2022 was a historic year for lithium producers. The rapid growth of renewable energy and electric vehicles (EVs), coupled with governments across the globe formalizing policies and subsidies in the clean energy space, saw the demand for lithium-ion batteries surge. As a critical element in these batteries, the demand for lithium also skyrocketed.

Strong Demand and Inelastic Supply Keep Prices Elevated

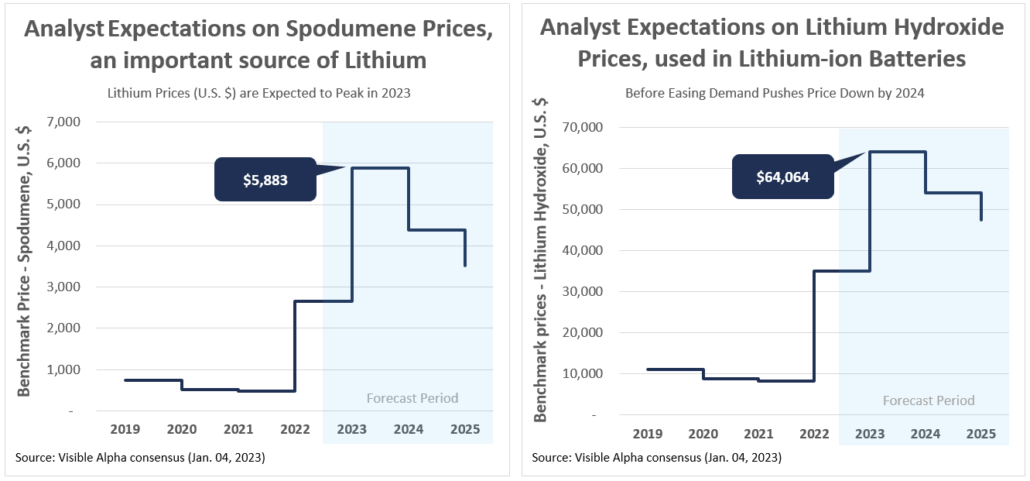

The steady decline in lithium prices over the last few years reversed direction in 2022. Benchmark prices for spodumene, an important source of lithium, rose by 495.6% from $468 per metric ton in January 2021 to $2,785 per metric ton in January 2022. Additionally, benchmark prices for the more expensive lithium hydroxide, used in the production of lithium-ion batteries, jumped 324% to $35,118 per metric ton. These price booms are the result of a combination of growing demand from the EVs and renewable energy industries, ongoing supply-chain disruptions, and the inelastic nature of lithium supply.

Lithium mining is a lengthy and capital-intensive process, making it difficult for supply to keep up with demand. However, several producers have made recent announcements on capacity expansion. To name a few, SQM plans to increase lithium production to 210,000 tonnes by early 2023 (double its 2021 capacity), while Jiangxi Ganfeng has announced a plan to boost lithium capacity fivefold to 600,000 tonnes. In the U.S., the government’s efforts to increase lithium capacity will see Albemarle receive $149.7 million in federal grants to develop lithium facilities. Analysts project expanding supply to ease the lithium industry’s demand-supply dynamics starting in 2024. Benchmark prices for spodumene are projected to peak at $5,473 per metric ton in 2023 and benchmark prices for lithium hydroxide are expected to peak at $61,111 per metric ton. Even though analysts project growth of lithium prices to slow down, they still expect them to remain elevated, rooted in the ongoing shift towards clean energy.

