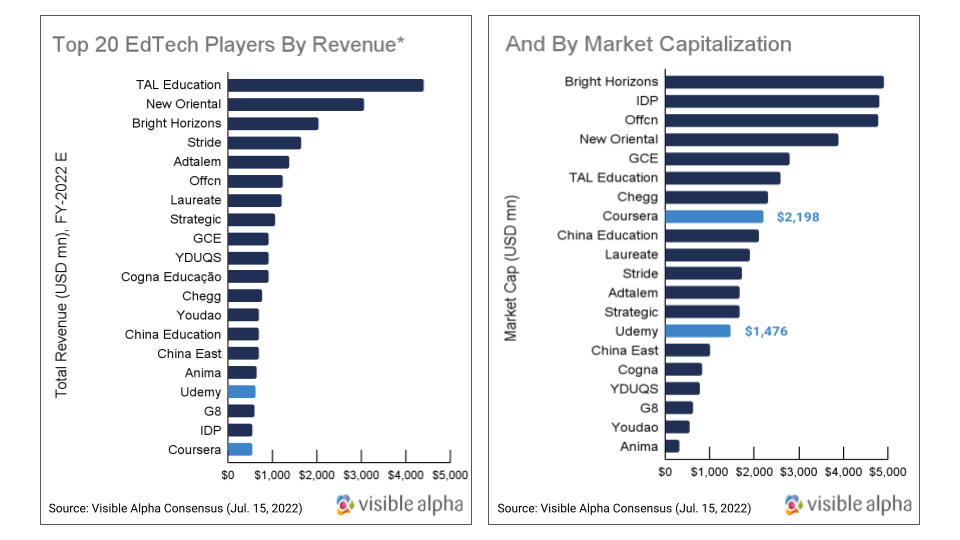

The Covid-19 pandemic brought strong momentum to the revenue growth of the EdTech industry, which expanded by 14.6% in 2021, according to Visible Alpha consensus. Furthermore, analysts project the aggregate of these companies to grow at a CAGR of 3.9% between 2020-25 to USD32 bn.

*Based on the 34 companies covered by Visible Alpha Insights

Over the last few years, the online education industry has seen a massive influx of players. In this blog, we look at two recently listed U.S. EdTech companies; Coursera (COUR_US) and Udemy (UDMY_US). We draw comparisons between the two players as they make a strategic shift away from the consumer segment to maximize profits. Both companies are very similar in their business model and operations compared to other EdTech platforms – both have a B2B and B2C business model, providing courses focusing on upskilling and reskilling. Moreover, when you look at their user bases, both companies cater to a mix of students, entry and mid-level professionals, academic institutions, governments, and businesses.

Financial Performance

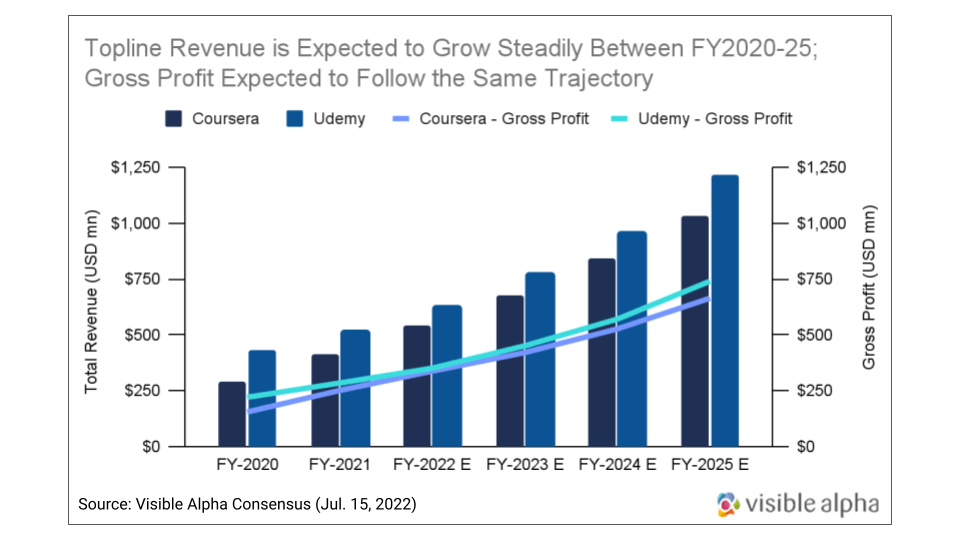

Coursera and Udemy saw their revenue grow by 59% and 56% in 2020. However, growth has been slowing for both companies; analysts expect Coursera’s revenue to grow by 31% YoY in 2022 and Udemy to grow by 21%, a significant drop compared to the impressive growth in 2020 when the pandemic began.

