Generative AI chatbots have taken the world by storm, but who will benefit from their usage? The market is full of debate about how these chatbots may disrupt search, user behavior, payments, and productivity. On top of this, the FTC has begun an investigation into how ChatGPT and OpenAI may threaten the privacy and data of consumers. Given the surge of interest and investment in generative AI, we focus here on a few examples of how AI chatbots may start to impact company fundamentals.

In this report, we show Expedia (NASDAQ: EXPE) and Amazon.com (NASDAQ: AMZN) revenues that may begin to benefit from generative AI chatbots. Visible Alpha has identified some of the critical line items in a company’s financial model to monitor, which may provide an early read into the trends. The dispersion of estimates and number of sources can reveal debates and changing trends in a company’s fundamentals, which can help to uncover potential new alpha not yet fully captured in the stock price.

What are plugins?

According to OpenAI, plugins connect ChatGPT to third-party applications. These plugins enable ChatGPT to interact with APIs defined by developers, enhancing ChatGPT’s capabilities and allowing it to perform a wide range of actions. Plugins enable ChatGPT to do things like:

-

- Assist users with actions; e.g., booking a hotel, shop for food, buy clothing

- Retrieve real-time information; e.g., sports scores, stock prices, the latest news

- Retrieve knowledge-base information; e.g., company docs, personal notes

Source: https://platform.openai.com/docs/plugins/introduction (July 6, 2023)

Companies in the consumer space may benefit from the capabilities of generative AI to assist users with actions by reducing noise and presenting users with specific goods and services they want to buy. Public and private companies, like Instacart, Shop.com, Shop, Amazon.com, Expedia, Kakaku.com, DoorDash and Kayak all currently have plugins on ChatGPT-4.

Background of capabilities

Users can access ChatGPT-3.5/4 and Google Bard generative AI tools by PC or mobile. The user’s experience is different depending on where and how the prompt is made. On a PC, ChatGPT-4’s beta version offers more capabilities than on mobile and seems to offer more capabilities than Google Bard, due to the many beta plugins available in ChatGPT-4 on a PC. Currently, ChatGPT-4 subscribers can access all of the plugins, but there is a waitlist for developers. According to OpenAI, “if you are a developer who has ChatGPT Plus and you are interested in making a plugin, you will need to fill out a form and join a waitlist.”

Through its beta features, ChatGPT-4 allows users to enable up to three plugins at a time on a PC. There are currently hundreds of plugins in ChatGPT-4 available for users to save and then enable as part of the three that can be run in their chats. Through ChatGPT-4, users can align their plugins to the type of prompt they are making. For example, if a user wants to book a hotel, they can start a new chat, then directly enable the Expedia plugin. In the chat, the user then adds a prompt, “hotel and flight Maui”, for example. ChatGPT-4 will automatically pick up the Expedia plugin and sync with ChatGPT-4 on PC, but not on mobile like Bard can with Google Search.

