Darden will report fiscal 4Q17 results on Tuesday before market open. This will be one of the first restaurants to report on results in calendar 2Q, and therefore will be watched closely by the industry.

For DRI, fiscal 4Q17 results are expected to be stronger than the prior quarter for several reasons.

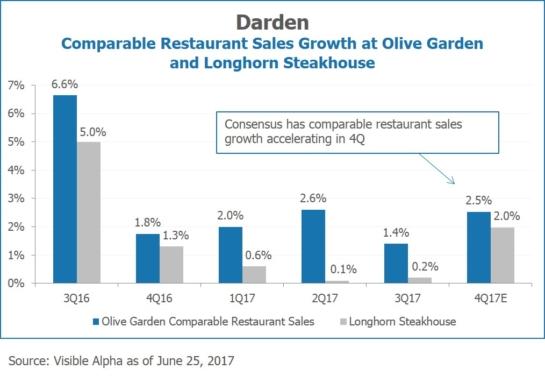

- This is the quarter in which they will be lapping the industry-wide slowdown last year. Many of DRI’s restaurants saw comparable restaurant sales growth decelerate by 200-400 basis points from 3Q16 to 4Q16. As a result, comparisons will be much easier for this quarter.

- Industry data from Knapp track suggests that the industry accelerated by ~250 basis points in the second quarter.

As a result, investors are expecting a comparable restaurant sales growth acceleration across many brands in 4Q17. For Olive Garden and Longhorn Steakhouse, the two largest restaurants responsible for 78% of DRI’s total sales, consensus expectations are for 2.5% and 2.0% comparable restaurant sales growth, respectively.

Analysts expect a similar acceleration across many of the other restaurant brands. Of note is the recently acquired Cheddar’s Scratch Kitchen, as this will be the first quarter under Darden. Consensus is for 0.5% comparable restaurant sales growth for the brand.