AI and Customer Impact

The integration of generative AI has presented both significant opportunities and challenges for companies to lock in sales of their products and services more quickly and to address customer questions and complaints. At a micro level, AI innovations are emerging within companies as bots, summaries, curation, and personalization. Looking more broadly, AI is also enhancing search functionality and capabilities in new, subtle ways.

Generative AI chatbots, like ChatGPT, seem to be expanding an app’s capabilities by synthesizing business processes and integrating customer questions and needs into a workflow solution. While human interaction is still critical, chatbots are a useful port of entry. As these chatbots potentially evolve into virtual assistants, the monetization model of search, ads, and traffic may be disrupted, as lines blur.

Travel and AI

- Online travel appears to be a compelling area for innovations from AI to potentially give companies a competitive advantage. Integrating this technology to meet customer needs, speed up engagement, and improve productivity, all point to supporting stronger fundamentals at a time when the macro backdrop may be softening.

- In particular, applying AI to the vacation rental market is an area that looks particularly compelling. Over the past 12 months, both Expedia (VRBO) (NASDAQ: EXPE) and Airbnb (NASDAQ: ABNB) have integrated AI into their user experience. These AI enhancements look poised to support sales and customer loyalty.

- While the traditional search experience still surfaces sponsored links that are paid for by advertisers, AI seems to be improving the depth of information in the results. Expedia spends over 3.5x more than Airbnb on sales and marketing expenses and this is expected to continue to increase. This significant spending for its ads and surfaced properties seems to be benefiting from the AI enhancements in Bing and Google. Both vacation rentals and hotels pop up for Expedia, but do not surface Airbnb properties or ads. With Expedia ads and properties clearly surfaced in both traditional Google Search and Bing’s Copilot, could Expedia’s VRBO take share from Airbnb?

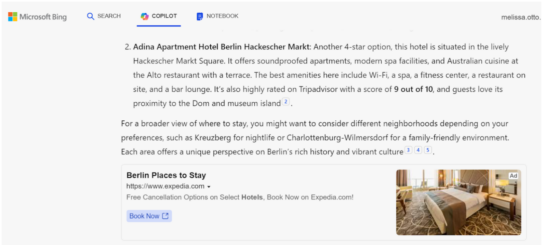

Figure 1: Places to stay in Berlin in Bing Copilot

In this search about places to stay in Berlin using Bing’s Copilot, the AI assistant returns a few detailed suggestions. Tripadvisor reviews are integrated into the descriptions. An Expedia ad appeared at the end of the Copilot summary. The Copilot offered other links to curate the search.

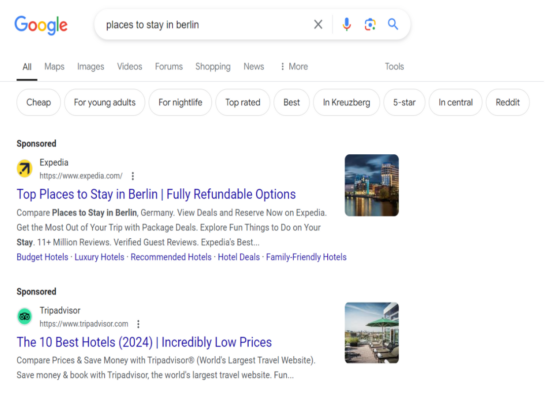

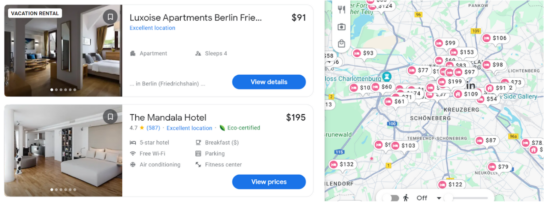

Figures 3 and 4: Places to stay in Berlin in Google

In a similar Google Search about Berlin, an Expedia-sponsored ad appeared at the top of the results summary. Within the list of search results, both hotel and apartment (VRBO) are shown to users together. Google and Tripadvisor reviews are integrated into the property descriptions and shown on a Google map.

