Drug development innovation continues at a robust pace as several first-in-class and groundbreaking therapies were approved by the FDA in 2023. Visible Alpha provides consensus revenue projections for novel therapeutic drugs approved in 2023 with the highest market potential and those with a major innovation impact. (See also our overview of 2022 FDA-approved drugs.)

Our picks for the two potentially most lucrative and innovative therapeutic drug development approvals in 2023 are Leqembi and Casgevy. We chose Leqembi for overcoming the scientific, clinical, and regulatory challenges in developing the first beta amyloid inhibitor for Alzheimer’s disease, a disease with complex and poorly understood biology as well as for the potential for blockbuster annual revenues of almost $10 billion by 2033. We picked Casgevy primarily for the innovation behind CRISPR gene-editing technology that marks a milestone in drug development history. Casgevy’s revenue potential is also impressive — over $4 billion in 2033.

Standouts in the class of 2023: Leqembi for Alzheimer’s and the first CRISPR gene-editing therapy

The 2023 FDA therapeutic drug approval list reflects continued innovation in drug development. In our view, the approval of the first beta amyloid targeting antibody for Alzheimer’s disease, Leqembi (lecanemab), marks a major milestone after decades of research and development hiccups in attempting to develop a beta amyloid inhibitor. Leqembi was developed by Eisai (TSE: 4523) and Biogen (NASDAQ: BIIB), and was approved in July 2023 as the first disease-modifying therapy that targets the underlying cause of Alzheimer’s disease (see also our previous article on Leqembi). With the approval of Leqembi, we expect a long pipeline of improved beta amyloid pathway inhibitors in clinical development. According to Visible Alpha consensus, analysts project revenues of $9.8 billion for Leqembi in 2033.

The invention of the first gene-editing CRISPR technology (“genetic scissors”) was awarded the Nobel Prize in chemistry in 2020, less than a decade after the discovery of all the various molecular components of the system (CRISPR/Cas9). Casgevy (Exa-cel), the first CRISPR-based gene-editing therapy for sickle cell disease (SCD), was approved by the FDA in December 2023. The rapid pace of innovation and drug development within a short timespan is remarkable. The approval of the first CRISPR-based therapeutic opens the floodgates to many more CRISPR-based therapeutics targeting a broad repertoire of gene-editing targets for several indications. According to Visible Alpha consensus, analysts project 2033 revenues of $4.1 billion for Casgevy.

Comparing market potential with GLP-1 drugs approved in prior years

While Leqembi and Casgevy are potentially blockbuster drugs by most historical standards, they are dwarfed when compared to the market potential of the GLP-1 based drugs approved in prior years. Last year, we projected Eli Lilly’s Mounjaro, approved in 2022 for type 2 diabetes, at around $20B in estimated consensus revenues for 2030. Mounjaro has since been granted expanded FDA approval for obesity in 2023, marketed under the brand name Zepbound. Currently, Visible Alpha consensus revenue projections for 2033 for Mounjaro and Zepbound combined are at a staggering $45 billion ($22 billion for Mounjaro for type 2 diabetes plus $23 billion for Zepbound for obesity). Novo Nordisk’s competing GLP-1 franchise, which includes Ozempic (approved in 2017 for type 2 diabetes), Wegovy (approved in 2021 for obesity), and Rybelsus (approved in 2019 as an oral drug for type 2 diabetes), are projected to reach a combined $38 billion in revenue by 2033.

Checkpoint inhibitors also have large market potential

Another drug with massive market potential is Keytruda, the checkpoint inhibitor targeting the PD-1/PD-L1 pathway for oncology that was first approved by the FDA in 2014 for advanced melanoma. Keytruda is FDA approved for 16 different cancers today. Visible Alpha consensus revenue estimates project peak revenues in 2027 of $34.4 billion.

