Last week, Bed Bath & Beyond reported 1Q17 results that were well-below expectations. The results were highlighted by -2.0% comparable store sales growth, which compared to the company’s full-year guidance of “relatively flat to slightly positive” comparable store sales growth. Reported EPS of $0.53 was also well-below consensus of $0.66.

Interestingly, management did not provide an update to guidance for the full year despite the miss in 1Q17, noting 1Q’s small contribution to full-year results, the late start to the summer season, and better visibility into the year after 2Q.

A look into consensus estimates and analyst revisions provides a better view of how expectations have changed after the quarter. Comparable store sales growth estimates were revised down by roughly 1.5 points for each quarter, and estimates for the full year are now calling for a 0.9% decline (below management’s guidance).

Join the thousands of financial professionals leveraging Visible Alpha to access deep analyst views. Get access today.

The reasons for this are varied, with analysts citing increased competition and a choppy consumer backdrop.

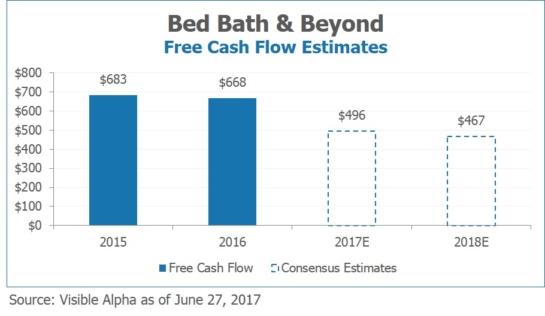

However, one positive that Bed Bath & Beyond has long had is its free cash flow generation. Consensus estimates show that analysts expect significant levels of free cash flow in 2017 and 2018, with 2018 levels representing a 10%+ free cash flow yield on the current stock price. However, these levels would also represent declines of 26% in 2017 and an additional 6% the following year. Should this continue to be revised downwards, it may not provide the support that bulls are looking for.