Big Tech companies — Meta (NASDAQ: META), Microsoft (NASDAQ: MSFT), Amazon (NASDAQ: AMZN), and Apple (NASDAQ: AAPL) — reported their latest earnings. Here’s a recap of those earnings, some key takeaways, and the resulting shifts in analysts’ estimates, according to Visible Alpha consensus.

Summary of Earnings

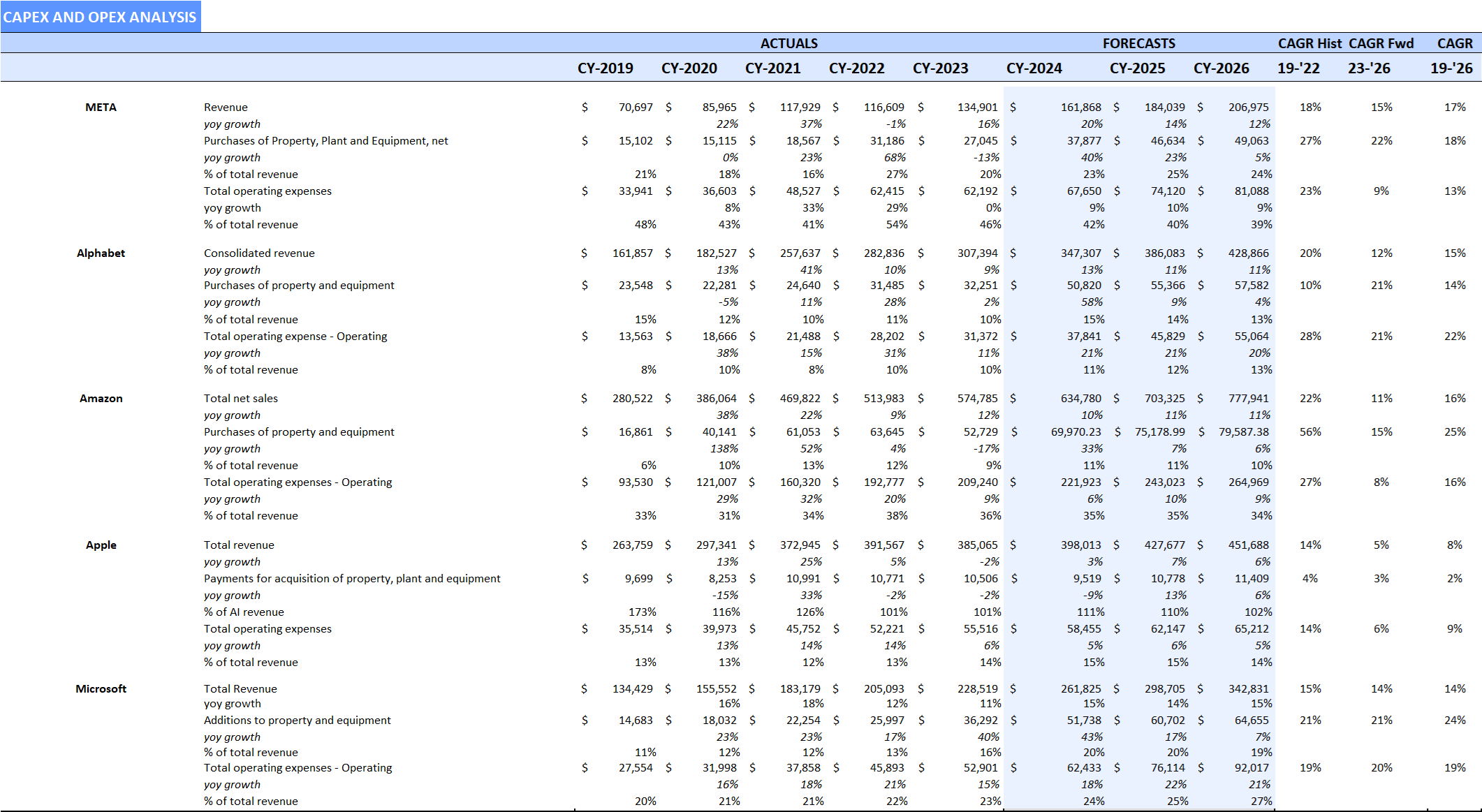

For the mega-cap tech companies, this earnings season has been dominated by mixed results around the core businesses and investing in generative AI (GAI). The dynamics of juggling talent and investment in multiple layers of the stack have added complexity to the business fundamentals. The mega-cap firms are all, in their own way, enhancing aspects of infrastructure, building off the existing large language models (LLMs), and supporting an environment for creating new GAI apps. However, given the strong pace of both CapEx and OpEx spending, there has been some concern that revenues have not grown in tandem and expectations have become too high.

When will revenue growth begin to expand as rapidly as expenses?