Other notable drugs approved in 2023 with significant market potential

There are several other drugs approved in 2023 that are noteworthy in their own right in overcoming an innovation challenge or in addressing an unmet medical need for patients:

- Bimzelx (bimekizumab), developed by UCB, is projected to reach $3.4 billion in revenue by 2033. Bimzelx, a monoclonal antibody against IL-17A and IL-17F, is approved for moderate-to-severe plaque psoriasis. While there are other approved IL-17A inhibitors, Bimzelx is the first that targets both IL-17A and IL-17F. Both IL-17A and IL-17F contribute to inflammatory signals in autoimmune disease.

- Arexvy, developed by GSK with 2033 consensus revenue estimates at $3.1 billion, and Abrysvo, developed by Pfizer with 2033 consensus revenue estimates at $2.3 billion, are pioneering RSV vaccines approved for adults over 60 years of age. Abrysvo is also approved for pregnant women at risk for transmitting RSV to their infants. The RSV vaccine is poised to have a major impact globally — there are over 33 million RSV infections worldwide and over 100,000 deaths annually.

- Elevidys (delandistrogene moxeparvovec-rokl), developed by Roche, Sarepta, and Chugai, is projected to reach revenue of $2.7 billion in 2033. Elevidys is the first gene therapy approved for patients aged 4 through 5 years with Duchenne Muscular Dystrophy (DMD) with a confirmed mutation in the DMD gene. The gene therapy corrects for a mutation in the dystrophin gene that regulates muscle cell cytoskeleton and muscle cell membrane interaction with the extracellular matrix. The mutation results in loss of muscle function (muscular dystrophy) affecting walking, breathing, cardiovascular health and even learning disabilities. Elevidys is a one-time treatment that will alter the course of a disease with acute unmet needs.

- Truqap (capivasertib), developed by AstraZeneca with 2033 consensus revenue estimates at $926 million in 2033, is the first AKT inhibitor approved in combination with estrogen receptor antagonist fulvestrant for hormone-receptor-positive, HER2-negative metastatic breast cancer that is biomarker positive.

- Vowst (fecal microbiota spores, live, in a capsule form), developed by Seres Therapeutics, has consensus revenue estimates of $334 million by 2033. Vowst is approved to prevent the recurrence of Clostridioides difficile infection. The drug is derived from human fecal matter sourced from qualified donors. The repertoire of healthy natural microbiota in Vowst competes with Clostridioides difficile and restores the gut’s natural resistance to infection with Clostridioides difficile.

Below, we’ve selected 16 therapeutic drugs with a high market potential and notable innovation, and provide consensus revenue estimates for the year 2033 (Table 1).

Table 1: Consensus revenue estimates for therapeutic drugs approved in 2023 with robust market potential and notable innovation

A Breakdown of the CDER and CBER 2023 Approvals

There are two branches that approve drugs under the FDA — Center for Drug Evaluation and Research (CDER) and Center for Biologics Evaluation and Research (CBER). CDER approves new molecular entities (NMEs, or small molecule drugs) under a New Drug Application (NDA), or as new therapeutic biological products (large molecule drugs that include antibody-based therapeutics, enzymes, peptides) under a Biologic License Application (BLA). The CBER branch regulates vaccines, blood products, cell therapies (including CAR-T cells), gene therapies, and CRISPR/gene-editing therapies.