Expedia launched its OneKeyCash loyalty program, which rewards customers for spending within the Expedia ecosystem. The rewards can be particularly generous for longer VRBO rentals or long-haul flights. It is worth highlighting that Airbnb does not have a loyalty rewards program. This new incentive program may lure users to book through Expedia’s VRBO, instead of Airbnb, to get rewards. In addition, since VRBO properties surface in search results, a user that comes in randomly through search may be locked in with the rewards program.

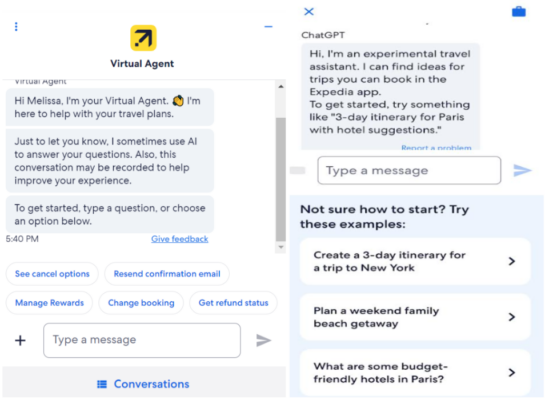

In tandem with the OneKeyCash program, Expedia’s Virtual Agent seems focused on solving customer service issues. There are a number of pre-populated buttons with specific suggestions to direct the chat. Along with the actual rewards, this chatbot helps users answer questions and address feedback, which may help with sales retention and brand loyalty. One area that may be particularly beneficial is that users can address loyalty rewards issues via the Virtual Agent.

In addition to the Virtual Agent, Expedia’s ChatGPT travel assistant within its app gives users lots of information about destinations and enables them to curate details about their travel itineraries. However, users cannot make bookings through the travel assistant and must still transact in the actual Expedia app or website. Perhaps this will change in the future, as Expedia’s plugin within ChatGPT4 enabled users to create travel itineraries and link directly to book hotels, flights, and experiences.

Figures 5 and 6: Expedia’s Virtual Agent and Chat GPT Travel Assistant

Expedia’s AI Takeaways from Q2 2024

This quote from the earnings call captures the observations about AI, loyalty, and the company’s potential to drive growth going forward. In addition to the fundamental efforts Expedia is making to its own business model, it also appears to be benefiting from the AI-related innovations happening within the broader Search tools in Bing and Google.

On the Q2 2024 call, Expedia management explained,

“We’re capitalizing on our tech investments from the last few years, while at the same time, digging into what product capabilities and configurations we need to strengthen VRBO and the Hotels.com brands. We’re getting surgical in identifying drivers of repeat behavior in addition to loyalty and app usage, whether it’s burning OneKeyCash or adopting AI-enabled products like price predictions.”

