Summer headlines are littered with tales of chaotic air travel and disgruntled travelers. With frequent cancellations, extended delays, stranded passengers, extraordinary flight change incentives, new Covid-related restrictions, economic instability, and an ongoing pilot shortage, the airline industry’s turbulent recovery collided with pent-up travel demand just in time to wreak havoc on the summer travel season.

Of pilots and pandemics

Airlines are setting the wrong records in 2022. With flight delays and cancellations hitting new highs, the industry is striving — and struggling — to meet seasonal demand. This summer was meant to mark the return of something like “normal,” pre-pandemic travel, but Covid, and now monkeypox, continue to raise global health concerns. International travel restrictions are trending lighter, but global air travel remains subject to local destination vaccine, testing, and quarantine requirements.

As if ongoing public health crises weren’t challenging enough, airlines are also juggling airspace restrictions and skyrocketing fuel prices. And then there’s the pilot shortage.

Lessons in chaos management

Airlines are struggling to maintain passenger loyalty and keep pilots on the roster. Disruptions trigger a domino effect in a pilot’s flight schedule, creating increasing flight interruptions throughout the day and around the globe. As for this summer’s record delays and cancellations, each airline has its own approach to chaos management.

Contract negotiations are increasing pilot compensation offers, with United Airlines (NASDAQ:UAL) agreeing to a 14% salary increase and paid maternity leave for pilots while American Airlines (NASDAQ:AAL) is offering a 17% overall salary increase with a 6% raise effective at signing. With airlines increasingly desperate for pilots, some have taken to “poaching” from other airlines.

Meanwhile, airlines are making extraordinary moves to compensate passengers for their inconvenience. Delta Air Lines (NYSE:DAL) efforts extend from a video apology statement by CEO Ed Bastian to a “pizza party” for delayed passengers and, most recently, $10,000 cash incentives for voluntarily leaving an oversold flight. The “big three” are also cutting regional flights and reducing capacity in preparation for the fall travel season.

Q2 earnings

Summer turbulence notwithstanding, passenger demand remains high, and with labor shortages, increasing pilot salaries, and fuel costs keeping fares up as well, airlines are reporting second quarter profits.

Second quarter earnings show a return to profitability for American, Delta, and United in the U.S. and global leaders, such as Lufthansa (OTCMKTS:DLAKY) and International Airlines Group (OTCMKTS: ICAGY). Each leading airline’s Q2 earnings shows a return to profitability for the first time since pandemic disruptions, with some setting new records for second quarter performance even while flying at reduced capacity. All five airlines express confidence in ongoing recovery even as they adjust capacity to align with lower third quarter expectations for demand.

By the numbers

As airlines show profit despite the summer chaos, forecasts for the industry’s key performance indicators (KPIs) predict continued recovery for domestic and international industry leaders.