CapEx and OpEx Snapshot

Earnings Overview: META, MSFT, AMZN, AAPL

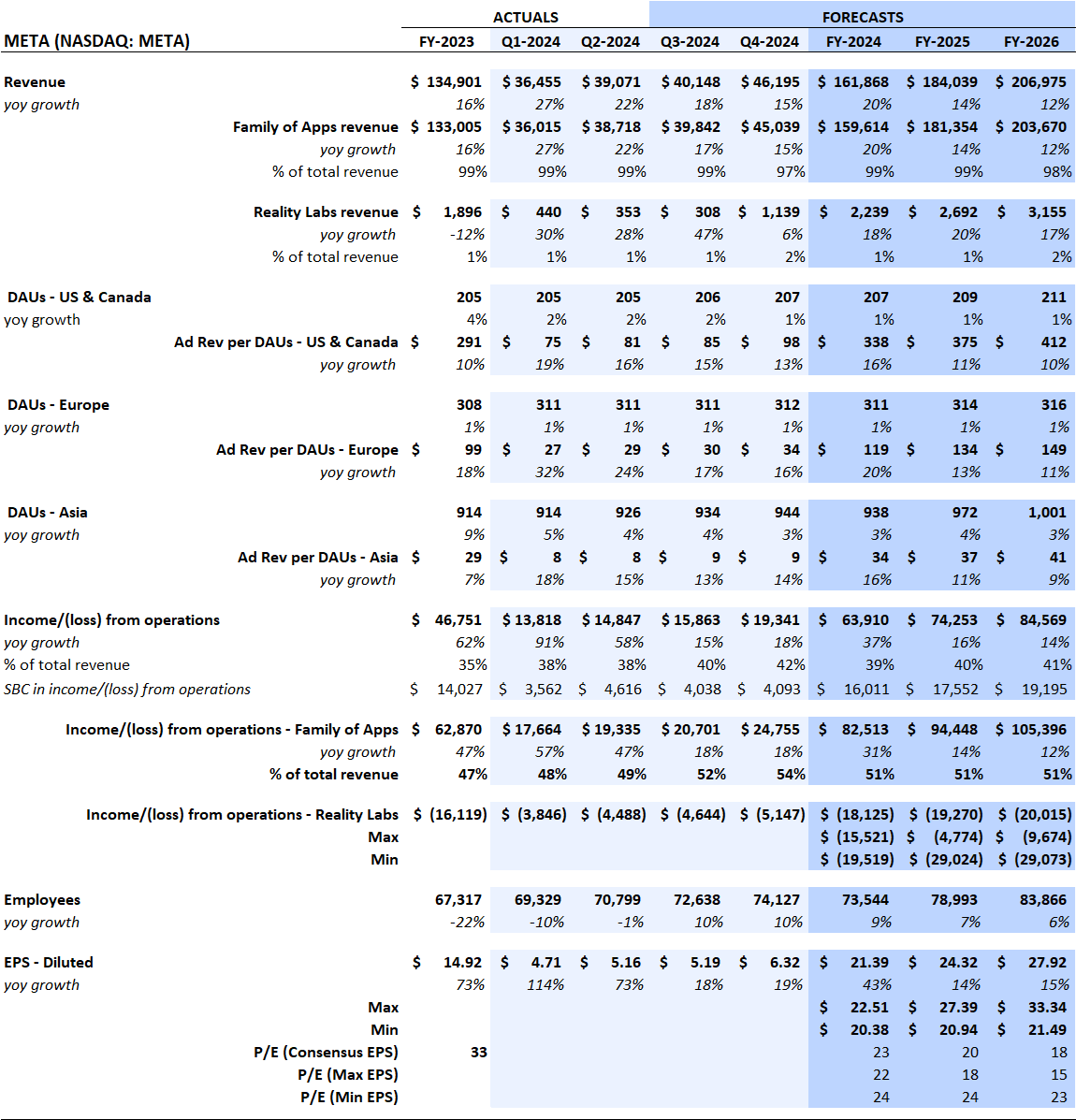

Meta Platforms’ Q2 2024 Earnings

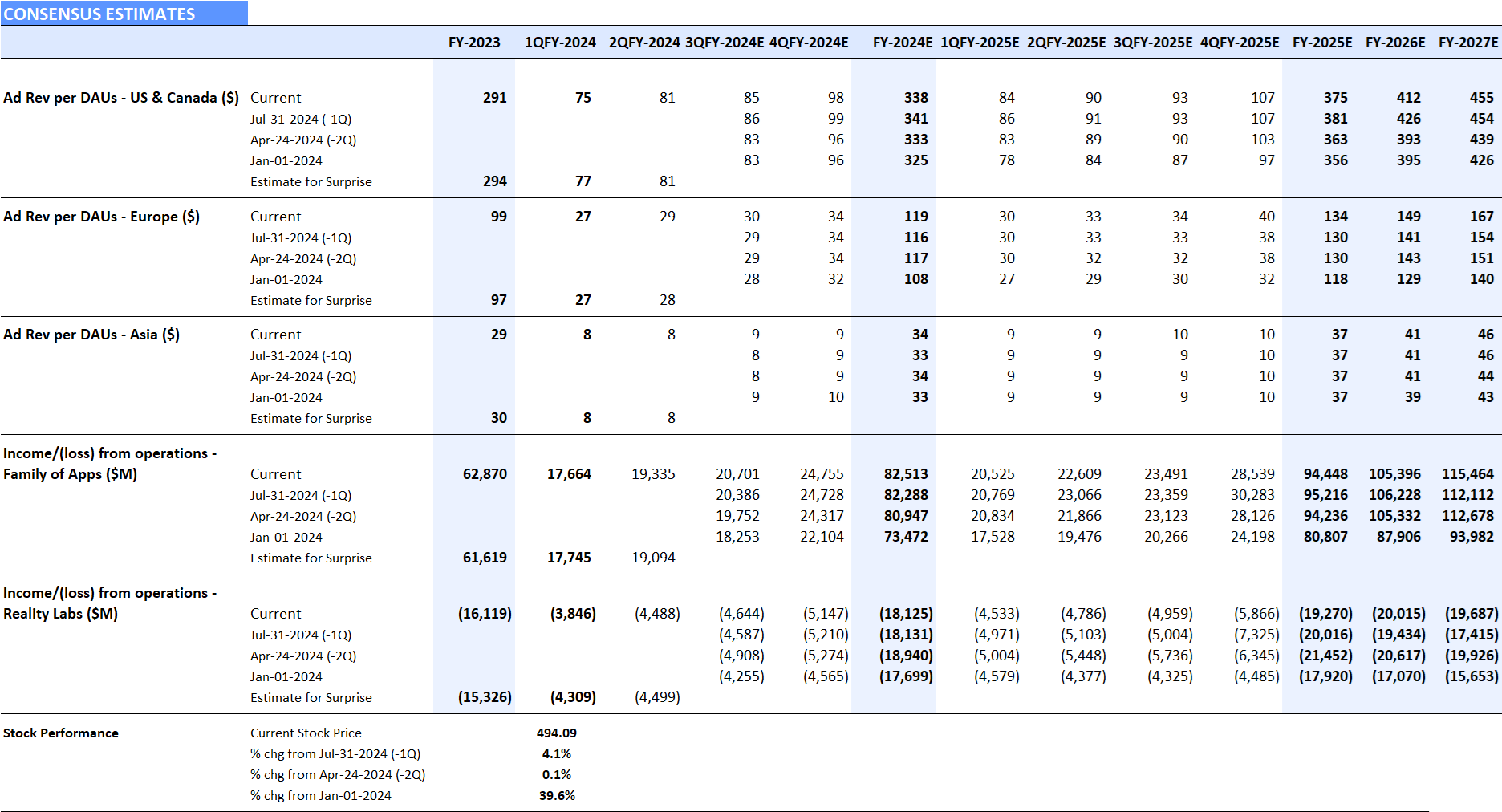

According to Visible Alpha consensus, total revenues for Q2 were in line with expectations at $39.1 billion, driven by solid performance in the Family of Apps segment, especially in the U.S. and Europe. However, operating profit exceeded expectations by around $350 million at $14.9 billion, driven by resilience in the Family of Apps.

The company’s revenue outlook for Q3 was in line with expectations, but full-year expense guidance was better than expectations. Consensus now expects the Q3 operating profit to be $15.9 billion, nearly $1 billion higher than pre-Q levels, driven by higher profitability at the Family of Apps. For 2024, post-earnings expectations for operating income from the Family of Apps have increased by almost $2.0 billion to $82.5 billion, driven by lower expenses in the business. In addition, the projected losses from Reality Labs for 2024 have remained flat since the earnings release.

In addition, CEO Mark Zuckerberg highlighted that the company will continue to invest in the infrastructure to support Generative AI because it is expected to drive marketing and customer engagement across the Family of Apps. CapEx came in below consensus for the quarter and is projected to be at the higher end of their initial FY guidance for H2 2024 and in line with expectations. On the earnings call, Meta explained that CapEx will further increase in 2025, but based on comments from the CFO, the company plans to remain flexible and disciplined around its spending.

META stock has been an outperformer year to date, up nearly 40%, but has pulled back a bit on the tech sell-off. Will Meta remain disciplined in H2 2024 and 2025 and remain resilient?

Meta Platforms Revisions

Source: Visible Alpha consensus (August 5, 2024). Stock price data courtesy of FactSet. META’s current stock price is as of the market close on August 2, 2024

Meta Platforms Consensus Estimates

Source: Visible Alpha consensus (August 5, 2024). Stock price data courtesy of FactSet. META’s current stock price is as of the market close on August 2, 2024

