensus.

Mounjaro (tirzepatide) is a dual agonist targeting the GLP-1 (glucagon-like peptide-1) and GIP (glucose-dependent insulinotropic polypeptide) receptor pathways. Agonism of GLP-1 and GIP receptors leads to an increase in insulin secretion, improvement of insulin sensitivity, reduction in glucagon levels, decreased food intake, and slowing of gastric emptying. The net effect is glucose control for T2D, and weight loss for obesity.

Plug Power to See Rising Revenues Fueled By Hydrogen Ecosystem

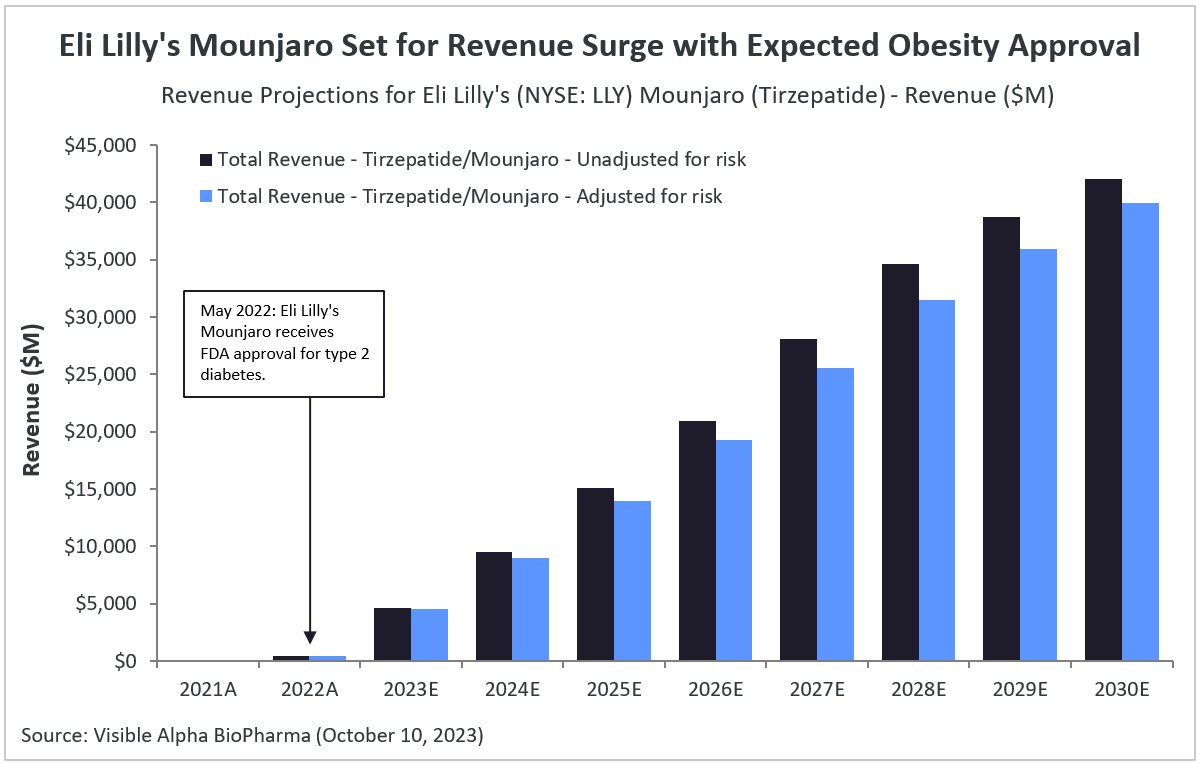

According to Visible Alpha consensus, hydrogen fuel cell company Plug Power (NASDAQ: PLUG) is expected to see revenues jump across all of its segments in the forecast period, boosted by the company’s investments in building a hydrogen ecosystem. Plug Power has ambitious plans to build a vertically integrated ecosystem with the aim of becoming a one-stop shop for the hydrogen economy.

Analysts expect the company’s three main revenue segments — product, services, and fuel delivered to customers — to see annual revenue growth in 2023 of 85%, 17%, and 38%, respectively. Between 2023-2030, total product revenue is projected to grow at a CAGR of 32%, services at 27%, and fuel delivered to customers at 60%.

