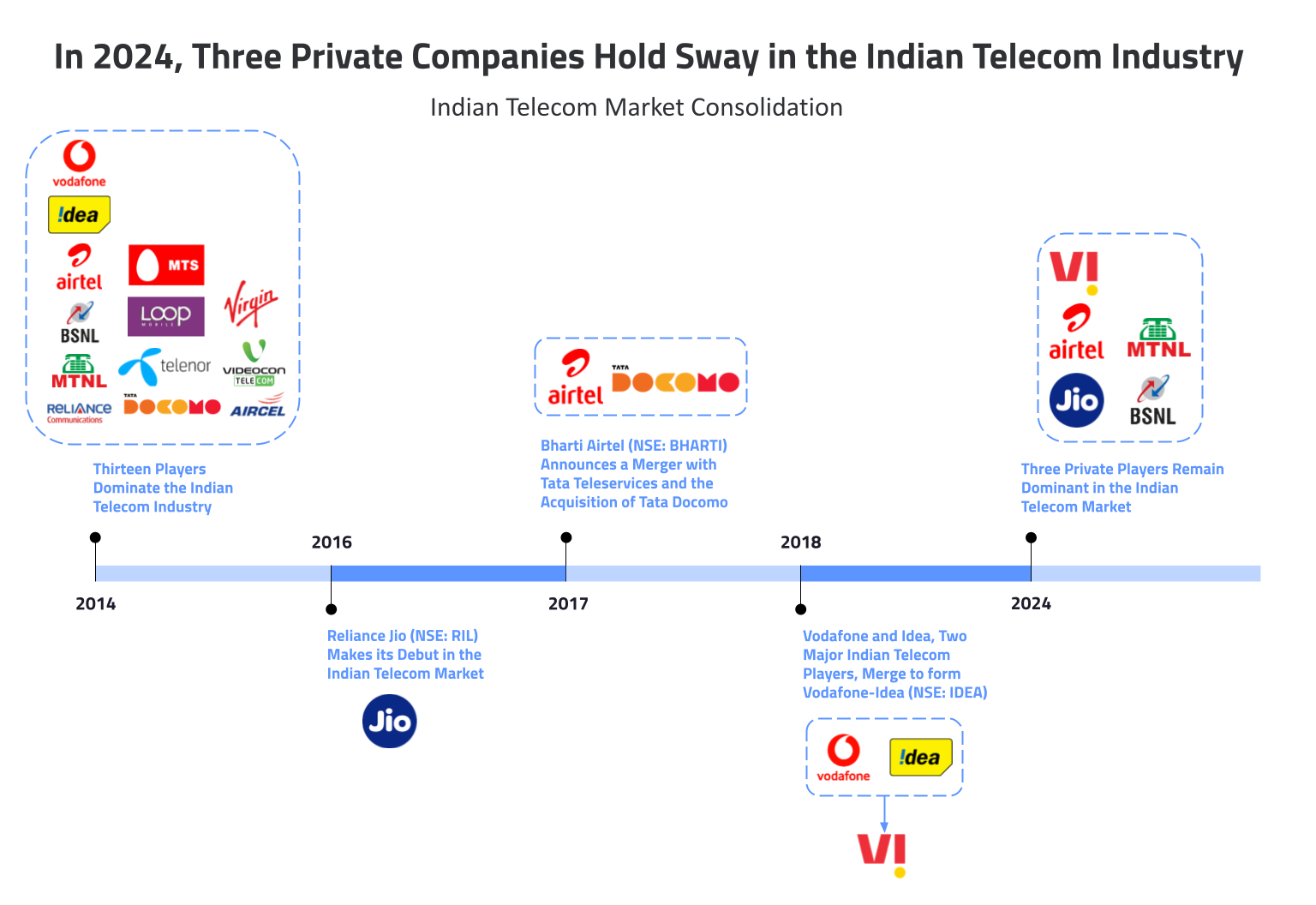

The Indian telecom industry has experienced major consolidation in the last decade. Thirteen players dominated the Indian telecom market back in 2014. As of 2024, the market is monopolized by three private players: Reliance Jio (NSE: RIL), Bharti Airtel (NSE: BHARTI), and Vodafone-Idea (NSE: IDEA). Jio, in particular, stands out amongst its peers. Having entered the market only in 2016, the telecom player has rapidly evolved as a dominant player in the industry. With its compelling offers of unlimited data and related services at nominal prices, Jio has prompted other telecom operators to consolidate.