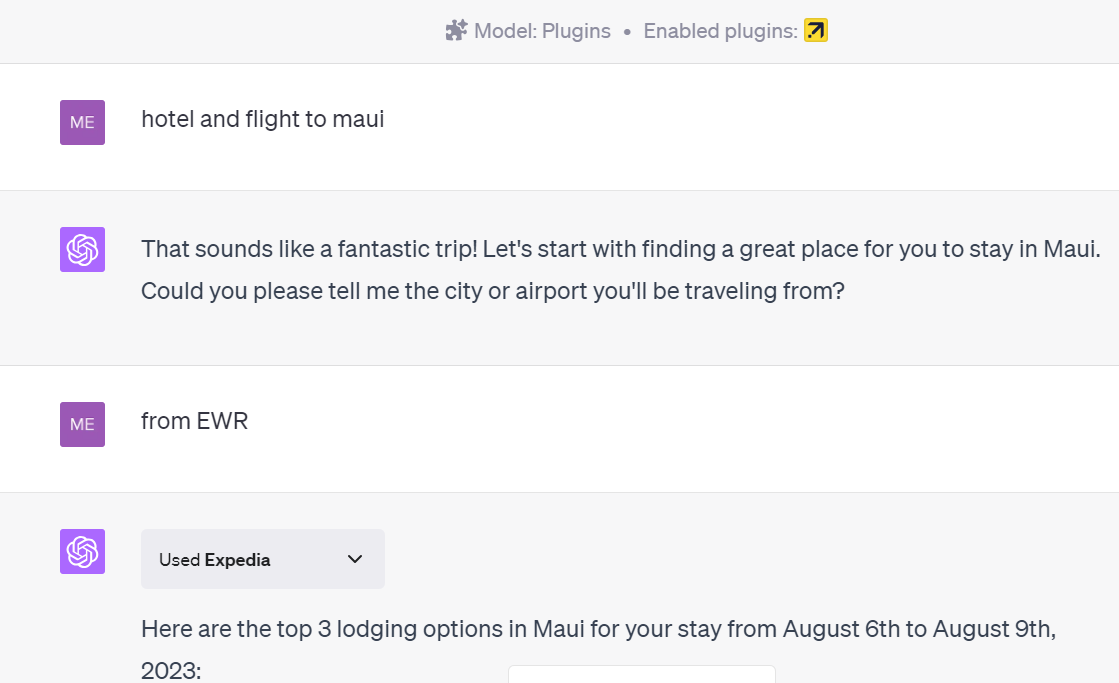

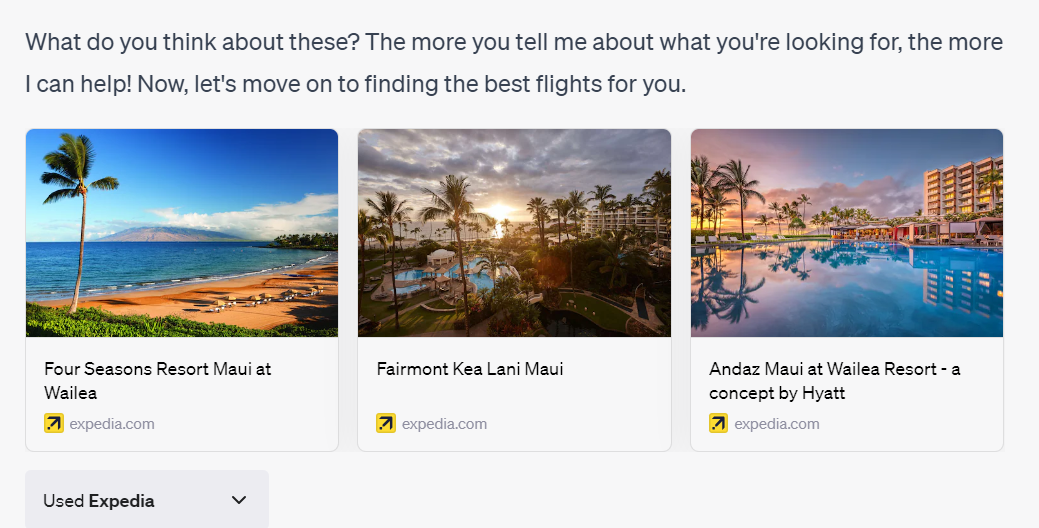

Figure 1: ChatGPT-4 Expedia plugin prompt and results

Source: ChatGPT-4 with Expedia plugin (July 11, 2023)

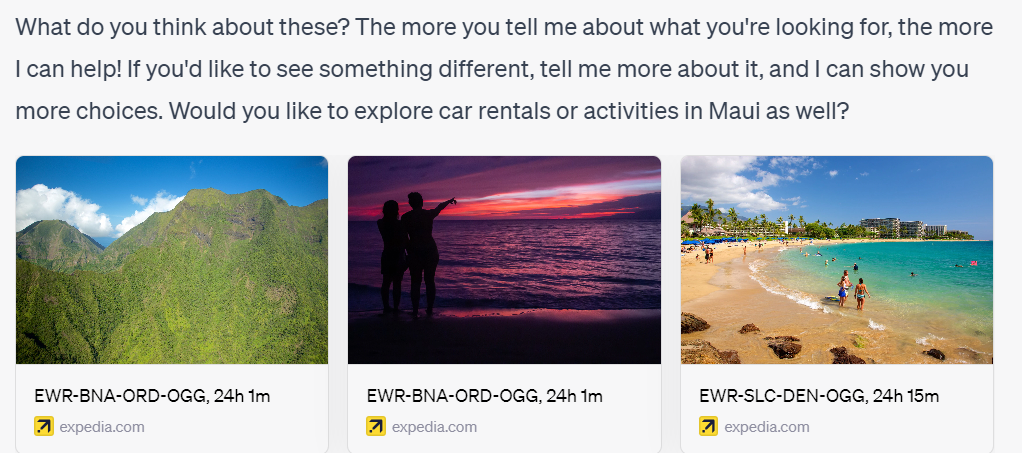

The user can then simply link directly and make a purchase. The Expedia plugin also surfaces prices, reviews, duration and details, which help keep the user in the specific plugin/application. How will this plugin impact revenues and operating profit at Expedia?