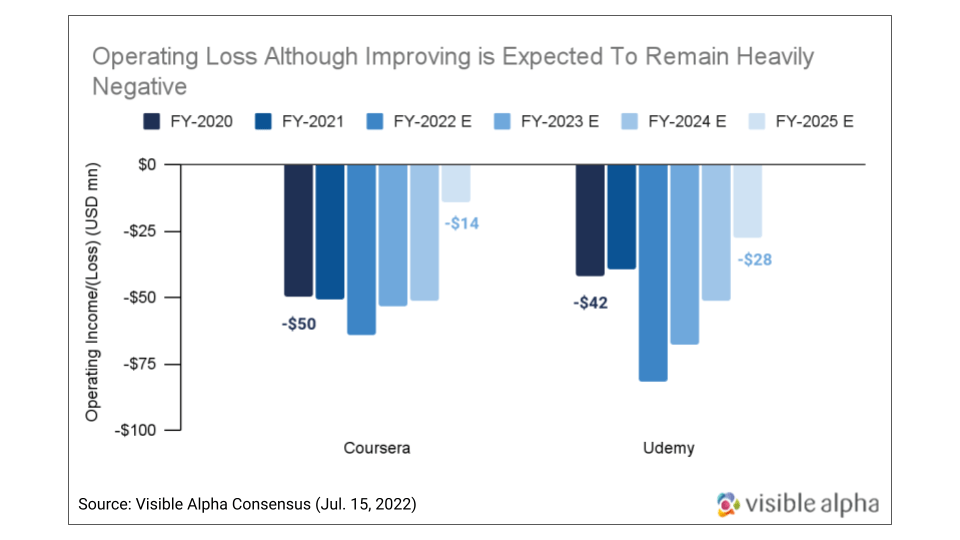

Analysts project gross profit to grow by 34% YoY for Coursera and 23% for Udemy in 2022. However, total operating expenses are expected to grow at approximately the same pace – 33% YoY for Coursera, and 34% YoY for Udemy in 2022, leading to large but declining operating losses for both companies.

Revenue Segments

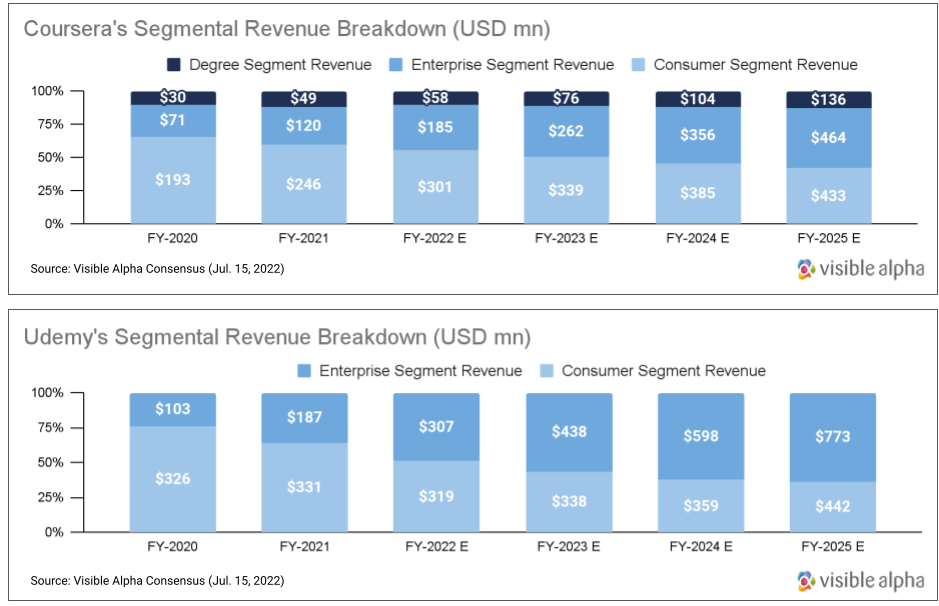

The two main revenue streams for both Coursera and Udemy include the consumer and enterprise segments. Coursera has a more diversified revenue stream because of its degrees segment, which, based on analyst estimates, accounts for 11% of total revenue and will grow 18% YoY in 2022.

