Netflix Inc. (NASDAQ: NFLX) reported Q3 2023 results on Wednesday, October 18, 2023. What happened in Q3 and what may be next?

According to Visible Alpha consensus, total revenues expected prior to the Q3 release were $8.5 billion, down from $8.78 billion at the Q2 earnings release.

The stock was trading down around -25% from the Q2 release in July to the Q3 release, but reacted positively immediately after the Q3 release, rising 12% after hours and up strongly to open the following trading day. In our preview note, we asked, “Could the Q3 release provide a positive catalyst for the stock?” Indeed, it looks like the Q3 results were solid and the outlook better than expected.

The discussion and debate from the earnings interview were around the paid-sharing program and the potential for advertising to drive revenues while maintaining margin. In addition, the company noted that the SAG-AFTRA strike is continuing.

1. The SAG-AFTRA strike continues. What are the industry dynamics at work?

According to management, a conclusion is needed for the strike, but the issues are still getting worked through. A final request for a per-subscriber levy from the guild broke down the negotiations, resulting in the SAG-AFTRA strike continuing. In the earnings call, company management noted that talent metrics will become more transparent and about engagement.

It is worth reiterating the role of AI in the strike. Actors have been concerned about where and how their images are shown, especially AI-generated images used in advertising and endorsing products and services, which may explain why the Writers Guild of America (WGA) may have reached an agreement more quickly. According to the Center for Democracy and Technology, “AI can’t write or rewrite literary material, and AI-generated material will not be considered source material under the [agreement], meaning that AI-generated material can’t be used to undermine a writer’s credit or separated rights.”

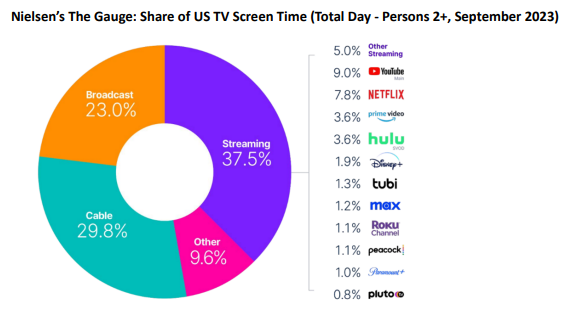

Netflix highlighted the competitive environment and presented a market share chart (Figure 1 below), which shows how both Netflix and YouTube have remained at the top. However, YouTube has pulled ahead with a share that’s now 120 basis points higher than Netflix, up 60 bps from Q2. In this new era of AI, will YouTube have an advantage over Netflix and others, given Google’s substantial AI investments? Will the SAG-AFTRA strike and issues related to AI impact Netflix’s longer-term competitiveness?

Figure 1: Share of US TV Screen Time

Source: Netflix Q3 Shareholder Letter, October 18, 2023

New question: When and how will the strike conclude, and what concessions may Netflix make, especially related to AI?

2. What happened in Q3 and how has the outlook changed?

Revenue

Q3 performance: Q3 year-over-year revenue growth of 7.8% was in line with consensus estimates. There were no upside revenue surprises in Q3. However, the company reported 8.8 million new subscribers, driven mainly by overseas regions. The U.S. market added 1.75 million new subscribers, which demonstrated that its new paid-sharing program is working. While monetization for this program is happening, it has been at a slower pace than some of the more optimistic analysts originally expected. Paid sharing has been rolled out as planned in every region. According to Netflix’s Q3 shareholder letter, “The cancel reaction continues to be low, exceeding our expectations, and borrower households converting into full paying memberships are demonstrating healthy retention.”