Within products, the company’s largest revenue-generating segment, revenue from electrolyzers is projected to reach $210 million (+639% YoY) in 2023, hydrogen infrastructure sites revenue to $266 million (+88% YoY), and cell system/forklift units/gendrive units revenue to $298 million (+43% YoY). The company’s total revenue is projected to be $1.2 billion in 2023, and analysts expect the company to become profitable by 2024, generating an estimated gross profit of $228 million.

OPAL Fuels’ Strategic Focus on Renewable Natural Gas to Boost Future Revenue

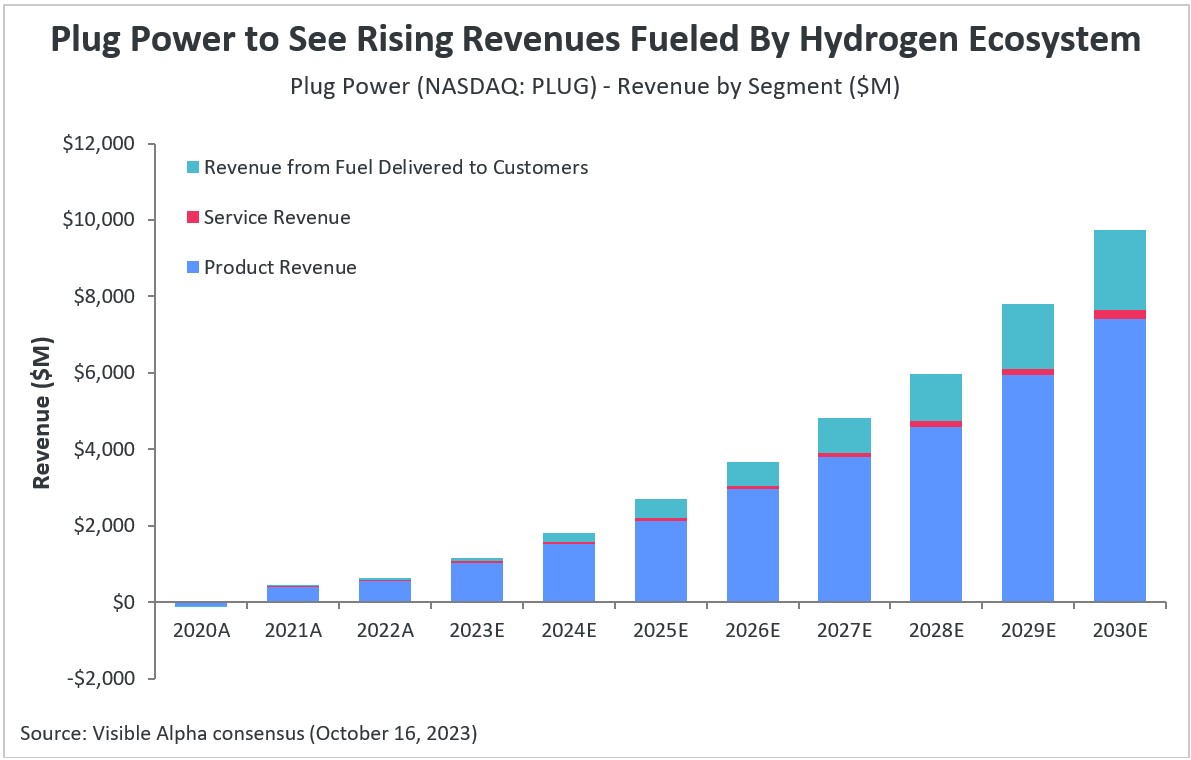

OPAL Fuels (NASDAQ: OPAL), which specializes in the production and distribution of renewable natural gas (RNG) and renewable electricity, has recently made a strategic shift, placing a stronger emphasis on RNG generation. With the RNG transition, analysts anticipate robust revenue growth for the company in the coming years. According to Visible Alpha consensus, OPAL Fuels is expected to boost its RNG production volume from an estimated 3.0 million MMBtu in 2023 to a projected 9.7 million MMBtu by 2025, growing at a CAGR of 82%.

Total revenue for the company is estimated to grow by 15% year over year in 2023, partially offset by an expected 7% decline in RNG revenue. This decline is primarily due to the company selling fewer units of RNG fuel in the first half of 2023, deferring environmental credit sales amid lower market prices, as the market awaited new clean fuel standards from the U.S. Environmental Protection Agency (EPA). In 2024, however, analysts expect RNG revenues to pick up, growing 100% year over year to $236 million, while total revenue is projected to grow by 56% to $421 million.