Figure 2: Expedia’s revenue breakdown

Source: Visible Alpha consensus (July 12, 2023)

Bard seems to have better basic functionality on mobile, given its sync to Google Search and also more timely data, since ChatGPT results do not automatically incorporate information beyond September 2021 (enabling a specific plugin is required). For example, an iPhone user can ask Bard for hotel recommendations and then directly access a link to booking.com to make the reservation in a mobile environment. In ChatGPT on mobile, this connection between the prompt results and a transaction can not currently be done. ChatGPT-4 users currently can not access the plugins on mobile.

If the user is looking to host a party or make a specific recipe, the Instacart plugin will automatically upload a shopping list to a cart to be purchased and delivered or picked up, in one seamless interaction. However, these actions still cannot be done on ChatGPT or Bard for mobile. Plugins are currently not available in Google’s Bard, but Bard does link to Google. At the Google I/O conference in May, the company announced that they will integrate Google applications/services and be adding “tools,” similar to plugins. It’s not clear yet exactly what the tools will do.

Amazon

With Amazon’s Prime Day occurring this past week, we wanted to think about the potential impact to Amazon’s numbers as the generative AI chatbots potentially take hold in the future. How may these impact consumer behavior and drive not only more spending, but also more efficient, faster spending?

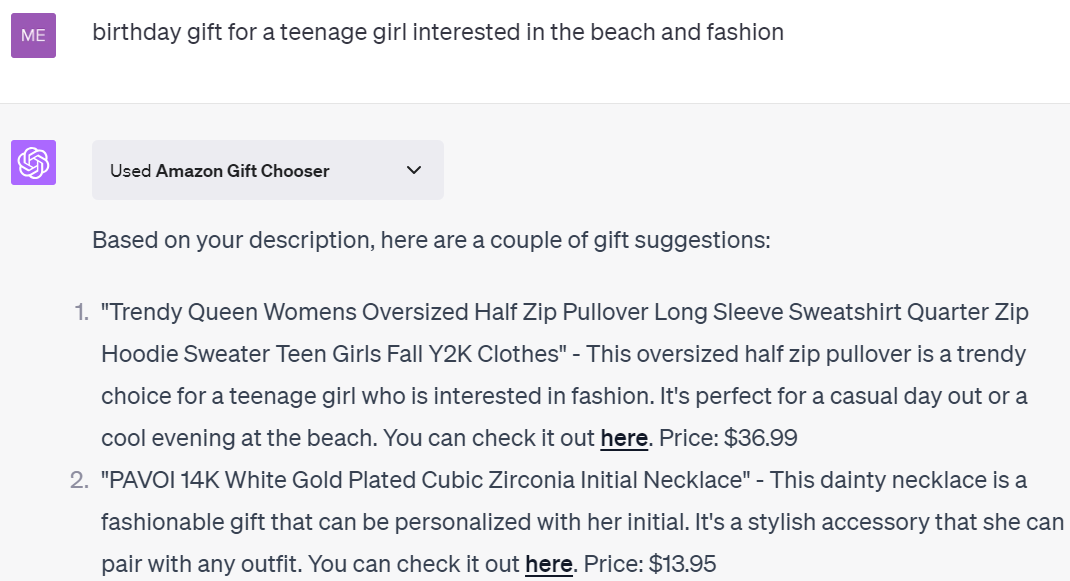

Figure 3: ChatGPT-4 Amazon Gift Chooser plugin prompt and results

Source: ChatGPT-4 with Amazon Gift Chooser plugin (July 7, 2023)

