Key Takeaways

|

The move to accelerated computing could have the potential to enable deeper integration of AI into heavy industry. How could this impact companies that adopt and scale innovative solutions to their manufacturing processes?

As we’ve seen already, this move to accelerated computing in data centers has been underpinning the investment story for Nvidia. As Cloud Service Providers (CSP) and consumer internet companies have raced to transform their data centers from general purpose computing to accelerated computing, the platform shift has opened questions about the broader, longer-term implications of moving from the CPU (central processing unit) to the GPU (graphics processing unit).

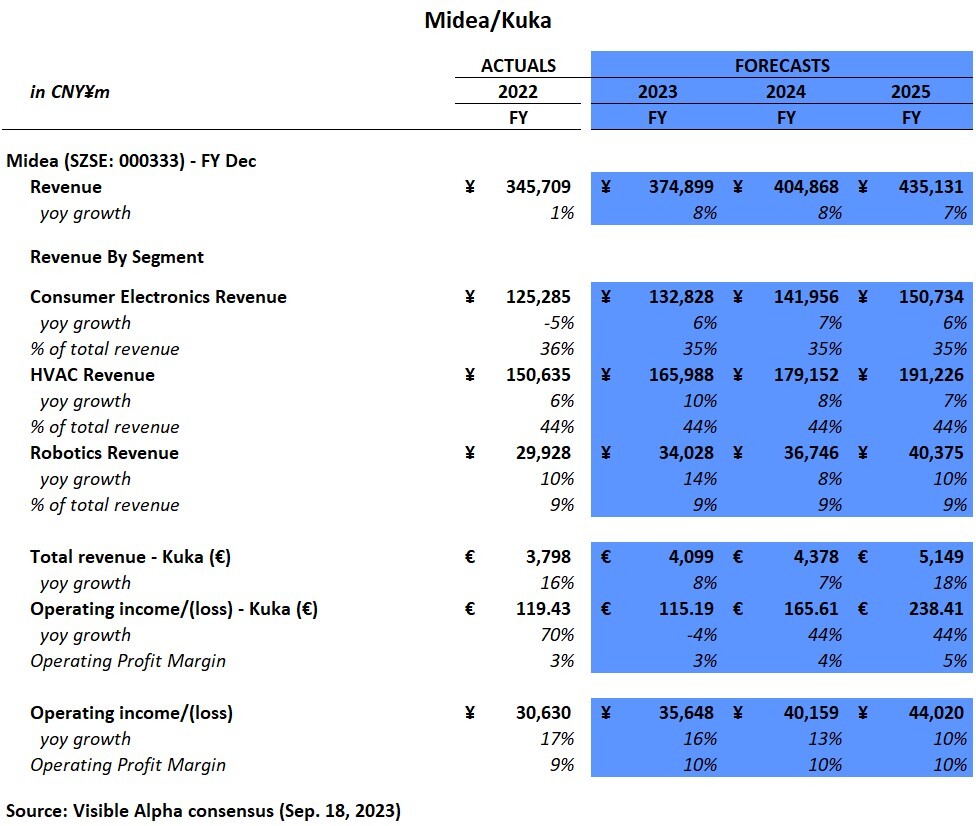

Figure 1: Upward revenue revisions (%) for Nvidia (NASDAQ: NVDA) segments

Source: Visible Alpha Insights (September 14, 2023)

Accelerated computing enables faster data processing with lower power consumption. In addition to speed and energy efficiency, accelerated computing is highly optimized for specific tasks, making it easier to scale tasks that can be parallelized (i.e., big data applications), making it ideal for AI/ML, modeling, and graphics. Generative AI (GAI) is currently used mainly by light industry (information, words, images, and music), but not broadly by heavy industry as of yet.

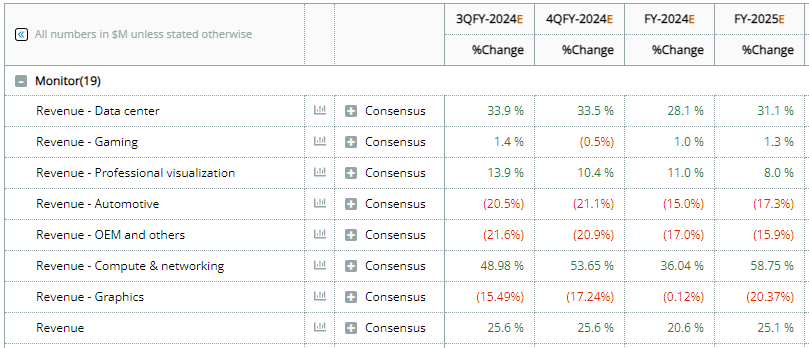

This platform move has the potential to enable deeper integration of AI/ML to heavy industry and to provide a foundation for the broader use and application of robotics. At Computex 2023, Nvidia CEO Jensen Huang highlighted the Omniverse and how the Digital Twin will provide a virtual environment for replicating environments and situations ideal for testing automation.

