Apple (NASDAQ: AAPL) and Amazon (NASDAQ: AMZN) will report results next week. Here are the key numbers that we’re watching.

Apple’s Fiscal Q2 2024 Earnings Preview

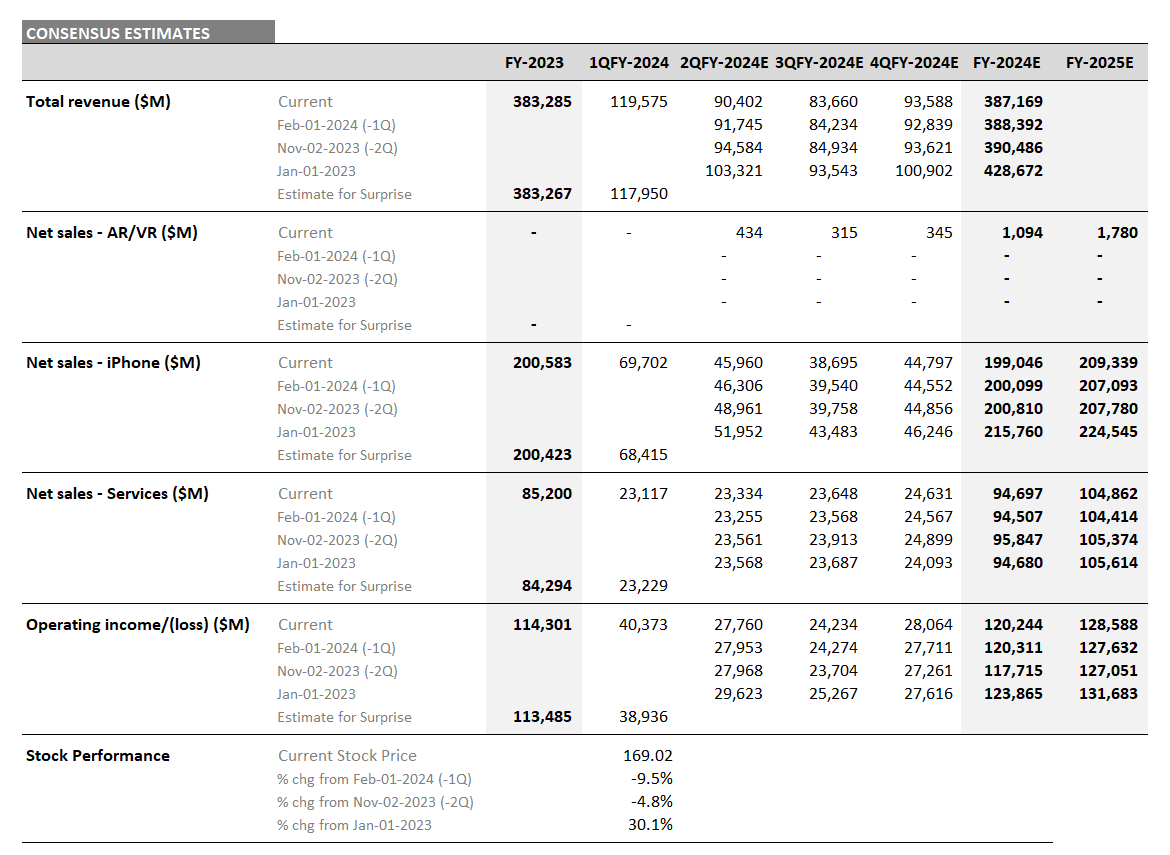

Total revenues expected for fiscal Q2 have continued to come down from the beginning of last year, according to Visible Alpha consensus, from $103 billion to $90 billion, driven by decreased optimism about the iPhone. Expected Q2 iPhone 15 units range from 34 million to 40 million, with consensus at 36 million. Overall Q2 and full year iPhone revenue expectations have continued to trend down since January 2023. Currently, Q2 is expected to deliver $46 billion in iPhone sales and $199 billion for 2024.

While iPhone sentiment has come down, expectations for the high-margin Services segment and for total operating profit have remained consistent. Gross margin for the Services segment is over 70%, significantly higher than the 36% gross margin for Products. It will be helpful to hear what the company says in the earnings release about growth in Services and if this is enough to offset declines in iPhone sales.

Vision Pro will show its first set of results this quarter. In Q2, analysts estimate 127,000 units sold, generating $434 million. For the full year, consensus revenue estimates for the Vision Pro have ticked up recently from an initial projection of around $900 million to a current $1.1 billion.