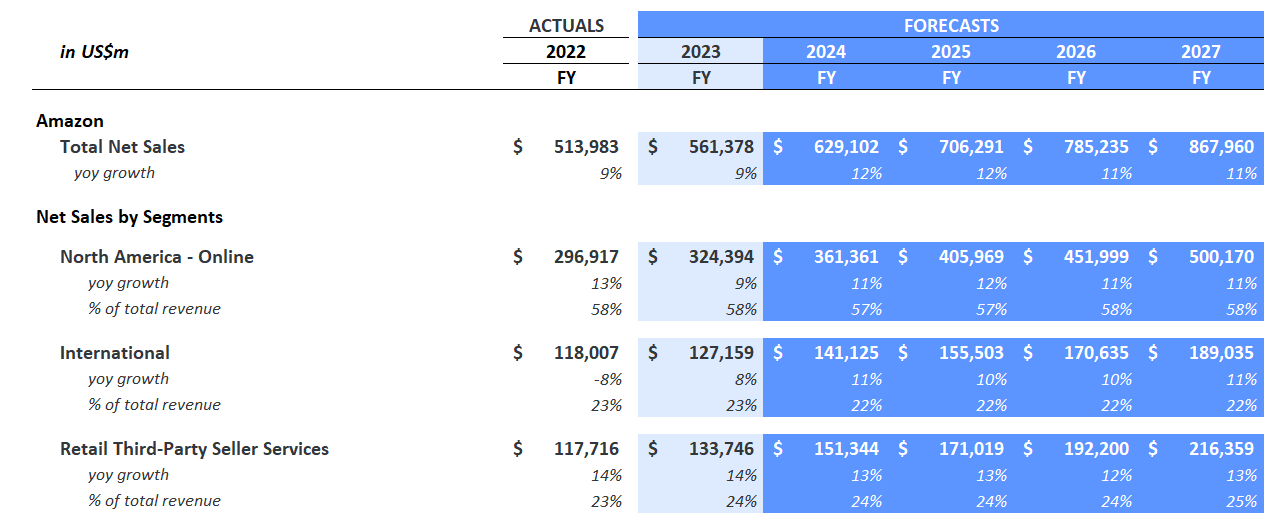

Figure 4: Amazon revenue breakdown

Source: Visible Alpha consensus (July 11, 2023)

Currently, the retail third-party seller services segment is expected to expand by almost $100 billion from $118 billion at the end of 2022 to $216 billion by the end of 2027. This business is expected to make up 25% of Amazon’s total revenues by the end of 2027.

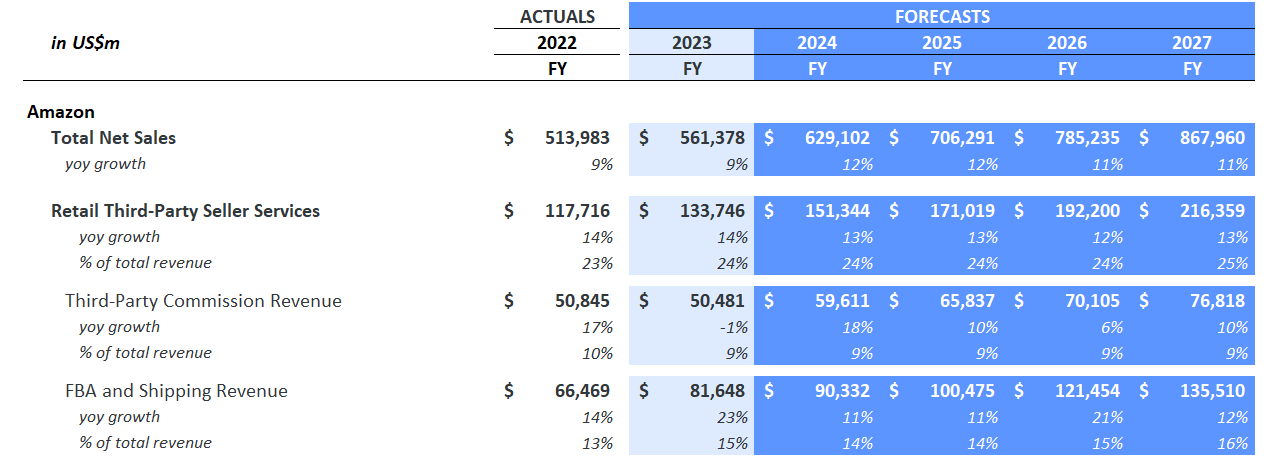

Impact to third-party seller services revenue: With greater curation, Amazon can align consumers more quickly to items they want or need to buy. Amazon’s plugin focuses on gift giving and may help drive third-party seller services revenues, including shipping, FBA, and commissions. Visible Alpha has a few sources modeling the third-party line items, including a break out of commission and FBA/shipping revenues. These estimates seem to be worth watching and may serve as a way to capture and gauge how generative AI may be influencing and growing their third-party segment.