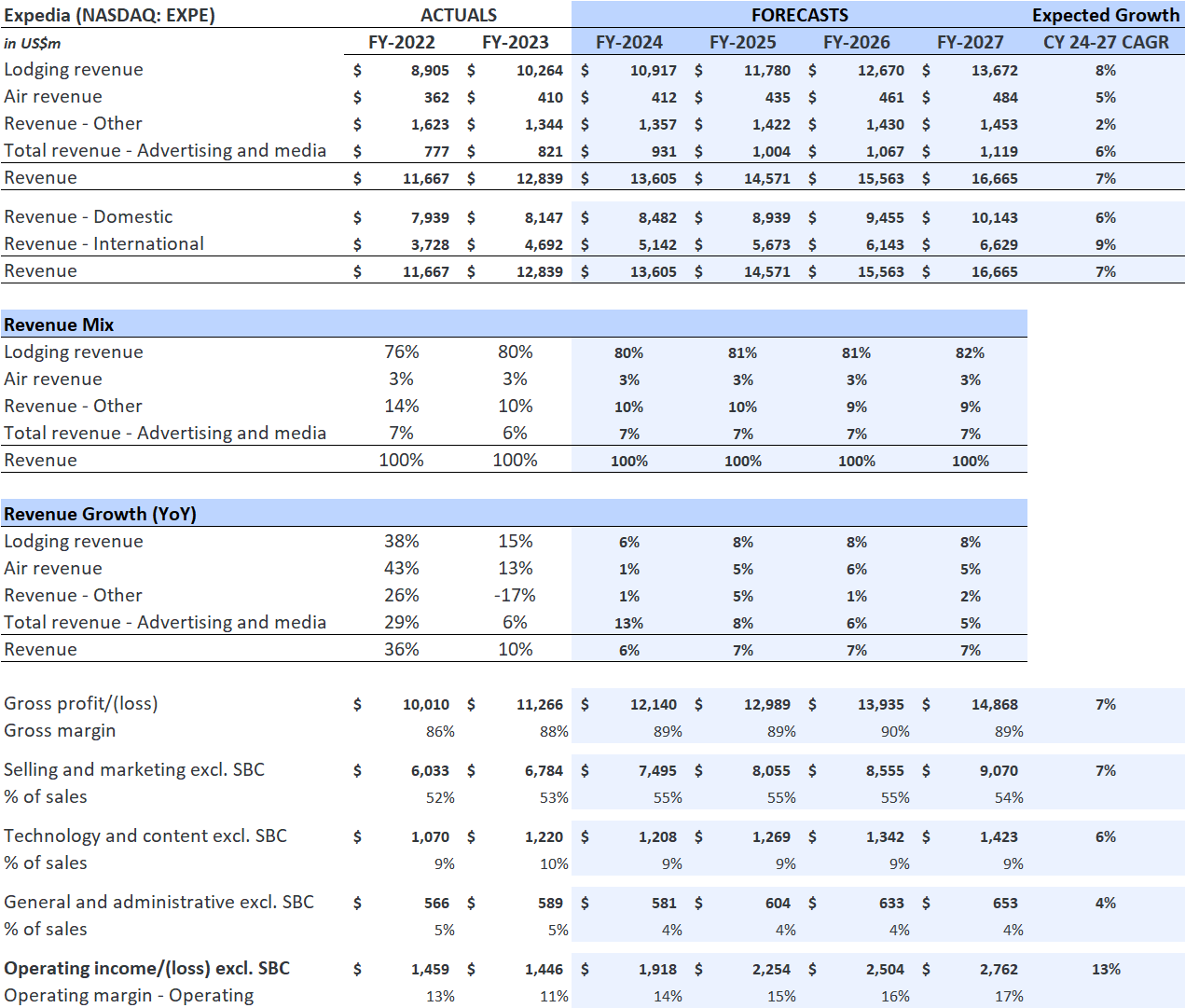

According to Visible Alpha consensus, analysts are currently expecting Expedia to see its operating profit margin improve from 13% in 2022 to 17% by 2027, driven by 300bps of gross margin improvement. Excluding stock-based compensation, consensus expects Expedia to optimize the right mix of selling/marketing, technology/content, and general/administrative costs. We are watching the role that AI will play in both driving sales growth and supporting cost reductions at the gross and operating profit lines.

