Netflix Inc. (NASDAQ: NFLX) reported Q4 2023 results on Tuesday, January 23, 2024. What happened in Q4 and what may be next?

In a pivot from the usual recorded interview, Netflix live streamed their earnings call on YouTube. Spencer Wang, vice president of finance, hosted the call and asked the co-CEOs questions. The discussion and debate from the earnings interview were around the growth of engagement and monetization and the potential for advertising to drive revenues while maintaining margin.

1. How is the landscape shifting for Netflix?

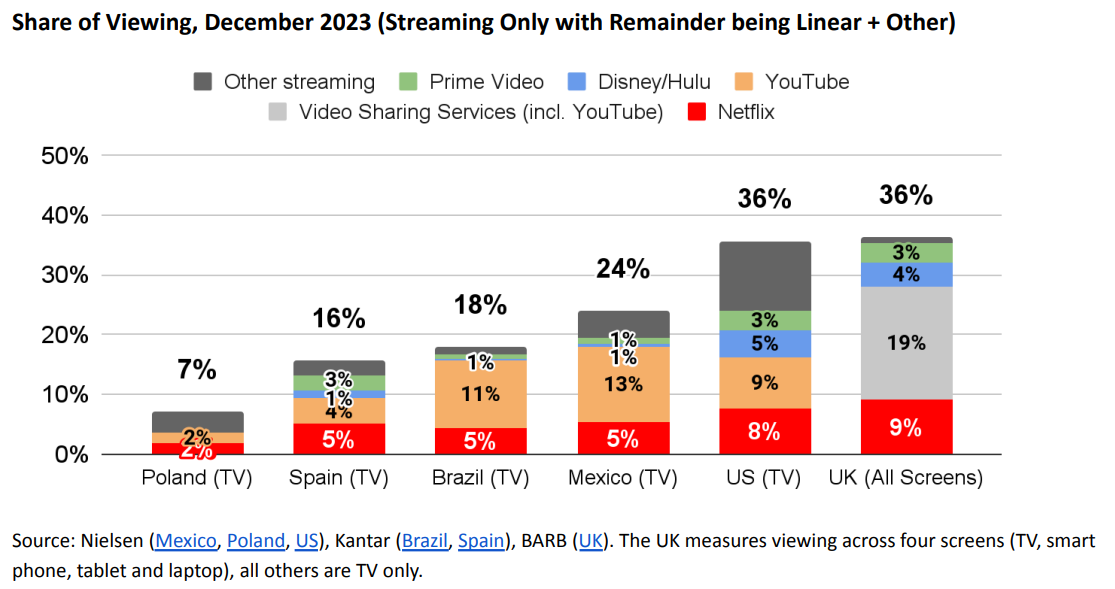

In previous quarters, Netflix shared a Nielsen chart showing a breakdown of major players’ share of TV screen time in the U.S., where YouTube has been leading. This quarter, however, in addition to the U.S. data they included Nielsen data from other key markets, including Brazil and Mexico, where YouTube leads by a substantial margin.

Given the recent WWE announcement and the newly livestreamed earnings call, is Netflix looking to provide more live events? While the company noted on their call that they prefer to build and not buy, could more partnerships be in the works?

Figure 1: Share of TV screen time

New question: Going forward, how will live events play a role in Netflix’s content offering?

