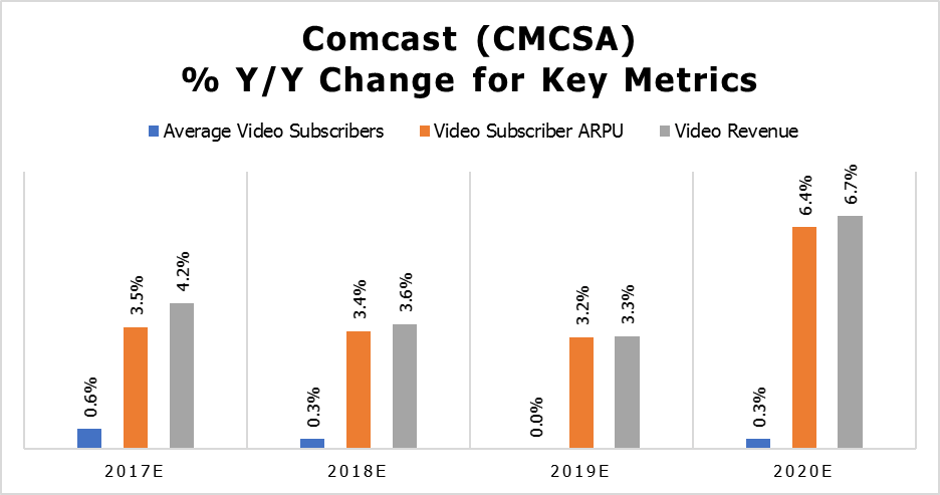

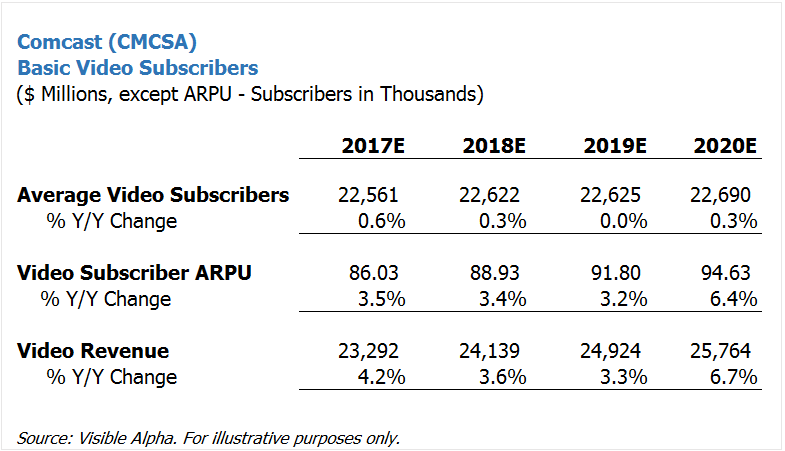

Comcast analysts have become increasingly optimistic on the company’s video division over the last 6 months. While still declining, analysts think the rate of decline will be much slower than expected (declining from 4.2% growth in 2017 to 3.3% in 2019). For example, for the fiscal year 2019, Visible Alpha revenue consensus for Comcast’s video segment has been revised up by 280 basis points in the last 6 months (0.5% year over year growth compared to 3.3%). The revenue growth is expected to be driven by an increase in Average Revenue Per User (ARPU), demonstrating Comcast’s increasing ability to monetize its userbase. Analysts estimate ARPU to increase almost 10.5% by 2019 compared to the $86 video ARPU seen in 2016. The number of subscribers is expected to remain flat.

Source: Visible Alpha. For illustrative purposes only. Learn more about Visible Alpha.

The increase in estimates seems counter to underlying industry trends. Basic video is facing increasing competition from several a la carte services including Netflix and Amazon, which should put more pricing pressure on large cable bundles.

Two key factors may be the root of this new optimism.

- Comcast reported the first annual increase in net basic video subscribers in the past decade with a net gain of 161K basic video subscribers for full year 2016, up 0.3% from 2015.

- Comcast’s Management highlighted the success of the X1/Xfinity video cable box/service on the company’s investor conference call in late January 2017.