Since its IPO in late June, Blue Apron stock has declined by over 48%, driven largely by 2Q results that missed expectations. Since that time, investors have debated about the slowdown in the company’s results and whether they are temporary, execution-related issues, or symptomatic of a larger fundamental issue with the company and its services.

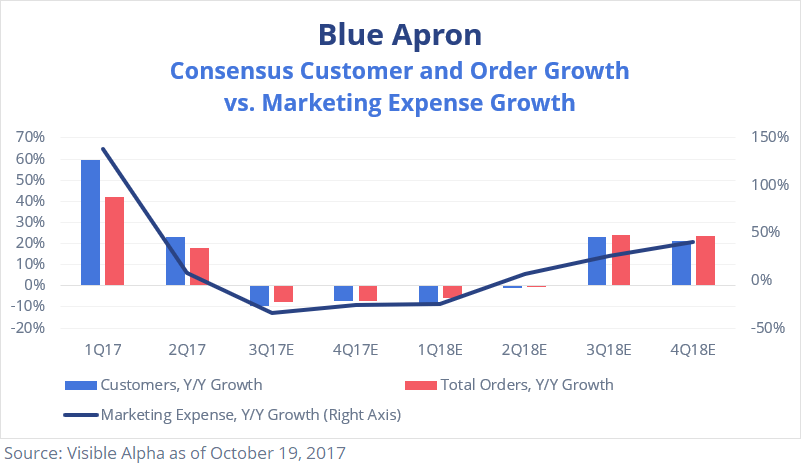

Blue Apron argues that the slowdown in customers is due to a significant reduction in marketing expense as the company was forced to reallocate expenses to other initiatives, including the ramp of its Linden fulfillment facility and an expansion of its product offerings. Once these issues are behind them and the Linden facility is fully ramped, they argue, marketing expense will return to prior levels, customer growth will turn positive, and margins will expand as the company gains scale.

Bears have brought up several concerns, including the low barriers to entry and competitive landscape, negative profitability, and near-term executional risks (highlighted by the fulfillment center’s delays) that could hurt the company’s reputation among customers.

Looking at Wall Street analyst estimates, we find that the consensus view leans more towards the bull thesis. Analysts are expecting total orders and customers to rebound to strongly-positive growth in 2H18, in line with the company’s marketing expense.

Go Beyond Consensus with Visible Alpha.

Uncover new insights with access to deep information on more than 2000 companies.

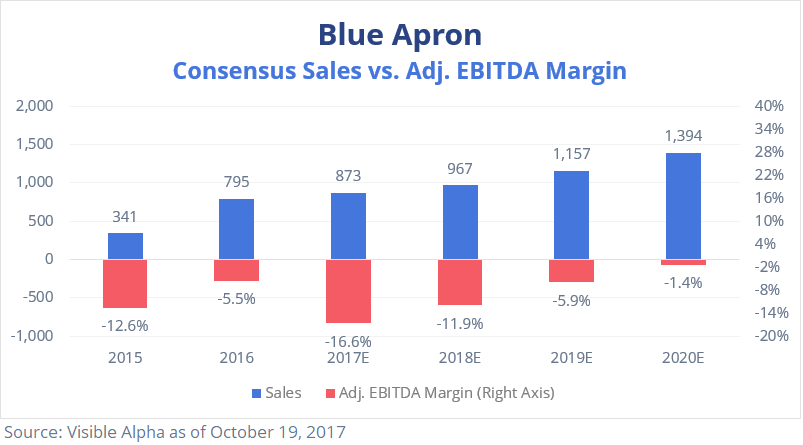

Additionally, longer-term, analysts expect margins to approach break-even as their sales grow. Analysts expect Blue Apron’s sales to approach $1.4 billion in 2020 and achieve Adj. EBITDA margins of -1.4%. While that margin is still negative, it would represent a significant improvement from the -16.6% margin that is expected for 2017.