2. What happened in Q4 and how has the outlook changed?

Revenue

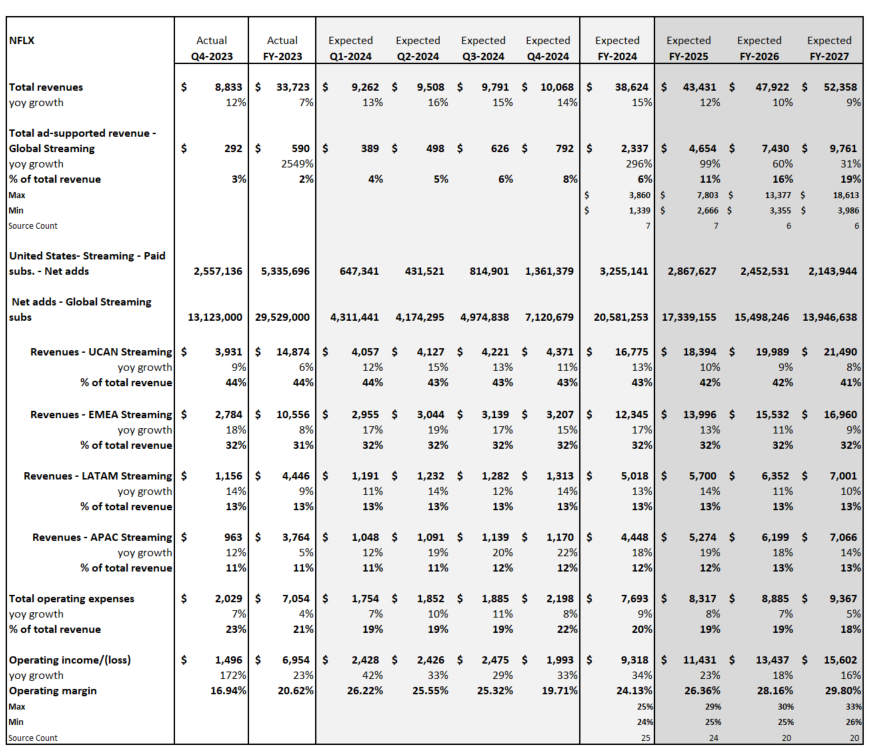

Q4 performance: Q4 year-over-year revenue growth of 12% was $115 million ahead of consensus estimates, driven by strong net adds. The company reported 13 million new subscribers, driven by both the U.S. and overseas regions. The UCan market added 2.81 million new subscribers, which demonstrated that its new paid-sharing program has worked. There is concern that password-sharing customers have been pulled forward, and could show a slowdown going forward.

Q1 2024 expectations: The company guided Q1 to 13% year-over-year revenue growth with revenue of $9.3 billion, in line with consensus estimates, and supported by the continued positive expected revenue impact of paid-sharing, growth of the ads business, and further monetization. Regarding pricing, the company will be providing a range of prices and plans.

FY 2024 expectations: The company expects to grow revenues by increasing engagement trends and reducing churn with a more diverse entertainment offering. Gaming and the growth of ads could be key drivers in 2024. According to Visible Alpha consensus, analysts expect the company to generate revenue of $38.6 billion in FY 2024, up from expectations of $38 billion in January 2023.

Operating profit

Q4 performance: Netflix delivered Q4 operating profit of $1.9 billion and a 17% operating profit margin, almost $300 million ahead of consensus estimates coming into the quarter.

FY 2024 expectations: Looking ahead, the operating profit margin outlook for FY 2024 is now expected to be 24%, up from 22-23%, driven by the strength in Q4 continuing into 2024 and an assumption around a weaker dollar.

Longer-term: The company did not give a long-term margin target. Based on Visible Alpha consensus, operating profit margin is expected to grow from 24.1% in FY 2024 to 30% in FY 2027. Currently, consensus estimates project an improvement from FY 2024 in the operating margin, and for this to grow to 30% by the end of FY 2027, which may be aggressive given the investment likely required to scale the ads business. There is significant debate among analysts with respect to FY 2027 margin estimates, which range from 26% to 33%.

New question: Is the longer-term pace of margin expansion too aggressive?

3. What additional visibility into the Ads business was provided in the Q4 release?

According to the company, in Q4, ads membership increased 70% quarter-on-quarter and accounts for 40% of new sign-ups, up from 30% last quarter. In the Q4 shareholder letter and earnings call, management highlighted that they aim to drive engagement to attract advertisers, which they expect to help the ads business continue to scale.

Netflix remains upbeat about the long-term opportunity, given the size of their user base. The company continues to have work to do on advertising business features, both to scale and to build out the technical capabilities, in order to create formats that brands will value. In particular, the company called out the need to continue improving the targeting and measurement they offer to their customers.

Long-term ad-supported revenue expectations: Currently, consensus estimates project total ad-supported revenue to expand to nearly $10 billion by the end of FY 2027, up over 15x from FY 2023 levels. There is a significant range of views on the magnitude of this growth. For FY 2027, analyst estimates range from $3.9 billion to $18.6 billion, which narrowed from $2.9 billion to $19.6 billion last quarter.

New question: How big can the ads business become?