In a rapidly evolving investment landscape, staying ahead of the curve is more challenging than ever for asset managers. High inflation, market volatility, and technological advancements are reshaping the industry, demanding innovative strategies and tools. We explore how leading asset managers are leveraging technology to modernize their investment research processes, addressing industry pressures, and transforming their operations to maintain a competitive edge. For a deeper dive into these insights and strategies, download our comprehensive whitepaper, “The Race to Stay Ahead: How Leading Asset Managers are Modernizing the Investment Research Process.”

Q: Why is the asset management industry under pressure?

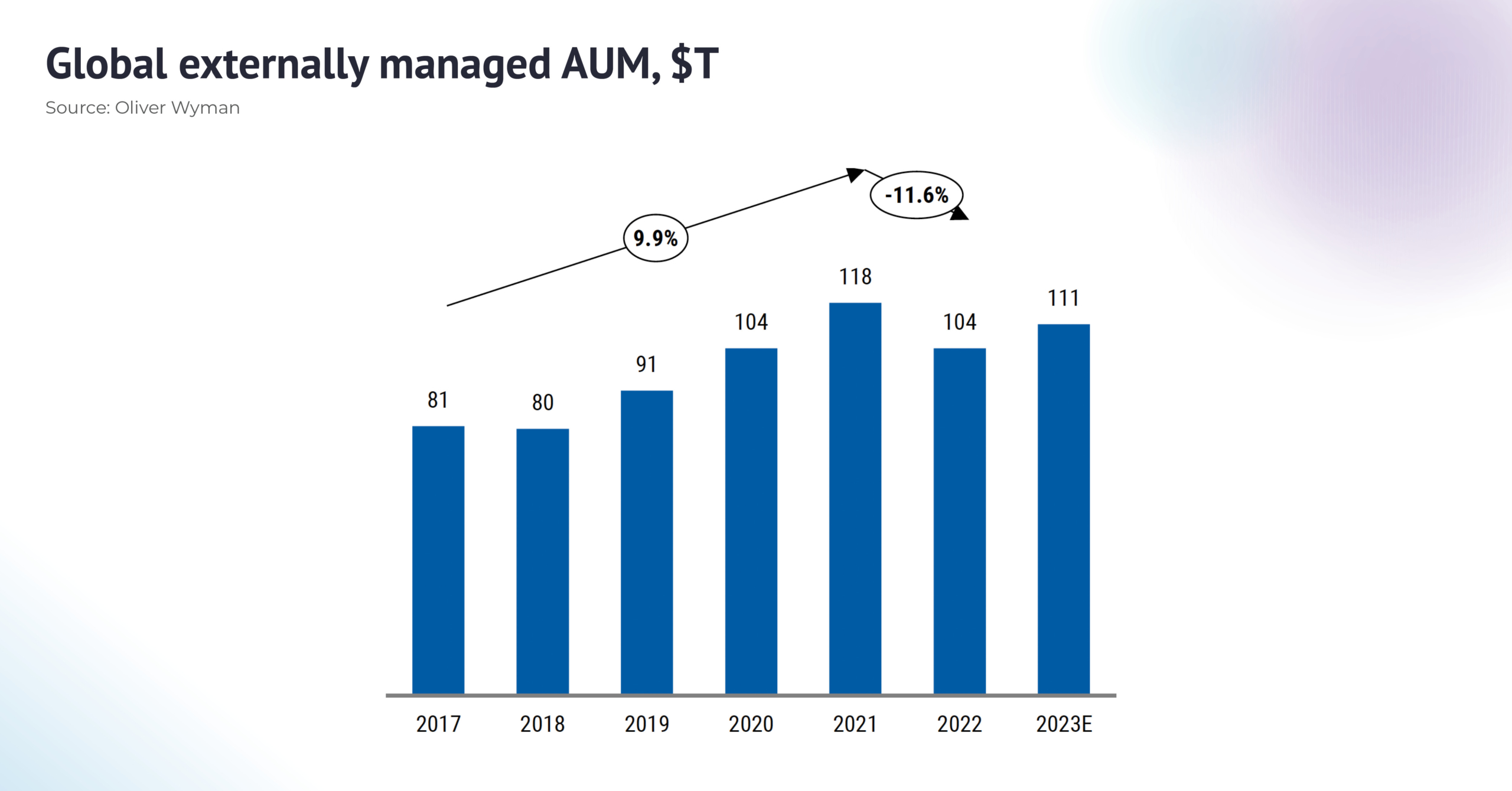

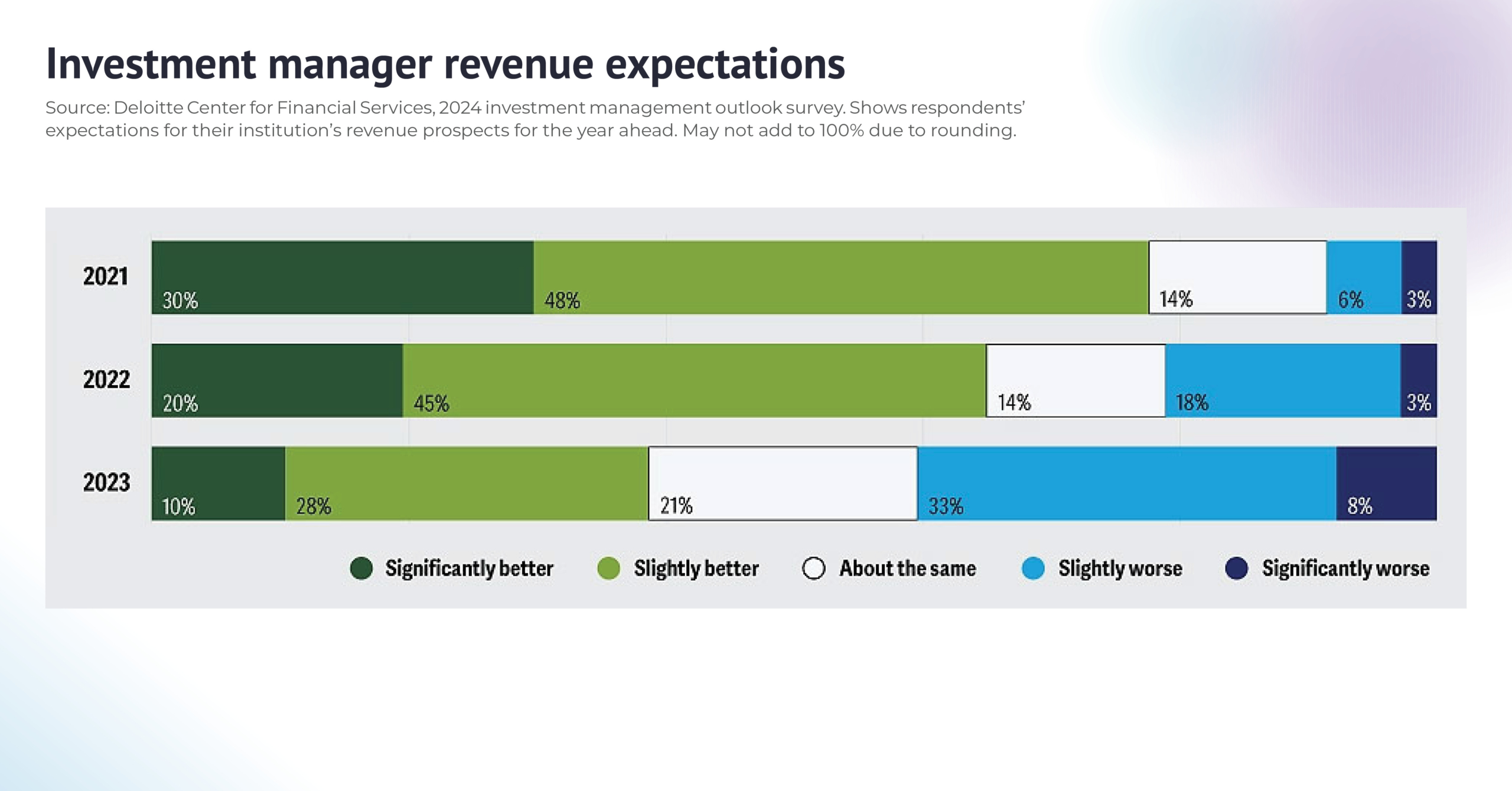

A: The last few years have been turbulent for the global investment management industry, marked by high inflation, rising interest rates, market volatility, and geopolitical tensions. These factors have strained traditional operating models, resulting in a decline in global assets under management (AUM), reduced operating margins, and a shift toward lower-fee passive equity strategies.

Q: How are leading firms responding to these challenges?

A: Different firms are adopting various strategies, widening the gap between leaders and laggards. Key responses include:

- Embracing new product structures like ETFs and SMAs.

- Shifting to platform-based business models.

- Adopting more flexible and scalable operating models.

Q: What role does technology play in modernizing the investment process?

A: Technology is central to the transformation, with firms focusing on:

- Strategic positioning towards growth areas.

- Future-proofing investment platforms with AI and automation.

- Adopting new operating models emphasizing flexibility and scale.

- Enhancing execution through digital tools and strategic partnerships.

