Costco reported 4Q17 earnings results on October 5th, and the stock reacted with an almost 9% decline in the following days. As we detailed in a prior blog post, bears remain concerned about Costco’s membership trends amid increased competition from Amazon and other grocery retailers. 4Q results supported some of these concerns as gross margin, membership growth, and membership renewal rates were below expectations.

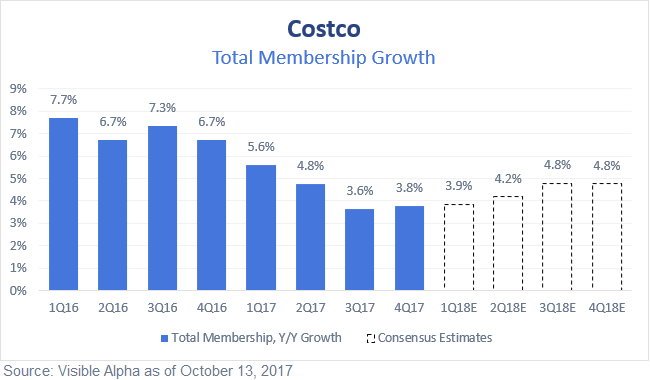

Investors focused specifically on two membership metrics. The first is membership growth, which has slowed from high-single digits in 2016 to low-single digits today. Interestingly, despite recent datapoints, Visible Alpha’s consensus data shows that analysts remain bullish that membership growth will reaccelerate in the following fiscal year.

Discover how you can go beyond consensus with Visible Alpha.

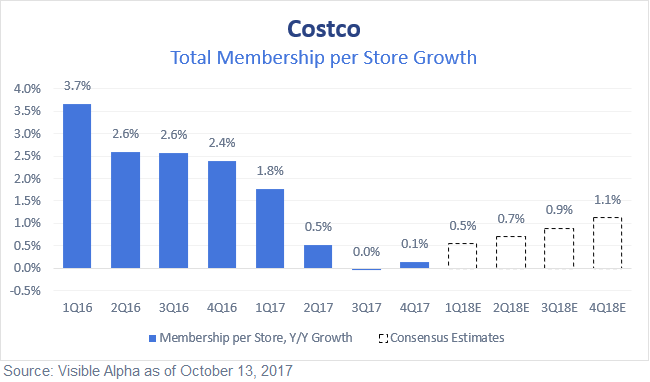

Secondly, investors have also taken a closer look at another, less-discussed metric – membership per store. This figure has been slowing for some time, and was essentially flat in the last two quarters. However, our consensus data on this metric shows a similar story to total members – analysts expect this metric to reaccelerate in the coming quarters.

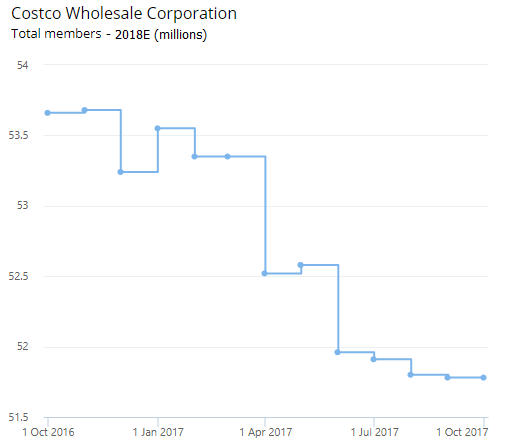

While analysts remain positive, revision data shows why the stock has moved down and why the bears’ concerns have grown louder. Total membership for 2018 has been revised downward by 3.5% over the last year. And with competition within the grocery space seemingly growing each day, membership data will be increasingly scrutinized going forward. Use Visible Alpha to find consensus estimates on detailed membership data like executive members, total cardholders, and membership per store.

Source: Visible Alpha as of October 13, 2017