Amazon.com (NASDAQ: AMZN) reported earnings for Q4 2023 on Thursday, February 1, 2024. What happened during the release and earnings call, and what are the key questions to focus on?

With total sales coming in at $170.0 billion, slightly above consensus, and operating profit at $13.0 billion, over 20% ahead of consensus, Amazon delivered a strong Q4, sending the shares up 8% following the release. In particular, Amazon delivered an 8% operating profit margin again this quarter, above the 6.4% expected by analysts.

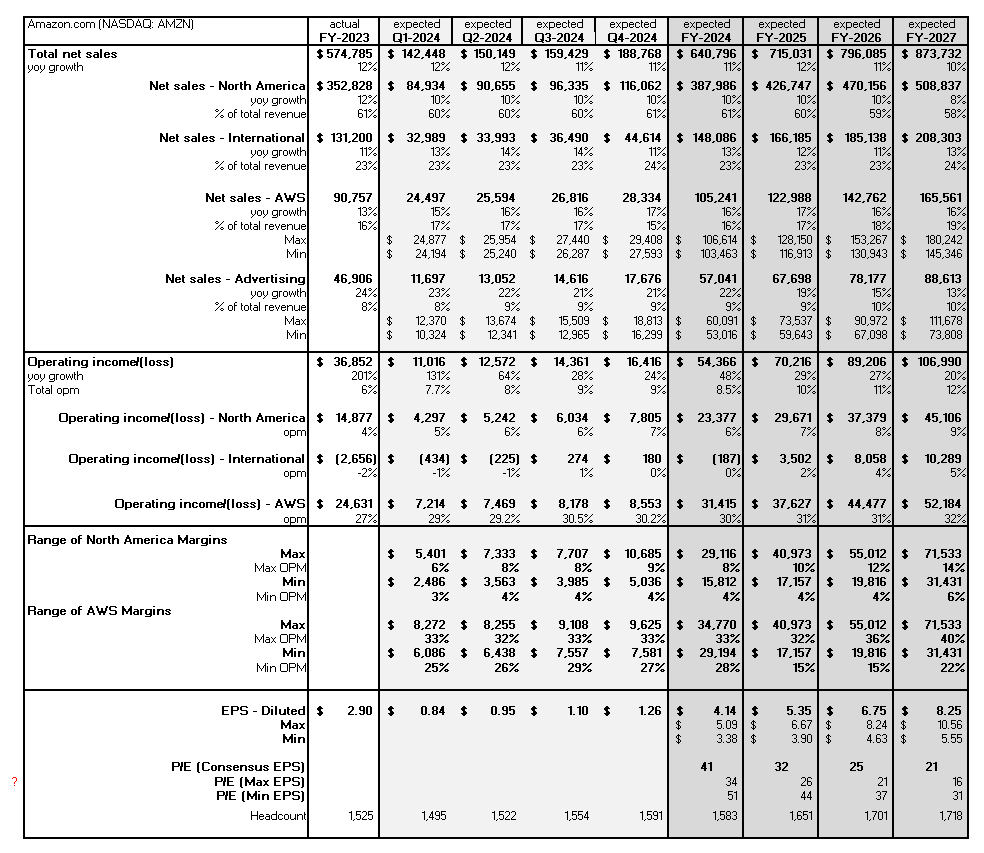

The company released Q1 guidance of $138.0-143.5 billion in revenues and $8.0-12.0 billion in operating profit, inline with expectations of $142.4 billion in sales and $11.0 billion in operating profit. Since January 2023, Visible Alpha consensus for FY 2024 declined slightly from $645.1 billion to $640.7 billion in total sales, but increased from $38.8 billion to $54.4 billion in operating profit.

Driven by improvements in the North America online business and strength in AWS, analysts project Amazon’s total operating profit margin to grow to 8.5% in 2024, more than triple 2022’s 2.4% level, and rise to 10% by the end of 2025 and 12% by the end of 2027.

1. How did AWS perform?

AWS revenues were in line with expectations at $24.2 billion, but operating profit was $2.6 billion above consensus. This resulted in a 29.8% operating profit margin, which was 140 basis points ahead of the 28.4% expected according to Visible Alpha consensus, but driven mainly by headcount reductions. While this result is a notable improvement from Q4 2022’s 24% margin, it is 50 bps lower than Q3 2023’s 30.3% margin.

Since the Q4 earnings release, the consensus margin for AWS climbed to 31.0% starting from the second half of 2024, and is expected to remain at that level through FY 2027. For Q1 2024, however, the range is 25-33% and 28-33% for FY 2024. Longer-term, there is significant debate about both top-line growth and margin levels for the AWS business, which is likely driven by varying views on the pace of cloud migration and the development of GenAI applications.

AWS has picked up the pace on the AI front. CEO Andy Jassy pointed to Bedrock helping to fuel early traction in GenAI. Jassy explained that GenAI is and will continue to be an area of pervasive focus and investment across the company and believes it will “ultimately drive tens of billions of dollars of revenue for Amazon over the next several years.” (Visible Alpha’s AI Monitor tracks the pace of AI-exposed revenue growth, including Amazon’s AWS business.)

New Question: Will AWS margin remain at 30-31% levels in 2024-2025?

2. Is the advertising business continuing to show growth?

The Ads business continued its strength by growing 26% in Q4 to $14.5 billion and 24% in 2023 to $46.9 billion, in line with expectations, driven by sponsored products. Jassy reiterated that they are still in the early days for Ads and noted in the quarter that “streaming TV advertising continues to grow quickly.” CFO Brian Olsavsky further explained that the company is looking for ways to increase advertising in its streaming properties, including Fire TV, Prime Video, Free V and Twitch. Jassy also noted that Amazon is focused on improving its measurement and transparency, enabling brands to see the payback of their advertising spend.

Consensus expectations for ad revenue in 2024 are at $57.0 billion, with the most aggressive estimates at $60.0 billion, down from $70 billion expected in Q1 last year. Longer term, there is also debate about the magnitude of revenue growth for this business. By the end of 2026, analysts expect this business to generate $78.2 billion in revenues, but the range is from $67.1-91.0 billion.

New Question: Will Amazon be able to maintain more than a 20% CAGR for the Ads business going forward?

3. What’s supporting Amazon’s online margin improvement?

Both the North America and International online businesses saw sales and operating profit come in ahead of expectations again, delivering margin improvement. In 2023, Amazon delivered 500 bps of margin improvement in North America, going from 1.2% in Q1 2023 to 6.2% in Q4, and the company noted that there’s still more to go. According to Visible Alpha consensus, analysts project Amazon’s North America operating profit margin to remain at 6% for 2024. However, margin assumptions range from 4-8%, while top-line growth is estimated to remain consistent at 10%. This range continues to widen through 2027, with estimates from 6% to 14%.

Combined with the ongoing strength and success of advertising, the company has also made significant improvements to its regional fulfillment centers. The benefits of regionalization and advertising are projected to continue to enhance margins.

New Question: Will Amazon’s North America online business be able to generate a 10% operating profit margin by the end of 2025?