The stock has traded down 10.7% since last quarter’s release, underperforming other Big Tech stocks and the S&P 500. Could the Q2 release provide a positive catalyst for the stock?

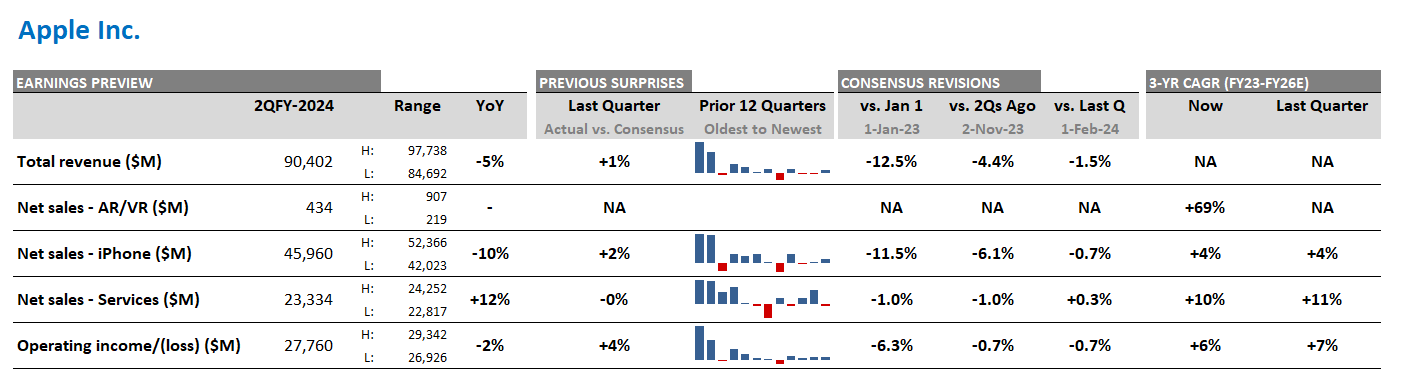

Figure 1: Apple – consensus expectations for Q2 2024, past earnings surprises, revisions, and CAGR

Source: Visible Alpha consensus (April 24, 2024). “Previous Surprises” indicate the direction that specific line items beat or missed. “Consensus Revisions” show the trajectory of line items from a given date.

Figure 2: Apple consensus estimates

Source: Visible Alpha consensus (April 24, 2024). Stock price data courtesy of FactSet. AAPL’s current stock price is as of the market close on April 23, 2024.