The Digital Twin can be applied to many industrial scenarios and help manufacturers manage risks and deliver more precise results and, ultimately, more impactful solutions. For example, a factory may wish to personalize parts of its assembly and want to test this in a virtual factory or want to have greater visibility into the timing of its supply chain.

Figure 2: The Digital Twin

Source: Nvidia Keynote at Computex 2023

Virtual factory: Digitalizing heavy industry

Back in October 2016, Nvidia (NASDAQ: NVDA) and Fanuc (TSE: 6954) teamed up to build AI-powered factory robots with GPU-accelerated deep learning in the cloud. Given the innovations with the Omniverse, manufacturing, factory automation and industrial robotics may begin to show new capabilities.

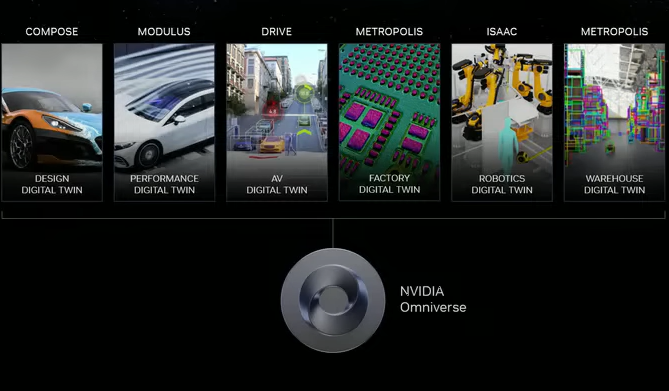

According to Huang, the $45 trillion global manufacturing industry is racing to have its factories become software defined to ensure they can produce products with quality and speed, and as cost efficiently as possible. The application of AI via software to manufacturing can support these objectives.

Figure 3: GAI use cases for manufacturing

Source: Google Cloud GAI Use Cases for Manufacturing

By leveraging one unified source of data across the company, teams can virtually design, build, and operate a factory before actually breaking ground. In the Omniverse, teams can start by building a Digital Twin of their factory, unifying siloed datasets to provide a real-time view of their factory data to their planning teams, stakeholders, and suppliers. In the cloud, native Digital Twin planners can then optimize the factory virtually before deploying changes to the real factory.

Figure 4: Factory simulation in a Digital Twin

Source: Nvidia Keynote at Computex 2023

Fully autonomous robots can be trained on complex tasks entirely in simulation and operations can be validated before deployment to the real world. This process has the potential to significantly help manufacturers reduce risks, improve efficiency, and reduce cost in heavy industries like automotive and electronics manufacturing.

Companies and expectations

There are several players in the factory automation and industrial robotics space. Based on Visible Alpha data, growth and profitability vary among the players. Additionally, China’s slowing, foreign exchange impacts, and product cyclicality have created some volatility in the pace and outlook for growth. However, with the consensus outlook looking cautious, could this be an interesting time to revisit these names, given the broader industry trends?

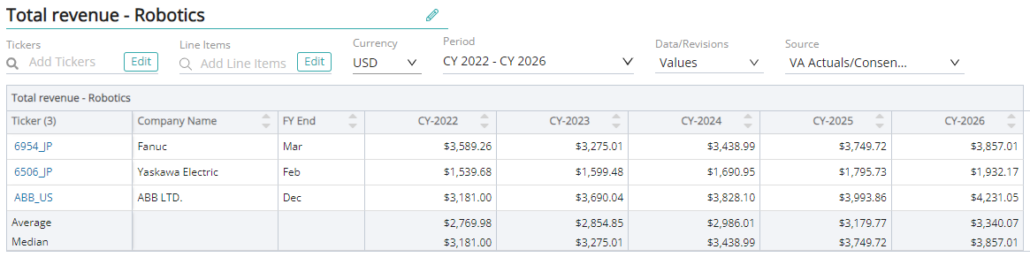

Figure 5: Peer analysis of robotics revenue in U.S. dollars

Source: Visible Alpha Insights (September 14, 2023)

How these firms integrate some of the new AI capabilities to the brain of the robot and to aspects of automation will be critical to the investment story and outlook. The potential growth could be significant for companies that adopt and scale innovative solutions to their manufacturing processes. Additionally, based on the platform shift to accelerated computing, Nvidia seems well-positioned to support the tech stack and data unification that needs to happen to embed AI more holistically into the manufacturing process and to the supply chain.

