Amazon.com (NASDAQ: AMZN) reported earnings for Q3 2023 after the market close on Thursday, October 26, 2023. What happened during the release and earnings call, and what are the key questions to focus on?

With total sales coming in at $143.1 billion, slightly above the top end of guidance, and operating profit at $11.2 billion, over 40% ahead of consensus and 32% ahead of the top end of guidance, AMZN delivered a strong Q3, sending the shares up 5% in the after-market following the release. In particular, the operating income was $3.5 billion ahead of consensus estimates, delivering an 8% operating profit margin, significantly above the 5.5% expected by analysts.

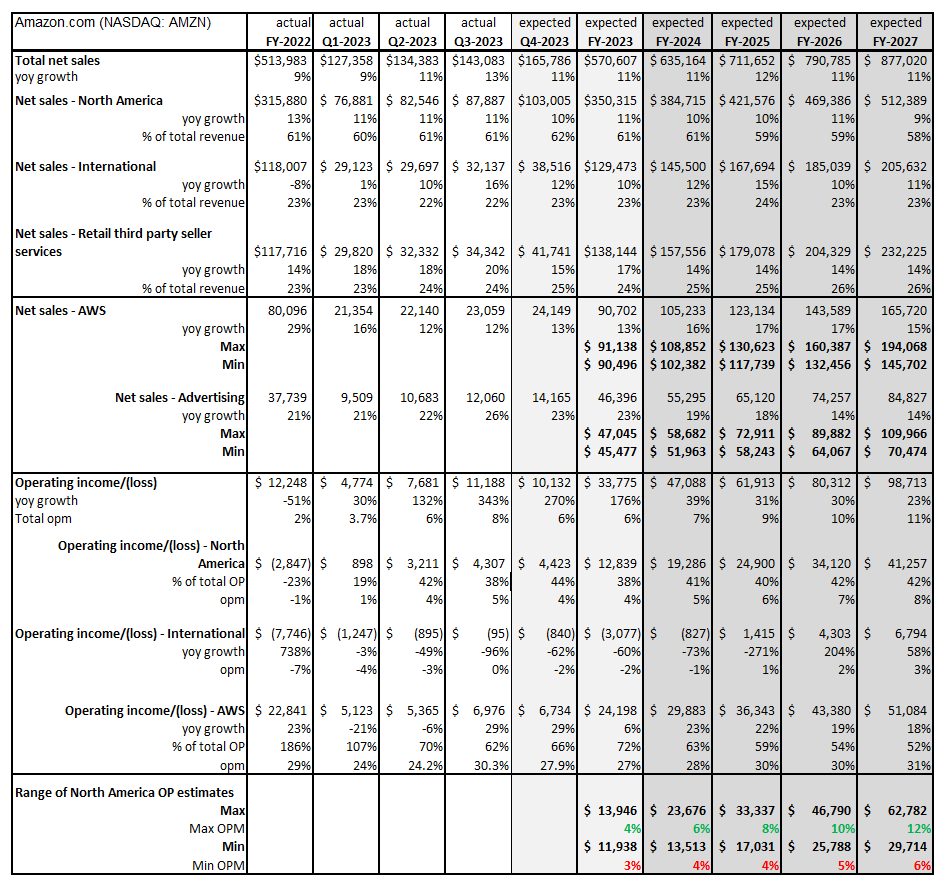

The company released Q4 guidance of $160-167 billion in revenues and $7-11 billion in operating profit, in line with current expectations of $165.8 billion in sales and $10.1 billion in operating profit. For 2023, Visible Alpha consensus for AMZN moved up (from Q2 to now) from $562 billion to $571 billion in total sales and from $22 billion to $34 billion in operating profit.

Driven by improvements in the North America online business and stability in AWS, analysts project AMZN’s total operating profit margin to return to 6% in 2023, more than double 2022’s 2.4% level, and rise to 7% by the end of 2024 and 10% by the end of 2026.

1. How did AWS perform?

AWS revenues were in line with expectations at $23.1 billion in sales, but the operating profit was $7 billion, significantly outperforming. This resulted in a 30.3% operating profit margin, which was 580 basis points ahead of the 24.5% expected according to Visible Alpha consensus. Analysts had been projecting AWS revenues of $23.1 billion and operating profit of $5.6 billion in Q3. For Q4, analysts had been projecting AWS operating profit margin of 24.8%. However, this estimate has been revised up to 27.9%.

Since Q2, the consensus margin for AWS has remained at 24.4% for 2023, and there is now less debate about the future performance of AWS margin for 2023. For 2024, however, the range is from 22-30%. Based on comments from CEO Andy Jassy, most of the optimization will happen in 2023. However, Jassy explained that this is now getting offset by a shift to new workloads, suggesting a more upbeat outlook for the AWS business into 2024. He also reiterated this quarter that 90% of IT is still on-premises and more is likely to move to the cloud with their Generative AI (GAI) initiatives.

AWS has picked up the pace on the AI front. CEO Andy Jassy pointed to Bedrock helping to fuel early traction in GAI. Jassy explained that companies will want to leverage LLMs, but will need to customize the models and applications. Applications built on top of the LLMs will likely be key. Plugins available in ChatGPT4 provide a sneak peek into how companies and their customers may see GAI integrated into existing applications.

New Question: Will AWS margin remain at 30% next year?

2. Is the advertising business continuing to show growth?

Analysts had been expecting the Ads business to grow 22% in Q3 to $11.6 billion, and 22% in 2023 to $45.9 billion. Amazon delivered a nice beat in Q3 with $12.1 billion, up 26% year over year. Expectations for ad revenue by 2024 are at $55 billion, with the most aggressive estimates at close to $59 billion, down from $70 billion in Q1. The company reiterated that they are still in the early days for Ads.

New Question: How significantly will AI help grow ad revenues at AMZN going forward?

3. What’s supporting Amazon’s online margin improvement?

Both the North America and International online businesses saw sales and operating profit come in ahead of expectations, delivering margin improvement. The company has continued to show margin improvement, going from 1% in Q1 to 4% in Q2 and now 5% in Q3, in the North America online business, and the company noted that they still have more to go. Analysts project AMZN’s North America operating profit margin to be 4.2% for Q4, leading to an expected 4% for 2023. By the end of 2024, analysts expect a further 100-basis-point margin expansion in North America to 5%.

In addition, analysts had expected a -3% operating loss margin for the international business, but instead, it almost broke even. Analysts are currently not expecting this business to break even until the end of 2025, which may be too conservative given this quarter’s improvement.

The company has made significant improvements to its regional fulfillment centers and these are projected to continue to enhance margins. In addition, the company is also finding more efficiencies to support margin growth.

New Question: Will Amazon’s North America online business be able to generate a 10% operating profit margin by the end of 2026?

Figure 1: Amazon’s key financial items

Source: Visible Alpha consensus (October 31, 2023)