Figure 5: Amazon third-party seller services revenue breakdown

Source: Visible Alpha consensus (July 11, 2023)

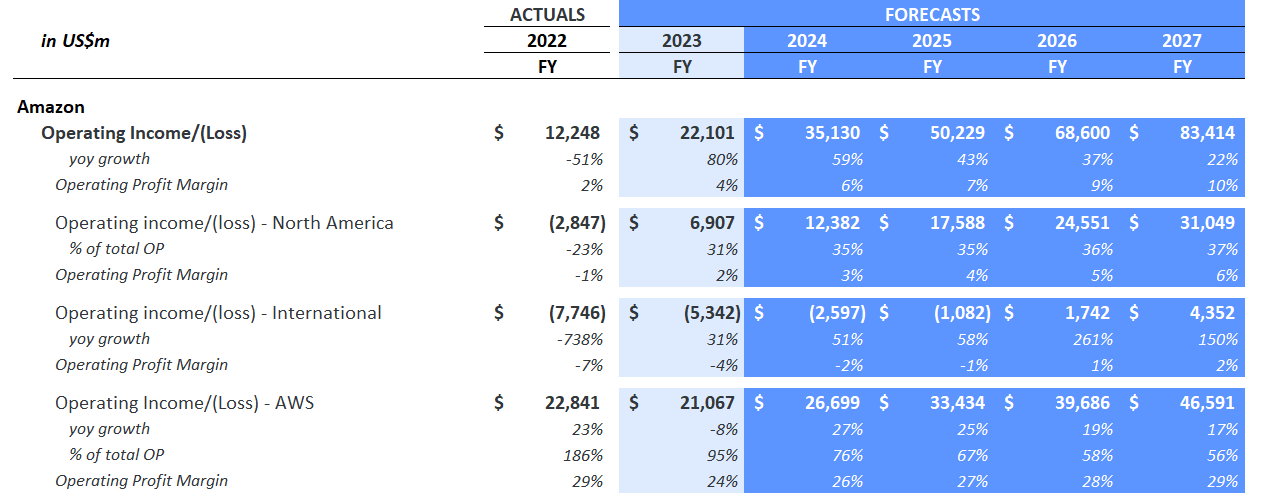

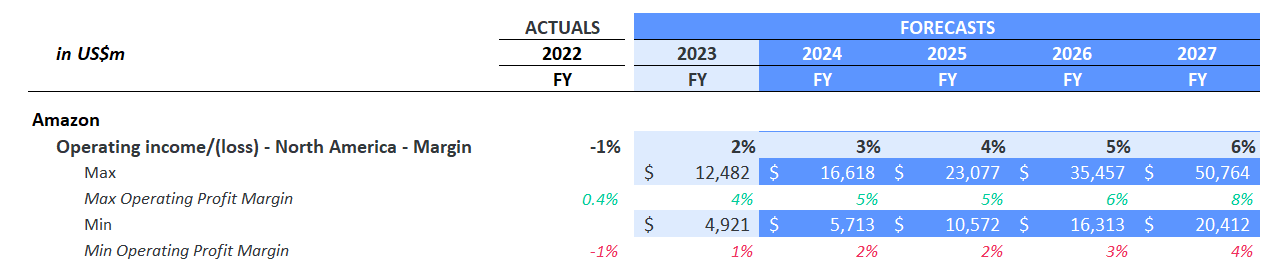

The profitability of this segment could expand as services revenues scale further, particularly in the North America market. North America operating profit margin is expected to expand 680 basis points and go from an operating loss at the end of 2022 to 6% at the end of 2027, surpassing historic highs of 5%, but still substantially below AWS’s operating profit margin of 28.5% at the end of 2022. Internationally, Amazon generated a -7% operating loss margin at the end of 2022 and is projected to improve it to 2% by the end of 2027. Can applications of generative AI help drive Amazon’s retail business in the U.S. and abroad to higher margins?

Figure 6: Amazon operating profit breakdown

Source: Visible Alpha consensus (July 11, 2023)

There is significant debate about the trajectory and size of these margin improvements in Amazon’s North America business. It will be interesting to see how chatbots may help to drive revenues from third party sellers. The most optimistic analyst is expecting the North America business to generate an ambitious 8% operating profit margin, over 200 basis points above consensus of 6% and $20 billion ahead of the $30 billion of operating profit expected by analysts by the end of 2027. The most conservative analyst is baking in a lower 4% operating profit margin and is expecting revenues to be $10 billion below consensus estimates of $30 billion.

Figure 7: Amazon operating profit margin dispersion

Source: Visible Alpha consensus (July 12, 2023)

The bottom line

ChatGPT-4’s plugins provide a sneak peek into the next generation of innovation to come. While it is early days, generative AI has the potential to make consumers and businesses more productive and effective with more comprehensive, curated responses. By syncing the results to actual products and services, ChatGPT-4 plugins may start to change consumer behavior, leading to potential changes in the digital advertising space, and how and where revenues are generated.

Coming into this earnings season, we are looking forward to hearing updates from companies about their generative AI strategies, chatbot impact, and where we may see AI start to impact the fundamentals of their business models. Will AI drive higher revenues, increase margins, and help companies overall become more profitable and productive?