- Will these innovations drive a scalable new product cycle?

- Will these manufacturing enhancements have higher price points and margins?

- Which companies are positioned to benefit longer term?

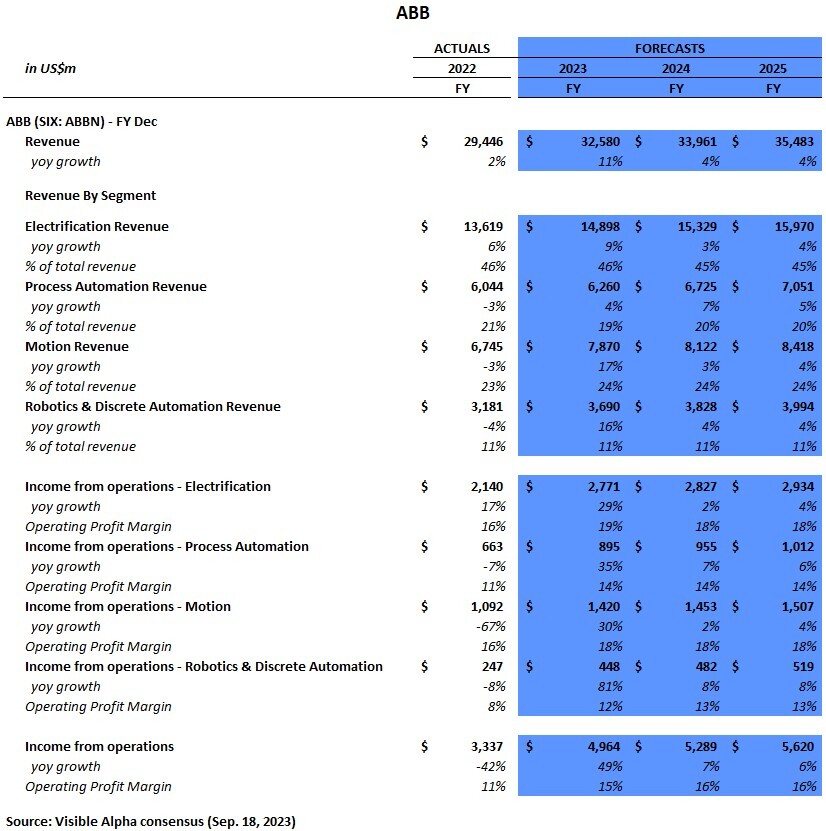

ABB: Sweden/Switzerland-based ABB (SIX: ABBN) has a leading electrification, robot, automation, and motion portfolio that it connects to software to drive better performance.

ABB is projected to generate a 16% margin, driven by its higher margin Electrification and Motion segments, but revenue growth is only projected to be 4% for FY 2024 and FY 2025. Could longer-term innovations in factories drive an uptick to numbers?