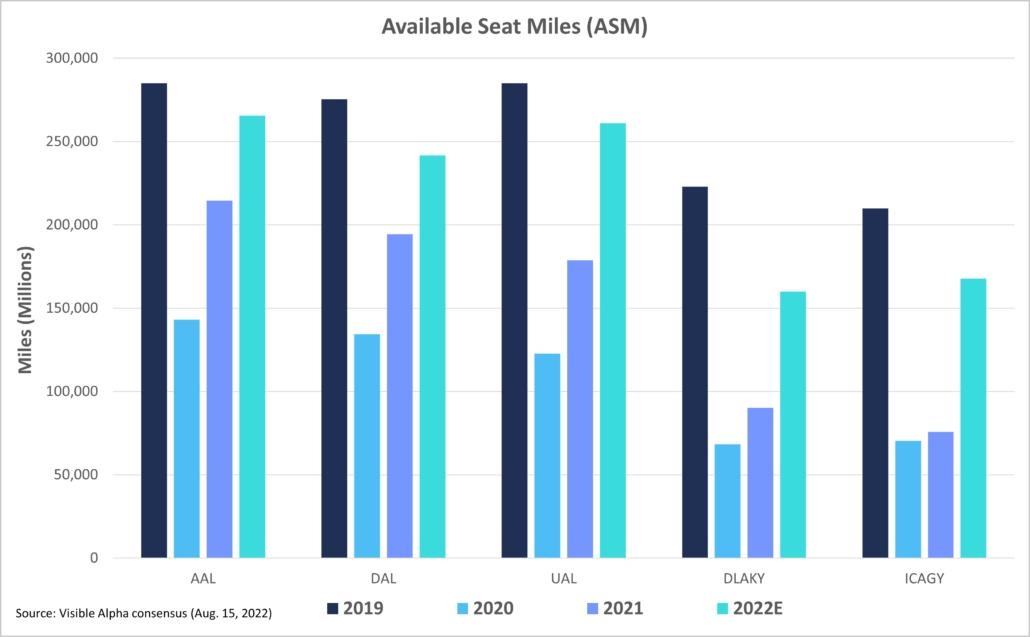

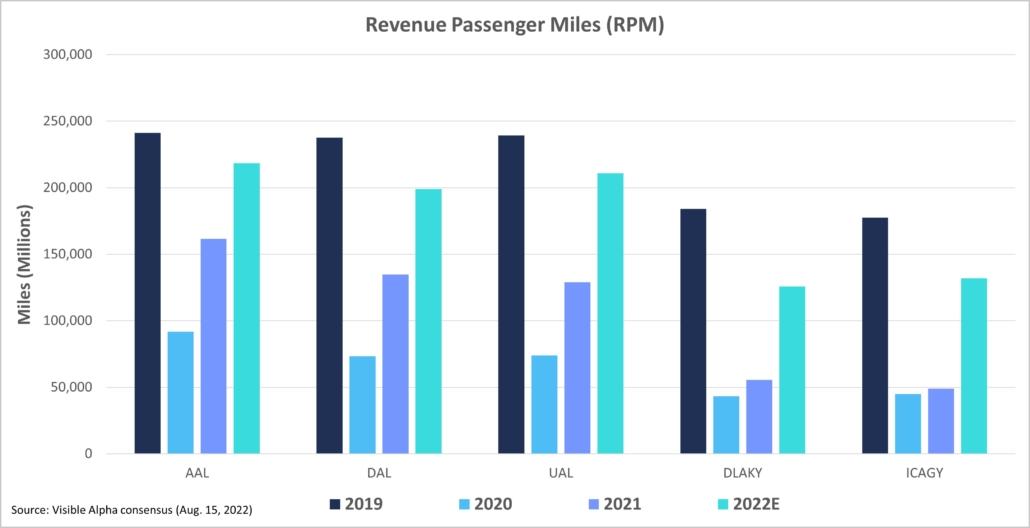

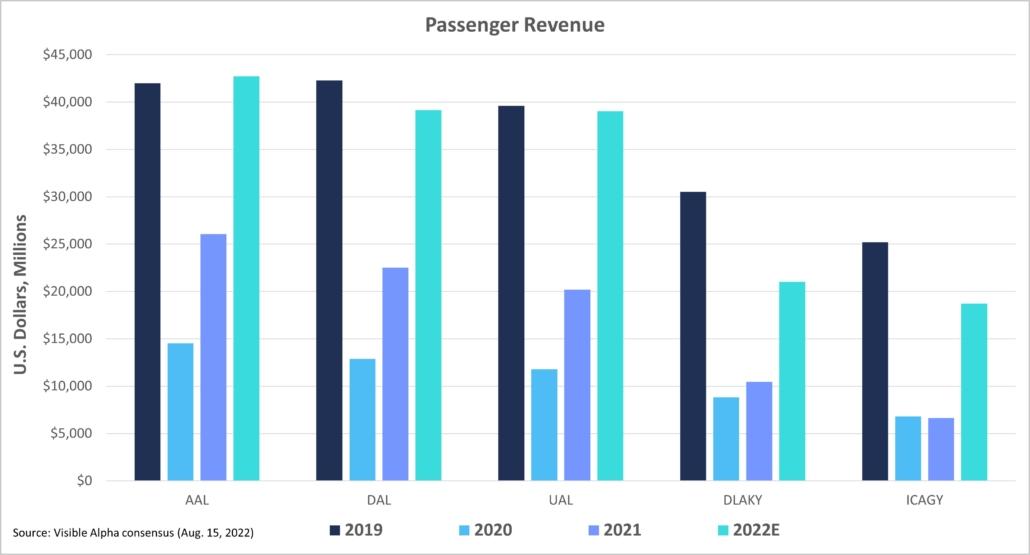

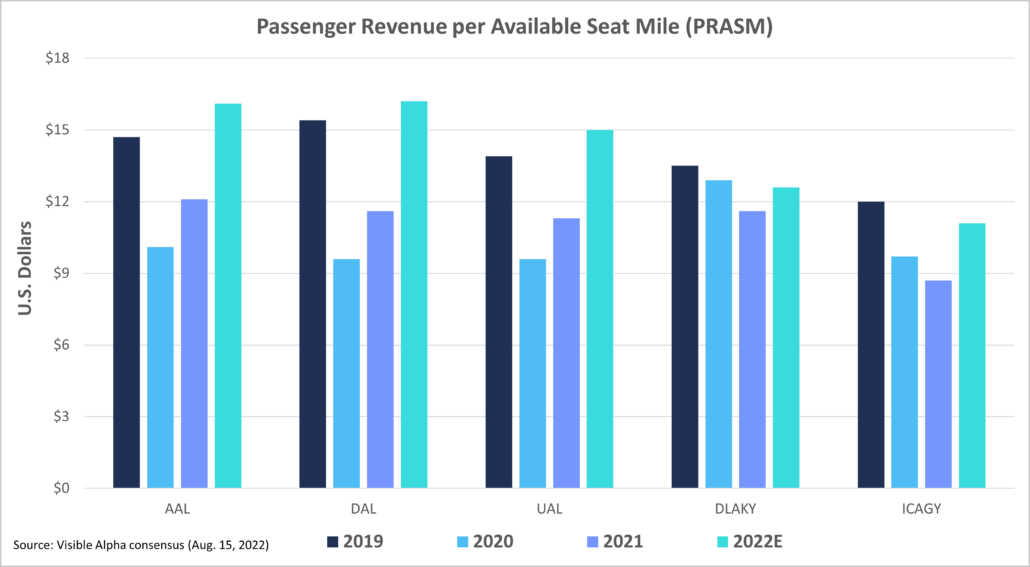

Of the leading airline examples listed above, analysts predict YoY increases for all five in available seat miles, revenue passenger miles, passenger revenue, and passenger revenue per available seat mile. Following record pandemic related drops across these core KPIs in 2020, the five example airlines showed recovery increases — ranging from unimpressive to overwhelming — for the same KPIs in 2021. Analysts expect recovery to continue for these KPIs in 2022.

Available seat miles (ASM) refers to flight miles in the context of capacity adjusted over time. In 2020, all five airlines experienced excessive, though expected, decreases in ASM. As airlines pushed to recover capacity in 2021, American countered pandemic related decreases with ASM up 49.8% YoY, a recovery trend analysts predict will continue with a strong 23.8% increase for 2022. Delta was up 44.8% in 2021, with another strong showing of 24.3% forecast for 2022. For United, 2020 decreases were followed by a 45.5% increase in 2021 and a high-end increase of 46.1% predicted for 2022. International Airlines Group’s (IAG) did not impress with its 7.7% increase in 2021, but it is predicted to bounce back in a big way with a forecast increase of 121.5% for 2022. Finally, Lufthansa’s drastic 2020 drop showed recovery in 2021 with a 32.2% increase, a trend expected to continue with an impressive 84.1% ASM increase predicted for 2022.

Revenue passenger miles (RPM) are the number of passenger flight miles from which an airline draws revenue. Analysts predict a similar pattern of ongoing recovery for this KPI. American increased RPM 75.9% YoY in 2021, and a continued increase of 35.2% YoY is forecast for 2022. Delta’s 2020 loss was more than balanced by a high recovery increase of 83.5% in 2021, another trend forecast to continue with a 47.8% YoY boost in 2022. United matched Delta’s 2020 loss in scale, and its 2021 increase of 74.6% almost matched that of American, but forecasts predict an increase of 63.5% — the strongest showing among the big three — for 2022. Lufthansa’s showed a more modest recovery with its 2021 increase of 28.7% but is forecast to make up for its modesty with a 2022 predicted increase of 126.4%. IAG’s 2021 increase of 8.9% was relatively unimpressive, but it’s forecast to regain a lot of ground in 2022 with a whopping 169.7% predicted YoY boost in RPM.