Volume Expectations Supported by Strong EV Sales

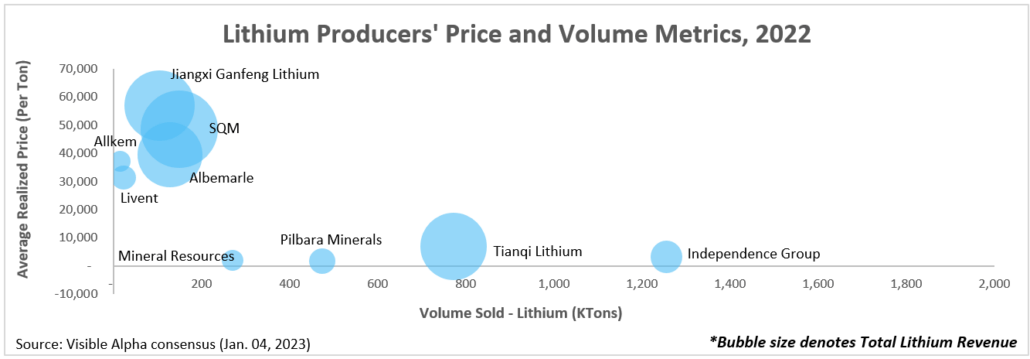

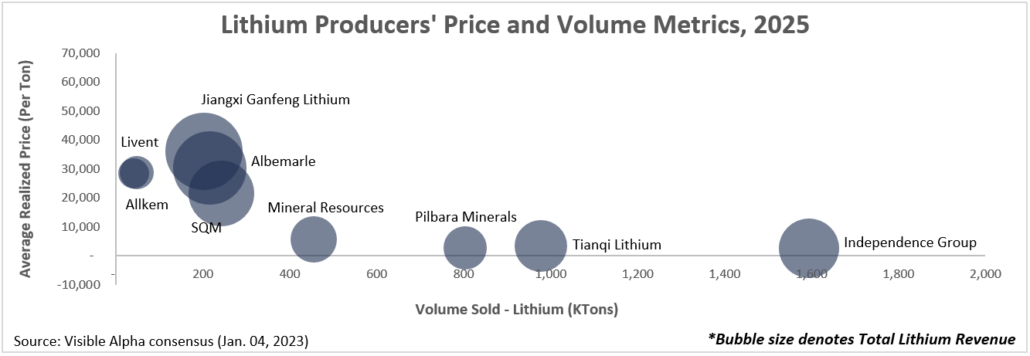

Passenger and commercial EVs drive the highest demand for lithium-ion batteries and, in turn, lithium. Core EV companies like Tesla, NIO, Xpeng, Rivan, and Li Auto, along with automakers like BYD, Great Wall, and Geely continue to ramp up EV production. Supported by favorable trends, analysts project the total volume sold by lithium producers to continue to increase between 2022-2025, with a slowdown in percentage growth beginning in 2023. The combined growth in total volume sold by the top nine lithium producers* is expected to see a 35% increase in 2022, before slowing to 19% in 2023 and 11% in 2024.

(Note: The average realized price difference between companies in the two charts is due to the type of lithium being sold. Companies, including Tianqi Lithium, Pilbara Minerals, Mineral Resources, and Independence Group, sell spodumene, which is generally less expensive than lithium hydroxide. Hence the average realized prices of these companies are much lower than others).

For leading producers by lithium revenue – SQM and China’s Jiangxi Ganfeng Lithium and Tianqi Lithium – analysts expect sales volume to expand by 47%, 16%, and 29% respectively in 2022. For SQM, this growth equals 149,000 metric tons, the highest annual volume sold by the company so far. Lithium producers are expected to see improved average realized prices in 2022 as higher prices drive revenue growth. However, as lithium prices ease, average realized prices per ton of lithium are forecasted to shrink starting in 2024.