Figure 6: ABB segment revenue and income consensus

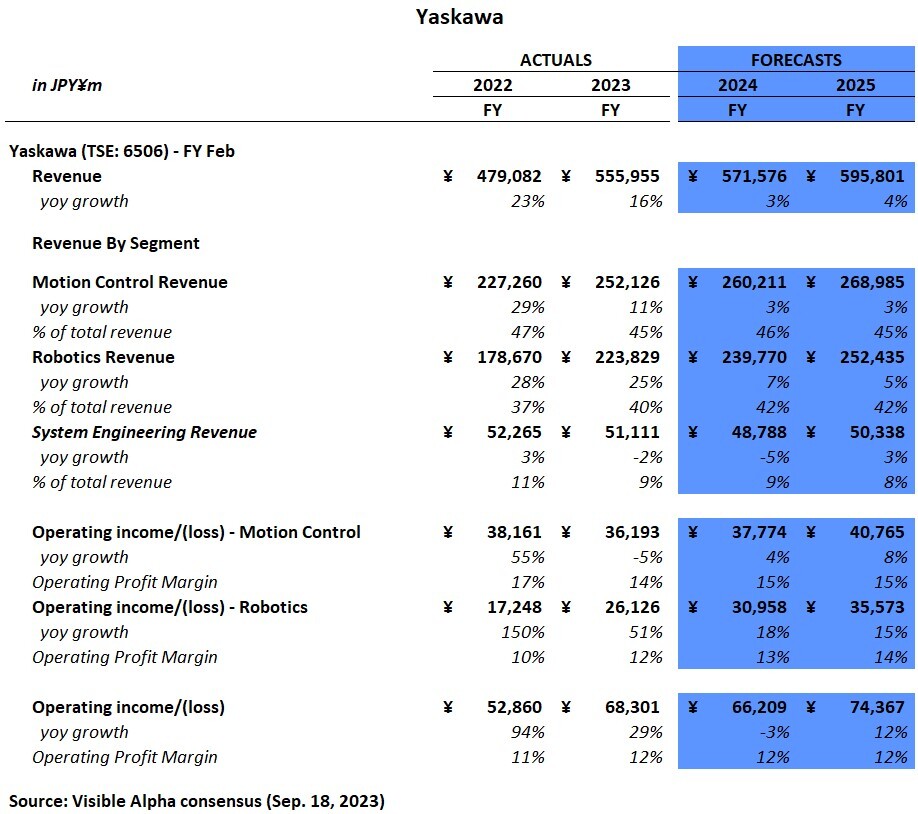

Yaskawa: Japan-based Yaskawa (TSE: 6506) is a leading manufacturer of motion controls and robotics for the automobile, semiconductor, food and biotech industries.

Similar to ABB, Yaskawa is projected to generate a 12% margin, driven by its higher margin Robotics and Motion segments. While the revenue and profitability growth of its robotics segment is expected to outperform other segments, the company overall is expected to see mild growth till FY 2026. Could longer-term expectations be overly cautious given the shift toward AI?

Figure 7: Yaskawa segment revenue and income consensus

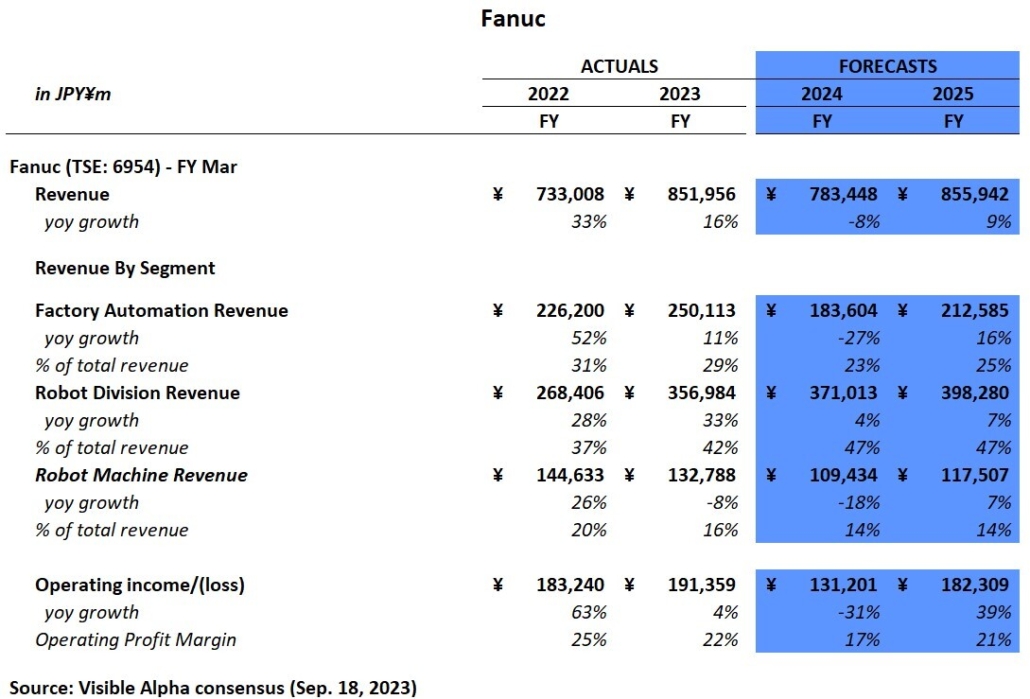

Fanuc: Japan-based Fanuc (TSE: 6954) is a global leader in factory automation and robotics. Fanuc is the clear leader for profitability in automation and robotics with over 20% operating profit margins expected. With enhancements to robotics and factory automation, could Yaskawa, ABB and Kuka (Midea) catch up to Fanuc? Could Fanuc’s projected margins return to their FY 2022 level of 25%?