Amazon’s Q1 2024 Earnings Preview

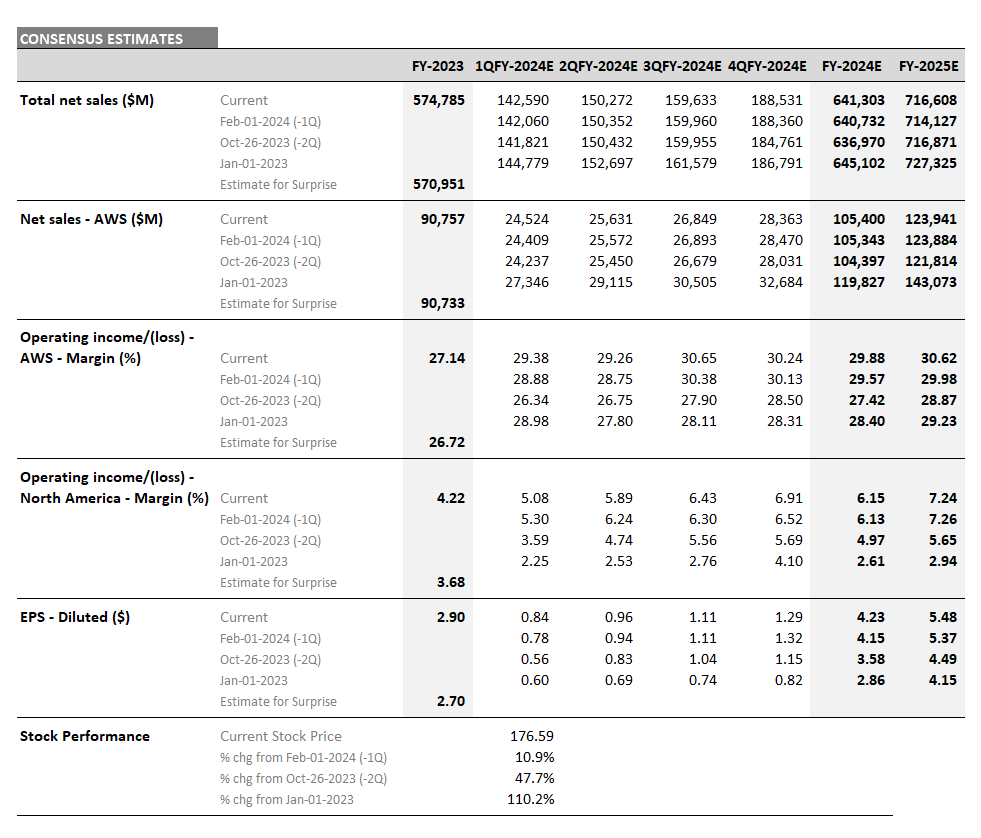

According to Visible Alpha consensus, total revenues expected for Q1 have come up slightly from Q4 2023, from $141.8 billion to $142.6 billion, driven by expected resilience in Amazon’s North America retail, advertising, and AWS businesses. The focus will likely be on the Q1 performance and outlook for the online retail and AWS margins, and their impact on EPS.

The North America retail operating margin has increased significantly from a meager 1.1% at the beginning of last year to 5% currently, ahead of Q1 earnings. Operating margin expectations for North America have been moving around since October, and considerable debate exists about the right level. For Q1 2024, the estimated margin ranges from 3% to 7%, with consensus at 5%. The current consensus 5% margin is slightly toned down from 5.3% earlier in the year. What will the company say about the outlook for the online business?

AWS margin came in at 27% last year and 29.6% last quarter. For Q1, analysts are expecting 29%. There is, however, a significant range of estimates for the Q1 AWS margin into next week’s release, with analysts expecting from 21-34%, an increase from the 24-31% range last quarter.

The stock has traded up 12% since last quarter’s release, outperforming the S&P 500. Could the Q1 release provide the next positive catalyst for the stock?

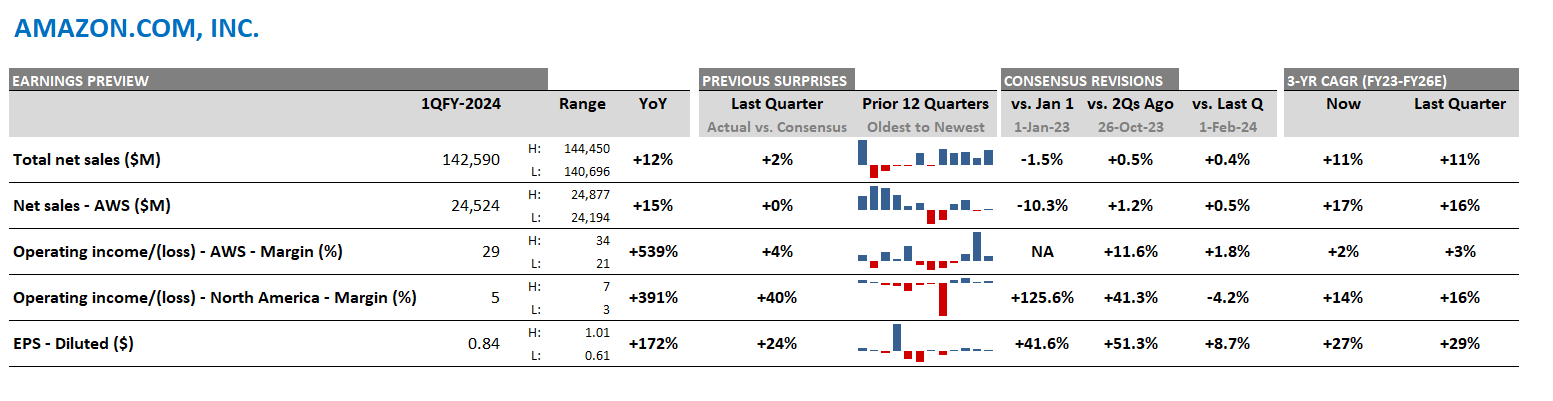

Figure 3: Amazon – consensus expectations for Q1 2024, past earnings surprises, revisions, and CAGR

Source: Visible Alpha consensus (April 24, 2024). “Previous Surprises” indicate the direction that specific line items beat or missed. “Consensus Revisions” show the trajectory of line items from a given date.

Figure 4: Amazon consensus estimates

Source: Visible Alpha consensus (April 24, 2024). Stock price data courtesy of FactSet. AMZN’s current stock price is as of the market close on April 23, 2024.