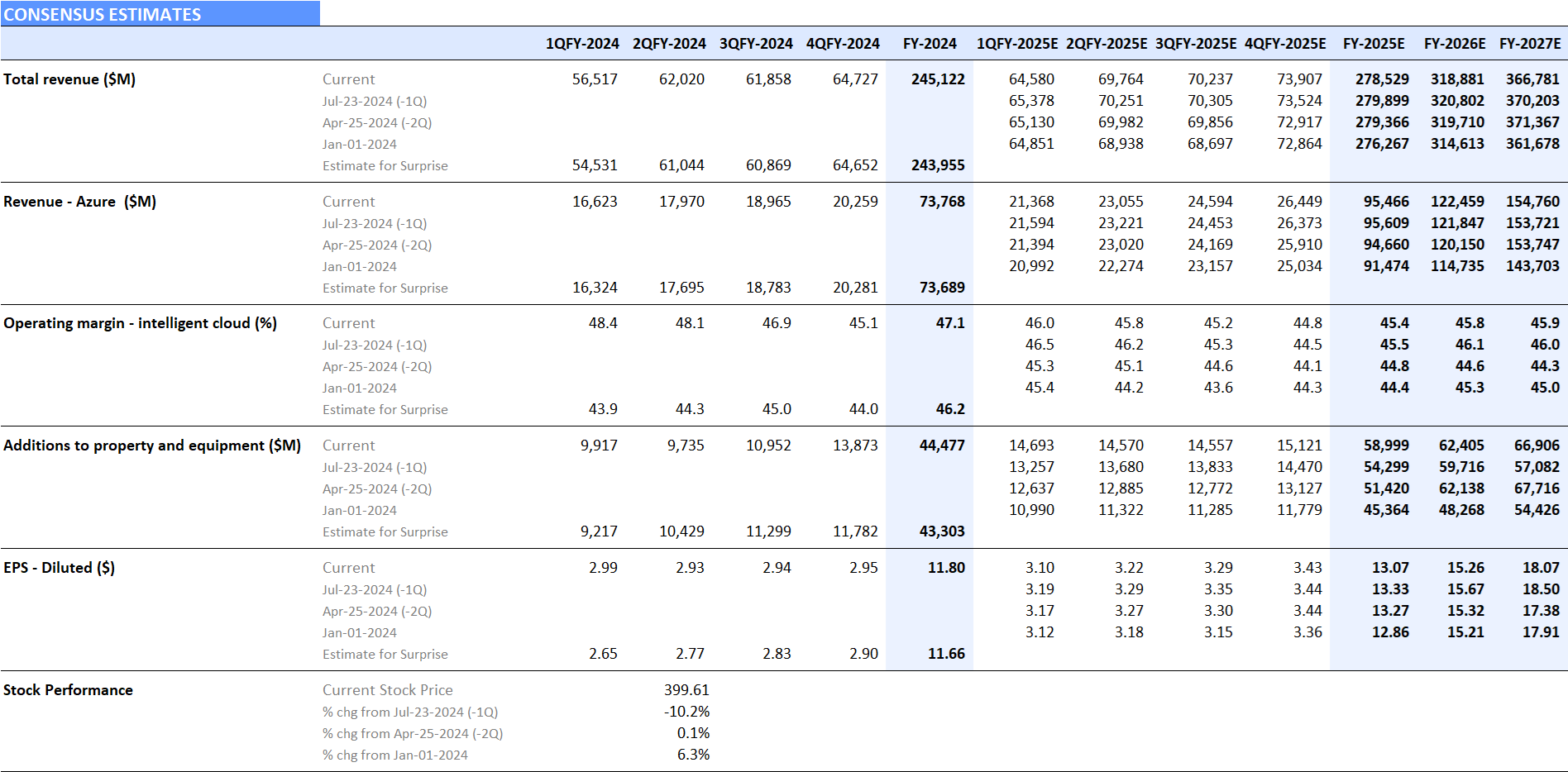

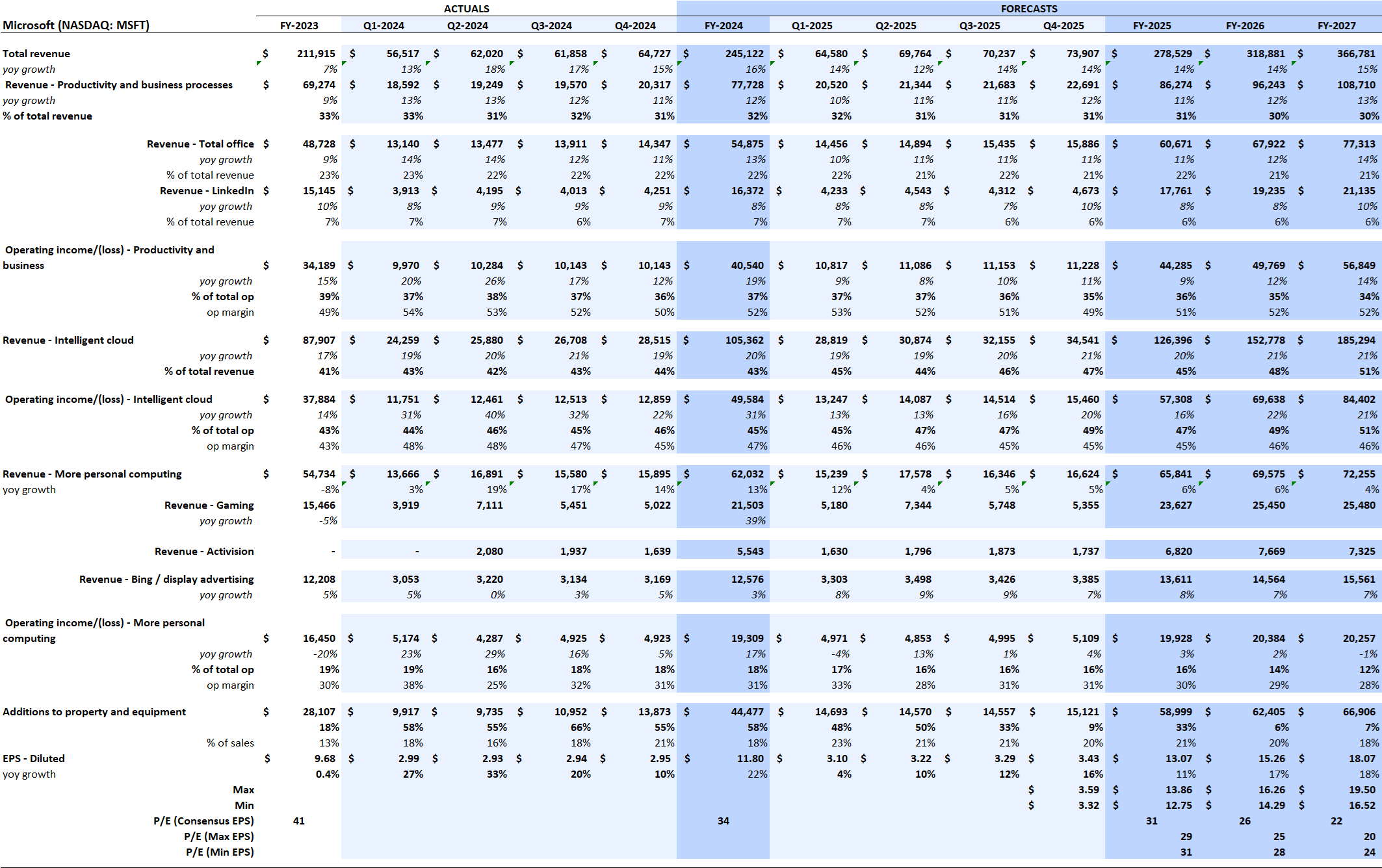

Microsoft’s Fiscal Q4 2024 Earnings

According to Visible Alpha consensus, total revenues for Q4 were in line with expectations, coming in at $64.7 billion, driven by the Intelligent Cloud segment, which made up over 45% of total revenues and over 50% of total operating income. The profitability of the Intelligent Cloud business beat expectations by over 100 bps in the quarter. Ahead of Q4 2024, a consensus of 14 analysts for the Intelligent Cloud segment’s operating profit margin was 44%, but Microsoft delivered a 45.1% margin, finishing out FY 2024 with a better-than-expected 47% margin.

In the earnings call, Management highlighted that AI and Cloud products will continue to drive growth. However, the high expectations projected initially seem to be coming down. For 2025, Azure’s post-earnings consensus revenue edged down slightly. In addition, the overall Intelligent Cloud margin is expected to decrease nearly 170 bps year-over-year to 45.4%. The operating profit margin for this business segment is projected to remain at 45-46% levels till the end of FY 2027. Will the generative AI investments continue to drive upside to fundamentals in 2025 or have growth and margins peaked in 2024?

CapEx numbers increased by more than $2 billion expected in Q4 2024 to $13.9 billion. According to consensus projections, CapEx estimates have climbed $13.6 billion from $45.4 billion in January 2024 to currently $59 billion for FY 2025, up significantly from FY 2019 and outpacing peers. Coming out of this quarter, the 2025 CapEx estimate has increased another $4.5 billion, moving from $54.4 billion to $59 billion. Since January 2024, the consensus CapEx estimate for FY 2026 has moved up from $48.3 billion to $62.4 billion, increasing over $14 billion and demonstrating the strong pace of investment for AI platforms and tools.

Microsoft stock has been up 8.6% year-to-date, but has been an underperformer post-earnings. Could the Q1 be a catalyst for the stock?

Microsoft Revisions

Source: Visible Alpha consensus (August 5, 2024). Stock price data courtesy of FactSet. MSFT’s current stock price is as of the market close on August 2, 2024

Microsoft Consensus Estimates

Source: Visible Alpha consensus (August 5, 2024). Stock price data courtesy of FactSet. MSFT’s current stock price is as of the market close on August 2, 2024