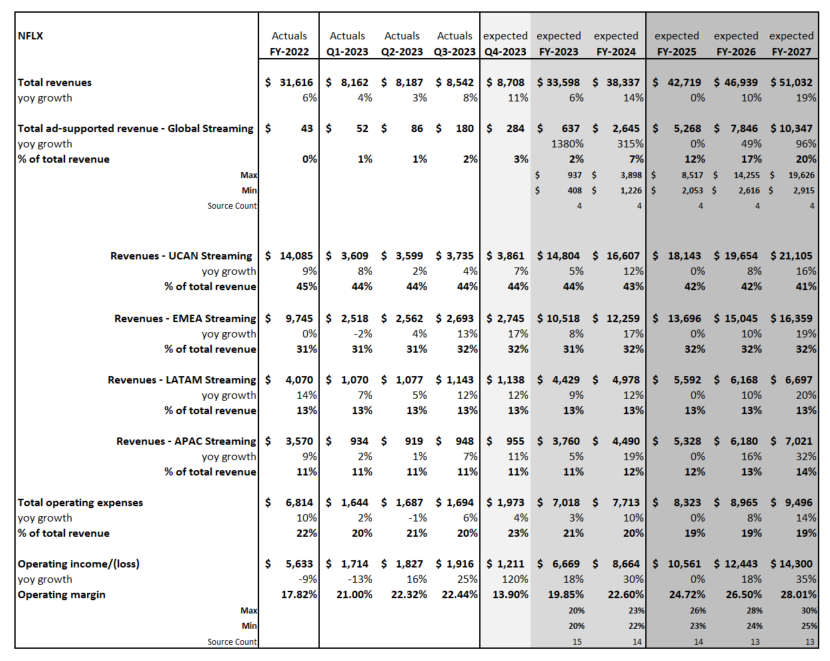

Q4 expectations: The company guided Q4 to 11% year-over-year revenue growth with revenue of $8.7 billion, in line with consensus estimates, and supported by the continued positive expected revenue impact of the paid-sharing program. In addition, the company will be adjusting prices in the U.S., UK, and France. Total revenue expectations for FY2023 have remained around the current level of $33.7 billion since last quarter’s release on July 18, 2023.

FY2024 expectations: FY2024 expectations have decreased by $4.4 billion to $38.3 billion from $42.7 billion, indicating analysts remain more cautious on the FY2024 outlook for Netflix. The company noted that they expect a more balanced mix of member and ARM growth in FY2024, which should support the operating margin growth projected.

Operating profit

Q3 performance: NFLX delivered Q3 operating profit of $1.9 billion and a 22.4% operating profit margin, in line with consensus estimates coming into the quarter.

Q4 and FY2024 expectations: The company guided Q4 to a 14% operating profit margin, based on the company hitting the top-end of the FY2023 operating profit margin outlook of 18-20%. Looking ahead, the operating profit margin outlook for FY2024 is now expected to be 22-23%, above the 22% expected by analysts.

Longer-term: The company did not give a long-term margin target when asked on its call. Currently, consensus estimates project more than 800 bps improvement from FY2023 in the operating margin, and for this to grow to 28.2% by the end of FY2027, which may be aggressive given the investment likely required to scale the ads business. There is a significant 300-500 bps range in the margin assumptions beyond FY2024, which are also worth watching.

New question: What will be the longer-term pace of margin expansion?

3. What additional visibility into the Ads business was provided in the Q3 release?

According to the company, in Q3, ads membership increased 70% quarter-on-quarter and accounts for 30% of new sign-ups. In the Q3 shareholder letter and earnings call, management highlighted that they are confident in the Q4 outlook and expect monetization from continuing to scale the ads business.

There was a management change in the ads business and the company is optimistic about driving it to the next level, as scale is very important. Netflix remains upbeat about the long-term opportunity, given the size of their user base, and expects the ads business to be a multi-billion dollar opportunity. The company has a lot of work to do on advertising business features, both to scale and to build out the technical capabilities, in order to create formats the brands will value. It will be worth watching both operating expenses and CapEx related to the expansion of the ads business going forward.

Long-term ad-supported revenue expectations: Currently, consensus estimates project total ad-supported revenue to expand to over $7 billion by the end FY2027, up 10x from expected FY2023 levels. However, there is a large range of views on the magnitude and the trajectory of this growth. For example, in FY2025, analyst estimates range from $2 billion to $8.5 billion, with consensus at $5.3 billion. However, this range only increases in FY2027 from $2.9 billion to $19.6 billion.

Figure 2: Key Financials for Netflix

Source: Visible Alpha consensus (October 19, 2023).

Source: Visible Alpha consensus (October 19, 2023).