Figure 8: Fanuc segment revenue and income consensus

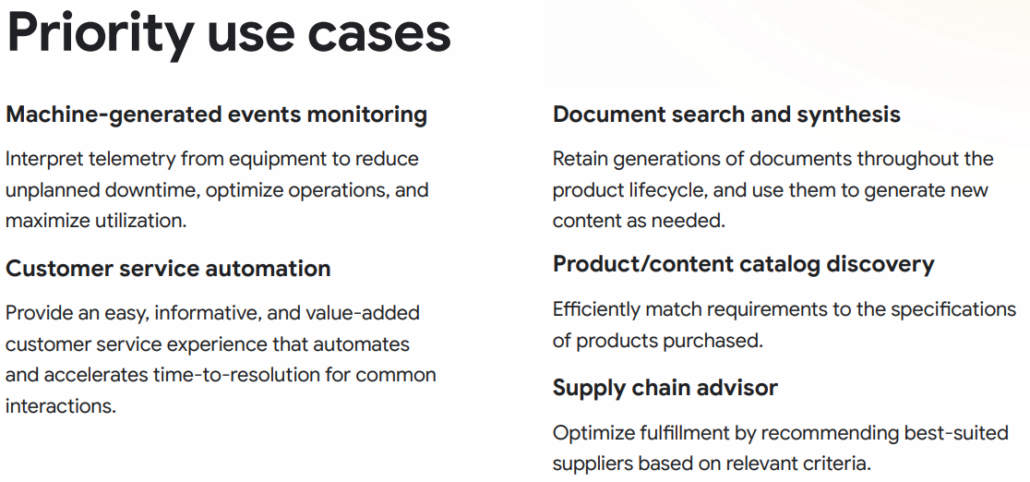

Midea (Kuka): Midea (SZSE: 000333) is an electrical appliance manufacturer based in China. Leading German-based robotics firm, Kuka, was acquired by Midea in 2016.

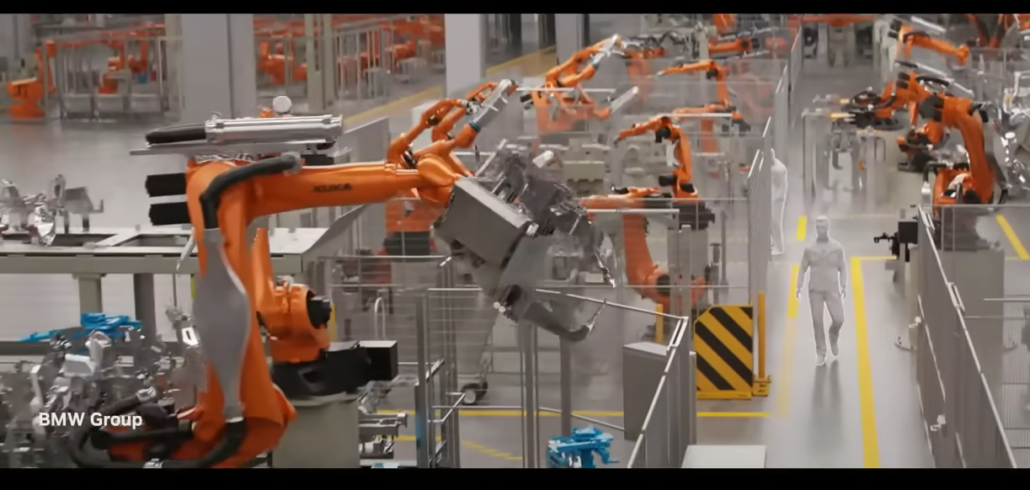

Figure 9: BMW factory simulation using Kuka robots

Source: Nvidia Keynote at Computex 2023

Kuka’s margins remain well-below both Midea’s 10% margin and the 15-20% ranges of competitors. Will parent company Midea be able to drive margin expansion at Kuka?

Figure 10: Midea (and Kuka) segment revenue and income consensus