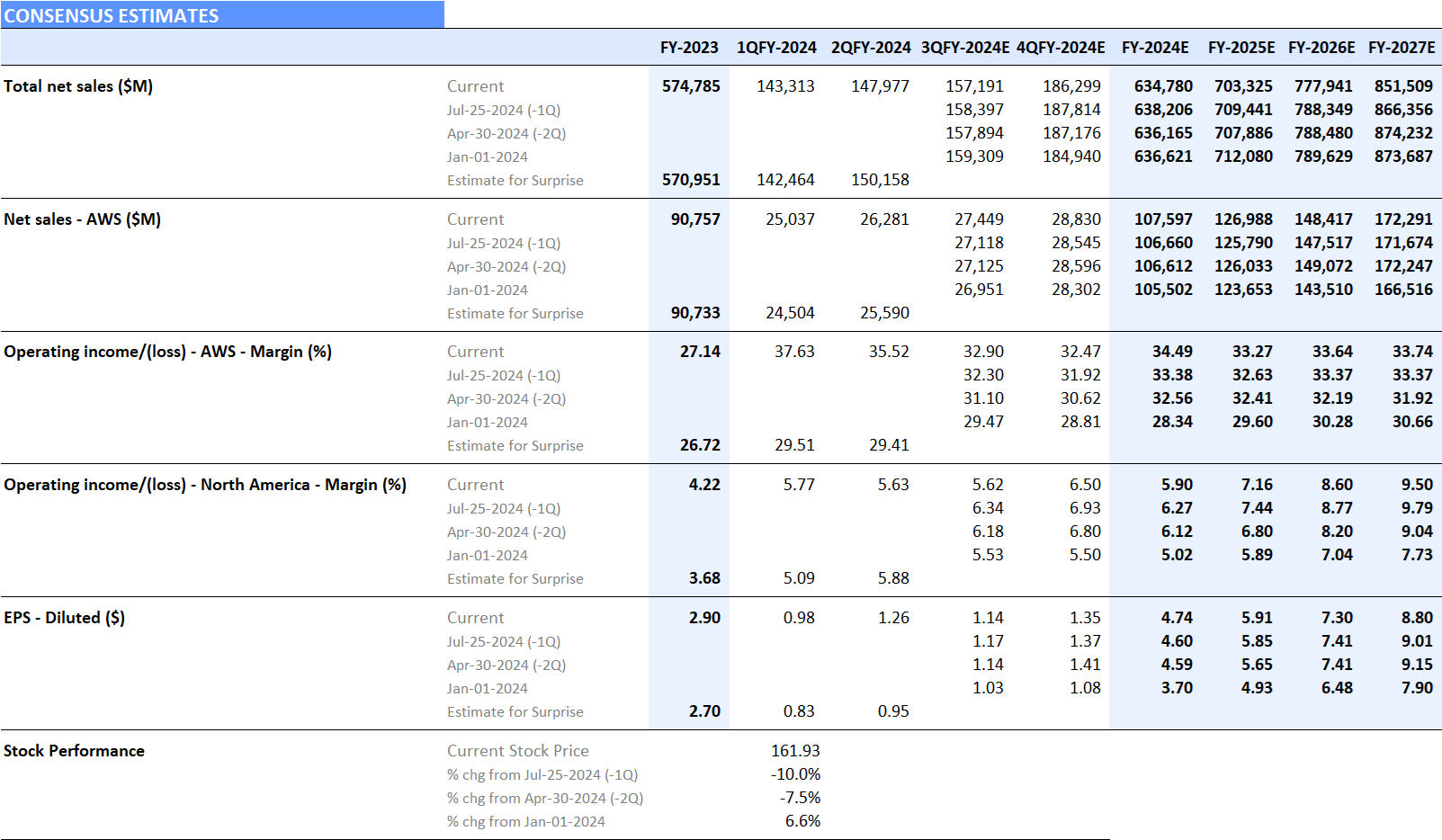

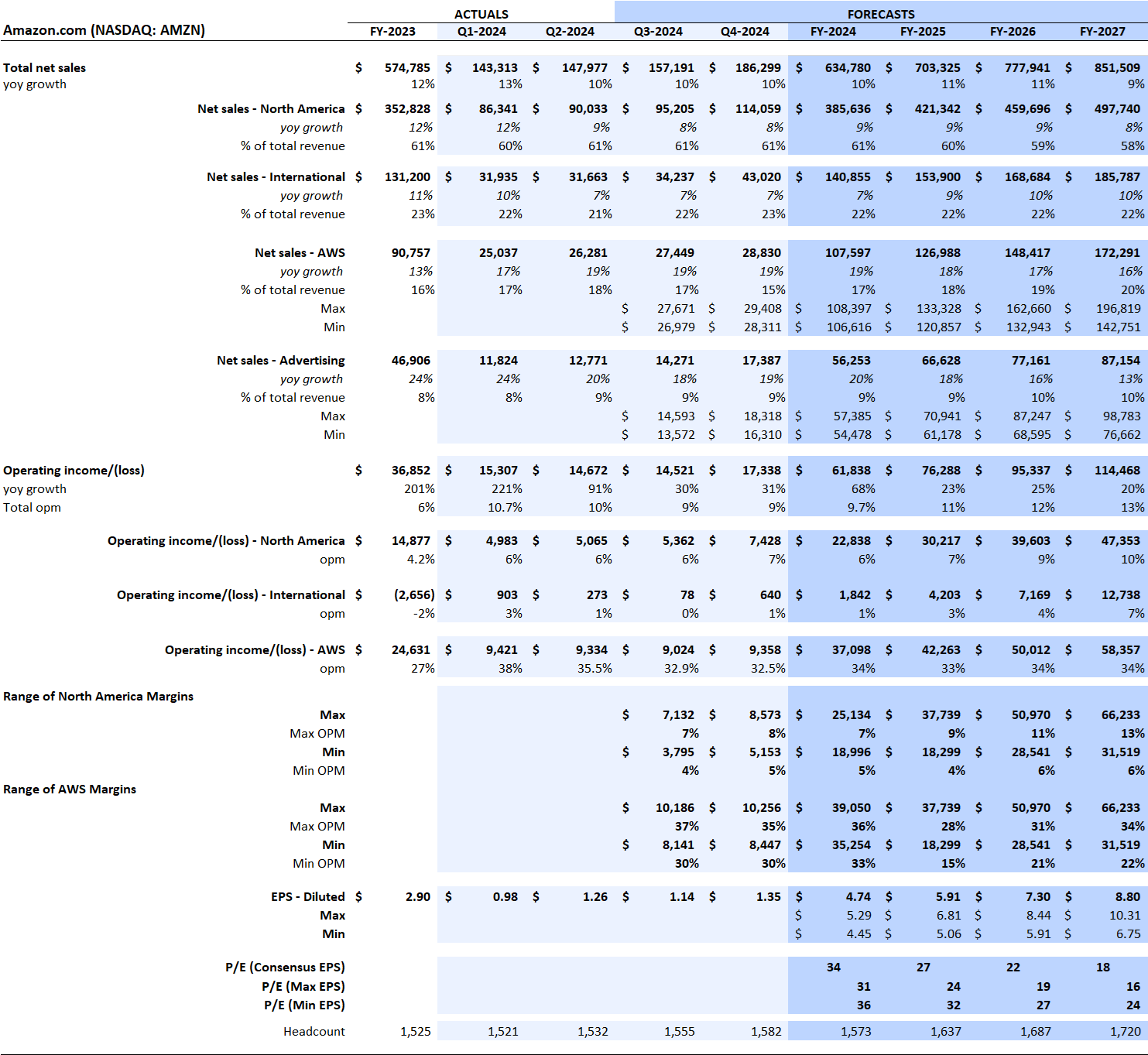

Amazon’s Q2 2024 Earnings

Total revenues for Q2 were over $2 billion below consensus, driven by lower revenues in North America and International retail, but were offset by better-than-expected performance at AWS.

The North American retail operating margin increased to 5.6%, but was below the consensus expectation of 5.9%. After the Q1, consensus moved to a more upbeat 6-7% level outlook for the rest of H2 2024, but after the Q2, those expectations have now come down, especially for Q3.