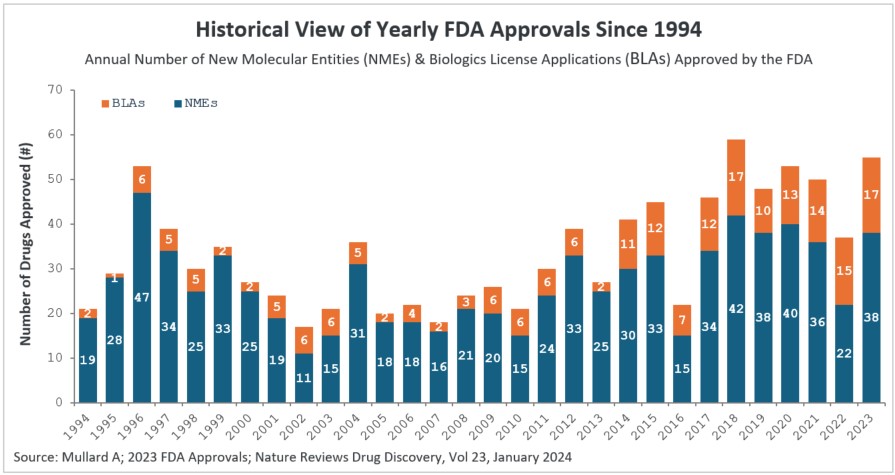

- There was a substantial increase in 2023 approvals compared to 2022. In 2023, the CDER branch approved 53 novel therapeutic drugs (see Table 2). We exclude Posluma, the prostate cancer diagnostic agent, and Paxlovid, the COVID anti-viral, since it had already been granted Emergency Use Authorization (EUA) during the pandemic in 2021 (including Posluma & Paxlovid, the 2023 CDER approvals are 55). The 53 novel therapeutic drugs approved is a significant increase over the 37 drugs approved by CDER in 2022. The 2023 rate of drug approval is in keeping with prior years — 2022 was an anomaly (see Figure 1), with COVID being a major factor. Notably, 2023 had the second highest number of drugs approved by CDER, behind the 59 drugs approved in 2018.

- CBER approved 16 novel drugs in 2023 — we count the RSV vaccine Abrysvo, approved for pregnant women and for adults above the age of 60, as one approval (CBER lists it separately). In comparison, in 2022, CBER approved 14 novel drugs.

- CDER approvals in 2023 based on modality included: 29 small-molecule drugs (not including a diagnostic agent small molecule), 12 antibody-based drugs (these include bispecifics and ADCs), 8 proteins/peptides/fusion proteins, and 4 DNA/RNA-based drugs.

- CBER approvals in 2023 based on modality included: 5 vaccines, 2 autologous cell therapy gene therapies (including CRISPR), 2 allogeneic cell therapies, 3 viral vector-based gene therapies, 1 fecal microbiota, 1 enzyme replacement therapy, 1 fusion protein, and 1 natural plasma derived protein.

- The highest number of drugs approved in 2023 were for oncology (17), followed by neurology (6), infectious diseases (5), metabolic disorders (5), and ophthalmology (3).

- Based on the FDA regulatory pathway of approval (some drugs may fall under more than one regulatory pathway): 9 Accelerated Approvals, 8 Orphan Drug designations, 16 Fast-Track designations, 24 Priority Reviews, and 9 Breakthrough Therapy designations.

See Tables 2 and 3 for descriptions, including modality, indication, and mechanism of action for CDER and CBER approvals in 2023.

Figure 1: Historical view of yearly FDA approvals since 1994

New molecular entities (NMEs) and biologics license applications (BLAs) approved by the FDA’s Center for Drug Evaluation and Research (CDER) branch since 1994. Note that CBER approvals are not depicted here. The 55 drug approvals in 2023 were significantly higher than the 37 drugs approved by CDER in the previous year.

References

- Novel Drug Approvals for 2023 (CDER). https://www.fda.gov/drugs/new-drugs-fda-cders-new-molecular-entities-and-new-therapeutic-biological-products/novel-drug-approvals-2023

- 2023 Biological Approvals (CBER). https://www.fda.gov/vaccines-blood-biologics/development-approval-process-cber/2023-biological-approvals

- FDA Approves Many New Drugs in 2023 that Will Benefit Patients and Consumers. Patrizia Cavazzoni, M.D., Director, Center for Drug Research and Evaluation. https://www.fda.gov/news-events/fda-voices/fda-approves-many-new-drugs-2023-will-benefit-patients-and-consumers

- Mullard A; 2023 FDA approvals. Nature Reviews Drug Discovery, 2024 Jan 2. https://pubmed.ncbi.nlm.nih.gov/38168801/