Figure 7: Expedia

Airbnb’s AI Takeaways from Q2 2024

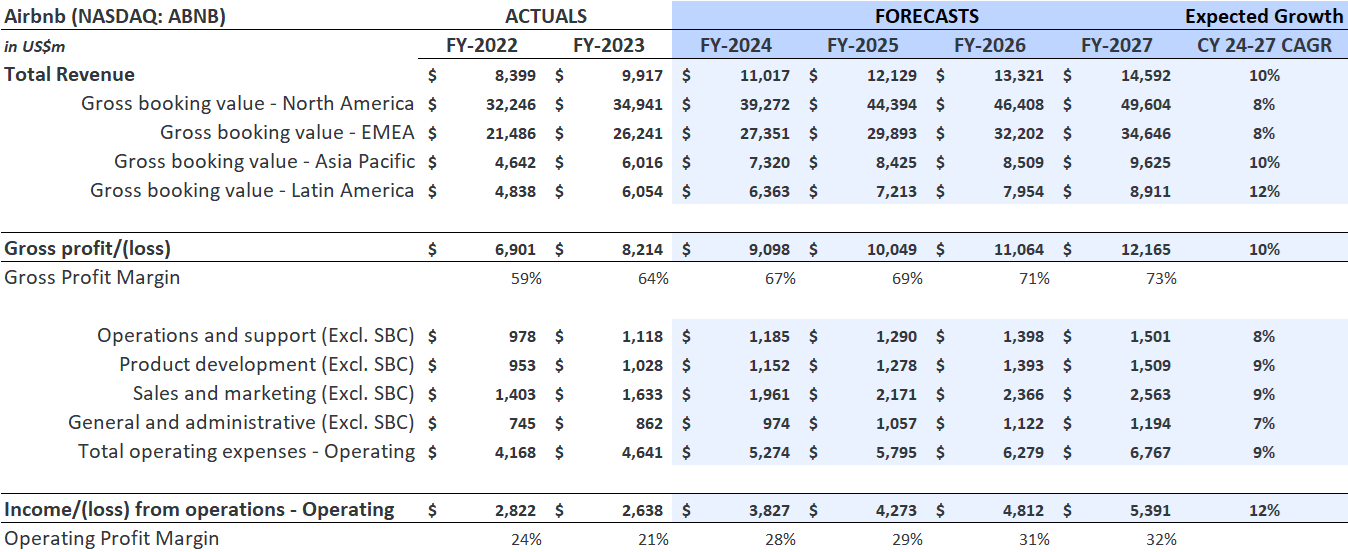

While Expedia has moved faster, Management at Airbnb is taking a different approach related to AI. In their earnings call, Management highlighted how the company is taking a longer-term perspective and developing an AI travel concierge application that is native to the model. Currently, both Expedia and Airbnb both appear to spend just over a $1 billion on technology and product development expenses. As the company seems to be prioritizing long-term development, questions emerge about how this may impact the company’s cost structure and outlook. Could this threaten the future trajectory of the FY 2027 consensus operating profit margin of 32%?

Airbnb’s acquisition of GamePlanner.AI may give the company an edge in developing its travel concierge app native to the model. There is debate about whether a travel concierge AI app will give Airbnb a competitive advantage further out or, ultimately, be a disadvantage given the time and, possibly, cost it may take to develop?

On the Q2 2024 Airbnb earnings call, management discussed their AI approach.

“And so what we need to do is we need to actually develop AI applications that are native to the model. No one has done this yet.

So that’s one of the things that we’re working on. And I do think Airbnb will eventually be much more than a search box where you type a destination, add dates, and find a listing. It’s going to be much more of a travel concierge. It’s having a conversation, learning, and adapting to you. It’s going to take a number of years to develop this. And so it won’t be in the next year that this will happen. And I think this is probably what most of my tech friends are also saying, is it’s going to just take a bit more time.”

According to Visible Alpha consensus, analysts are currently expecting Airbnb to see its operating profit margin steadily increase from 24% in 2022 to 32% by 2027, driven by 1400bps of gross margin improvement. Excluding stock-based compensation, consensus expects Airbnb to increase costs at a slower pace than revenues. How will the multi-year development cost for its AI initiative potentially impact the longer-term operating profit line?

Figure 8: Airbnb

Final Thoughts

AI is driving better travel lodging results by synthesizing more information in Bing and Google for users. It seems to be compounding the need for advertisers to stay front and center with their ads and the user’s engagement with their products. As the race to remain relevant to travelers continues, Expedia’s VRBO and Airbnb are approaching AI and the customer experience differently.

With the travel outlook becoming more challenging, the combination of saving the customer time with AI tools and incentivizing them to remain loyal with rewards may give Expedia an edge. However, longer term, Airbnb’s travel concierge may reimagine online travel as we know it and bring a new generation of innovation to their business model, provided it does not cost too much or take too long. The situation is still in flux as these companies invest in AI initiatives and try to triangulate these efforts to grow their existing revenue and profit streams.