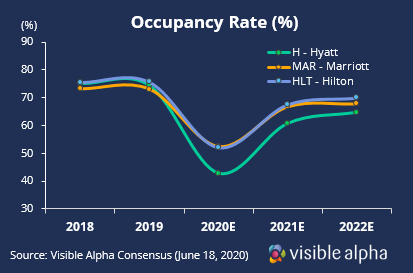

The hotel industry is facing headwinds caused by the Covid-19 pandemic, which brought leisure and business travel to a virtual standstill in the first half of 2020. Now, as countries begin lifting travel restrictions after some signs of controlling the virus, there is some optimism in the market that pent-up demand to travel might be underestimated. Nevertheless, as of now Wall Street analysts do not expect large hoteliers will see a full recovery in occupancy before 2022, according to Visible Alpha consensus.

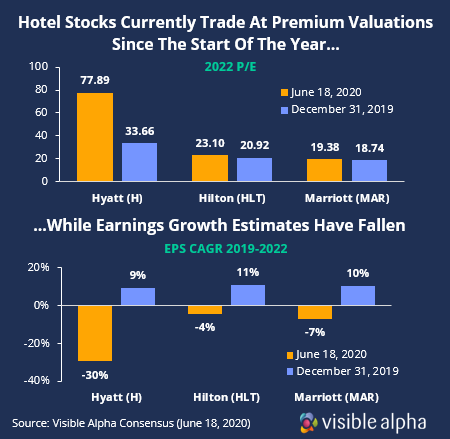

Despite analysts slashing future growth estimates, the 2022 P/E of the largest hotel stocks – Hyatt, Hilton, and Marriott – are higher now than at the start of the year before the novel coronavirus spread globally.

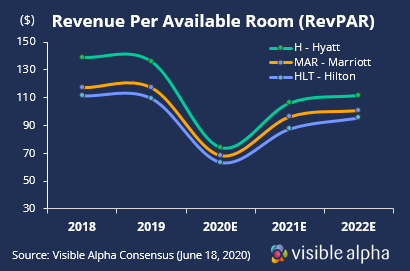

The valuation gap appears largely driven by estimate revisions since the performance of all three stocks year to date have been fairly correlated with Hyatt and Marriott dropping about 40% and Hilton falling by around 30%. Hyatt’s relatively higher valuation was largely driven by negative earnings revisions but offset in part by their higher luxury property exposure, which has helped maintain higher Revenue per Available Room (RevPAR) and more attractive margins compared to peers.

Learn more about the ongoing revisions across every sector here.

This content was created using Visible Alpha Insights.

Visible Alpha Insights is an investment research technology platform that provides instant access to deep forecast data and unique analytics on thousands of companies across the globe. This granular consensus data is easily incorporated into the workflows of investment professionals, investor relations teams and the media to quickly understand the sell-side view on a company at a level of granularity, timeliness and interactivity that has never before been possible.