Figure 1: Three private companies hold sway in the Indian telecom industry

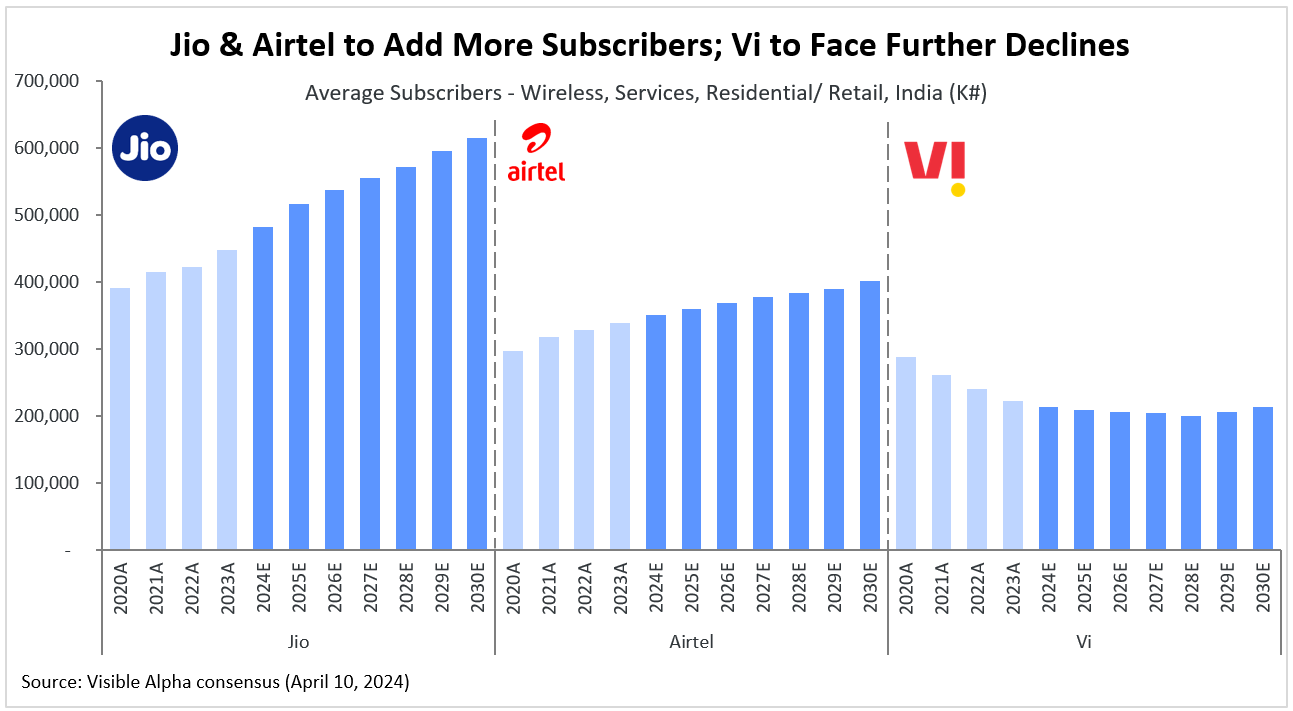

According to the Telecom Regulatory Authority of India (TRAI), India had 1.14 billion1 wireless subscribers at the end of fiscal 2023. In 2023, Jio accounted for 39% of this wireless subscriber base, with an average wireless subscriber count of 447 million. Airtel followed the lead with its hold on 30% of India’s wireless subscriber base, at an average wireless subscriber count of 339 million, while Vi had an average wireless subscriber base of 223 million. According to Visible Alpha consensus, Jio, Airtel, and Vi together account for approximately 88% of the 1.14 billion wireless subscribers in India in 2024.

Jio & Airtel Ringing Up More Subscribers, Vi to See Further Drop in Numbers

Jio and Airtel are steadily increasing their subscriber bases, whereas Vi has been experiencing a decline in subscribers since 2020 due to its delayed network investments, particularly in 5G technology. In 2023, Jio saw the largest growth in subscribers, adding 37 million new wireless subscribers (compared to 17.8 million in 2022), while Airtel added 12.3 million (compared to 8.2 million in 2022). Conversely, Vi experienced a decline of -12.8 million (compared to -19.4 million) in net wireless subscriber additions.

Looking ahead to 2024, analysts expect both Jio and Airtel to continue to expand their subscriber bases, with Jio expected to add 34.4 million new wireless subscribers and Airtel projected to add 11 million. Both companies are on track to achieve nationwide 5G coverage by the end of 2024. In contrast, Vi, currently the only private telecom company in India yet to roll out 5G services, is estimated to continue losing subscribers, with a projected decline of -5.5 million in net wireless subscriber additions.