Slowing Consumer Growth

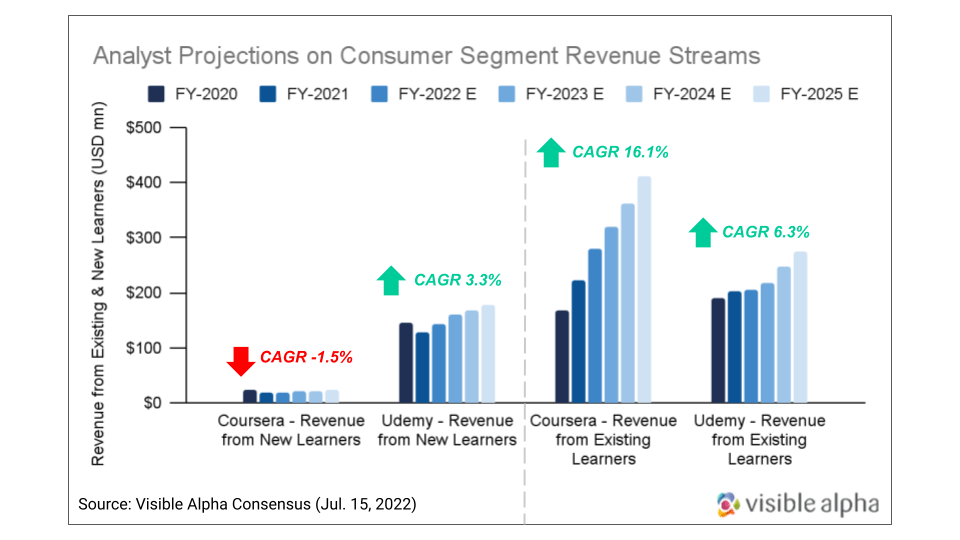

Within the consumer segment, Udemy beats Coursera in attracting new users. With its vast library of 196,000 courses and low cost per course, analysts expect Udemy’s revenue from new consumers to increase by 10.8% YoY in 2022 v.s 0.9% for Coursera. Although Udemy tends to attract new customers, it struggles to retain them. Coursera’s existing consumer segment will generate revenues of USD279 mn in 2022, up 25% v.s Udemy’s USD206 mn, up a meager 2% YoY. Coursera’s edge lies in the quality of its courses, having more certified courses with degree options through partnerships with prominent universities.

Analysts expect Udemy to generate USD319 mn in revenue from its consumer segment against Coursera’s USD301 mn in 2022. In terms of growth, however, Coursera’s consumer segment is growing much faster than Udemy, with revenue from the consumer segment expected to grow at 22% v.s a decline of 4% YoY for Udemy in 2022.

Analysts expect the consumer segment to account for 55% of Coursera’s total revenue in 2022, down from 66% in 2020. For Udemy, this share will shrink from 76% in 2020 to an estimated 51% in 2022. While growth in the consumer segment has been slowing for both companies, the future of their enterprise businesses is quite promising, according to analysts.

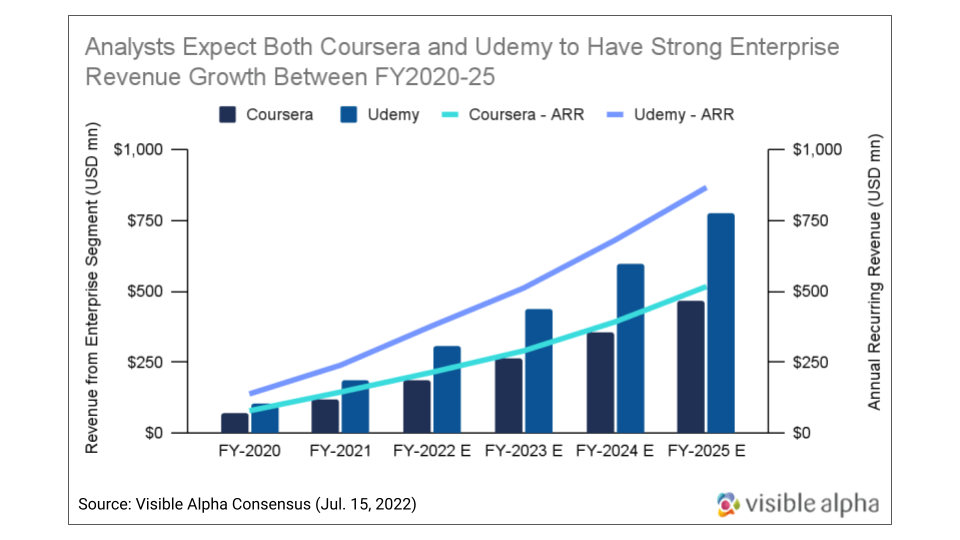

Strategic Shift to Enterprise

The enterprise segment is potentially higher-growth with a more predictable revenue stream based on its subscription model. As a result, both companies have made a strategic shift, focusing more on the enterprise segment and ramping up their pursuit of enterprise customers. As a result, we see a rising share of the enterprise segment in total revenue for both companies in the consensus estimates. Moreover, when measured using annual recurring revenue (ARR) analysts project that the enterprise segment will increase at a CAGR of 37% for Coursera and 36% for Udemy between 2020-25.

Conclusion

In absolute terms, Udemy’s numbers are much stronger than Coursera’s. However, Coursera’s profile looks much more promising in terms of growth rates. While the consensus numbers suggest impressive topline growth for several more years, rising expenses have continued to weigh down on profitability; analysts don’t expect either to become profitable before 2026.