Martin Pyykkonen, Consulting Analyst

Trends to Watch Ahead of Earnings

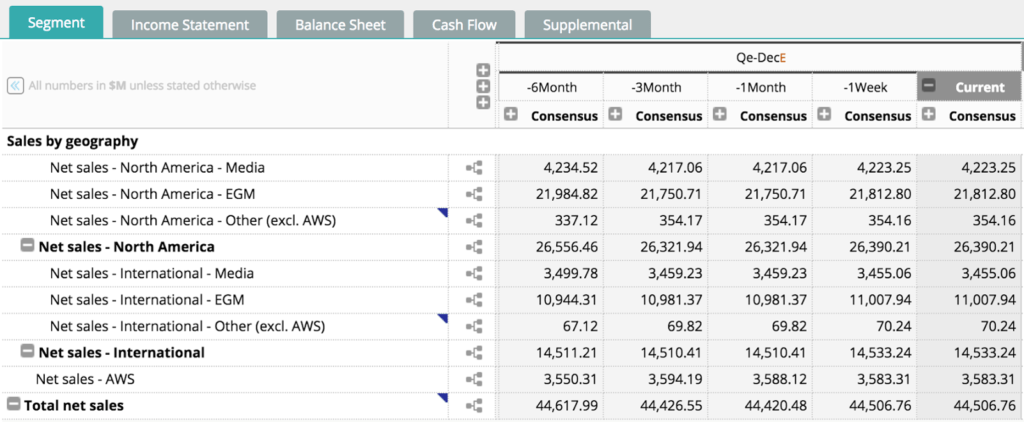

Current Visible Alpha consensus for AMZN’s 4Q16 total revenue is above the company’s mid-point guidance for the quarter of $42.5 to $45.5 billion. Based on traditional retailers’ reported 4Q16 results so far, it’s evident that AMZN gained further market share vs. brick-and-mortar retail sales in the recent holiday period (which is typically > 30% of retailers’ total annual sales).

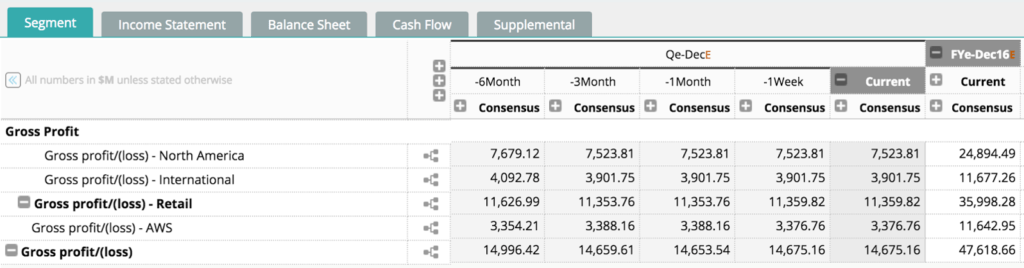

While revenue estimates for AMZN in 4Q16 and 2016 have shown positive signs, EBITDA margin and operating margin consensus have been adjusted downward more meaningfully over the past six months. We think this larger impact on AMZN’s margins (vs. revenue) is based on increasing market share in the lower margin retail environment.

Amazon Sales by Geography in Visible Alpha (4Q16E Revisions On)

For illustrative purposes only. Learn more about Visible Alpha or request a trial.

Amazon Gross Profit by Geography in Visible Alpha (4Q16E Revisions On)

For illustrative purposes only.

What does this mean for AMZN?

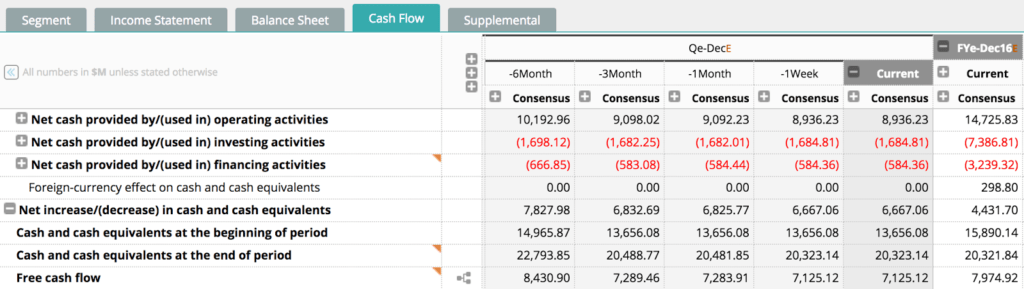

AMZN has always been clear about sacrificing operating margin in favor of sales growth and market share gains vs. traditional retailers. This profitability tradeoff also applies, although to a lesser extent to free cash flow, as AMZN’s lower physical infrastructure costs insulates free cash flow.

Amazon Abbreviated Cash Flow Statement (4Q16E Revisions On)

For illustrative purposes only.

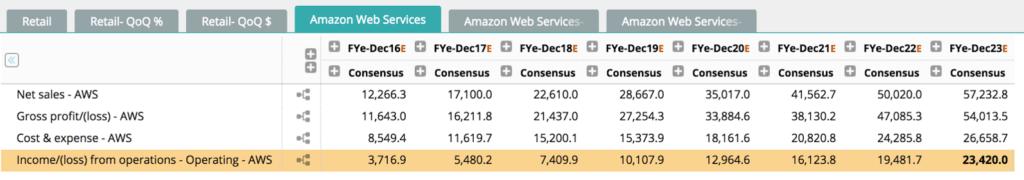

Initial signs point to a similar story in 2017, where operating margin, EBITDA margin and free cash flow have been revised down in anticipation of AMZN’s continued efforts to strive for further retail market share gains this year, especially as some traditional retailers become more aggressive with their relatively smaller, but faster growing online properties (ex: WalMart). A potential mitigator of margin declines could be the growing influence of AMZN’s cloud platform (AWS) in the overall revenue mix. The current consensus shows an increase in AWS as a percentage of total revenue to 10.3% for full year 2017 (vs. 9.1% of total revenue in 2016).

Amazon Web Services on Visible Alpha (2016E to 2023E)

For illustrative purposes only. Learn more or request a trial of Visible Alpha.