Q: What specific challenges do fundamental long-only managers face?

A: Fundamental managers, particularly those not attached to advanced data platforms, face unique challenges such as:

- Building and maintaining company and industry models.

- Comparing KPIs across peer groups.

- Identifying valuation opportunities and tracking sentiment changes.

- Reducing manual effort in research workflows.

Q: How can platform access to sell-side models help fundamental managers?

A: Platform access to raw sell-side models can significantly enhance efficiency and alpha capture. Benefits include:

- Identifying undervalued companies.

- Generating investment ideas.

- Jumpstarting the modeling process.

- Making meaningful comparisons across companies and industries.

- Tracking market sentiment and staying current with rapid updates.

Q: What steps should asset managers take to embrace the future?

A: Managers should:

- Leave outdated technology behind.

- Embrace AI and machine learning.

- Commit to data quality and outcomes.

- Foster a culture open to change.

Q: How can asset managers transform their tech and data stack?

A: Transforming the tech stack involves:

- Assessing current capabilities.

- Building advanced data models.

- Incorporating alternative data.

- Redefining operating models.

- Exploring new partnerships.

- Keeping the approach agile.

Q: Why is this transformation urgent?

A: The industry is rapidly evolving, and firms must leverage technology to enhance efficiency, scale operations, and improve portfolio outcomes. Managers who do not adapt risk falling behind in an increasingly competitive environment.

For an in-depth analysis and detailed strategies, download the full report “The Race to Stay Ahead: How Leading Asset Managers are Modernizing the Investment Research Process.” Explore insights, case studies, and actionable recommendations to navigate the future of asset management.