Passenger revenue is just that, an airline’s total revenue generated by passengers. Pandemic travel restrictions resulted in universal losses for the airline industry, but analyst predictions show universal recovery is expected to continue, to varying degrees, across the industry. American was up 79.5% in 2021, and is forecast to continue upward with a YoY increase of 64.0% for 2022. Delta passenger revenue increased 74.8% for 2021 with another 73.9% boost predicted for 2022. United’s 2021 recovery increase of 71.1% is followed by a forecast increase — standout among the big three again — of 93.2%. Lufthansa’s initial recovery boost, modest again at 27.4% in 2021, is forecast for a 118.9% increase in 2022, and IAG remained on the low end of the recovery range in 2021 — up a mere 4.6% — but is forecast for a dramatic 207.4% YoY increase in passenger revenue for 2022.

Passenger revenue per available seat mile (PRASM) is earned passenger revenue from each mile flown. More than any other industry KPI, PRASM ($US) provides insight on the relationship of supply to demand and the impact of cost increases (e.g., fuel prices) and industry challenges (e.g., labor shortages) on passenger fares and airline revenue. Beginning with 2019, each of the big three domestic airlines follows a similar trend in PRASM loss and recovery. American Airlines went from $14.7 in 2019 to $10.1 in 2020, $12.1 in 2021, and a predicted $16.1 for 2022. Delta started at $15.4 in 2019, dropped to $9.6 in 2020, went up to $11.6 in 2021, and is forecast at $16.2 for 2022. In the same period, United began at $13.9 (2019), dropped to $9.6 (2020), increased to $11.3 (2021), and is forecast to reach $15.0 in 2022.

The pattern changes with international examples, decreasing more gradually over two years, and while forecast for increases in 2022, they are not predicted to reach or surpass 2019 numbers. Lufthansa was at $13.5 in 2019, decreased to $12.9 (2020), dropped again to $11.6 (2021), and is forecast to reach $12.6 in 2022. IAG began at $12.0 (2019), dropped to $9.7 (2020), decreased again to $8.7 (2021), and is predicted to increase to $11.1 for 2022.

Chaos and consensus

A tumultuous summer travel season aside, analysts predict continued recovery for the embattled industry as major airlines adjust regional schedules and capacity for the coming months, scramble to expand pilot rosters, and report their first profitable post-pandemic quarter.