Amazon.com, Inc. (NASDAQ: AMZN) will report Q3 2023 results on Thursday, October 26, 2023. Here are the key numbers that we’re watching.

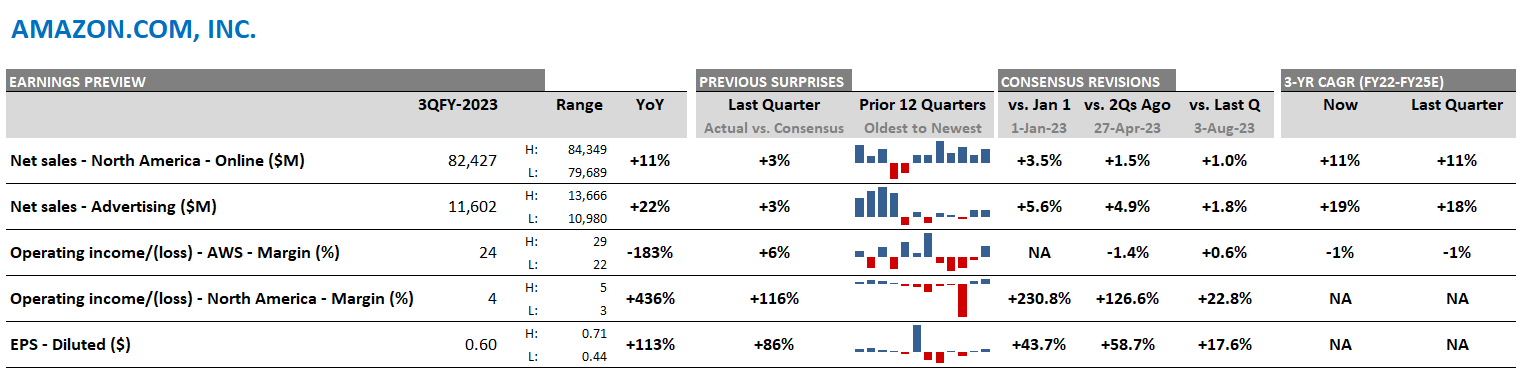

Figure 1: Amazon – consensus expectations for Q3, past earnings surprises, revisions, and CAGR

Source: Visible Alpha consensus (October 24, 2023). “Previous Surprises” indicate the direction that specific line items beat or missed. “Consensus Revisions” show the trajectory of line items from a given date.

Amazon Q3 Earnings Preview

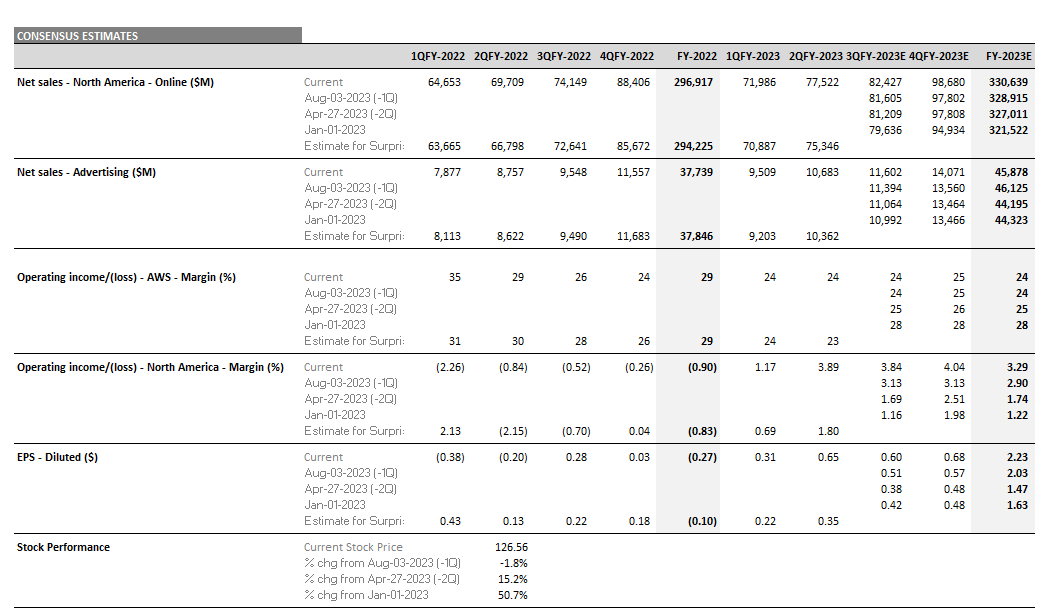

According to Visible Alpha consensus, total revenues expected for Q3 have come up slightly from the beginning of the year, from $139.6 billion to $141.6 billion, driven by increased optimism about the resilience of Amazon’s revenue for retail and AWS. There is some debate about the top line performance of the profitable advertising business, with analysts expecting between $11.0 billion to $13.7 billion.

The focus will likely be on the Q3 expectations for the retail and AWS margins. The North America retail operating margin has increased significantly from a meager 1.1% at the beginning of the year to 3.8% now, ahead of Q3 earnings. While margin expectations jumped substantially from April to July, operating margin expectations for North America have continued to grind higher since July, rising from 3.1% to 3.8%. AWS margin came down to 24% in August from 28% at the beginning of the year, and has since remained at 24%. There is, however, a significant range of analyst estimates for AWS margin into Q3 earnings, with analysts expecting from 22% to 29%.

The stock has traded down slightly since last quarter’s July release but is up over 50% year to date. Could the Q3 release provide the next positive catalyst for the stock?

Figure 2: Amazon consensus estimates

Source: Visible Alpha consensus (October 24, 2023). Stock price data courtesy of FactSet. Amazon’s current stock price is as of the market close on October 23, 2023.