AWS margin came in very strong at 35.5% in Q2, well ahead of the consensus estimate of 29%, driven by a combination of managing costs and a change in the estimated useful life of their servers. For 2024, analysts are now expecting a 34.4% margin, up from 28.3% at the beginning of the year. The company expects AWS growth to continue, driven by high demand for GAI.

The company guided to revenue of $154-159 billion, in line with consensus of $158.4 billion, and to operating profit of $11.5-15 billion, which came in below consensus of $15.7 billion, disappointing shareholders. The stock traded down 10% after the Q2 release. Could the retail business surprise to the upside in the H2 2024 or have retail margins peaked this year?

CapEx continued to increase in the quarter. Consensus for 2024 is now expected to be $70 billion, up over $5 billion since Q1. CapEx is projected to increase in 2025 to $75 billion, up significantly from $52 billion in 2023.

Amazon Revisions

Source: Visible Alpha consensus (August 5, 2024). Stock price data courtesy of FactSet. AMZN’s current stock price is as of the market close on August 2, 2024

Amazon Consensus Estimates

Source: Visible Alpha consensus (August 5, 2024). Stock price data courtesy of FactSet. AMZN’s current stock price is as of the market close on August 2, 2024

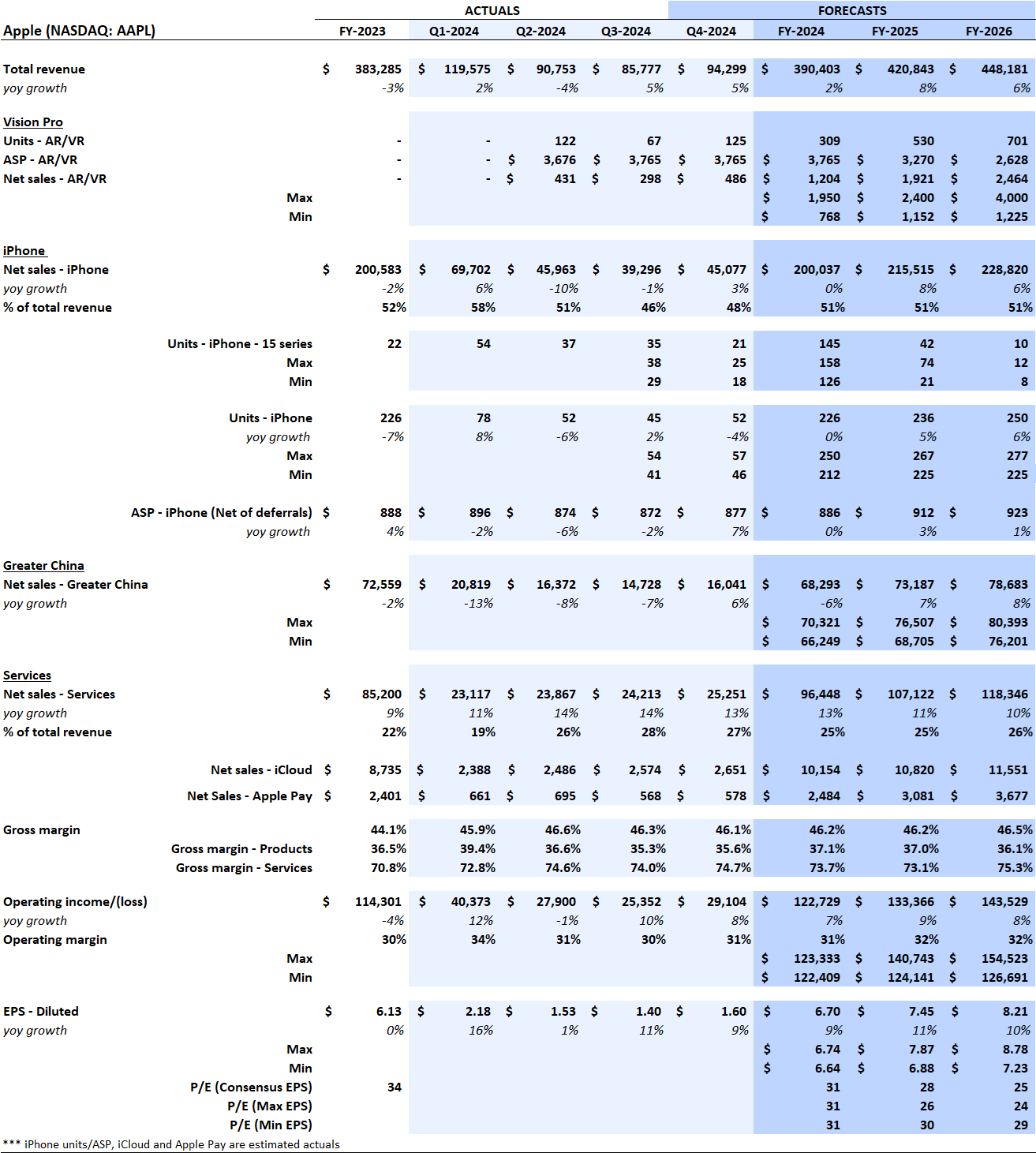

Apple’s Fiscal Q3 2024 Earnings

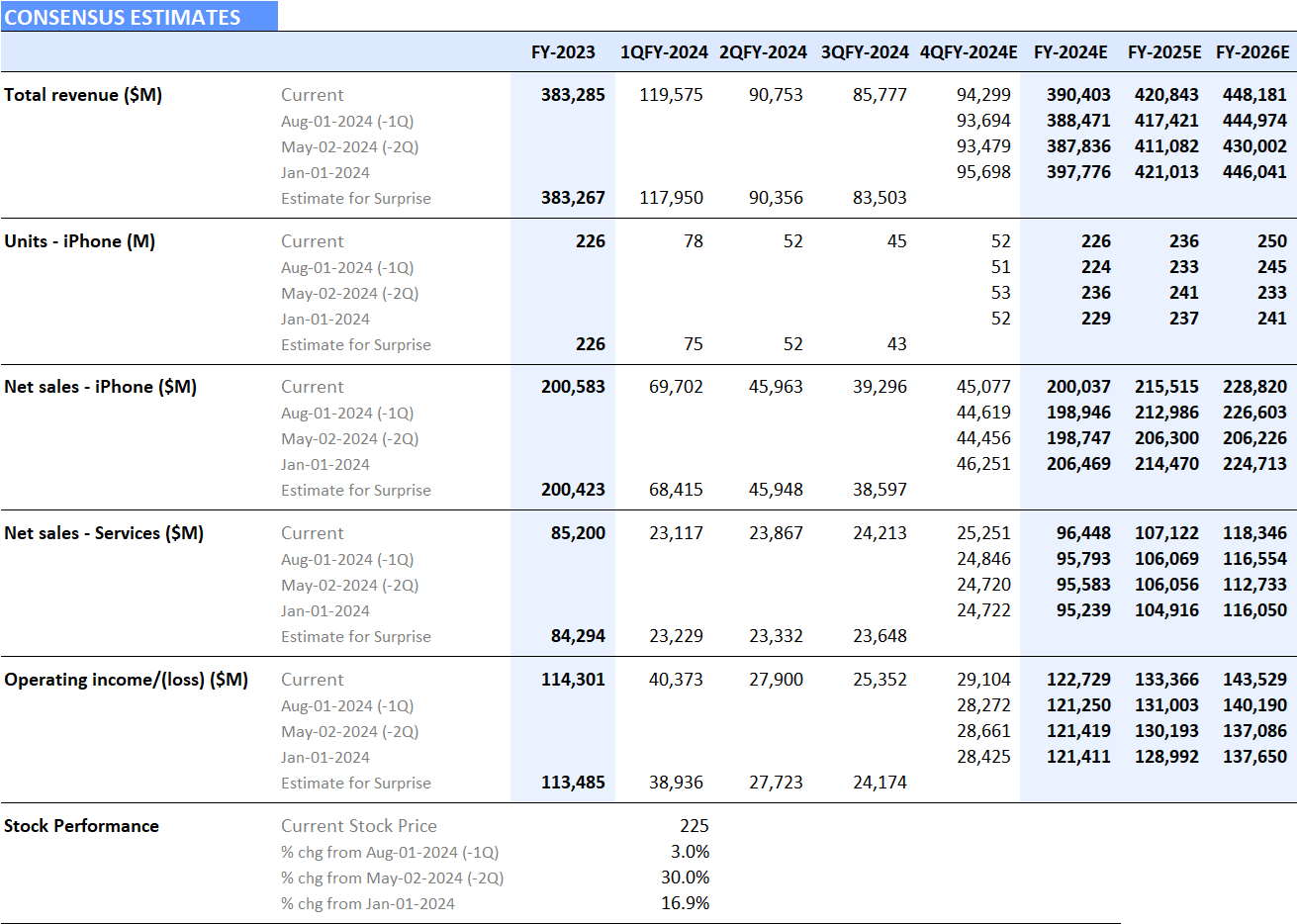

Total revenues for Q3 were in line with Visible Alpha consensus of $94.3 billion. Revenues of $45.1 billion from iPhone in Q3 were down 1% year-over-year. Based on consensus, Q3 iPhone 15 units were in line at 35 million, with estimates ranging from 29 million to 38 million units. China continues to decline, but this has been well understood by the market.

