In our weekly round-up of the top charts and market-moving analyst insights: Tesla’s Model 3 and Model Y are expected to continue contributing the most to Tesla’s overall sales; Carvana’s used car sales are projected to move even lower; Coinbase is not expected to recover lost revenue any time soon; and Nerdwallet’s credit cards segment is poised to help drive sales growth.

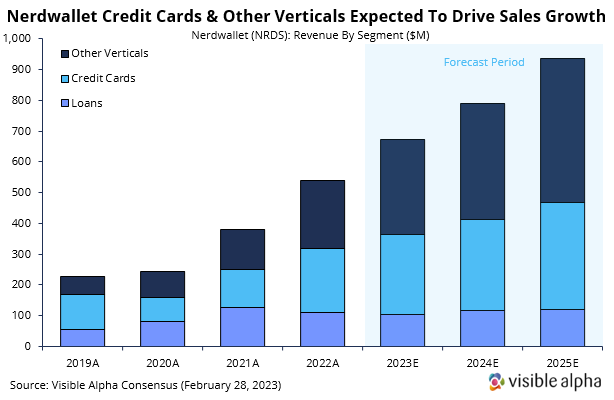

Tesla’s Model 3/Y Will Contribute Majority of Sales Until 2028, Say Analysts

Analysts believe the majority of Tesla’s (TSLA) sales will come from Model 3 and Model Y until 2028, according to Visible Alpha consensus. The company is planning to launch several new models in the coming years, such as the CyberTruck, Semi-Truck, Roadster, and a compact entry-level “Model 2” which is expected to be priced around $25K.

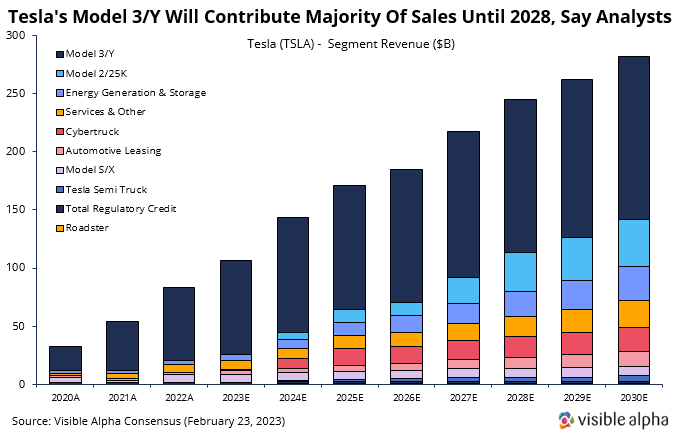

Carvana Car Sales Estimates Crash as Company Cuts Advertising Spend

Carvana’s (CVNA) retail used car sales estimates were slashed again by analysts following weaker-than-expected 4Q22 results due in part to lower advertising spending. The company also announced a plan to reduce total expenditures by $1B over the next 6 months.

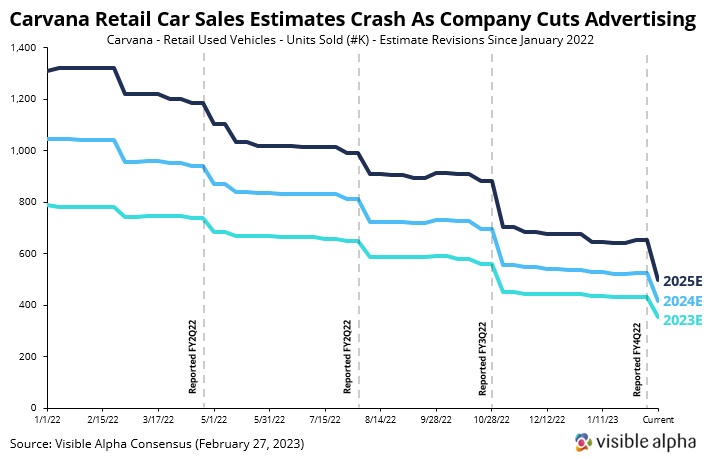

Coinbase Not Expected to Recover Lost Revenue Anytime Soon, Say Analysts

Coinbase (COIN) revenues are expected to remain below 50% of all-time highs until 2025, according to Visible Alpha consensus. Macroeconomic and regulatory uncertainties have some analysts concerned they may negatively impact transaction volumes, and staking & blockchain rewards revenue.

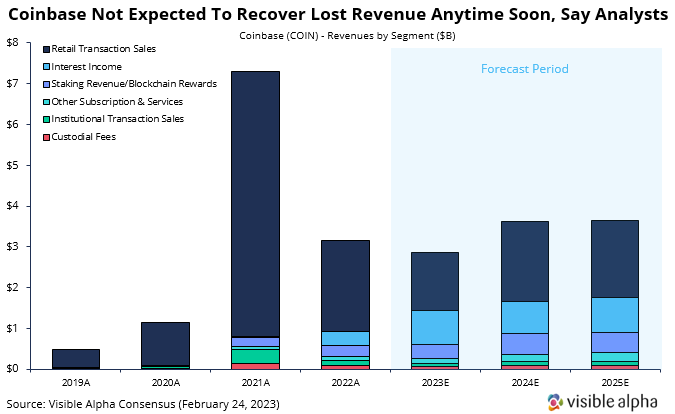

Nerdwallet Credit Cards & Other Verticals Expected to Drive Sales Growth

Nerdwallet (NRDS) is expected to see its credit card & other verticals segments drive sales growth going forward as the company sees benefits from an improved UX and new products such as a revamped auto insurance marketplace. Analysts believe Nerdwallet will double segment sales in other verticals by 2025, according to Visible Alpha consensus.