Figure 2: Jio & Airtel to add more subscribers; Vi to face further declines

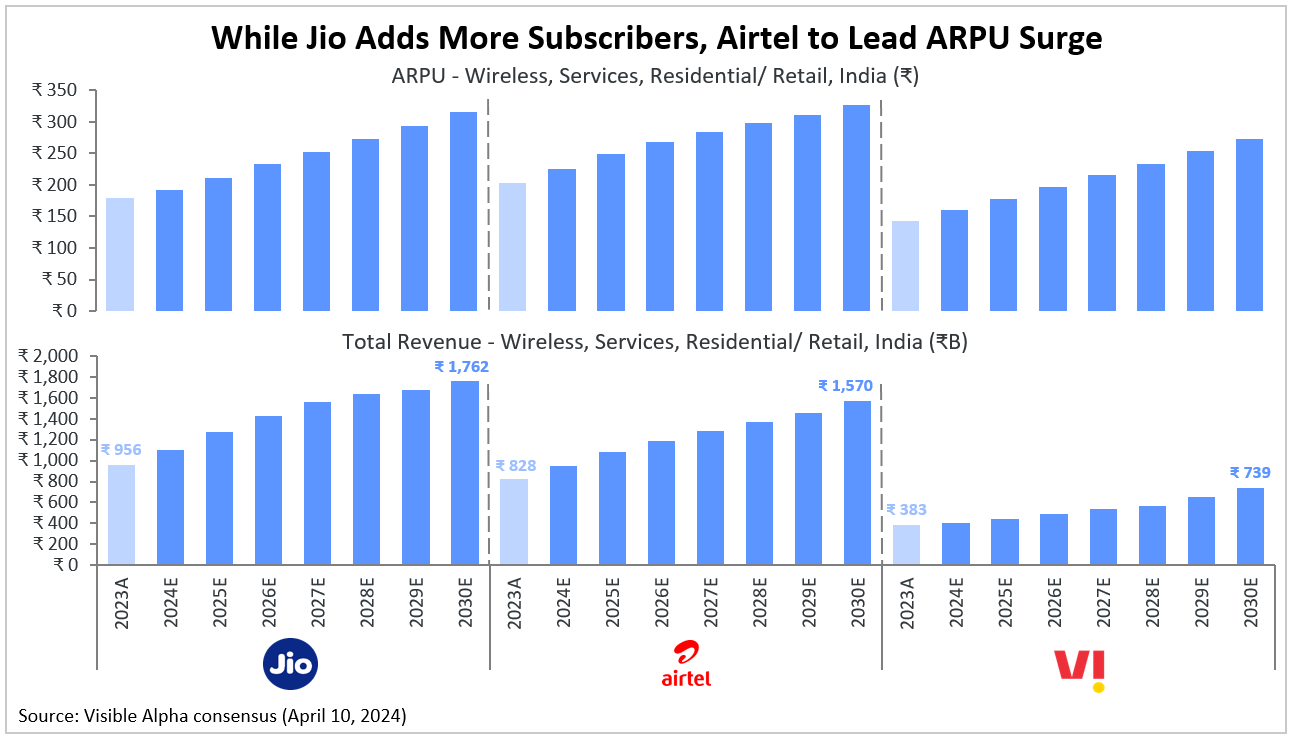

While Jio Gains More Subscribers, Airtel to Dial-Up ARPU Growth

While Jio is leading in terms of the number of subscribers, Airtel is expected to experience higher growth in average revenue per user (ARPU). Airtel has been actively expanding its premium subscriber base by encouraging users to switch from prepaid to postpaid plans through family postpaid offerings. Additionally, Airtel is intensifying its focus on 5G services, enhancing internet monetization by offering extra data or higher data limit plans. The company has also simplified its plans and significantly increased its entry-level prepaid tariffs as part of its premiumization strategy. This focus on premium customers has resulted in substantial ARPU growth for Airtel.

Both Jio and Airtel have been rolling out 5G services nationwide in India, but are yet to monetize their 5G services. After more than a year, both companies continue to provide unlimited 5G data to subscribers with 5G-enabled devices, at 4G rates. However, there are expectations of tariff increases in mid-2024, which could benefit these telecom players. Jio and Airtel are anticipated to end their unlimited 5G data plans for premium customers and charge more for 5G services compared to 4G in the latter half of 2024, aiming to drive monetization and revenue growth. Airtel, with its larger base of high-end users, is expected to benefit the most from these tariff hikes.

Analysts estimate a +11% year-on-year increase in Airtel’s ARPU in 2024, reaching ₹226 per subscriber ($2.71). In comparison, Jio’s ARPU is expected to grow by +7% to ₹191 per subscriber ($2.30), while Vi’s ARPU is estimated to increase by +11% to ₹160 per subscriber ($1.91). Furthermore, both Jio and Airtel are projected to see wireless revenue grow by +15% year over year in 2024, reaching ₹1,103 billion ($13.2 billion) and ₹953 billion ($11 billion), respectively. In comparison, Vi is estimated to see more modest growth of +6%, generating total wireless revenue of ₹407 billion ($5 billion).

Figure 3: While Jio adds more subscribers, Airtel to lead ARPU surge

References

- TRAI Yearly Telecom Services Performance Indicator Report 2022-23: https://www.trai.gov.in/sites/default/files/PR_No.12of2024.pdf

- TRAI Annual Report 2014-15: https://www.trai.gov.in/sites/default/files/TRAI-Annual-Report-%28English%29%3D01042015.pdf