Overall full-year iPhone revenue expectations have started to improve post-Q3 2024. Currently, Q4 is expected to deliver $45 billion in iPhone sales and $200 billion for 2024, a small increase post-Q2.

While iPhone sentiment has come down since the beginning of the year, expectations for the high-margin Services segment and for total operating profit have remained consistent. In Q3, the Services segment delivered $24.2 billion, up 14% year over year and slightly better than consensus. Gross margin for the Services segment was a solid 74%, significantly higher than the 35.3% gross margin for Products, which was down 130 bps sequentially. The company said that it continues to see increased customer engagement, with the Apple ecosystem supporting the future growth of the Services business. Based on consensus, Services is expected to hit $118 billion at the end of FY 2026, up over $22 billion from this year’s estimate of $96.4 billion.

Vision Pro delivered another set of results this quarter, in line with expectations. For the full year, consensus revenue estimates for the Vision Pro have ticked up from an initial consensus projection of around $900 million to a current $1.2 billion.

The stock has traded up 3% around the Q2 release, and up a strong 30% since the Apple Intelligence announcement at WWDC, outperforming the S&P 500. Could iPhone upgrades start to exceed expectations in the H2 2024 or will it be a 2025 story?

Apple Revisions

Source: Visible Alpha consensus (August 5, 2024). Stock price data courtesy of FactSet. AAPL’s current stock price is as of the market close on August 2, 2024