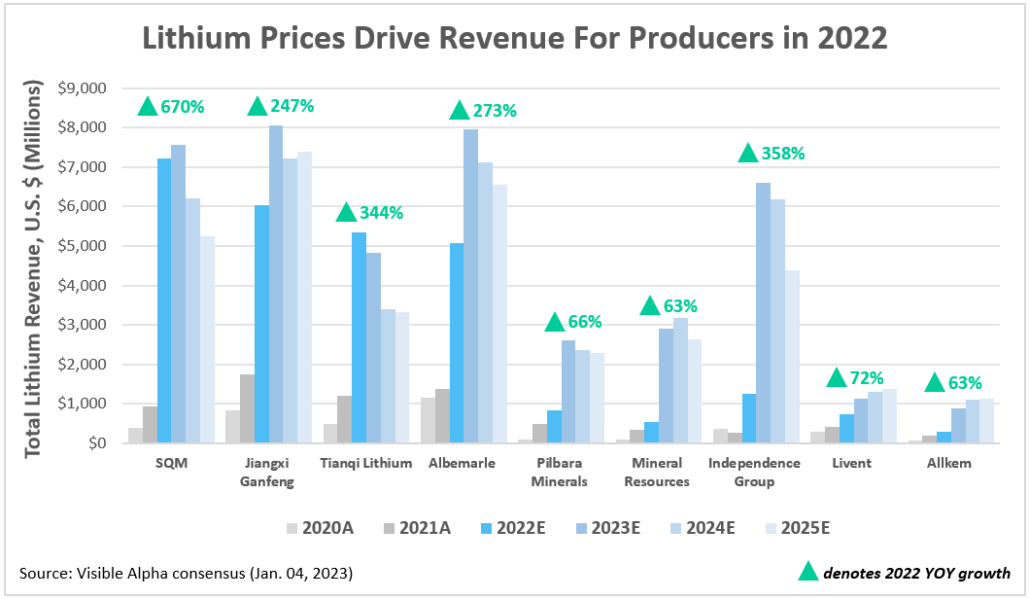

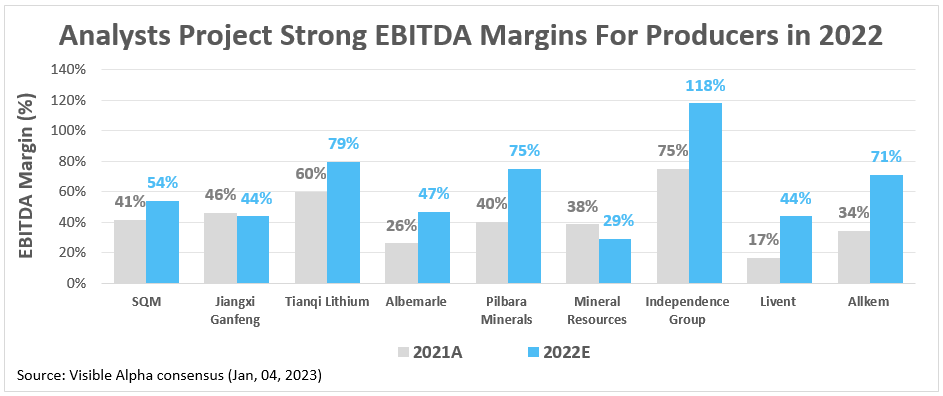

Rising Prices Drive Lithium Producers’ Revenue Expectations

Surging lithium prices along with plans to increase production capacity have boosted the top and bottom-line expectations for lithium producers. Across all key players*, analysts expect total lithium revenue to grow at a CAGR of 60% from $4.5 billion in 2019 to $29.5 billion in 2022. At the company level, analysts project total lithium revenue for Chile’s SQM to increase by 666% year-over-year in 2022, followed by Australia’s Mineral Resources and Independence Group at 367% and 352%, respectively. U.S.-based lithium producers Albemarle and Livent are expected to see lithium revenue growth of 273% and 72%. While lithium prices rise, operating expenses for producers have remained relatively steady driving an improvement in already high EBITDA margins for companies in the industry.

While Producers Thrive, Battery Manufacturers Struggle

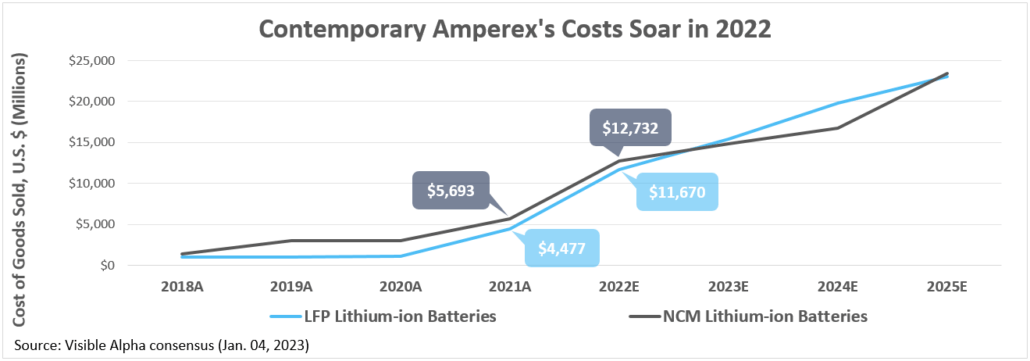

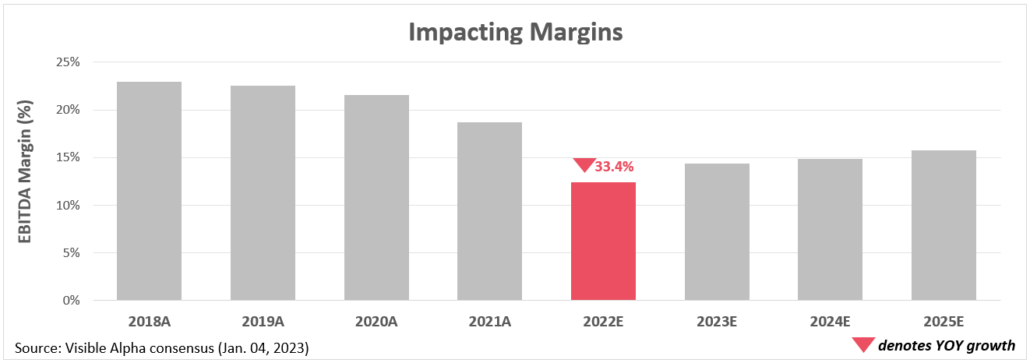

Lithium-ion battery manufacturers are facing a challenging market. While the demand for batteries from EV manufacturers has increased significantly, resulting in high volume growth, lithium-ion battery manufacturers like Contemporary Amperex Technology (300750_CN) are also struggling with rising raw material costs and declining margins. Contemporary Amperex is expected to significantly increase deliveries of their LFP and NCM lithium-ion batteries in 2022. Deliveries of LFP batteries are predicted to rise by 106%, while NCM deliveries are expected to increase by 101% in 2022. While deliveries are expected to increase, analysts anticipate that the cost of selling batteries will rise at a faster rate, outpacing volume and revenue growth, and leading to a contraction in margins in 2022. On a cost-per-unit basis, the cost of producing each unit of lithium battery is expected to increase by 26% in 2022, while the profit made from selling each unit is expected to decrease by 6%.

*Lithium producers covered in this blog include Jiangxi Ganfeng Lithium (002460_CN), Albemarle (ALB), Livent (LTHM_US), Sociedad Quimica y Minera de Chile (SQM), Allkem (AKE_AU), Tianqi Lithium (002466_CN), Pilbara Minerals (PLS_AU), Mineral Resources (MIN_AU), and Independence Group NL (IGO_AU).